Are clients fully prepared to fund their post-retirement dreams?

Are clients fully prepared to fund their post-retirement dreams?

Recent research shows that while many people are contemplating what they will enjoy doing in retirement, they aren’t fully factoring in the potential expense of their new activities.

Have you ever thought about running a family-friendly farm featuring llamas, alpacas, sheep, goats, and more? Starting a charter boat business in the Florida Keys or opening a bed-and-breakfast in the Pacific Northwest? Or leading church youth groups on missionary trips abroad?

Perhaps you want to join the growing ranks of RV enthusiasts, living on the road full- or part-time? Or return to school to earn a degree in culinary arts, creative writing, or computer programming—or some other field? Or have the ambitious goal of touring (though not necessarily climbing) the Seven Summits—the highest peaks on each continent?

While you may not be contemplating any of these objectives in your future, these are just a few of the thousands of activities today’s retirees are seriously considering.

The retirement stereotype of a quiet life of “family, friends, and free time,” while still attractive to many people in one form or another, is being turned on its head by another large retirement cohort interested in starting a new business, full-time volunteering or mentoring, joining nonprofit or community boards, becoming deeply involved in faith-based activities, gaining new skills and knowledge, beginning a second career, or exploring any number of other avenues for personal fulfillment.

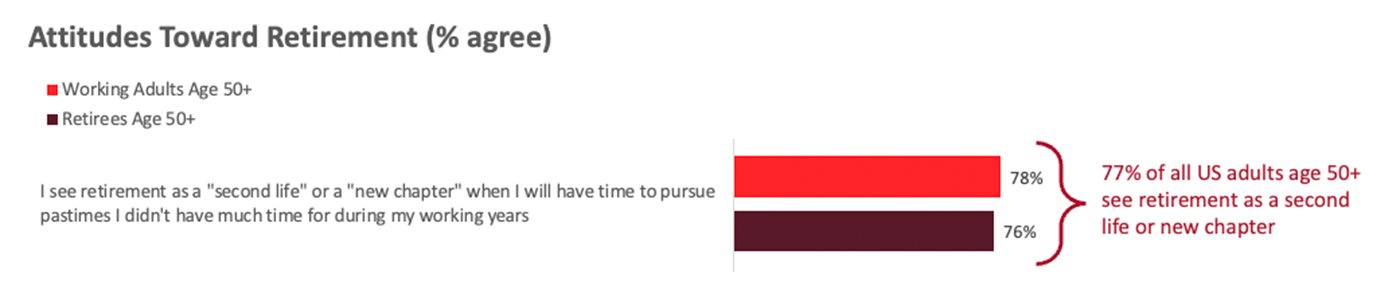

According to recent research from Lincoln Financial Group, for many people, “Retirement is seen as a ‘new chapter’ to pursue passions and pastimes people didn’t have time for during their working years.”

Source: Lincoln Financial, Consumer Sentiment Tracker, September 2023

“Often when you think you’re at the end of something, you’re at the beginning of something else.”

–Fred Rogers, television host, author, and minister

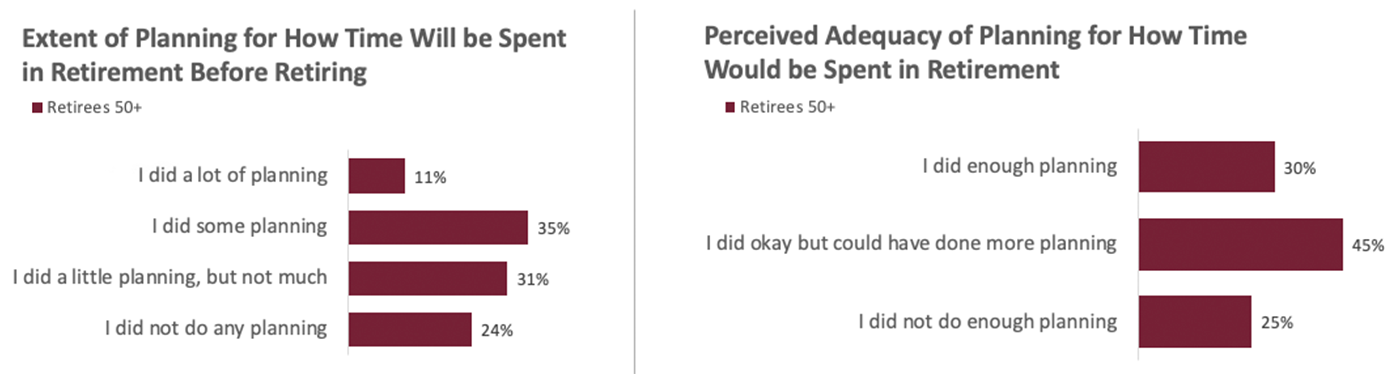

However, one of the issues facing this group is that their ultimate retirement objective or lifestyle may not be apparent to them as pre-retirees or even several years into retirement. And associated with this, while many people over the age of 50 may have an adequate financial and investment plan for basic lifestyle needs in retirement, they have not adequately planned for the expenses involved in pursuing all of their retirement aspirations. Lincoln’s research notes, “Despite the desire to plan for exactly what they want to do in retirement, only 11% of pre-retirees say they have done a lot of planning for pastimes in retirement.”

Source: Lincoln Financial, Consumer Sentiment Tracker, September 2023

The research further shows the following:

- “87% of individuals in their 50s and 60s who work with a financial professional have discussed an investment strategy for retirement, but only 53% have discussed a budget for their favorite activities.

- “Nearly half (48%) of individuals aged 50+ who work with a financial professional but have not discussed budgeting for their pastimes in retirement have grown more worried about their finances.

“‘Those approaching retirement today have no plans to slow down, and that’s what so many are overlooking in the planning process,’ said John Kennedy, EVP, Chief Distribution and Brand Officer at Lincoln Financial. ‘We want to help the next generation of retirees ensure their pastimes last a lifetime, and this research is a clear indication that there needs to be more of an emphasis on planning to do the things that you love, especially when you finally have time for them after your working years.’”

Kennedy added in a recent interview, “Advisors owe it to their clients to help them create a real lifestyle—complete with time and funds to explore these passions and pastimes—and to ensure that loved ones can be part of this plan,” Kennedy said. “More energy must be put toward a plan for these activities.”

For this issue, we asked experienced financial advisors the following question:

How do you help clients define—and plan for—their post-retirement aspirations?

Allen Jenson • Foley, MN

Allen Jenson • Foley, MN

Caliber Financial Group

Read full article

“… We believe that ‘retirement’ is an outdated term. We prefer to refer to people reaching the point in their lives where working becomes optional, opening up many different possibilities for their continued personal growth and the active lifestyle of their choice.

“… The discovery process is very important, both in a qualitative and quantitative sense. We spend a lot of time early on just asking questions intended to draw clients out on what their lives are all about, their dreams and aspirations, and what will be most important to them in the financial-planning process. We use excellent software that facilitates a collaborative process and allows us to build a goals-based financial plan, develop a thorough retirement-income blueprint, and examine various real-life ‘what if’ scenarios customized for each client.”

Tara Nolan, MBA • Kris McKinney • Colorado Springs, CO

Tara Nolan, MBA • Kris McKinney • Colorado Springs, CO

Nolan Financial Partners

Read full article

Tara Nolan: “We are passionate about helping our clients become highly confident about their total financial picture. I love guiding clients as they work through the puzzle of identifying, and then achieving, their financial priorities. This plays a key role in helping people accomplish their overall life goals. If someone asks what they can expect when they work with us, it is pretty straightforward. We are going to assist them in identifying what success looks like for them. We’re going to couple that with the resources that they have. And we’re going to show them the potential routes for getting there.”

Kris McKinney: “Helping clients achieve a sense of control over their current finances—and their financial future—is our top priority. In many ways, money is just a tool to allow people to pursue their life goals. We believe that as clients work to achieve the lifestyle they want that they also want to make their lives more meaningful. In that sense, we want to build close relationships so that our clients’ financial plans can be consistent with their values and aspirations. That is what makes our jobs so rewarding—to see clients lead more abundant lives.”

Toby Lewis • Bardstown, KY

Toby Lewis • Bardstown, KY

Thoroughbred Asset Management

Read full article

“We use a holistic approach to retirement planning that allows us to learn about our clients’ current circumstances and future goals, assess their financial situation, make investment recommendations, and develop a comprehensive financial road map that fits their unique needs. Our approach to retirement planning is thorough, covering everything from the essentials of budgeting and debt management to risk management and tax-mitigation strategies—and, most importantly, guiding clients as they seek to achieve their most aspirational financial and life goals. …”

“… The technical aspects of our role in providing financial guidance are very important. Our chief mission is to help clients gain a clear focus on their goals and then help them find appropriate solutions. I have years of experience doing just that and take a lot of pride in our retirement-planning process. But I derive the most satisfaction from building meaningful personal relationships with clients. I see my job as part counselor, part teacher, and part coach. We want to work collaboratively with clients and help them truly understand their retirement plan. We want to be there for them in good times and tough times—and be seen as a team that is trustworthy, caring, and always placing their interests first.”

Daniel J. Friedman • Farmington, CT

Daniel J. Friedman • Farmington, CT

WMGNA Tax-Out Financial Solutions

Read full article

“We believe ‘retirement’ is an antiquated term that connotes someone taking Social Security and fading into a sedentary lifestyle. Instead of ‘retirement,’ we refer to that stage of our clients’ lives as ‘Restylement.’ People today want to remain active, whether that means living a robust lifestyle, performing volunteer work, starting a business, or even beginning a second career. We also talk to clients about what we call ‘true success’ as they look to their future. We define this as having a great lifestyle plus money multiplied by the time to enjoy it. …

“We pride ourselves on staying actively engaged with clients and on our proactive, forward-looking approach. Candid and frequent communication is at the heart of our practice. By specializing in tax-optimization strategies with ongoing financial planning, we strive to make sure our clients’ financial solutions are in continuous alignment with their life situations and goals. This includes both a diverse array of individual clients and families and business-owner clients, whose unique needs are effectively addressed by our process, strategies, and implementation planning.”

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

RECENT POSTS