Advisors and active management: Grounded in behavioral finance

Advisors and active management: Grounded in behavioral finance

Financial advisors are increasingly recognizing the importance of applied behavioral finance theory in guiding their clients. Active investment management, with a focus on mitigating risk, fits well with the underlying philosophy of this approach.

Our October article “From Aristotle to active management” provided a perspective on proactive financial and investment planning that is grounded in the principles of behavioral finance. The article also provided strong rationale for how active investment management is well-suited in helping to meet both the performance and behavioral needs of today’s investors.

Three excerpts from that article highlight this point.

According to a Cerulli Associates report released in 2020, summarized at ThinkAdvisor,

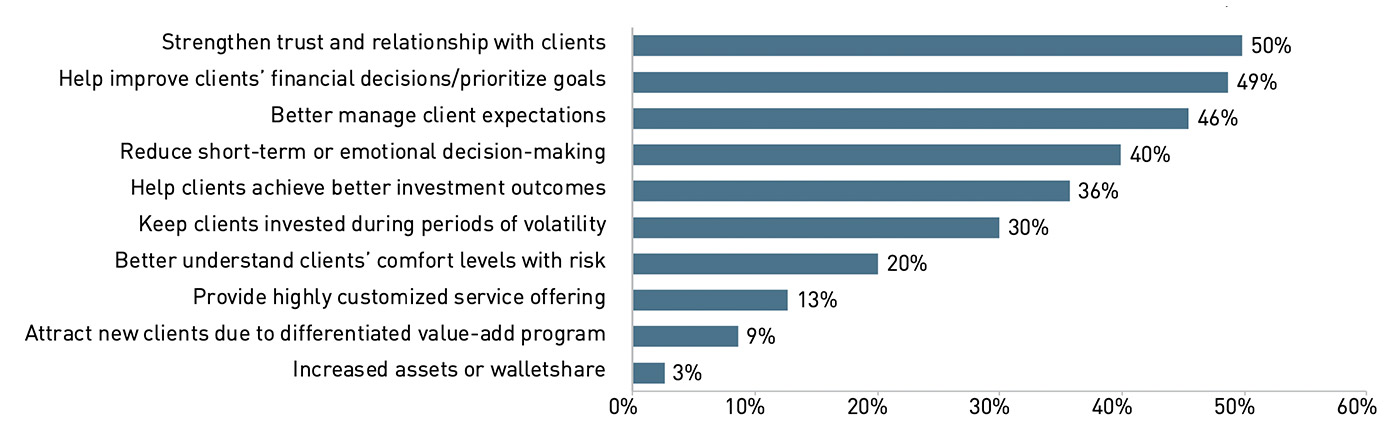

Cerulli Associates’ 2019 report “The Role of Behavioral Finance in Advising Clients” provides further detail on the benefits financial advisors see in the use of behavioral finance in their practices.

Sources: Cerulli Associates in partnership with Investments and Wealth Institute

The nonprofit CFA Institute Research Foundation, in a study titled “Behavioral Finance: The Second Generation,” notes,

“Behavioral finance has blossomed—and justly so. It is a key to the justification for active portfolio management. If investors were perfectly rational and always acted in their enlightened self-interest, active management would still have a role because different investors have different goals and preferences and may require different portfolios.”

And Richard Lehman, a professor of behavioral finance and founder of BehavioralFinance.com, has written in our publication,

These viewpoints have been reinforced by many of the independent financial advisors we have interviewed for Proactive Advisor Magazine. For this issue, we explore the following question with several advisors:

David Turner • Greenville-Spartanburg, SC

David Turner • Greenville-Spartanburg, SC

Read full article

“My investment philosophy centers on what I call ‘downside management.’ After 25 years in the business and seeing quite a few significant downturns, we know that clients hate losses more than they love gains. There’s a strong psychological or behavioral-finance component to that. I connect my analytical approach to finance and investment management with a strong appreciation for client attitudes around investing. My investment-planning process is grounded in an extensive background in finance and investment theory. I care about scenario-building, Monte Carlo simulations, and especially about the sequence of returns. I take a strong due diligence perspective to find out exactly what the target needs of the client are, and then I develop investment recommendations that strive to meet their objectives over the long term.

“I believe in actively managed strategies and think they can provide more dollars in a client’s account over time than that of a passive portfolio, even when the average returns might be similar. This is because investment returns are not normally distributed—they’re abnormally distributed. That said, passive strategies can play a valuable role in an actively managed portfolio approach. The core point is that you can build a multiple-strategy portfolio using a ‘safety first,’ actively managed approach that I think provides a stronger probability of earning the minimum required returns over time than a purely passive approach.”

Cheri Johnson • Gig Harbor, WA

Cheri Johnson • Gig Harbor, WA

Read full article

“Active management is a tool that is especially critical for these market times. Even though we have been in a bull market for several years now, we still see pockets of elevated volatility. They may not last very long, but it is pretty much a given that at some point we will see some significant market declines again. We want clients to be prepared for that, in line with our primary goals of preserving assets and providing an adequate income stream in retirement.

“I explain to clients that we need investment tools that are built for today’s and tomorrow’s market. I show them a simple chart of the S&P 500 over the last 20 years, and it instantly becomes apparent to them how the market has gone through some dramatic cycles up and down. Why would one not want to try to take advantage of following major trends when there have been at least five major established trends since the late 1990s? Of course, it is easy to see them with perfect 20/20 hindsight—not so easy when you are in the middle of them and a trend is in the process of shifting.

“This is why we employ the service of professional third-party active managers for client portfolios. They have very sophisticated models, employing a quantitative and analytical approach that attempts to stay in sync with the trends. Active management allows us to focus on developing portfolios consistent with clients’ risk profiles and their longer-term objectives. If we can avoid and sidestep a major pitfall in the market with true active management, we’re already leaps and bounds ahead of the old style of passive investing.

“When you manage for risk, a client may miss a portion of the big run-ups in the market. But over a longer time frame, we want our advisory practice to help clients achieve what is truly most important: preserving assets and growing them carefully throughout their lifetime.”

Steve Deppe • San Diego, CA

Steve Deppe • San Diego, CA

Read full article

“Our overall investment philosophy is to help our clients meet the minimum annual return necessary to achieve their stated financial objectives with a sustainable level of risk or volatility in their portfolio. … Risk management is a vital component of our process since it helps encourage behavioral adherence to the underlying strategy. Everyone wants the S&P 500’s current trailing 10-year annualized returns, but few can behave through the hard times—the 10 years before this period—in a way that would have allowed their portfolio to prosper. Prudent risk management optimizes the likelihood of behavioral adherence, which, in turn, optimizes the likelihood of investing for success over the long term. …

“The foundation of our discretionary investment management services is the goal of helping to optimize all ‘active’ decisions a long-term investor makes: what asset classes to own, when to rebalance the portfolio, what to rebalance the portfolio to. Our philosophy falls in the ‘tactical asset allocation’ camp, so our client’s asset allocation will change as the opportunities and trends in the investable universe change.

“This is done to optimize the likelihood of achieving the minimum return necessary to achieve financial objectives over the full market cycle, which is generally the result of minimizing substantial portfolio drawdown during unfavorable climates for various asset classes. Using a disciplined, rules-based approach to asset allocations, specific investment selections, and risk-management decisions can minimize portfolio drawdowns and maximize the likelihood of clients’ attaining their strategies’ long-term potential returns.”

Jack Dominge • Sunnyvale, CA

Jack Dominge • Sunnyvale, CA

Read full article

“I have been in the advisory business since 2001. We have obviously seen two major market displacements since that time. My initial training was in modern portfolio management and classic principles of asset allocation, but clearly that has not worked well in times of market stress.

“While my clients pulled through these periods by and large intact, it was not a pleasant experience. It took several years of portfolio recovery for those who were willing to stay the course. Fortunately, while it took many meetings and phone calls, almost all my clients did manage to weather the storms. I have since moved to an investment philosophy of defense first. I tell clients that we are not looking to ride markets all the way to the top, but we are also certainly not going to ride them all the way to the bottom. I say that we are attempting to benefit from the 75% of the market in between the extremes.

“I think this approach benefits clients in pragmatic investment terms and is also a psychologically more attractive approach, trying to lessen the emotional stress associated with market volatility. I try to help people set realistic return expectations, manage their emotions when it comes to the markets, and understand what we have seen historically in terms of market cycles.

“How do we do this from a strategy perspective? Speaking generally, I use a blend of active and passive strategies. I employ the services of highly sophisticated outside money managers. Both managers use quantitative methodologies that help take emotion out of the investing equation. As a student of behavioral finance, I know how important that can be when discussing strategies and investment performance with clients.”

Dennis Yamasaki • Lynnwood, WA

Dennis Yamasaki • Lynnwood, WA

Read full article

“I think a prospect’s mindset is every bit as important as their demographic. … I like to start with a discussion with clients about their personal investment experiences, focusing on their returns, as well as their emotional state of mind, during the last two major market downturns. We will then probe their current attitudes about risk. …

“I am passionate about helping clients protect what they have, both from an insurance and investment perspective. But I am equally passionate about helping them grow their wealth. I see clearly in hindsight how an actively managed and more conservative approach could have had a tremendous impact on the bottom line of my personal portfolio. That starts with avoiding the big losses concentrated around a large market decline—the power of not losing money is often more powerful than only focusing on investment gains.

“I started my financial career on the insurance side of the business and a few years later moved on to more holistic planning and investment management. I then was exposed to active money management and have become a true believer in that philosophy. We know all about economic and market cycles from history. There will be boom and bust cycles, recessions, and bear markets. Active and tactical managers cannot predict with 100% certainty when these will start and end. But they certainly can improve the investment odds and probabilities for my clients with their focus on risk-adjusted returns. That is the essential message I deliver to clients, and, for just about everyone, it makes perfect logical sense.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This article first published in Proactive Advisor Magazine on Nov. 19, 2020, Volume 28, Issue 7.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.