Orchestrating a team approach for clients’ financial needs

Orchestrating a team approach for clients’ financial needs

Baldino & Perry Associates Inc. • Cetera Advisor Networks LLC

Read full biography below

Baldino & Perry Associates Inc. • Cetera Advisor Networks LLC

Read full biography below

Our firm provides holistic financial planning. We see our model as being the conductor of the orchestra, putting together a team of professionals that we may call upon for assistance on a wide variety of issues in the financial realm, whether that involves investments, insurance, retirement plans, college planning, Medicare and Social Security planning, legacy planning, or employee benefits, to mention just some. We have much of this capability in-house, but we also work with a client’s current advisors or facilitate their engagement with our team such that clients feel confident that their financial needs are being addressed in a coordinated fashion.

Stephen: We believe strongly in the importance of setting goals, a thorough review of strategic options to help meet those goals, an implementation plan that is efficient, and then periodic review sessions to monitor progress toward goals. While we hope that each of our clients takes advantage of our full holistic financial-planning process, we do encounter clients who have a singular need or concern, and we are happy to assist them with that. Where we really shine, I think, is when we can bring the full resources of our internal and external professional team to bear on a client’s complete financial-planning needs.

Stephen: We believe strongly in the importance of setting goals, a thorough review of strategic options to help meet those goals, an implementation plan that is efficient, and then periodic review sessions to monitor progress toward goals. While we hope that each of our clients takes advantage of our full holistic financial-planning process, we do encounter clients who have a singular need or concern, and we are happy to assist them with that. Where we really shine, I think, is when we can bring the full resources of our internal and external professional team to bear on a client’s complete financial-planning needs.

Once clients understand what we have to offer, most engage in the more holistic approach to their overall financial health. We do that in a way comparable to a general medical practitioner bringing in a cardiologist for a patient’s heart issues. We might bring in an attorney, accountant, Social Security specialist, or other specific resource as we consider the client’s financial objectives.

Susan: One of the areas we pride ourselves on is developing a prioritized list of concrete action steps for clients. Clients, especially those facing retirement, can be overwhelmed by what they perceive to be the magnitude of getting their financial house in order and covering all the bases as they prepare for retirement. That is exactly why we are there to guide them and to break the process down into readily digestible pieces. We want to first attack what they perceive as their most pressing worry points and then systematically work through a “punch list” of priorities. I think clients feel very reassured by this type of disciplined guidance, attention to detail, and thoroughness in addressing their financial needs.

Stephen: Let’s take the case of a couple nearing retirement and assume we have conducted a full discovery process and identified a solid list of objectives. How we then approach investment planning depends on their time frame, risk profile, and a look at what we call “fund balanced planning.” We work with the client to identify a potential level of income that they will require in retirement and the funds necessary to generate that income. We subtract out any fixed income they can depend on, such as Social Security or a fixed pension, and then determine the shortfall, if any.

Based on their asset levels, how can we best fund that shortfall? That is essentially a combination of educated assumptions around return levels and risk exposure. The smaller the shortfall, the less risk the client may assume. If the shortfall is significant, they may either need to tap into other assets, assume more risk, or reduce their income expectations in retirement. By attaching real numbers to these scenarios, a lightbulb will often turn on for the client as they start to fully grasp the variables in the equation. At times, the discussion comes down to whether the client is more risk-averse and desires a guaranteed income solution for all or part of their retirement income or is comfortable with a nonguaranteed, more traditional investment plan.

Based on their asset levels, how can we best fund that shortfall? That is essentially a combination of educated assumptions around return levels and risk exposure. The smaller the shortfall, the less risk the client may assume. If the shortfall is significant, they may either need to tap into other assets, assume more risk, or reduce their income expectations in retirement. By attaching real numbers to these scenarios, a lightbulb will often turn on for the client as they start to fully grasp the variables in the equation. At times, the discussion comes down to whether the client is more risk-averse and desires a guaranteed income solution for all or part of their retirement income or is comfortable with a nonguaranteed, more traditional investment plan.

For a nonguaranteed income solution, we often look to third-party investment managers who offer actively managed strategies with a strong risk-management component. I ask clients, “Would you drive a car without brakes?” We think the same rationale holds true for their investment portfolio, which should have some level of protection in case the market enters a significant downtrend. Their hard-earned assets should not be fully exposed to the worst of potential drawdowns in a bear market scenario. While there are no guarantees, we walk clients through illustrations of how their specific portfolio allocations and strategies have performed historically.

Susan: We work with multiple third-party investment managers and providers of investment products and will design a portfolio allocation that is customized to a client’s specific needs and risk tolerance, anywhere from very conservative to very aggressive. We pride ourselves on going “above and beyond” for clients in addressing their financial concerns and providing guidance in good market times and bad. We expect the same out of the investment companies that we work with.

Key criteria in evaluating third-party investment managers

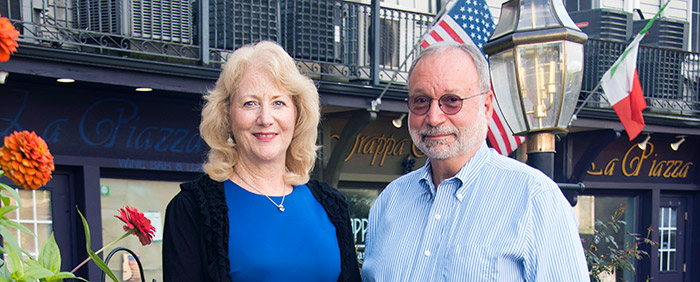

Stephen Baldino and Susan Perry, partners at Baldino & Perry Associates Inc., provide holistic financial planning and a range of financial services to individual and business clients. They see their practice model as “being the conductor of the orchestra,” putting together a team of professionals they may call upon for assistance on a wide variety of issues in the financial realm. Among those professionals are third-party investment managers that can provide the following:

- Outstanding, personalized service.

- A range of strategic options, suitable for clients with varying risk profiles.

- Sound money management and strong investment risk-management services.

- Transparency and accessibility of senior managers.

- The ability to effectively resolve problems.

- Consultative services, especially for complex client cases.

- An overall working relationship that fosters a sense of “partnership.”

Stephen Baldino is a founding partner of Baldino & Perry Associates Inc., located in Warwick, New York. Mr. Baldino has more than three decades of experience working with individual and business clients on a wide variety of financial needs, including financial planning, investment management, insurance, estate planning, and retirement and health plans.

Mr. Baldino was raised in New York City and earned an undergraduate degree in education at the State University of New York at Buffalo (SUNY) and a master’s degree in public education administration at SUNY–New Paltz. Mr. Baldino taught electronics and computer science at the high school level for 12 years, with a goal of entering senior administration. He says he made a difficult decision to change careers when recruited into the financial-services industry, but he places “great value on the educational aspects of providing financial guidance.”

Mr. Baldino worked initially with New York Life, where he provided insurance and investment products and services to clients for 14 years. He became an independent financial advisor in 1998, when he started his holistic financial-planning practice. He and Susan Perry became business partners in 2013.

Mr. Baldino and his wife have one grown son. Mr. Baldino was a volunteer fireman and member of the local ambulance corps for 15 years. He has held leadership positions at his church and has coached youth sports. Mr. Baldino was an officer of the local Rotary Club, member of his town’s school board, and is currently president of the Orange County Legal Aid Society. He enjoys family time, reading, golf, woodworking, and model trains.

Susan Perry is a partner at Baldino & Perry Associates Inc. Ms. Perry was raised in Staten Island, New York, and had a “wonderful family that lived in a beautiful part of New York.” She graduated with a bachelor’s degree from Ryder College with a major in sociology and minor in marketing and business management.

Susan Perry is a partner at Baldino & Perry Associates Inc. Ms. Perry was raised in Staten Island, New York, and had a “wonderful family that lived in a beautiful part of New York.” She graduated with a bachelor’s degree from Ryder College with a major in sociology and minor in marketing and business management.

Ms. Perry started her career at Merrill Lynch, where she joined the commodity trading department. She worked as a sales assistant for several brokers and eventually joined the financial futures desk. Ms. Perry later joined a smaller commodity trading firm where she helped manage commodity funds in “the early days of managed money and computerized trading.” She later worked at two national financial firms before joining Mr. Baldino’s firm in 2001, where she managed many operational aspects. She earned her insurance licenses and securities registrations, began working as a financial advisor, and became a partner in 2013.

Ms. Perry has a grown daughter who lives near her, and they enjoy spending time together and jointly caring for their “beloved dog.” Ms. Perry enjoys hiking, biking, and skiing. She is a member of the Warwick Valley Chamber of Commerce and is involved with several charitable activities.

Disclosure: Investment advisor representatives offering securities and advisory services through Cetera Advisor Networks LLC, member FINRA/SIPC. Cetera is under separate ownership from any other named entity. Branch: 10 Oakland Ave., 2nd Floor, Warwick, NY 10990. All investing involves risk, including the possible loss of principal. There is no assurance that any investment strategy will be successful.

Photography by Tom LaBarbera