Why advisors use third-party active management to mitigate risk and volatility

Why advisors use third-party active management to mitigate risk and volatility

Market volatility remains the greatest concern of financial advisors. They say managing risk is their biggest portfolio-construction challenge. Several experienced advisors explain how active investment management can help address both issues.

With the headwinds of uncertainty regarding Federal Reserve interest-rate policy, elevated inflation levels, and the global spike in COVID cases, few analysts will claim to know what 2022 truly holds for equity markets.

That said, many Wall Street firms nonetheless released their usual year-end market prognostications for 2022.

In December, Barron’s “Outlook 2022” captured the observations of several of these analysts for the coming year:

“Strategists forecast more-muted gains for next year, with year-end targets ranging from the mid-4000s to the low-5000 area. … Expect a tug of war between rising earnings and pressured price/earnings ratios, capping the market’s gains. S&P 500 earnings are on track to rise nearly 50% this year [2021]; the average Wall Street forecast calls for profit growth of about 9% in 2022. As interest rates rise, the present value of future earnings will fall.”

One area where there seems to be a consensus is the call for increased market volatility in 2022. Barron’s outlook summarizes, “All of this adds up to a forecast for diminished equity returns, negative returns on bonds, and increased volatility across asset classes.”

Similarly, Tony Dwyer, U.S. portfolio strategist for Canaccord Genuity, wrote in an article featured in our publication on Dec. 15, 2021, “Although our positive fundamental core thesis remains positive, we expect 2022 to be a volatile trading range environment.”

An independent research study sponsored by PGIM Investments and published in 2021 explored advisor concerns and trends in portfolio construction in the current (and future) investment environment.

The study concluded that “advisors are relying heavily on active strategies in guiding clients through this period … as they seek to capture outperformance opportunities and mitigate portfolio risk. … As we move forward, advisors are aiming to build flexibility and resilience into client portfolios through a diversified mix of active and passive strategies.”

Two of the notable findings of the study specifically addressed market volatility and risk management:

- “Market volatility remains advisors’ greatest concern for client portfolios. Stock market volatility remains the top concern (68%) for advisors today, along with the potential impact of an economic slowdown (43%) and a low-return environment (41%). …

- “Advisors say managing risk is their biggest portfolio construction challenge. … Advisors rely on active management but say passive strategies have their place. They largely agree that certain segments of the equity and fixed income markets favor active management. The majority of client assets are allocated to actively managed investments (62%), with a third (34%) in passive investments and the remainder (4%) in cash or cash equivalents.”

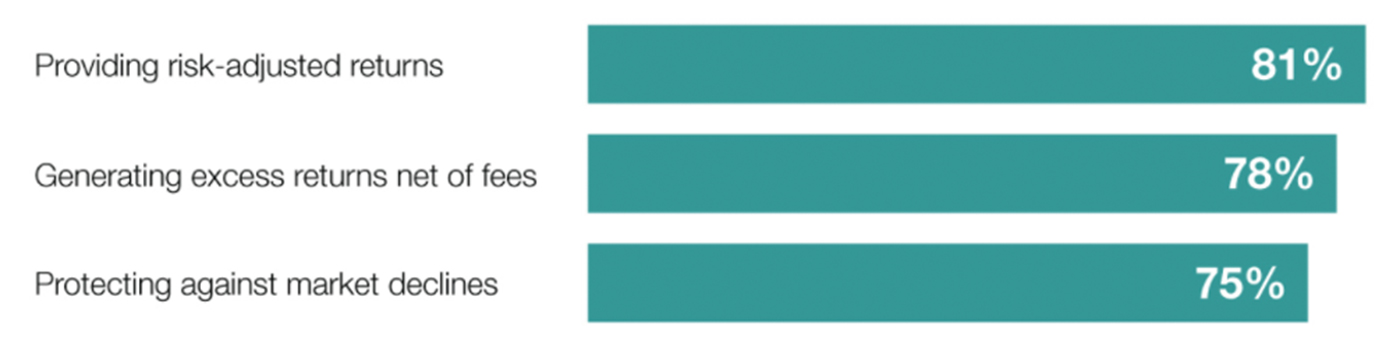

The following chart, based on the study’s findings, examines key success factors for active managers in the eyes of financial advisors.

Additionally, when asked about strategy preference for different market conditions, 87% of advisor respondents favored active strategies versus passive strategies in times of “high equity volatility.”

In our interviews with dozens of financial advisors across the country, they have cited several reasons for employing third-party actively managed strategies for their client portfolios. These include the following:

- Access to modern analytical strategies in portfolio allocations.

- Emphasis on risk mitigation and dampening volatility.

- The ability to be responsive to current market conditions.

- Generating competitive returns in both bull and bear markets.

- Helping to remove “emotion” from investment decision-making.

- Client satisfaction over full market cycles.

For this issue, we asked several advisors to provide their perspective on these and other factors in addressing the question:

David L. Rhodes • Bryan, TX

David L. Rhodes • Bryan, TX

Read full article

“… I am a believer in active investment management, and I educate clients on the potential benefits of professional money management. I have reviewed extensive research on many types of actively managed investment approaches and believe the holistic portfolio approach of certain managers can deliver highly desirable risk-adjusted performance over full market cycles.

“That is not to say that they are always going to outperform a broad index in any given year. But I educate clients on both sequence-of-returns risk and the mathematics of recovering from bear market losses. Few clients realize, for example, that it takes a 100% gain to make up for a 50% investment loss. If losses in poor market conditions are mitigated, that allows a portfolio to become reinvested as conditions improve from a higher overall portfolio value, which can provide a significant compounding advantage over time.”

Richard F. Grant Jr. • Gilbert, AZ

Richard F. Grant Jr. • Gilbert, AZ

Read full article

“We provide access to personalized investment strategies with a focus on protecting investor capital through various market environments. Applying the expertise of investment specialists, we combine fundamental, quantitative, and technical factors to build portfolios designed to capitalize on market inefficiencies. …

“Our fee-based asset-management platform provides a variety of risk-managed investment choices to help retirees in their efforts to secure a better retirement. We believe in tactical asset management, where strategies can go ‘risk-off’ to cash, taking advantage of trends in the equities market. Using tactical money management, we can also potentially help clients generate positive returns if interest rates change.

“We are moving more of our client money to one third-party investment manager. Their ‘risk management first’ philosophy aligns well with the objectives of most of our clients.”

Susan Perry and Stephen Baldino • Warwick, NY

Susan Perry and Stephen Baldino • Warwick, NY

Read full article

Stephen: “… We often look to third-party investment managers who offer actively managed strategies with a strong risk-management component. I ask clients, ‘Would you drive a car without brakes?’ We think the same rationale holds true for their investment portfolio, which should have some level of protection in case the market enters a significant downtrend. Their hard-earned assets should not be fully exposed to the worst of potential drawdowns in a bear market scenario.”

Susan: “We work with multiple third-party investment managers and providers of investment products and will design a portfolio allocation that is customized to a client’s specific needs and risk tolerance, anywhere from very conservative to very aggressive. We pride ourselves on going ‘above and beyond’ for clients in addressing their financial concerns and providing guidance in good market times and bad. We expect the same out of the investment companies that we work with. …

“We are proud of the fact that clients will seldom call us in a panic over a short-term market move. They have been educated on their investment objectives, recognize that their portfolios are built for long-term performance, and understand that risk management is integral to our investment process.”

Mark Mensack • Malvern, PA

Mark Mensack • Malvern, PA

Read full article

“Each client is unique, and their investment plan will reflect their customized plan objectives, time horizon, risk profile, and other factors. That said, I often recommend a three-prong strategy consisting of a blend of dividend-paying closed-end funds, variable annuities with living benefits, and risk-managed tactical investment strategies. …

“Most understand active management as a money manager attempting to outperform an index. The evidence is that very few achieve this with any consistency.

“However, the money manager I use doesn’t focus on attempting to outperform. Their philosophy of active management is to manage risk and ‘win by not losing,’ which is a different philosophy than the typical active manager. And their historical risk-reward profile proves the value of their active management philosophy, which seeks to provide competitive returns while mitigating steep drawdowns. I use this piece to also help fund client income through periodic withdrawals.”

Robert Norton • Hammonton, NJ

Robert Norton • Hammonton, NJ

Read full article

“We have the tools to construct investment plans with the highest expected return over any given time frame. But will that plan make clients really comfortable and ultimately happy? Could they stick with a plan that has investment exposure to steep drawdowns? We have to consider their investment plan from a behavioral and risk-management perspective, while also striving to help them meet their future quantitative goals. It is an important balancing of risk and reward. This is where I think a good financial advisor adds value to the process. …

“… One of the key elements of my investment philosophy is a belief in the value of tactical investment management offered by third-party managers. I am referring to rules-based strategies that rely on sophisticated investment models and indicators that can adapt to changes in the investment environment. It is not an approach of manager discretion. Rather, these objective models will constantly analyze a variety of data points and adjust market exposure accordingly.

“One of the priorities is risk management. If market or sector conditions deteriorate, a specific strategy can adjust allocations, reduce exposure, or go predominantly to cash. This is something that is just not possible with a typical mutual fund. I think it is an excellent way for people to participate in the market with a degree of risk management that a purely passive portfolio approach does not offer. The objective is to capture market upside during favorable periods and help reduce risk exposure during more uncertain periods.”

New this week:

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.