Investing with purpose: Successful advisors weigh in on the ESG conversation

Investing with purpose: Successful advisors weigh in on the ESG conversation

The heightened focus on investments that reflect ESG factors has generated vigorous discussion within the financial industry, among policymakers, and within society at large. What are successful financial advisors saying about the issue?

Investments that take into account ESG—environmental, social, and governance—factors are gaining a great deal of attention these days, from both those who wholeheartedly embrace it and those who claim it goes against an advisor’s fiduciary duty to get the best returns possible for clients.

Many believe this latter view has been politicized—and even “weaponized”—by those who stand to have their enterprises greatly disrupted if they are forced to change their business practices to adhere to ESG goals. Indeed, Congress in February tried to nullify a 2022 Department of Labor rule stating that retirement plan fiduciaries may consider ESG factors when making retirement plan investing decisions—only to have President Biden veto the resolution.

Many states are pushing back against ESG initiatives, promising “to lead state-level efforts to protect individuals from the ESG movement that threatens the vitality of the American economy and Americans’ economic freedom.”

This pushback in turn has been countered on several fronts. For example, more than 270 investors and institutions, including Franklin Templeton, CalSTRS, Boston Common Asset Management, and Impax Asset Management issued a statement and called on policymakers to “protect the freedom to invest responsibly in light of a political backlash against sustainable investment and business practices.”

Data supports continued institutional and investor interest in ESG considerations

Many investors continue to look to ESG as a foundational part of their asset-allocation strategies, writes consultancy EY (Ernst & Young). EY notes that 88% of asset owners in Cerulli Associates’ 2020 ESG Report said they place at least moderate importance on managers having ESG capabilities. The demand is highest among Generation Z and millennial clients.

Wealth- and asset-management firms have responded, says EY. In Europe, 94% of institutional investors reported adopting ESG practices, according to a 2020 survey by RBC Global Asset Management. In the U.S., 65% of institutions said they had embraced ESG principles.

According to EY’s lengthy 2021 analysis, many more FIs (financial institutions) are adding language about ESG priorities and criteria to their investment policy statements. And at the time of the report in 2021, the firm forecast that “at least 200 new funds with ESG investment mandates are expected to launch during the next three years.” EY added, “As one asset manager puts it, ESG used to be viewed as a cost center with intangible benefits; today, it is seen as an engine for driving profits and market value for FIs, ESG is no longer a niche; it’s becoming a strategic imperative.”

Citing more recent data, Wealth Management recently wrote in an introduction to a webinar, “Sustainable investment practices aren’t going anywhere, anytime soon. According to the PwC 2022 Global Investor Survey, 82% of investors demand their portfolios have an ESG lens. Plus, 70% of asset and wealth management CEOs said they were concerned about climate in PwC’s Annual Global CEO Survey from March 2021.”

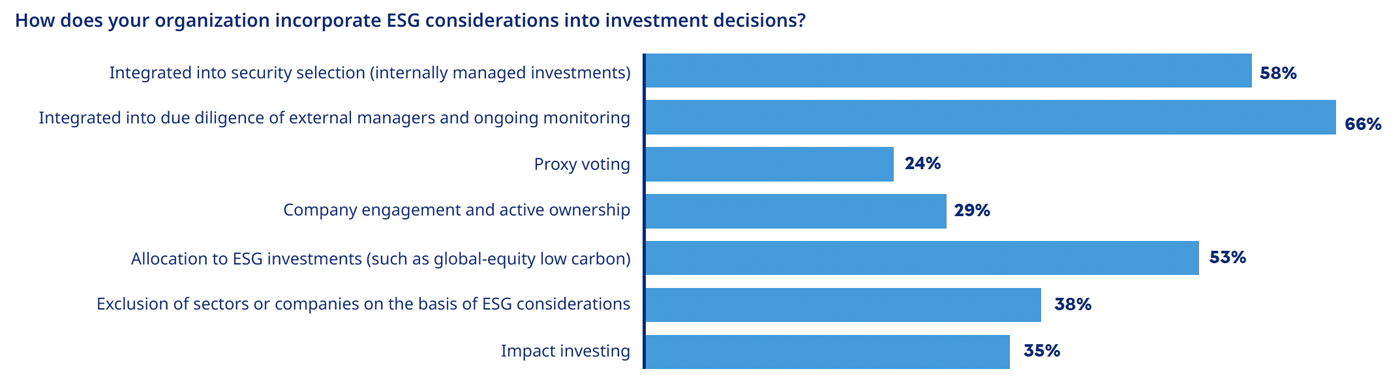

Mercer’s 2022 Global Wealth Management Investment Survey identified several different ways that financial institutions address ESG considerations in their investment process.

Source: Mercer’s 2022 Global Wealth Management Investment Survey

An analysis from the 2022 Federated Hermes ESG investment survey took a decidedly even-handed approach to the varying opinions surrounding the ESG debate:

“Most investors continued to increase their ESG and responsible-investing fluency in the face of market and economic headwinds. Discussion is ramping up: 92% of advisors said they had a client ask about ESG, and more than three-quarters of high-net-worth investors report asking an advisor or wealth manager about ESG. Traditional financial factors still dominate institutional portfolio construction, but more than 50% of investors indicated their intent to invest using ESG-related strategies. …

“Despite the loud voices heard on each ‘tail’ of the political bell curve, we find in the current iteration of our survey that investors and advisors are constructive on long-term financial and non-financial ESG considerations. Our data shows that most people fall decidedly in the middle of the curve: ESG plays a role in the financial analysis of investments but remains complementary to traditional financial factors. … We found that politics had a negligible or neutral influence on investment decision making for institutional investors and advisors.”

For this issue, we asked several successful financial advisors the following question—and received a wide range of responses:

How do you address ESG considerations for client portfolios?

Richard Grant, NSSA, ChFEBC

Richard Grant, NSSA, ChFEBC

Founder, CFO, and managing member at RFG Capital Management LLC in Gilbert, AZ

“Clients are asking for ESG investments, especially of late, after changes and events that have happened around the world over the past few years. These include the death of George Floyd here in the U.S. and the reaction to that, and the focus and importance of human rights around the world.

“Some clients focus more on diversity, some on the environment, and some on governance, like making sure companies have appropriate compensation for corporate executives. If a client wants their portfolio to be socially responsible in a comprehensive way, I can do that inside the portfolios of one of our third-party active money managers. I can do it in a conservative, balanced, or growth way, depending on the client’s investment personality.

“Socially responsible investing works perfectly with fiduciary duty. The definition of fiduciary duty is to look at what is in the best interest of the client, and their likes and dislikes in the realm of the real world. You try to create a portfolio based on what kinds of investments they don’t want, like tobacco or gun companies, and then what kinds of investments they do want, like clean technology or a company that successfully meets its DEI [diversity, equity, and inclusion] goals.

“I think it’s most important to find out who your client is as a person, period. That ties the bond with the advisor and client even more.”

Ivan Illan, AIF, CFS,

Ivan Illan, AIF, CFS,

Founder and chief investment officer of Aligne Wealth Advisors Investment Management (AWAIM) in Los Angeles, CA

“As a member of the Financial Advisor IQ [FA-IQ] Leadership Council, I contributed to a recent study it conducted. FA-IQ surveyed 216 advisors across all channels to gauge their view of the role ESG metrics play in a retail portfolio and what demand they’re seeing from clients.

“Roughly equal portions of respondents said the volume of client questions about ESG has moved in either direction, with 12.5% reporting an increase and 11.6% reporting a decrease in the past six months. About 37.5% said they have never received questions about ESG, and about 39.8% said they haven’t noticed a change.

“Responses varied by geography. While half of the respondents in the South reported they never receive client questions about ESG, only one in five advisors in the Northeast said the same. And while the respondents reporting an increase in interest around ESG outnumbered those reporting a decline in the Northeast and West, more respondents in the South and Midwest reported decreases in interest than those reporting increases.

“In our firm, clients rarely ask about ESG—maybe a handful of times over the past few years. Even when we are doing a review of an existing portfolio, we never get the questions about having screens or filters for investments related to ESG. About 60% of our client base is between the ages of 50 and 70, and most are business owners, corporate executives, or retirees—ESG seems to be a nonissue for them.

“As for our investment philosophy, we really believe that if we could extract some good performance for our clients by leaning into E [environmental] initiatives, or S [social] initiatives—to any significant extent—we would. The G—or governance part—has always been very core to our investment philosophy.

“Labeling investments as productive and positive for the environment and for social issues is very complex and not so black and white. For example, one of the largest investors in renewable energy are the oil and gas companies. So one of the arguments we make is that if you really want there to be environmental solutions to energy, then invest in oil and gas companies, because they are really committed to maintaining their leadership role in being energy producers—whatever that may evolve into.

“We don’t employ an ESG screen when selecting our investments—we just really find those types of screens fairly useless. At the end of the day, as an investor fiduciary, I have to make sure we’re acting in the best interest of clients. I feel that investing in ESG—as a blanket label—is not something that is currently going to provide much value to the client, so I wouldn’t be acting in good faith as a fiduciary.”

Anjali Jariwala, CFP, CPA

Anjali Jariwala, CFP, CPA

Principal of FIT Advisors, Redondo Beach, CA

“I like the concept of ESG, and it’s becoming more and more popular. Historically, socially responsible funds would underperform the market, but that’s no longer the case.

“But I do have a concern about funds that group ESG together.

“There are a lot of screens being applied to the one fund, which increases the burden of the investor to understand how the scaling on the various screens is being applied. There are too many screens that can conflict with each other. Think about Tesla, which could be great for the environment but not great for governance. I prefer to focus on funds that have a narrower scope because I think it’s easier to apply screens without the conflicts. Sustainable investing is popular with my client base, so I like to use funds that focus on environmental sustainability. They do also apply social screens, but that comes after the primary goals of sustainability. Others ask for special funds for the S in ESG—social.

“I predominantly use one third-party fund manager, and it conducts really sound due diligence and good reporting on sustainable funds. For those clients who are more interested in social funds, unfortunately, the fund manager’s use of ESG data and reporting is not very robust right now. So I would have to call the fund manager to find out how it is building the funds and what kinds of data it is reporting.

“I take the current ‘controversy’ about ESG and fiduciary duty with a grain of salt—you can get really good returns from these investments. But it needs to make sense in the overall portfolio, and I would want to make sure that I’m building the portfolio so the client is still getting the returns they’re expecting long term.

“I think all of the differing discussions and pushback about ESG are actually a really good sign—it shows that ESG has become more mainstream, and there continues to be more and more interest in it. From a fiduciary standpoint, I think it’s imperative for all of us as advisors to let clients know that there are investments out there like this. We need to show them the data and have the conversation, so the client can decide for themselves.”

Timothy Lay, CFEI, AIF

Timothy Lay, CFEI, AIF

Principal advisor at TPA Financial in Sisters, OR

“I have two ‘titles’—investment advisor representative and trusted partner advisor—but informally I like to think of myself as a ‘servant leader.’ That simply means using my skills, experience, and knowledge to educate, influence, and guide people during the process of improving their personal and financial futures. It means actively showing clients patience, respect, confidence, and transparency.

“I have the ability to offer clients both ESG and faith-based investment solutions that provide the opportunity to serve clients’ investment objectives while meeting their social or spiritual values. We can incorporate impact investing into active portfolio management by using active managers who are skilled at conducting the appropriate research and who may offer several different investment options that incorporate ESG or faith-based parameters.

“You can also have a portion of the portfolio actively managed and a portion in more of the traditional investment models. Each strategy and each client may have different goals and objectives, and you can achieve those utilizing any number of methods. No matter what manager or combination of managers I may recommend, the key objective is delivering a customized investment solution designed to meet the financial goals of each investor—and acting in their best interests as a fiduciary.

“The impact investing space is growing in awareness, and there are several good platforms that offer ESG and faith-based investments. If you don’t currently offer ESG or faith-based options, my question would be why not? We have a duty to know what is out there and to be able to address the needs of our clients and future clients. Ask questions! If you don’t ask your clients if ESG or faith-based investing is important to them, chances are they don’t even know it’s an option.”

Divam N. Mehta, CFP, ChFC

Divam N. Mehta, CFP, ChFC

Founder of Mehta Financial Group LLC, in Richmond, VA

“Our team incorporates impact investing within the firm’s investment policy guidelines in the interest of meeting our clients’ specific interests and fostering strong client relationships. We do not view impact investing as a different asset class, but rather as a varying component of the investment strategy itself.

“For example, if the client is comfortable with a specific asset-allocation model, then we strive to find SRI [socially responsible investing] investments that will meet the strategic asset class. If this is not possible, then we use either individual equities, ETFs, mutual funds, or sectors to complete the asset-allocation model.

“Advisors who use actively managed strategies should remember that clients who desire impact investing ultimately do because of philosophical viewpoints, and not necessarily for the highest returns. With this in mind, it is important to consider that chasing the highest returns is not the end goal for many clients who want to participate in impact investing. Many clients would prefer to invest with their conscience rather than striving for the highest returns possible.

“I do not believe that active management and impact investing are necessarily mutually exclusive. You can definitely have both aspects of wealth accumulation accompany one another. Moreover, risk is subjective from one client relationship to the next.

“During the discovery phase of the relationship, we discuss the risk parameters of all investment strategies that we will develop for the client. Once the risk parameters have been quantified and established, our team will often begin to build the portfolio with SRI investments as an important component. We always err on the side of caution when it comes to SRI investments in the portfolio—meaning we will take a conservative approach rather than add a position that might push the risk parameter to an unwanted level.

“If a client decides that SRI investing is a strategy he or she wishes to strongly pursue, we will generally build a custom portfolio that is in line with their philosophical views. The process and mechanics of the portfolio usually will not change. We will continue to make tactical and active changes to the portfolio based on market performance and/or external factors, along with periodic rebalancing.

“The presence or absence of an SRI investment strategy should not alter this process unless requested by the client. The idea is to incorporate our firm’s dedication to the principles of risk management, diversification, and tactical portfolio management within all client portfolios. SRI investing and active management can coexist well in that context, and all client portfolio strategies are founded in ongoing quantitative and qualitative analysis.”

“Regarding fiduciary duty, I do not believe that fiduciary duty and ESG are incompatible—rather, they have synergistic mechanisms in place at the macro level where ESG should naturally be an option in a client’s portfolio if so desired. Ultimately, fiduciary duty should account for the client’s best interest. If the client wishes to proactively invest in ESG investments for moral and ethical reasons, there is no better fiduciary obligation than looking out for the client’s outlook on life.”

Clyde Cleveland

Clyde Cleveland

Co-founder and president of Impact Wealth Group (IWG), in Fort Lauderdale, FL

“I am passionate about preserving and improving the environment. But I have major issues with the way the current ESG ‘movement’ is being framed. I believe it is full of misinformation, driven by many different agendas, often founded on inconclusive research, and lacks honest and open debate.

“I have a lengthy background in supporting environmentally friendly investments. In 1979, my partner and I founded a company funding environmentally friendly technologies. One of our first ventures was to fund the installation of windmills in southern California. Over the next six years, we became the third-largest research and development partnership company in the country. We named our concept ‘environmental entrepreneurism.’ I am very proud that an international conference on socially conscious investing honored me as ‘the first socially conscious venture capitalist’ in 1986.

“With this background and decades of closely following this area, I believe that billions of dollars are being spent in the name of environmentally friendly efforts that do little to improve our environment, our society, or our health. In my opinion, many of these initiatives could even have a negative impact.

“I continue to support well-researched and effective efforts on the part of the private sector to improve the environment. However, political and interest-group agendas, as well as frequently misguided government regulations, are major obstacles. To me, the concepts of ethical responsibility and ‘do no harm—to anyone’ are all too often missing. If I were to start a company today, I would call the idea ‘ethical environmental entrepreneurism.’ I believe economic value creation and responsible stewardship of our planet go hand in hand with a strong ethical grounding.

“In my role as a financial advisor, I try to find creative ways to help clients who express an interest in investments that reflect their personal beliefs. Of course, they need to make sense in the context of the client’s overall financial and investment objectives. I would much prefer that their investments be in individual companies that have demonstrated an actual track record of having a positive impact in their specific area of expertise—rather than broad ESG-oriented funds. This may take some more work and due diligence, but it is totally worthwhile.”

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

New this week:

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.