Active Management 101

What is active management?

There is a great deal of confusion surrounding the term “active management” created by the business press. When one reads a headline in any given year that “active managers” are underperforming or overperforming their benchmarks, this typically is referring to “active” managers of a mutual fund—who are being measured against a specific index or competing funds within that style.

Within the field of true active portfolio management, this narrow and misleading definition really has little significance.

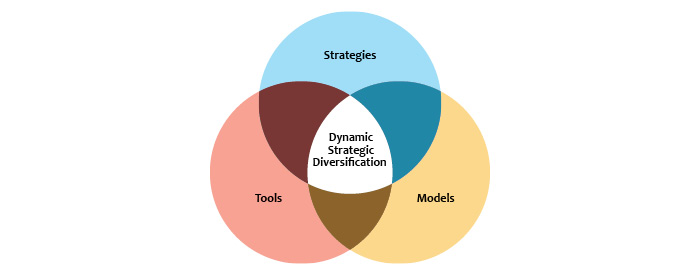

Active investment management is not about exceeding a specific benchmark or “beating the market.” Active management seeks favorable risk-adjusted returns in any market environment, generally employing sophisticated algorithms and models to capture gains and protect against losses in a wide variety of sectors, asset classes, and geographies.

It is about controlling risk in the markets, finding new ways to dynamically diversify, and smoothing out the long-term volatility typically found in any asset class. Active managers tend to rely on quantitative approaches for asset allocation, exposure to the market, and adjustments to portfolios based on current market conditions. When it comes to evaluating returns, they generally will not compare to the S&P 500 or global total market indexes, but they are far more interested in risk-adjusted returns and in meeting their portfolio objectives.

In theory, it is fundamentally about a long-term approach to portfolio management that is diametrically opposed to “buy and hold.”

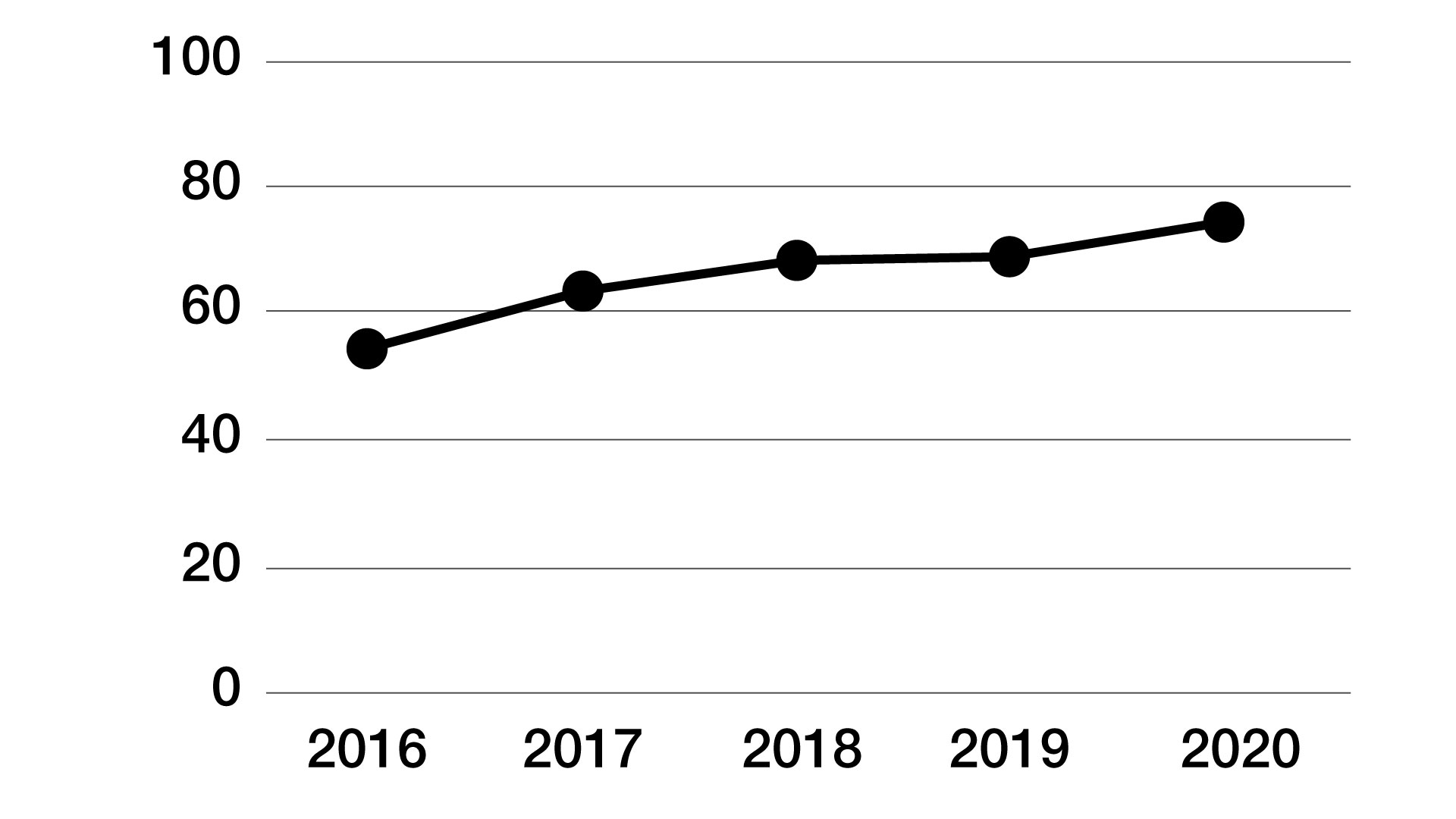

Fee-based revenue growing among advisors

According to data and analytics company PriceMetrix by McKinsey, “… more clients and their advisors continue to adopt the asset-based fee model. Revenues from fees now contribute almost three-quarters of overall gross production for financial advisors, up from 54 percent in 2016. Fifty-eight percent of client relationships now have fee-based accounts, up from 43 percent only four years ago.”

Source: PriceMetrix by McKinsey

Connect with us