Our 10th anniversary: Reflecting on a decade of insights for financial advisors

Our 10th anniversary: Reflecting on a decade of insights for financial advisors

Highlighting the past decade’s top trends in proactive investment and practice management for advisory firms.

Proactive Advisor Magazine is proud to be completing its 10th year of publication in 2023.

Please be sure to look for our special year-end issue in late December, which will feature many of our favorite and most-read articles from the past 10 years.

Our editorial team is pleased by the feedback from our readers and the continued growth of our audience. The advisory community clearly values leading-edge information, insights and knowledge from peers, and industry expertise on best practices in active investment management, along with other important topic areas relevant to all financial advisors. Proactive Advisor Magazine is the only weekly publication dedicated to promoting the understanding of active investment management and how advisors may best incorporate its tools in their practices.

This would not be possible without the insights from top financial and investment advisors. Over the course of the past 10 years, we have published in-depth interviews with nearly 300 such advisors across the United States. They are a diverse group, representing the many different business models in the industry, and they come in all “sizes and shapes”: independents working with regional and national broker-dealers, hybrid firms, and RIAs. Assets under management for their practices have ranged from under $30 million to well over $300 million. Some are sole independent practitioners, others are part of medium-sized firms, and still others are part of some of the largest advisory firms in the country. While most primarily focus on financial planning and wealth management for a broad client target market, others have niche practices or specialties.

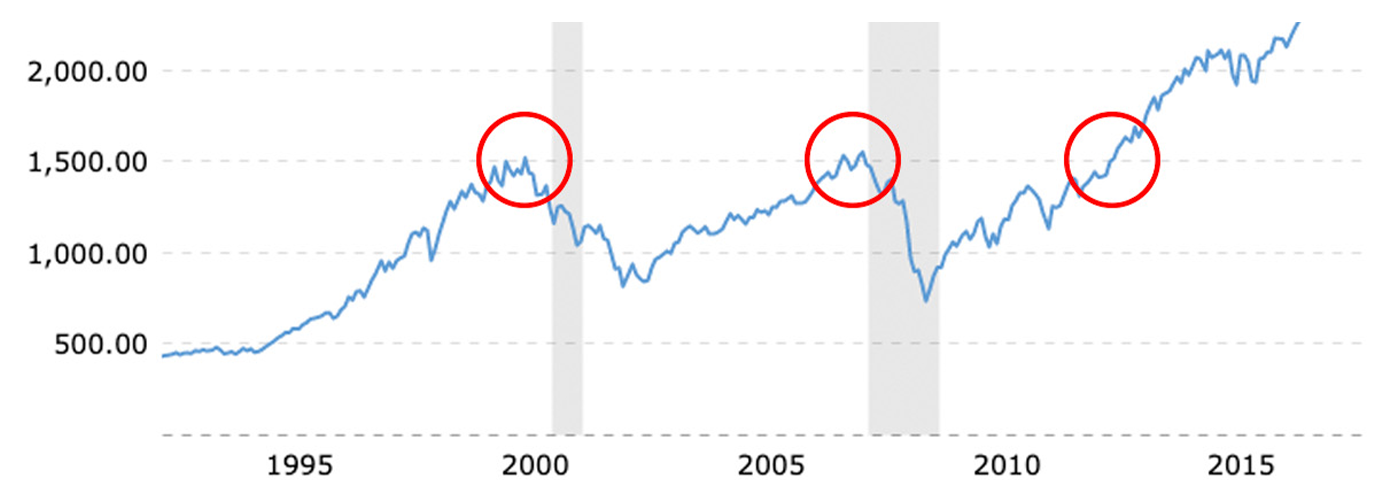

The past 10 years have presented many challenges—and opportunities—for financial advisors. When we started our publication in 2014, U.S. equity markets (as represented by the S&P 500 Index), had just come off 13 years of bouts of significant volatility and had suffered two major crashes. In 2013, the S&P 500 had finally recovered to levels first achieved in 2000. The NASDAQ 100 Index would take even longer to reach “breakeven” and had experienced even steeper drawdowns than the S&P 500.

HISTORICAL VIEW OF THE S&P 500 INDEX: 1993–2015

Note: Shaded areas are recessions.

Source: MacroTrends

Given the ever-present uncertainty of investment environments, advisors have consistently shared with our publication the strong desire to find financial-planning and investment solutions for their clients that would stand the test of time—through multiple market cycles. Simply put, this means employing strategic approaches that can generate competitive returns in both bull and bear markets through the use of strong risk-management techniques. It also means adopting a planning and investment philosophy that can accommodate investors all along the risk spectrum and with varying levels of financial sophistication. For this, they have consistently turned to active investment management.

Our 2021 article “Wealth-management trends: The benefits of third-party active investment management” reviewed several studies that assess advisor attitudes about outsourced portfolio management and risk mitigation for clients. The studies show a continued preference for actively managed strategies as a major component of a blended investment allocation approach. “Why active strategies complement holistic portfolio management” offers further perspective on the potential role of active strategies for client portfolios.

But why don’t we let financial advisors share their thoughts on active, risk-managed solutions from third-party investment managers in their own words?

Chuck Bigbie ● Tulsa, OK ● Woodland Wealth Management ● Geneos Wealth Management Inc.

“When we switched to the independent advisory channel, we utilized active management firms that had strategies with the ability to move to cash in dangerous markets, or to be strongly allocated to equities when the trend was right, or to change the asset class or mix of asset classes. We found that there was more downside protection. If clients didn’t lose as much, they didn’t have to recover as much. It should be a much smoother, more controlled ride, with an emphasis on risk management and taming volatility.”

“When we switched to the independent advisory channel, we utilized active management firms that had strategies with the ability to move to cash in dangerous markets, or to be strongly allocated to equities when the trend was right, or to change the asset class or mix of asset classes. We found that there was more downside protection. If clients didn’t lose as much, they didn’t have to recover as much. It should be a much smoother, more controlled ride, with an emphasis on risk management and taming volatility.”

Carla Zevnik-Seufzer ● Greenfield, WI ● ClearStep Financial ● Harbour Investments Inc.

“I like to go through a little history of the market, using simple charts. These show sideways, bull, and bear markets. … The point is, we do not know what the major trend of the market will be going forward, but we do know how hard [it is] and how long it takes to recover from losses in a portfolio. … So when I show what I call the ‘mountain chart,’ with the peaks and the valleys of the S&P, I ask clients, ‘Wouldn’t it be smarter to try to avoid those deep valleys? Perhaps even profiting during a bear market using inverse strategies? And to be more exposed to equities when market indicators are heading back up again?’”

“I like to go through a little history of the market, using simple charts. These show sideways, bull, and bear markets. … The point is, we do not know what the major trend of the market will be going forward, but we do know how hard [it is] and how long it takes to recover from losses in a portfolio. … So when I show what I call the ‘mountain chart,’ with the peaks and the valleys of the S&P, I ask clients, ‘Wouldn’t it be smarter to try to avoid those deep valleys? Perhaps even profiting during a bear market using inverse strategies? And to be more exposed to equities when market indicators are heading back up again?’”

Paul Saganey ● Worcester, MA ● Integrated Partners ● LPL Financial

“When I work with a client’s portfolio, I offer them active money-management strategies designed to help improve their probabilities for success. After the 2008 market collapse—it was probably around 2010—I fully realized that there had to be a better way to manage clients’ assets … especially clients that are retired and can’t afford to, or choose not to, see their assets drop by 30%, 40%, or even 50%. That’s when I realized that there are some wonderful active management stories out there that are time- and performance-tested and can help my clients increase their odds of success.”

“When I work with a client’s portfolio, I offer them active money-management strategies designed to help improve their probabilities for success. After the 2008 market collapse—it was probably around 2010—I fully realized that there had to be a better way to manage clients’ assets … especially clients that are retired and can’t afford to, or choose not to, see their assets drop by 30%, 40%, or even 50%. That’s when I realized that there are some wonderful active management stories out there that are time- and performance-tested and can help my clients increase their odds of success.”

Financial advisors favor third-party active management for several reasons: access to modern analytical strategies, emphasis on risk mitigation, response to current market conditions, and client satisfaction over full market cycles.

Richard F. Grant Jr. ● Gilbert, AZ ● RFG Capital Management LLC

“We provide access to personalized investment strategies with a focus on protecting investor capital through various market environments. Applying the expertise of investment specialists, we combine fundamental, quantitative, and technical factors to build portfolios designed to capitalize on market inefficiencies. … Our fee-based asset-management platform provides a variety of risk-managed investment choices to help retirees in their efforts to secure a better retirement.”

“We provide access to personalized investment strategies with a focus on protecting investor capital through various market environments. Applying the expertise of investment specialists, we combine fundamental, quantitative, and technical factors to build portfolios designed to capitalize on market inefficiencies. … Our fee-based asset-management platform provides a variety of risk-managed investment choices to help retirees in their efforts to secure a better retirement.”

Shannon LaRosse ● Reading, PA ● Informed Family Services ● USA Financial Securities Corp.

“While risk management can be beneficial to an accumulation plan, it becomes essential in retirement distribution planning. … We use the services of third-party investment managers for active, risk-managed strategies. These managers have been carefully vetted and have robust strategy, research, and management teams. Their sole responsibility is the daily management of their firm’s investment strategies. We carefully examine their performance in different types of market environments. We look to see if they can produce competitive returns in positive markets and—importantly—strive to mitigate losses in poor market conditions.”

“While risk management can be beneficial to an accumulation plan, it becomes essential in retirement distribution planning. … We use the services of third-party investment managers for active, risk-managed strategies. These managers have been carefully vetted and have robust strategy, research, and management teams. Their sole responsibility is the daily management of their firm’s investment strategies. We carefully examine their performance in different types of market environments. We look to see if they can produce competitive returns in positive markets and—importantly—strive to mitigate losses in poor market conditions.”

Edgardo Castro ● Fort Lauderdale, FL ● Aragon Capital LLC

“Most people are conditioned to think, ‘I am just going to set my investments up initially and not touch them. I may lose money over some periods but eventually my account will grow.’ I do not think that is an appropriate approach for investors, and especially those who are getting close to their retirement age. I introduce them to the concept of managed money, where professional money managers can employ research, sophisticated models, and risk-managed strategies on behalf of the client. That is usually a real eye-opener for most people. …”

“Most people are conditioned to think, ‘I am just going to set my investments up initially and not touch them. I may lose money over some periods but eventually my account will grow.’ I do not think that is an appropriate approach for investors, and especially those who are getting close to their retirement age. I introduce them to the concept of managed money, where professional money managers can employ research, sophisticated models, and risk-managed strategies on behalf of the client. That is usually a real eye-opener for most people. …”

Related Article: Dynamic risk management is right for investor portfolios![]()

10 years of changing environments marked by significant trends

The heightened emphasis on the role of actively managed strategies for client portfolios was just one of many topics Proactive Advisor Magazine has covered over the past 10 years.

Many thanks to the dozens of talented authors who have written in-depth examinations of significant developments in investment research, financial technology, practice management, behavioral finance, and active management approaches, including featured white papers from leading institutions and articles from industry thought leaders.

A few of the significant developments impacting advisors over the past decade include the following:

- The emergence of TAMPs as fee-based technology/investment platforms that help financial professionals optimize their clients’ returns. Please see “What is a TAMP—and what are the benefits of working with one?”

- Seizing the opportunity of next-generation clients during “the greatest wealth transfer in history,” as explained in “How advisors successfully grow with next-generation clients.”

- Behavioral finance coming of age as a value-added skill that advisors can deploy to enhance their client relationships. Behavioral finance professor and Wall Street veteran Richard Lehman explores this topic in two articles, “Are advisors missing the point about behavioral finance?” and “Psychographic due diligence: What you really need to know about your client.”

- How advisors and investment managers dealt with the significant impact of COVID-19: “How advisors—and their clients—successfully navigated 2020” and “Why 2020 was a rare opportunity to judge an active manager’s performance.”

- The growing recognition of the role gold can play in well-diversified client portfolios, with extensive analysis and supporting rationale: “How gold can help in creating a more optimal portfolio allocation” and “The decision to invest in gold should not be reactive.”

- The vigorous discussion of ESG investments among various constituencies and looking at a risk-managed approach to “impact” investing: Investing with purpose: Successful advisors weigh in on the ESG conversation and Impact investing and active management are not mutually exclusive strategies.

- Navigating the new environment of higher interest rates and inflation: “Client-centered guidance for uncertain economic times” and “The hidden cost of fleeing from equities to CDs and fixed-rate annuities.”

Serving the advisory community over the next 10 years

Proactive Advisor Magazine is proud of providing forward-looking editorial content that informs advisors about peer best practices, evolving trends impacting the industry, and ways to grow and improve their practices.

“On the cusp of change: North American wealth management in 2030” is a particularly insightful article by McKinsey and Company that explores the meaningful changes expected for the advisory industry in coming years.

“How clients—and advisors—are rethinking retirement options” reveals some surprising conclusions about the changing priorities of today’s retirees.

“Revolutionizing investment risk management through the power of AI” takes an insider’s look at developments in AI-enabled investment management.

“Retirement readiness: How actively managed retirement accounts can help” examines the growing popularity among advisors of using actively managed strategies within clients’ workplace retirement plans.

“Will climatology be the next ‘must-have’ skill in the financial industry?” looks beyond the politics of ESG investing to how climate change may impact both corporate and investment risk management in coming years.

And financial industry experts have contributed a number of articles on practice management tools for advisory firms looking for future growth, including: “Value propositions: How advisors can effectively communicate their unique offering” and “10 traits of top advisory teams.”

Working with financial advisors and the investment community has been very gratifying for the editorial team at Proactive Advisor Magazine these past 10 years. Thank you for your continued readership. We extend our best wishes for the holiday season and a prosperous and healthy new year.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

RECENT POSTS