Latest articles

INDUSTRY INSIGHTS

In-depth examinations of significant developments in investment research, financial technology, behavioral finance, and active management approaches.

ADVISOR PERSPECTIVES

Experienced financial advisors discuss practice philosophy, client service, investment strategies, and how they have set their practices apart.

MARKET COMMENTARY

Observations and outlooks from well-known technical and research analysts, financial authors, and economists.

PRACTICE MANAGEMENT

Successful financial advisors provide tips on business-building strategies, including prospecting, obtaining referrals, client communications, marketing, technology, and more.

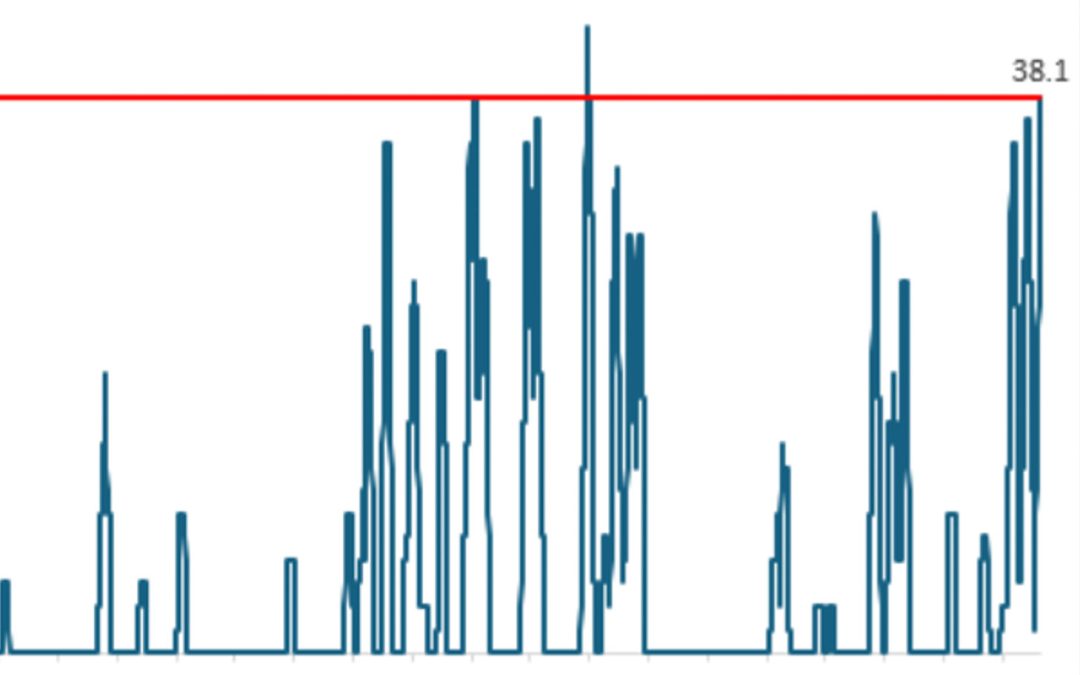

WEEKLY CHART REVIEW

Analysis of a timely market or economic theme illustrated with insightful charts.

Subscribe for new articles each week

No charge. Dedicated to promoting and educating the advisor community on active investment management through original, leading-edge content.

QUICK TIP

Comprehensive tools to meet clients’ financial needs

Harry Headrick is an investment consultant with ECU Asset Management, located at the Longview, Texas, branch.

“With the resources of ECU Asset Management, LPL Financial, and third-party providers, we are able to examine the many options available in today’s investment and financial-planning environment to develop customized strategies for clients,” says Mr. Headrick. “Because we are not tied to any provider of proprietary products, we have the flexibility to serve our clients’ best interests.”

Mr. Headrick offers the following comprehensive range of financial solutions:

Services

- Financial analysis

- Individual Retirement Accounts (IRAs) and IRA rollovers

- Retirement-income planning

- Asset-allocation design

- Business planning and company retirement plans

- College-savings plans

- Estate-planning guidance

- Social Security and Medicare benefits planning

Products

- CDs

- ETFs

- Fixed and variable annuities

- Insurance

- Mutual funds

- Fixed-income investments

- Managed investment accounts