Client-centered guidance for uncertain economic times

Client-centered guidance for uncertain economic times

There is no shortage of pessimism in the financial media about inflation, rising interest rates, and a possible economic slowdown. What guidance are financial advisors providing to their clients?

How are financial advisors guiding clients in this current economic environment, with high inflation and a possible economic downturn—or at least an economy that could be a lot better?

With prices for gas, heating, electricity, and food on the rise, many household budgets are stretched thin. Additionally, the impact of still-elevated real estate prices and decades-high mortgage rates has caused many who were considering moving to a larger home to pause their plans.

Moreover, the outlook for the economy means potential layoffs and lower wage hikes. And, of course, the economic situation, combined with inflation, is hitting retirees and their sources of income.

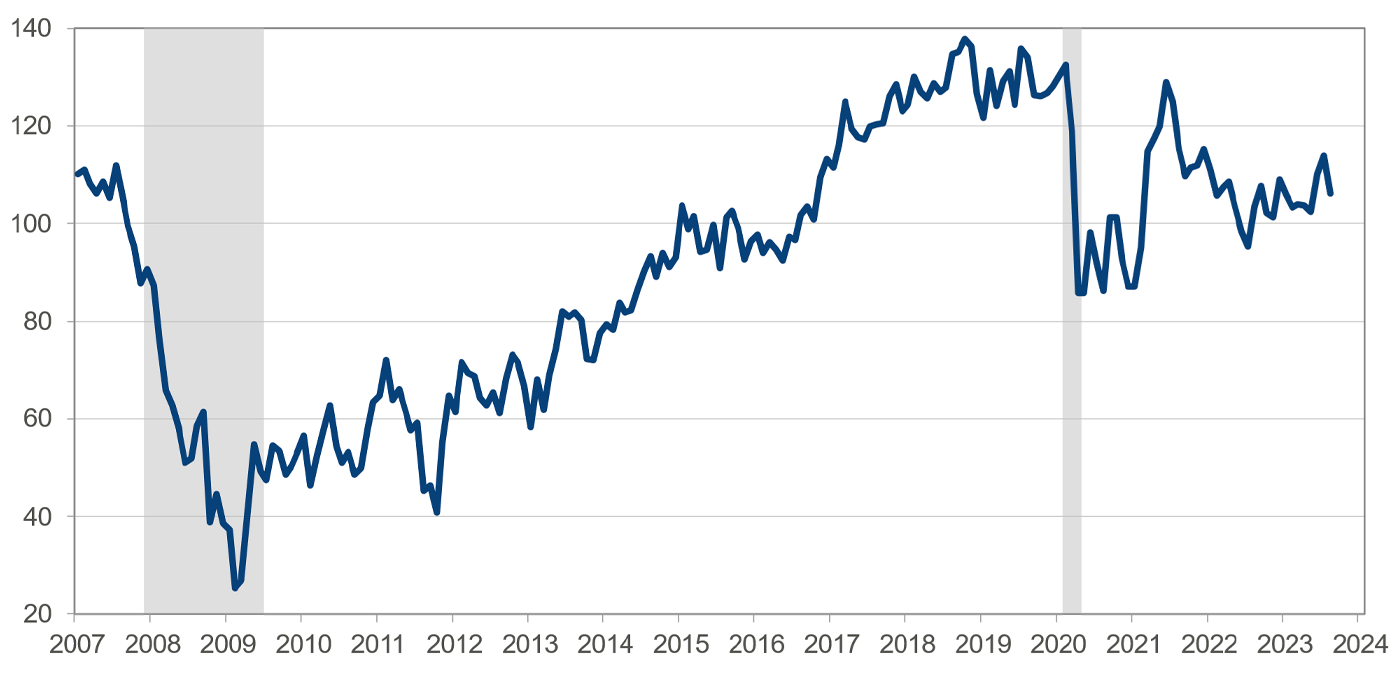

While U.S. consumer confidence has improved modestly over the past year, a key metric—The Conference Board Consumer Confidence Index—dropped to 106.1 in August from a revised 114 in July.

FIGURE 1: THE CONFERENCE BOARD CONSUMER CONFIDENCE INDEX

Note: Shaded areas represent periods of recession.

Sources: The Conference Board, National Bureau of Economic Research (NBER)

“Consumer confidence fell in August 2023, erasing back-to-back increases in June and July,” said Dana Peterson, chief economist at The Conference Board. “August’s disappointing headline number reflected dips in both the current conditions and expectations indexes. Write-in responses showed that consumers were once again preoccupied with rising prices in general, and for groceries and gasoline in particular.”

Peterson added, “Assessments of the present situation dipped in August on receding optimism around employment conditions: fewer consumers said jobs are ‘plentiful’ and more said jobs are ‘hard to get.’”

Moreover, the gauge measuring consumer expectations over the next six months—the Expectations Index—fell to 80.2 from 88. Any reading below 80 historically points to a recession within the next year. Indeed, The Conference Board still expects a recession to start by the end of this year.

Related Article: A different kind of bear![]()

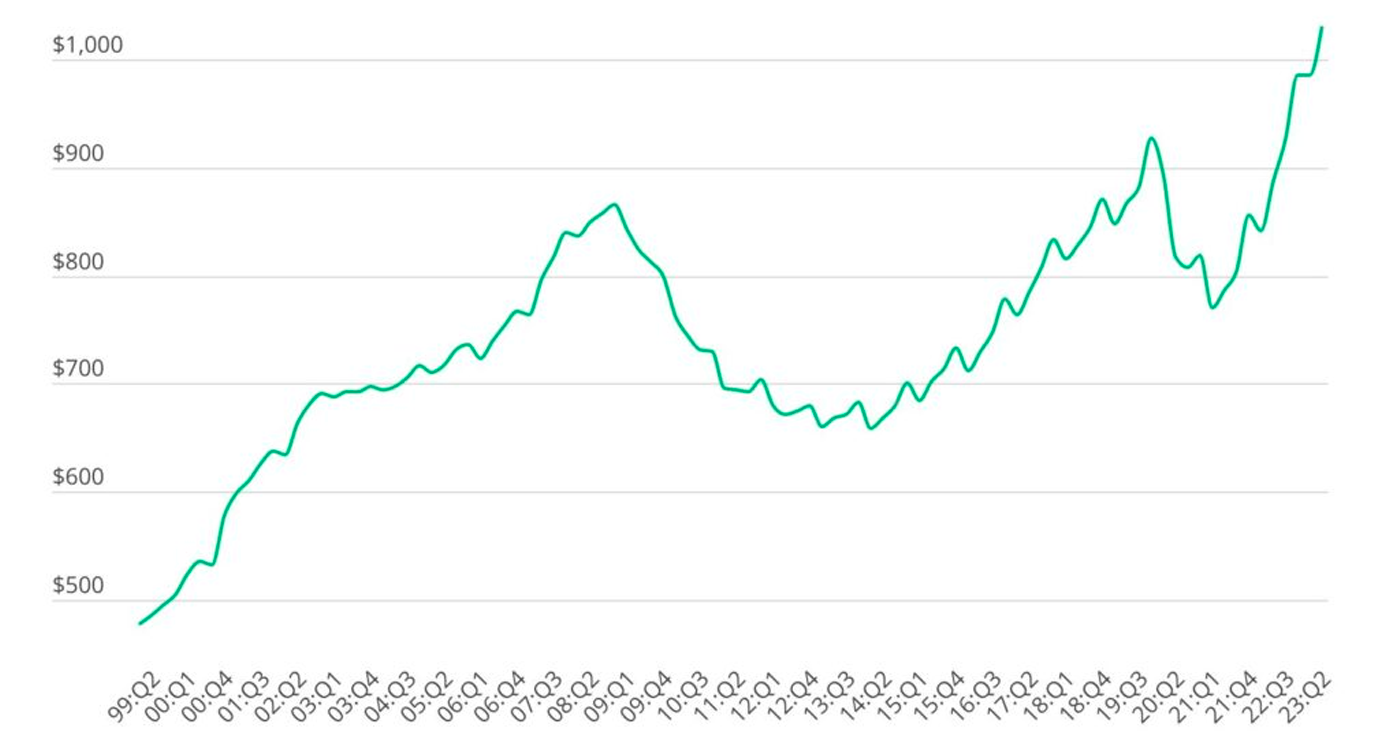

Another troubling statistic is that, according to Lending Tree, consumers’ total credit card debt has reached a record level, surpassing $1 trillion for the first time in the U.S.

The New York Post noted recently, “Inflation-squeezed Americans are defaulting on their credit cards and auto loans at levels not seen since the financial crisis—and the struggle to pay their bills is poised to get worse as interest rates rise and the moratorium on student loans expires. … This year, credit card delinquencies have hit 3.8%, while 3.6% have defaulted on their car loans, according to credit agency Equifax. Both figures are the highest in more than 10 years.”

FIGURE 2: TOTAL OUTSTANDING CREDIT CARD BALANCES (BILLIONS, SEASONALLY ADJUSTED)

Sources: Lending Tree, New York Federal Reserve, Equifax

Interestingly, the budget crunch for households is not limited to income segments that are typically considered middle class or lower. Data from a 2023 report from PYMNTS and LendingClub shows that nearly half of high-income consumers—those earning $100,000 or more—say they are living paycheck to paycheck. The report also notes that “80% of consumers who have noticed price increases believe their wages have not increased to at least match inflation.”

How are advisors responding to heightened client concerns about the economy?

Several financial advisors told Investment News that they are preparing their clients for a downturn.

Investments in client portfolios should be of high quality to better weather any storm, said Martin Smith, president of Wealthcare Financial Group.

“You have to look defensively to where consumers are likely to continue to spend money,” Smith said. “That won’t be luxury spending, it will be consumer staples, health care, insurance, energy, gold and short-term Treasuries.”

Ann Covington Alsina, founder and principal at CovingtonAlsina, told Investment News that her team doesn’t move portfolios much in response to a pending recession—rather they align portfolios with a client’s goals and the time until that goal.

“For a recession, we focus on employability and emergency savings,” Alsina said. “Paying down consumer debt and having six months’ of living expenses in easily accessible liquid assets are more important than trying to time the market.”

Above all, proactively communicate with your clients, said Matt Malone, head of investment management at Opto Investments.

“It’s paramount for advisors to establish a strong communication plan with your clients to ensure that classic behavioral finance issues do not disrupt a plan based on long-term goals,” Malone said. “To that end, make sure strategic portfolio allocations are in line with long-term goals and rebalance as needed.”

In line with that sentiment, many advisors we have interviewed over the past two years for Proactive Advisor Magazine say that “staying the course” with a risk-managed investment plan and portfolio allocation is usually the wisest course of action for clients—even in difficult economic times.

Brian Higdon, a co-owner of Thoroughbred Asset Management in Kentucky told our publication in August, “While fixed-income or annuity solutions might be appropriate for a specific client’s portfolio, we are great believers in the longer-term wealth-building opportunity of equity markets—especially when third-party managers can provide, if suitable for any given client, risk-managed strategies that can adjust to changing market conditions and help mitigate risk during large market declines.

Brian Higdon, a co-owner of Thoroughbred Asset Management in Kentucky told our publication in August, “While fixed-income or annuity solutions might be appropriate for a specific client’s portfolio, we are great believers in the longer-term wealth-building opportunity of equity markets—especially when third-party managers can provide, if suitable for any given client, risk-managed strategies that can adjust to changing market conditions and help mitigate risk during large market declines.

“These managers have access to sophisticated research tools and quantitative analysis that help inform their investment decisions, and most offer both tactical and strategic investment strategy options. We assess those offerings and then select what is usually a blend of strategies that aligns with a client’s risk profile and overall investment objectives.”

We asked several other advisors to share how their clients have been faring and what guidance they’ve offered on how to best weather rising interest rates, inflation, and a potential economic slowdown. As comprehensive financial planners, they all noted that it’s not just about clients’ investment portfolios—it’s about the entirety of their clients’ financial lives and their emotional reactions to what can be a challenging economic environment.

Frank A. Leyes, ChFC, founder, president, and principal financial advisor at Frank A. Leyes & Associates, a multi-office firm based in Roanoke, Virginia, has been helping clients deal with uncertainty by adjusting their spending and investment strategies: “Yes, clients are talking about some of these things. In particular, 2022 was the worst year in 50 years due to the combined decline in the stock and bond markets, and wages not keeping up with the surge of inflation—it really was the perfect storm.

Frank A. Leyes, ChFC, founder, president, and principal financial advisor at Frank A. Leyes & Associates, a multi-office firm based in Roanoke, Virginia, has been helping clients deal with uncertainty by adjusting their spending and investment strategies: “Yes, clients are talking about some of these things. In particular, 2022 was the worst year in 50 years due to the combined decline in the stock and bond markets, and wages not keeping up with the surge of inflation—it really was the perfect storm.

“Everyone is just trying to make ends meet, and with increasing inflation, there’s nowhere to hide. People who took withdrawals from their investment accounts for income saw a decline on both the stock and bond side.

“I’ve helped them make changes to their investment portfolio based on the conditions over the past couple of years. We made some shifts into income-oriented investments that had adjustable rates so clients wouldn’t be hammered as much in this interest rate environment. We also found commodity funds that benefit from inflation, money market accounts with good yields, and we’ve pared back international investing due to the Ukraine War.

“Everyone is making adjustments—not only in their investment approach but also in their lifestyle by spending less. A number of clients have adjusted their household budgets and deferred major purchases.”

Mary Lyons, founder of Wealth Woman Inc. and Benchmark Income Group in Dallas, Texas, says, “Clients are wanting more frequent touches during this time. I’m hearing from many clients that they feel a tremendous amount of pressure to make sure they can maintain their lifestyle—particularly if they’ve been laid off or are afraid they’re going to be laid off or even that they won’t get bonuses this year.

“One of the ways to mitigate their concerns is by handling clients’ income first and their net worth second. I do this by implementing an alternative source of income that they can pull from. That way, when the market goes down, they don’t have to withdraw money from their investment portfolio for income. If they are withdrawing money during a loss, that just compounds the loss—and when the market recovers, withdrawals just eat up the recovery in the portfolio, and they can’t get back to where they were. That just creates too much stress in retirement.

“The alternative fund for income is what I like to call a market shock absorber or a volatility buffer because it doesn’t fluctuate in value. For example, a custom-built whole life insurance policy, if structured properly, will provide after-tax cash in a buffer account that clients can use as income.

“That gives clients a permission slip to be more aggressive in their investment portfolio. It’s also a permission slip to save a little bit less now when money is tight, and they still can get where need to go for retirement. Rather than looking at investments as the only tool, I look at the entire suite of tools and sometimes do really creative things to enable clients to continuously have income and maintain their lifestyle in their retirement.

“Moreover, if clients have strategic capital on the sidelines, they will be able to take advantage of opportunities that might come up in the next 12 to 24 months. Sometimes having liquidity is more important than immediate yield.”

Adam Koos, CFP, CMT, CEPA, president, senior financial advisor, and portfolio manager at Libertas Wealth Management Group Inc. in Columbus, Ohio, offers this insight on how current economic conditions are affecting business-owner clients and their transition planning: “Business owners are most impacted right now, depending on the industry. Higher interest rates are affecting them as well, especially manufacturers—the cost of carrying inventory and loan costs are higher than they used to be.

Adam Koos, CFP, CMT, CEPA, president, senior financial advisor, and portfolio manager at Libertas Wealth Management Group Inc. in Columbus, Ohio, offers this insight on how current economic conditions are affecting business-owner clients and their transition planning: “Business owners are most impacted right now, depending on the industry. Higher interest rates are affecting them as well, especially manufacturers—the cost of carrying inventory and loan costs are higher than they used to be.

“For business owners getting to the end of their careers, last year was the best year to sell their company. Now rates are higher, and the buy side has to pay more, so M&A is slowing a bit. Many clients who are owners in their 70s are still operating because, while they may have been thinking of selling, they kept kicking the can down the road. Now they’re having trouble selling their business because of the lack of qualified buyers, all while being forced to continue working.

“Business transition planning is crucially important for every company, and one of my passions is to bring awareness to the business-owner community so that they throw the phrase ‘exit planning’ out of their vocabulary. Most owners say they’re not ready to sell, but that’s not the point. Anything can come up suddenly, at any time—an accident, disability, disease, partnerships that go awry, and even unexpected death.

“We want to make the company ready for anything, at any time. I encourage them to be prepared and plan now for their business transition and exit. That way, when a buyer comes around, they’re ready to go.

“The biggest problem is procrastination—it goes right along with estate planning, which is also the most neglected area of financial planning. In fact, only 52% of people have an estate plan at all, and owners need to have their financial house in order in case something unforeseen happens to them.

Koos adds, “I also work with a lot of clients who want to move—some want to upgrade, and others want to downsize. Before, with historically low interest rates, people could more easily do this, or even keep their home and buy a second home or condo. But now rates are going up and mortgage rates are reaching 15-year highs, all while real estate prices in many places have gone through the roof. So, if clients sell their current home and move, they are going to replace the lower rates they were paying with a much higher rate.

“Some who want to downsize only have 10 years left on their current mortgage, and they’re thinking of just paying cash for their smaller home from the proceeds of selling their current home. But even if someone downsizes, they’re going to end up paying more or the same for the new house. If clients want to upgrade to a bigger house, I’m a little concerned that they’re going to get themselves into trouble by not only having to pay a much higher mortgage but also higher taxes and insurance.

“Another thing that keeps coming up in this economy has more to do with emotions than the stock market or economic data.

“A lot of clients who have retired and don’t have as much to do are spending entirely too much time watching TV. What’s worse is, much of what they watch is either financial or political news that ultimately freaks them out with extreme opinions about market crashes, or an apocalypse du jour imposed on the country by whoever happens to be in office today.

“In some, albeit rare situations, a client might come to us, worried that the world is going to end. But our job as fiduciaries is to listen, educate, and keep our clients on course, not dissimilar to a marathon.

“At end of day, a financial plan is your road map, and no matter what the market throws at us—whether it’s a market crash, recession, or disinflation—as long as you have a clear and detailed financial plan in place, and as long as you’ve stress-tested it for a multitude of possible scenarios, we can keep our head down, push forward, and guide our clients with confidence, letting them know that they’re going to be OK.”

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.

RECENT POSTS