Win streak points to further market gains

Win streak points to further market gains

The S&P 500 Index (SPX) closed February with a 5.17% gain, marking its fourth consecutive monthly gain. Historically, when the SPX finishes the year with back-to-back monthly gains followed by back-to-back gains to start the following year, it suggests further gains.

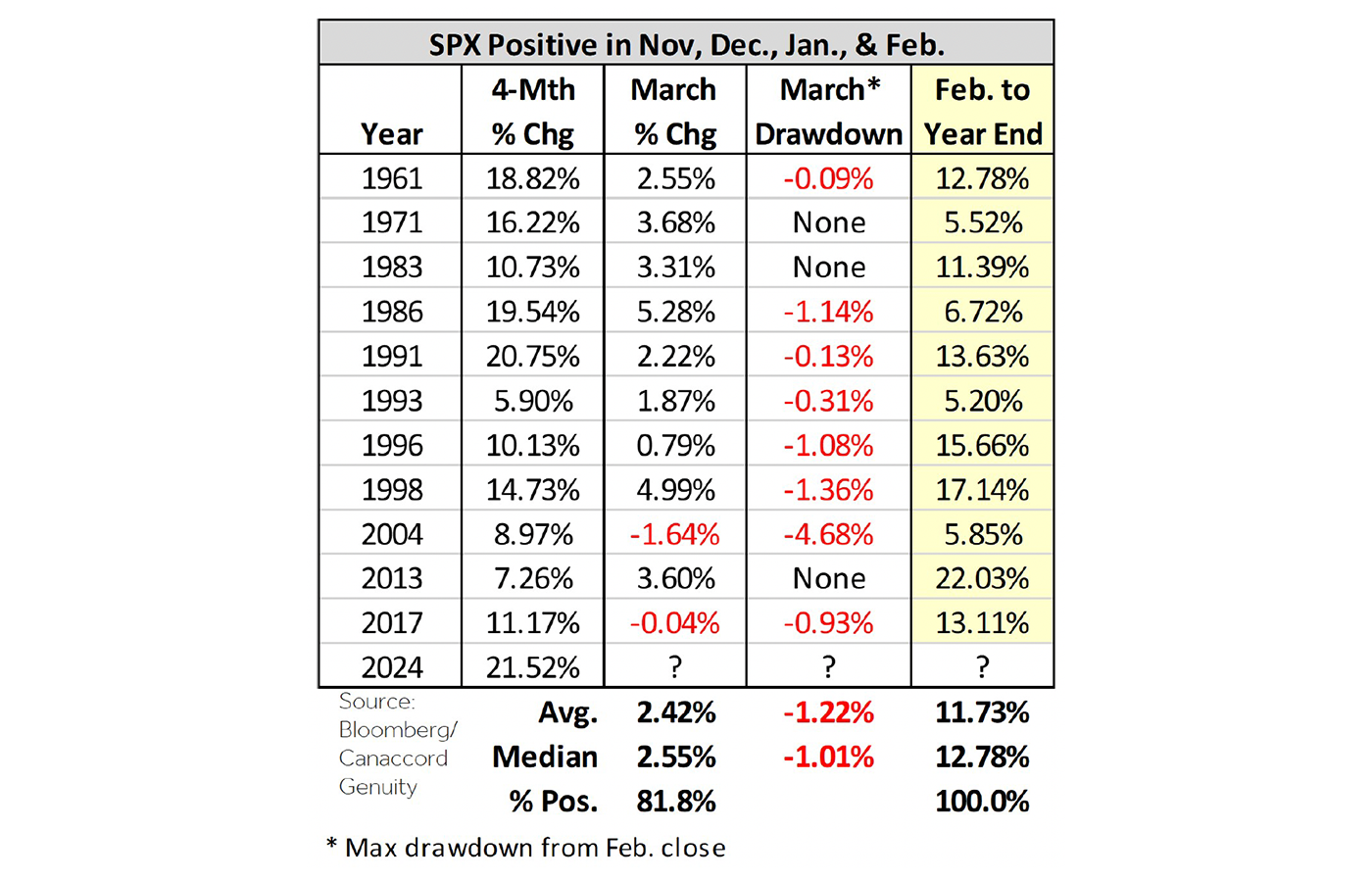

In the 11 prior instances since 1957 when the SPX was up in November, December, January, and February, the Index was always higher from its February close through the end of the year, with a median gain of 12.78%. The following month, March, saw a decrease only two out of 11 times.

We also looked at the max drawdown in March from the February close: The SPX remained above the February close three times. The eight times it did dip below, the median decline was 1% (Table 1). Notably, the current four-month run represents the largest gain compared to any of the previous periods. This made us wonder if the market was less likely to see further upside.

TABLE 1: YEARS WHEN SPX WAS POSITIVE IN NOV., DEC., JAN., AND FEB.

Sources: Bloomberg, Canaccord Genuity

Too much too fast? Not according to history

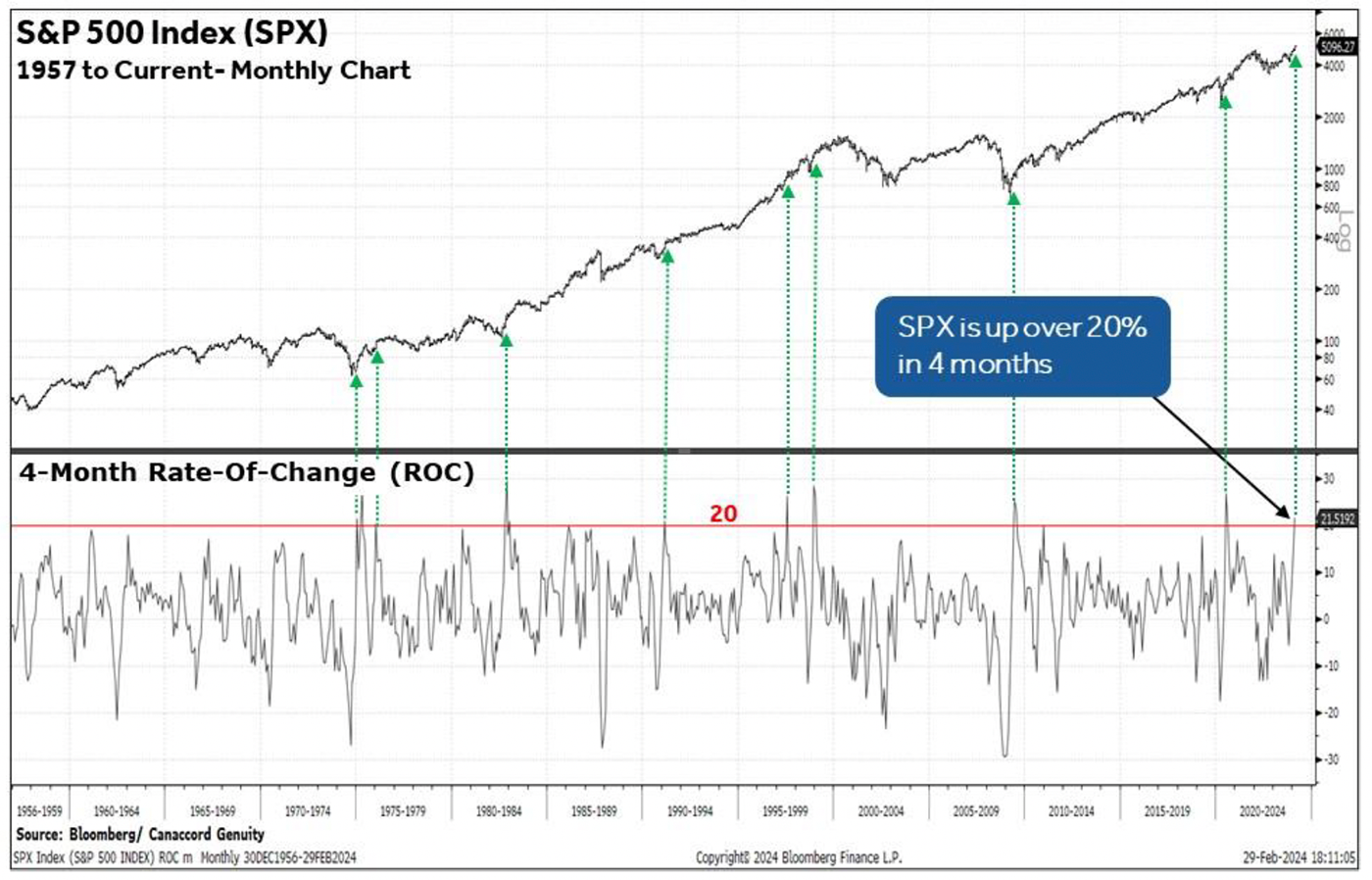

We looked back at previous periods when the SPX was up 20% or more over any four-month period. Using a four-month rate-of-change indicator, we found 14 prior occurrences since 1957. Removing the repeat signals (those that occurred within a few months of each other) narrowed the list down to eight (Figure 1).

FIGURE 1: S&P 500 INDEX WITH 4-MONTH RATE-OF-CHANGE (ROC)

Sources: Bloomberg, Canaccord Genuity

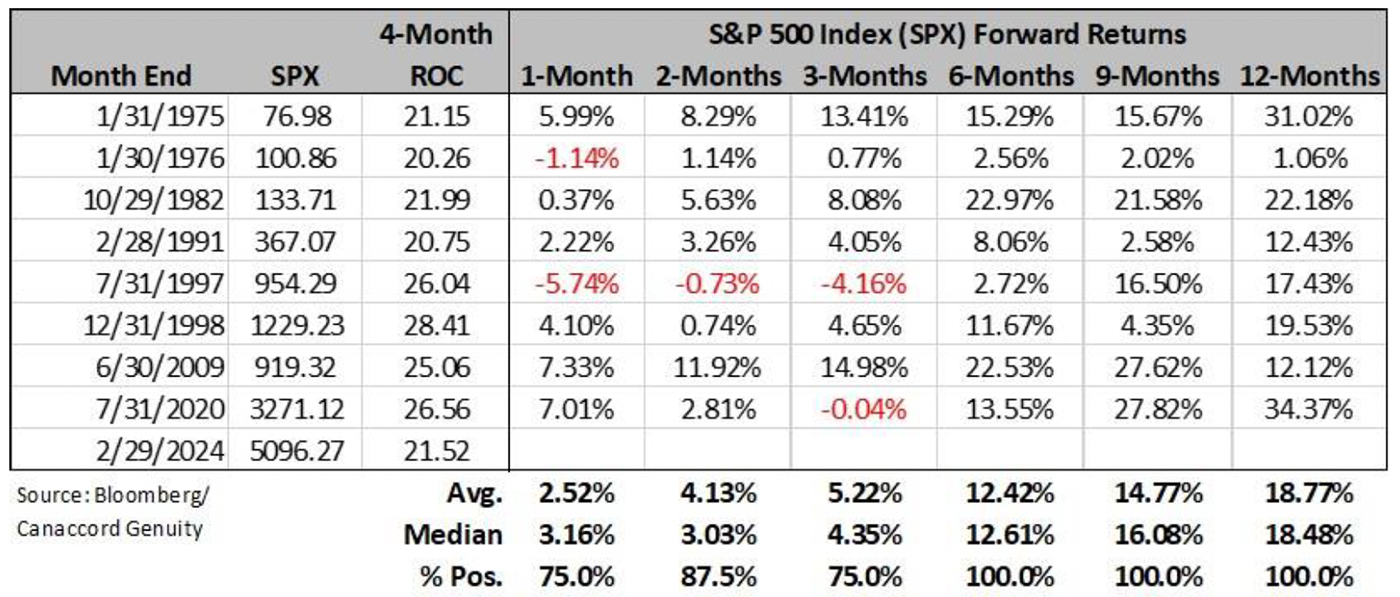

The forward returns through year-end were very favorable, with six-, nine-, and 12-month median returns of 12.61%, 16.08%, and 18.48%, respectively (Table 2). The SPX was positive every time.

TABLE 2: PRIOR INSTANCES OF SPX 4-MONTH ROC ≥ 20

Sources: Bloomberg, Canaccord Genuity

Improving outlook supports adding exposure

Although there has been some churn underneath the indices coupled with high investor optimism and an extreme overbought condition, the improved outlook for money and the history of such consistent gains over the past four months reinforces our view of adding exposure with a particular focus on the equal-weighted Health Care, Industrial, Financial, and Consumer Discretionary sectors during bouts of weakness.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

This is an edited version of an article first published by Canaccord Genuity U.S. Equity Research on March 1, 2024. Tony Dwyer, chief U.S. portfolio strategist for Canaccord Genuity, and his colleagues author frequent market commentaries. Michael Welch, analyst at Canaccord Genuity, was the lead author of this commentary.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

RECENT POSTS