INDUSTRY INSIGHTS

In-depth examinations of significant developments in investment research, financial technology, behavioral finance, and active management approaches.

ADVISOR PERSPECTIVES

Experienced financial advisors discuss practice philosophy, client service, investment strategies, and how they have set their practices apart.

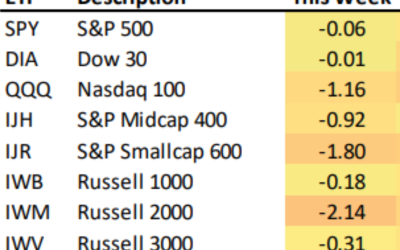

MARKET COMMENTARY

Observations and outlooks from well-known technical and research analysts, financial authors, and economists.

PRACTICE MANAGEMENT

Successful financial advisors provide tips on business-building strategies, including prospecting, obtaining referrals, client communications, marketing, technology, and more.

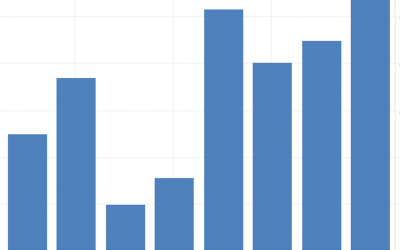

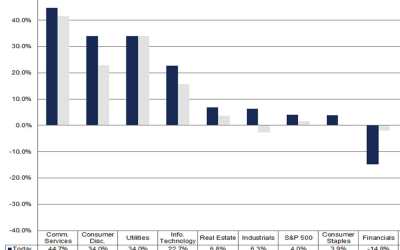

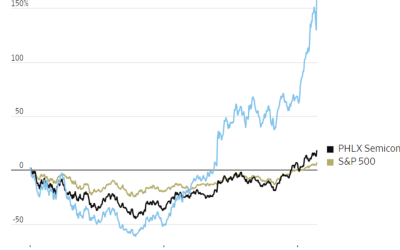

WEEKLY CHART REVIEW

Analysis of a timely market or economic theme illustrated with insightful charts.

Subscribe for new articles each week

No charge. Dedicated to promoting and educating the advisor community on active investment management through original, leading-edge content.

QUICK TIP

Addressing the complex planning needs of small-business owners

Arthur (Artie) Castro is the founder and president of Summit and Surf Wealth Management, located in Orange and Tustin, California. He is a highly experienced wealth manager with more than 25 years of experience creating goals-based wealth strategies for his clients.

Mr. Castro serves a diverse client base, including many entrepreneurs and small-business owners. He says, “Their planning needs can be complex, with a need to coordinate their personal financial-planning objectives with the unique needs of their role as a business owner. We can help small-business owners make informed decisions that promote long-term financial stability and growth.”

Mr. Castro’s firm provides a number of specific planning and implementation services for business clients, including the following:

- Comprehensive financial planning and cash-flow analysis across business and personal needs.

- Customized wealth management, with third-party managed accounts for nonqualified and qualified assets.

- Risk management and insurance planning, including key person insurance.

- Defined benefit and defined contribution retirement plan guidance and implementation.

- Succession and legacy planning.

- Consultation on executive compensation, profit-sharing plans, and employee stock ownership plans (ESOPs).

- Execution of living wills and trusts, using a highly qualified third-party resource.