The decision to invest in gold should not be reactive

The decision to invest in gold should not be reactive

While many view gold as an opportunistic “trade,” investors concerned about enhanced diversification, capital preservation, and optimized returns should consider gold as a key portfolio element.

Gold has been the topic of news and commentary throughout 2023—including the fact that the precious metal recently punched through the $2,000 level for the second time this year. Gold has been on a run higher since November 2022, with the most recent gains fueled in part by concerns over the banking crisis.

Gold’s continuous contract posted an increase of 8.6% in Q1 2023 (see Figure 1). According to data from Bespoke Investment Group near the end of Q1, gold was up about 25% since the overall market’s “COVID lows” in 2020.

FIGURE 1: GOLD CONTINUOUS CONTRACT—LAST SIX MONTHS

Source: MarketWatch, data as of 3/31/2023

Interest in gold has increased due to analyst outlooks for the metal, which have cited a wide range of factors: volatile equity markets, inflation, uncertainty over the Federal Reserve’s interest-rate policy, the dollar’s weakness for the past six months, rising government debt levels, and concern over recession forecasts and geopolitical unrest. Gold’s relative status as a “safe haven” investment has likely been influenced by all of these current conditions.

Reuters reported that Goldman Sachs and other firms have recently raised their outlooks for gold:

“Goldman Sachs on Thursday [3/23] raised its gold price forecasts, describing it as the best hedge against financial risks, and reiterated its bullish view on commodities as a banking crisis has yet to spill over into physical markets.

“It hiked its 12-month gold price target to $2,050 an ounce from $1,950, joining others such as Citi, ANZ and Commerzbank in raising forecasts.”

However, there is far from a consensus on the longer-term outlook for gold—especially if inflation shows real signs of abating and the Fed begins to enter a rate-cutting cycle. In a Reuters poll of 38 analysts and traders in late January, the median forecasts for gold were for prices around $1,890 in 2024.

An interesting and even-handed commentary from the World Gold Council examines the implications of interest-rate policy and rate volatility, inflation, and economic growth forecasts for their impact on gold. The author summarized,

“Cyclical developments in growth and inflation will dominate the short-term outlook. And while it is likely that the Fed pricing moves back up again, especially if recent financial sector fears can be put in the rear-view mirror, investors should keep an eye out for a hint from the Fed that it is close to done. This could provide more support for gold.

“Longer term, gold has a key role as a strategic long term investment and as a mainstay allocation in a well-diversified portfolio. While investors have been able to recognize much of gold’s value during times of market stress, the structural dynamics pointing towards a low-growth, low-yield environment should also be supportive for the precious metal.”

Gold’s advantages as a portfolio diversifier, particularly during inflationary periods

While all of the analyst commentaries are interesting, they are no more than educated opinions. They also tend to lean toward “trading opportunities” for gold, not viewing gold as an integral part of an investor’s portfolio.

Two phrases in several of the analyses we have reviewed are more important for financial advisors and their clients than a short- or intermediate-term outlook or trying to “chase” gold higher. These are “portfolio diversification” and “strategic allocation.”

What evidence supports a more long-term rationale for investors owning gold?

The World Gold Council’s paper, “The Relevance of Gold as a Strategic Asset 2020,” provided a wealth of data-driven findings. John Reade, head of research and chief market strategist noted the following:

- Since 1971, when gold was released from its peg against the U.S. dollar, its average annual return has averaged 7.8%—higher than cash, bonds, and emerging-market equities.

- Gold has demonstrated unique characteristics of correlation to U.S. equities since 1987:

- When the S&P 500 is relatively flat over a weekly period, gold has a very slightly negative correlation—essentially no correlation either way.

- When the S&P 500 has been especially strong over a weekly period, gold has had a moderately positive correlation—far more than traditional commodities.

- When the S&P 500 sharply declines over a weekly period, gold shifts over to a moderately negative correlation, unlike traditional commodities. (This is a historical average. As we have seen during volatile market “events,” the negative correlation of gold to equities can be far stronger.)

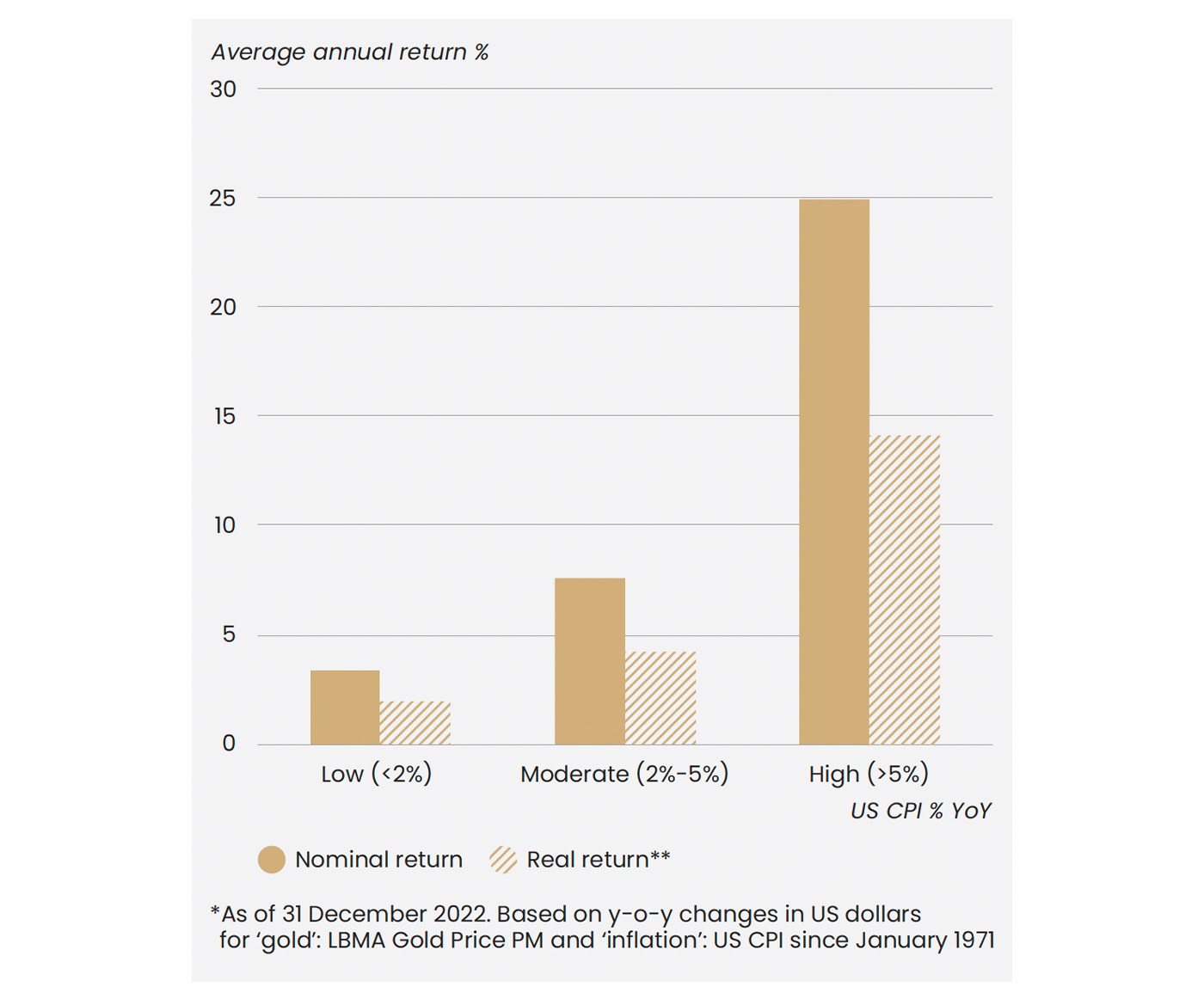

In a 2023 update to this paper, the World Gold Council points out that gold performs particularly well during periods of inflation.

FIGURE 2: GOLD HISTORICALLY RALLIES IN PERIODS

OF HIGH INFLATION

GOLD NOMINAL AND REAL RETURNS IN US DOLLARS AS A FUNCTION

OF ANNUAL INFLATION

Sources: Bloomberg, ICE Benchmark Administration, World Gold Council

Gold’s long-term role in investment portfolios

Jerry Wagner, founder and president of Flexible Plan Investments (FPI), a turnkey asset management program (TAMP) has remarked,

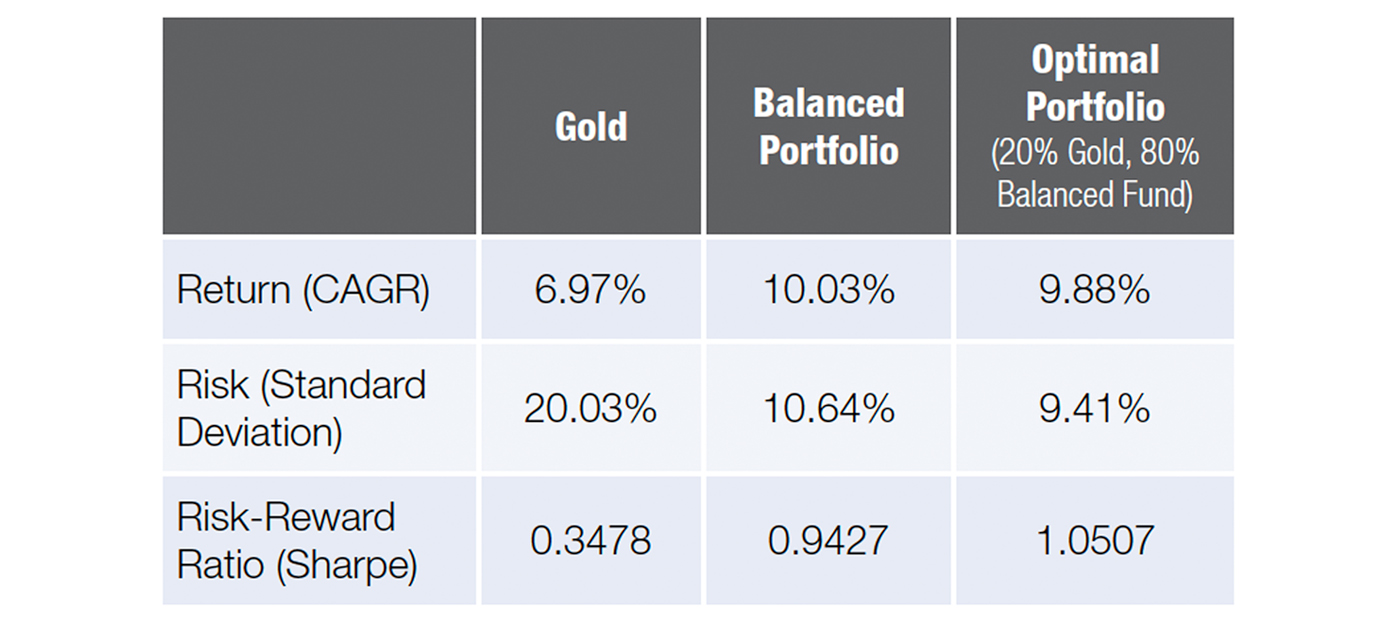

“For investors looking for further portfolio diversification, gold is a unique diversifier—especially in trying times. Our comprehensive white paper shows that over the past 40-plus years gold has proven to be the best or second-best asset class to hold during eight different investing scenarios that concern investors. And holding gold in even a balanced portfolio has increased risk-adjusted returns over that period.”

TABLE 1: GOLD VS. A BALANCED PORTFOLIO VS.

AN ‘OPTIMAL PORTFOLIO’ (1973–12/31/2021)

Source: Flexible Plan Investments, “The Role of Gold in Investment Portfolios,” July 2022

The FPI white paper referred to is a comprehensive analysis of gold’s performance, looking at data over a lengthy period (1973–2021).

Presented in part in our article “How gold can help in creating a more optimal portfolio allocation,” the paper gives the history and ongoing discussion about the investment merits of gold, offering many compelling reasons why investors should consider adding the precious metal to their portfolios.

The entire paper does the following:

- Examines the performance of gold relative to other asset classes under different market environments that typically concern investors.

- Looks closely at how gold performs under different classic economic regimes.

- Analyzes gold’s diversification characteristics versus other asset classes.

- Reviews the risk-reward characteristics of portfolios with different allocations to gold.

The study concludes, in part,

“Our study demonstrates that adding gold to a typical balanced portfolio has been beneficial across a wide range of allocations in terms of boosting risk-adjusted returns. Over the time period studied, the optimal allocation in a balanced portfolio has actually been 20% to gold and 80% to a balanced portfolio, representing a result of roughly 50% stocks, 30% bonds, and 20% gold. In fact, investors could have allocated as much as 35% to gold based on historical analysis and still placed higher on the frontier of efficient portfolios than a purely balanced fund. …

“… Based on our study, it appears most investors are likely underinvested in a full range of investment alternatives, and specifically in gold as a long-term asset class. …

“Investors concerned about capital preservation in times of macroeconomic risk and optimized returns in favorable times should strongly consider gold as a key portfolio element. Over the long term, gold offers the broad benefits of (a) ongoing marketplace demand in the face of limited supply; (b) historic protection from extreme market events, high periods of inflation, and devalued currencies; (c) a time-tested component of portfolio diversification; and (d) liquidity and versatility in terms of the many forms of ownership possible for an investor.”

***

While the news, macroeconomic data, monetary policy, and sentiment all influence short-term gold-price swings, historical data regarding gold’s potential role in a well-diversified portfolio should be the focus. No matter how an investor chooses to take advantage of the investment benefits of gold, the key point is that an investment in gold should be proactive, not reactive.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Please take the opportunity to download the referenced full white paper here (for investment professionals only).

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.