The power of professional knowledge in a changing advisory environment

The power of professional knowledge in a changing advisory environment

To prosper, advisory firms must learn to clearly define the value they provide clients. As part of this endeavor, they should recognize that prospects place great importance on expertise, knowledge, and a solid reputation.

In the past decade, the rise of robo-advisors, low-cost retail trading platforms, and increased access to data-driven investment technologies has challenged financial advisors to add value within the realm of wealth management.

Additionally, younger generations will gradually gain control of a greater percentage of wealth in coming years, with virtually all baby boomers reaching the age of 65 by 2030. Savvy financial advisory firms are already addressing these changing demographics, recognizing that younger generations will look for different approaches to client engagement and a broader adoption of interactive technologies.

In the article “On the cusp of change: North American wealth management in 2030,” consulting firm McKinsey writes,

“The North American wealth-management industry will undergo meaningful shifts in the next ten years, influenced by evolving customer segments and rules of engagement, rapid technological advances, and shifting competitive dynamics. These trends will have profound implications for both the nature of advice and for advisers’ and wealth-management firms’ broader talent strategy, operating model, and sources of competitive differentiation. …

“By 2030, we believe that all successful wealth managers will develop services that help their clients dynamically monitor, adjust, and achieve their goals. … As advice becomes increasingly analytics-driven and automated, advisers will shift their focus to comprehensive planning beyond the portfolio … and become more like integrated life/wealth coaches who advise clients on investments, banking, healthcare, protection, taxes, estate, and financial wellness needs more broadly. As the industry undergoes this shift, wealth managers will need to fundamentally rethink their recruiting strategies and training programs.”

Alignment of client needs and advisor perceptions/offerings

McKinsey also notes that the younger generations’ usage and familiarity with community-based ratings and reviews will offer opportunities to forward-looking advisory firms. McKinsey writes, “The transparency and community-based nature of these reviews tend to encourage superior performance and customer outcomes. …”

Within the changing environment described above, financial advisors will need to make sure that their value propositions resonate with both current and prospective clients—bridging the needs of those close to or in retirement and an upcoming younger client base. (For more on this, please see our article, “Value propositions: How advisors can effectively communicate their unique offering.”)

As advisors develop and articulate their firms’ value propositions, it is important to not only communicate what makes their offerings unique, but they must also recognize what potential prospects are looking for in a financial advisor.

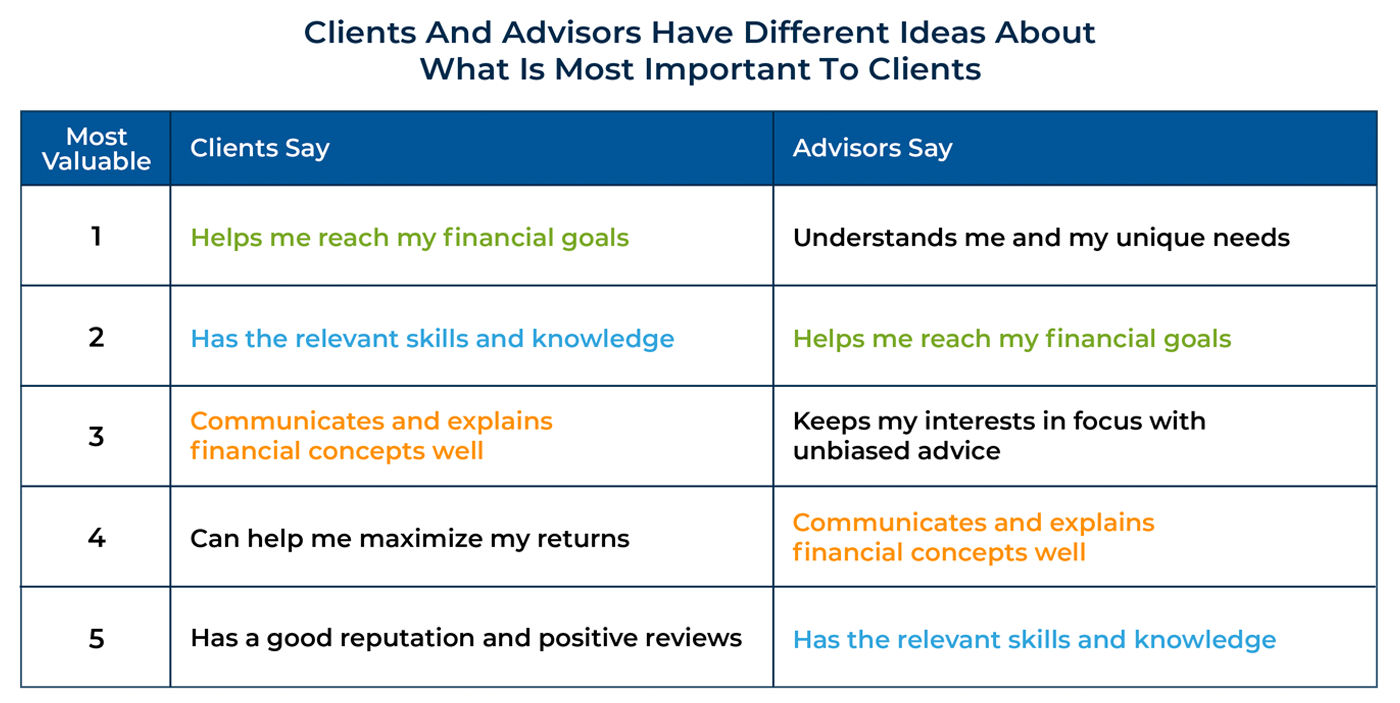

In one of his blog posts, well-known financial advisor, writer, and speaker Michael Kitces discusses the common disconnect between what prospective clients want most out of an advisory relationship and what advisors think clients want. He suggests that advisors often prioritize their financial-planning process and ability to understand each client, rather than the prospect’s desire to hear about what focus, knowledge, and expertise the advisor will bring to helping the prospect achieve his or her financial goals.

Kitces (and guest author Evan Beach, director of Wealth Advisory at Campbell Wealth Management in Alexandria, Virginia) cite a Morningstar study of attributes that clients say are most important in an advisor relationship versus those that advisors say are most important. The following chart summarizes these differences.

Sources: Morningstar, Michael Kitces

Kitces summarizes in his conclusion,

“Ultimately … to successfully convey to the client (and prospect) that you are on the same page with them and that you have the relevant knowledge and ability to help them achieve their goals, will be the most effective approach to providing the most value to your existing (and future) clients!”

For this issue, we asked several successful financial advisors the following question:

How do you communicate the knowledge and capabilities of your firm to clients and prospects?

Parker Carroll • Huntsville, AL

Infinity Tax and Financial Planning

Read full article

Parker Carroll, an investment advisor representative from Alabama, says, “We have a fairly unique business model, offering clients access to tax preparers, accountants, financial planners, investment managers, insurance agents, and estate-planning advisors. Most of our clients initially become involved with Infinity Tax and Financial Planning through our tax services. Our clients appreciate that they can get most, if not all, of their financial-planning needs met in one place. …

“Andy [Andy Zorovich, owner of Infinity Tax and Financial Planning] speaks often about our mission of helping clients protect, grow, use, and bestow financial assets. We help protect client assets via tax mitigation, investment risk management, and insurance strategies. We look to help grow assets through tax strategies that can increase net income, budgeting techniques, and sophisticated investment strategies. We help clients use their assets wisely by following the principles of a goals-based financial plan. And, finally, we can help clients bestow assets to the next generation, charity, church, or another recipient in a tax-efficient manner. We take these four strategic objectives very seriously and are passionate about helping clients plan for financial success in tax-advantaged ways.”

Ivan Illan, AIF, CFS • Los Angeles, CA

Aligne Wealth Advisors Investment Management (AWAIM)

Read full article

Ivan Illan, founder and chief investment officer of Aligne Wealth Advisors Investment Management (AWAIM) in Los Angeles, says, “One of the most significant lessons I have learned is the importance of having a well-defined and meaningful value proposition. Ours rests on our ability to allocate capital soundly in a risk-managed fashion, with accountability and transparency. Our ability as capital allocators drives our mission and instills confidence in our clients as we address virtually any financial, retirement-planning, or wealth-management need they may have. In addition to our firm’s financial advisors, we have a talented team of people in operations, client service, estate planning, tax overview, portfolio management, and business-owner services. We also have robust relationships with other firms in the financial industry. For example, we can help take a business public through our investment-banking resources. …

Mr. Illan adds, “We believe that cultivating unique intellectual capital is a valuable asset and is at the core of creating value for clients. Being a strong financial advisor inherently means giving advice based on acquired knowledge and experience and demonstrating these skills through real results—not slick sales pitches or sales techniques. We want advisors joining our firm to continue to build a deep knowledge base and an exceptional skill set. We are also committed to our advisors in that ongoing and important process. Success at our firm should mean not only financial success but also personal and professional fulfillment.”

Anjali Jariwala, CPA, CFP • Torrance, CA

Anjali Jariwala, CPA, CFP • Torrance, CA

FIT Advisors

Read full article

Anjali Jariwala, founder of FIT Advisors, an advisory firm located in Torrance, California, says, “I believe my experience in business management, taxation, finance, and investment strategy has positioned our firm well in serving the diverse financial-planning needs of our clients. I have intentionally tried to keep our client base at a manageable level so we can offer a high degree of personalized service.

“I think it is also important to understand our segment focus on physicians and business owners. My husband is a physician, comes from a family of physicians, and has a personal network of many physicians. I have seen firsthand their busy lives and how they are always being pulled in many directions. As they build their careers and families, they need highly skilled guidance in addressing what can be fairly complicated financial-planning objectives and implementing their plan in a stress-free manner.

“Similarly, I think I bring a unique perspective to the small-business-owner segment. My experience working as a CPA provided deep insights into not only tax-related matters but also business structuring, financial projections, and a host of other management issues. As a small-business owner myself, I am attuned to the time demands they face. I am here to provide knowledgeable guidance to business owners around their intertwined business and personal financial-planning needs. In many ways, I can act as their virtual CFO.”

Bradford D. Creger, AAMS, AIFA, CFS, CLTC, CPFA • Glendale, CA

Bradford D. Creger, AAMS, AIFA, CFS, CLTC, CPFA • Glendale, CA

BFF Financial Inc.

Read full article

Bradford Creger, founder of BFF Financial Inc., a full-service advisory firm based in Glendale, California, says, “My economics background provides the strong foundation that allows me to serve clients and understand macroeconomic and financial market trends. It has been enhanced through my rigorous industry training and the ongoing professional education necessary to earn numerous industry professional designations.

He adds, “BFF Financial acts as a financial architect and provides clients with a blueprint that addresses the totality of their financial-planning needs. We shape the final plan with the client’s input and then act as a ‘general contractor’ by coordinating and overseeing the services of other professionals they may use. We can also assist directly when it comes to implementing tax, insurance, legacy, and investment strategies. I believe the skill and expertise of the advisor are critical to this type of comprehensive approach—having a deep understanding of these disciplines. We have set a high bar for our firm’s collective background and professional training, knowledge base, and thought leadership. We are always questioning the status quo and seek to stay deeply informed on the markets, the economy, industry best practices, and financial products that are continually being developed and refined.”

Daniel J. Friedman • Farmington, CT

Daniel J. Friedman • Farmington, CT

WMGNA Tax-Out Financial Solutions

Read full article

Daniel Friedman, founding partner and CEO of WMGNA Tax-Out Financial Solutions, an advisory firm headquartered in Farmington, Connecticut, says, “Our firm has many points of differentiation, starting with the highly professional preparation of client tax returns and the fundamental focus on tax efficiency throughout our planning process. But equally important is the subscription model itself, which allows clients to actively engage with us on any financial question at any time. We are happy to help clients make well-informed decisions on employee benefits, cash-flow management, real estate purchases, educational funding, leasing or purchasing a car, or refinancing their mortgage, to cite just a few examples.

“We pride ourselves on staying actively engaged with clients and on our proactive, forward-looking approach. Candid and frequent communication is at the heart of our practice. By specializing in tax-optimization strategies with ongoing financial planning, we strive to make sure our clients’ financial solutions are in continuous alignment with their life situations and goals. This includes both a diverse array of individual clients and families and business-owner clients, whose unique needs are effectively addressed by our process, strategies, and implementation planning.”

Tara Nolan, MBA • Kris McKinney • Colorado Springs, CO

Tara Nolan, MBA • Kris McKinney • Colorado Springs, CO

Nolan Financial Partners

Read full article

Tara Nolan, founder of Nolan Financial Partners, a full-service financial-planning and advisory firm located in Colorado Springs, Colorado, says, “Our firm, Nolan Financial Partners, focuses on addressing clients’ financial-planning needs from a holistic, 360-degree perspective. Two essential drivers of the firm’s growth are (1) providing financial education and (2) communicating the firm’s overall planning philosophy, as well as our culture of transparency and authenticity.”

She adds, “We are passionate about helping our clients become highly confident about their total financial picture. I love guiding clients as they work through the puzzle of identifying, and then achieving, their financial priorities. This plays a key role in helping people accomplish their overall life goals. If someone asks what they can expect when they work with us, it is pretty straightforward. We are going to assist them in identifying what success looks like for them. We’re going to couple that with the resources that they have. And we’re going to show them the potential routes for getting there.”

Kris McKinney, co-founder of Nolan Financial Partners and a principal financial advisor for the firm, says, “We have adapted planning ‘best practices’ from several sources—including the Lifetime Economic Acceleration Process, or LEAP. This strategic allocation system allows us to identify, with the client, multiple financial solutions that can work together to help them achieve their financial goals. This helps clients better visualize how their assets can work in different ways to achieve their specific objectives for protection, savings, and growth. …

“Helping clients achieve a sense of control over their current finances—and their financial future—is our top priority. In many ways, money is just a tool to allow people to pursue their life goals. We believe that as clients work to achieve the lifestyle they want that they also want to make their lives more meaningful. In that sense, we want to build close relationships so that our clients’ financial plans can be consistent with their values and aspirations. That is what makes our jobs so rewarding—to see clients lead more abundant lives.

Emrich M. Stellar Jr., ChFC, CLU, CBEC • Bethlehem, PA

Emrich M. Stellar Jr., ChFC, CLU, CBEC • Bethlehem, PA

Stellar Advisor

Read full article

Emrich Stellar Jr., founder of Stellar Advisor, a financial-services practice located in Lehigh Valley, Pennsylvania, says, “I think the famous quote often attributed to Peter Drucker, ‘Culture eats strategy for breakfast,’ is very relevant in terms of how an advisory firm can best guide its clients. I think it’s important for advisors to affiliate with a value system that will stand the test of time. We have always believed in the ‘Serve First’ philosophy. This requires that we not only seek to understand our clients’ goals and objectives but that we also understand the myriad solutions that are available in both planning structures and through the implementation of investment and insurance solutions.

“Part of delivering on this belief system requires a foundation of deep professional knowledge and training, as well as continuing education. The rigorous study involved in earning the Chartered Financial Consultant (ChFC) and Certified Business Exit Consultant (CBEC) designations was very beneficial to my professional development. I am also a member of several professional organizations, including the Society of Financial Service Professionals, the International Exit Planning Association, and the Estate Planning Council.

“But credentials are really just foundational elements. I think a deeper level of professional knowledge—and wisdom—can only come through the sharing of ideas with other experienced financial professionals and centers of influence, such as highly competent accountants and attorneys. This philosophy of lifelong learning exists throughout our organization and is central to our ability to deliver truly excellent results for our clients.”

He adds, “Our firm is well qualified to handle the most sophisticated planning needs. We want to help all clients grow and transfer their wealth. We specialize in the design, implementation, funding, communications, and services of complex planning solutions.”

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

RECENT POSTS