Value propositions: How advisors can effectively communicate their unique offering

Value propositions: How advisors can effectively communicate their unique offering

To thrive in today’s challenging environment, it’s not enough to simply deliver exceptional service—advisors need to communicate a unique profile that sets them apart in the minds of their clients and prospects.

While advisors may deliver on their service commitment, industry studies have found gaps in how their clients actually perceive this value.1 According to a survey by the Financial Planning Association (FPA), while 73% of financial advisors felt it was important to communicate value to prospects, only about half felt they were doing so effectively.2

Even when clients report high levels of satisfaction and loyalty, they may be unable to say why or what their advisor has to offer.3 Investors also may have a difficult time distinguishing one advisor from another, especially as more firms move to the holistic wealth management/financial planning model.

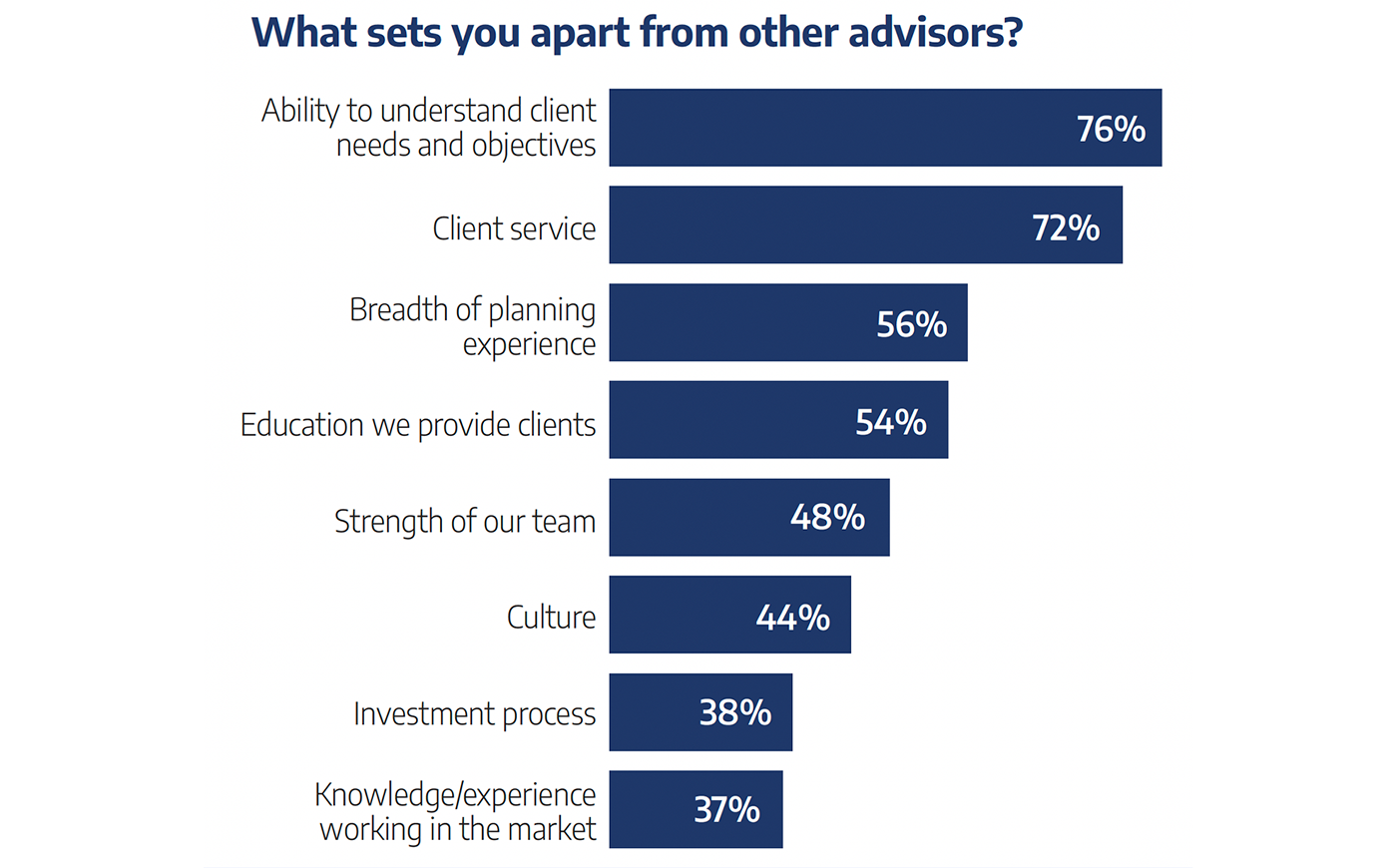

When asked what sets them apart, 70% of advisors in the FPA study picked two key attributes—understanding client needs and objectives and client service4 [see figure below]. When seven out of 10 advisors rely on the same selling points, it’s no wonder investors are having a difficult time telling advisors apart.

Clearly, advisors need to think more about not only delivering value, but also communicating how they are different and why that matters to the clients they seek.

Source: Financial Planning Association, Research and Practice Institute, 2016 Trends in Practice Management: Defining and Communicating Your Value.

Creating a unique value proposition

As you think about how to more effectively communicate with your clients and prospects, you might start by crafting a value proposition statement. This brief statement, usually one or two paragraphs, summarizes who you are and why you are unique. An effective value proposition statement goes beyond your qualifications to make deep connections between what you offer and what your ideal clients need.

As an example, which do you find more compelling?

As an example, which do you find more compelling?

“I provide holistic wealth management services.”

Or: “I help high-net-worth (HNW) clients plan for a secure, carefree retirement by providing targeted conservative investment strategies.”

Or: “I empower young professionals to get on a sound financial path and meet their financial commitments.”

The first could describe any number of financial advisors and does little to tell investors what you can actually do for them. The second and third communicate not only what you provide, but who you provide it to, and what overreaching goals you’re helping these investors achieve.

As an example, which do you find more compelling?

As an example, which do you find more compelling?

“I provide holistic wealth management services.”

Or: “I help high-net-worth (HNW) clients plan for a secure, carefree retirement by providing targeted conservative investment strategies.”

Or: “I empower young professionals to get on a sound financial path and meet their financial commitments.”

The first could describe any number of financial advisors and does little to tell investors what you can actually do for them. The second and third communicate not only what you provide, but who you provide it to, and what overreaching goals you’re helping these investors achieve.

An effective value proposition answers four key questions:

- Who are you and what do you offer?

- Who are your ideal clients?

- What specific benefits do you provide these clients?

- Why do you do what you do?

It also:

- Conveys your authentic passion for what you do and how you do it.

- Combines a rational argument with an emotional hook, linking your expertise to client outcomes.

- Can be tailored to individual markets and investors.

Creating a unique value position is a multi-step process and takes some reflection and investigation. Let’s consider the steps.

Step 1: What makes you unique?

As a start, do some self-reflection. In your view, what sets you apart from other advisors? Do you have special qualifications or experience? Are there unique products and services you offer?

You should also tap into your personal story. Why did you choose to become an advisor? What part of the job energizes you? For example, do you find satisfaction in helping clients achieve their dream retirement? Do you like helping clients resolve thorny problems in a way that helps them feel empowered? This kind of reflection can provide insights on which clients and solutions you’d like to target. It will also help you communicate with clients in an authentic, values-driven way.

Step 2: Who are your ideal clients?

Advisors cannot be all things to all people, and those who do risk spreading themselves too thin while muddying their value message. Instead, the more closely you can target your value proposition to specific clients—telling them exactly what you can do for them—the more likely you are to differentiate yourself.

To create a profile of your ideal client, think about existing clients who value what you do. Working through your client-segmentation process, you might identify strong sources of business, referrals, or professional satisfaction. You might also think about clients who inspire you to do your best work or share your general philosophy toward investing and risk.

As an additional step, you might consider potential clients you’d like to attract—especially those you think would be a good fit for your unique perspective or qualifications.

Once you settle on 10 to 20 “ideal” clients, look for a common thread. Do they fall into a demographic group or profession? Do they share similar approaches to investing, risk, or advisor-client communication? For example, you might settle on small-business owners who value guidance on selecting retirement and health-care plans, or executives approaching retirement seeking a conservative investment approach.

Many advisors undertake this process only to recognize a disconnect between the clients they want and those who make up their book of business. Only one-third of advisors in the FPA study reported that ideal clients made up 75% or more of their client base.5 If this is the case, you might consider referring some clients to a colleague or associate who can better suit their needs. That way, you can free up more time to spend on pursuing clients who are a better fit.

Step 3: What do your ideal clients value?

Once you’ve identified 10 or so “ideal” clients, the next step is to learn as much as you can about what motivates them and what they value. The goal is to create a detailed profile of your ideal clients, going beyond simple investment objectives to the deep emotional needs that drive their decision-making.

For example, according to a recent study by the Investments and Wealth Institute, the top three things HNW investors say they pay their advisors for are ongoing guidance/advice to help reach their goals (90%), help in avoiding costly financial and investment mistakes (84%), and monitoring of their goals (81%).6

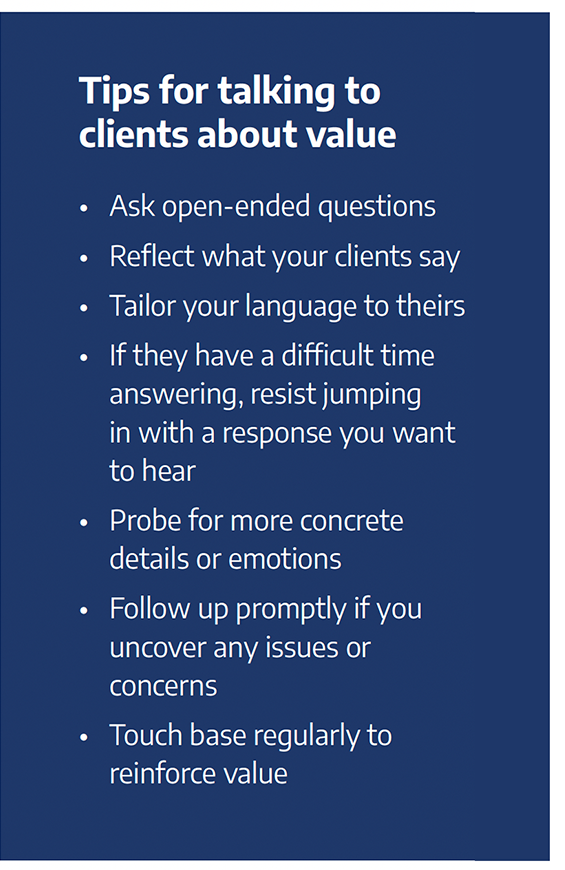

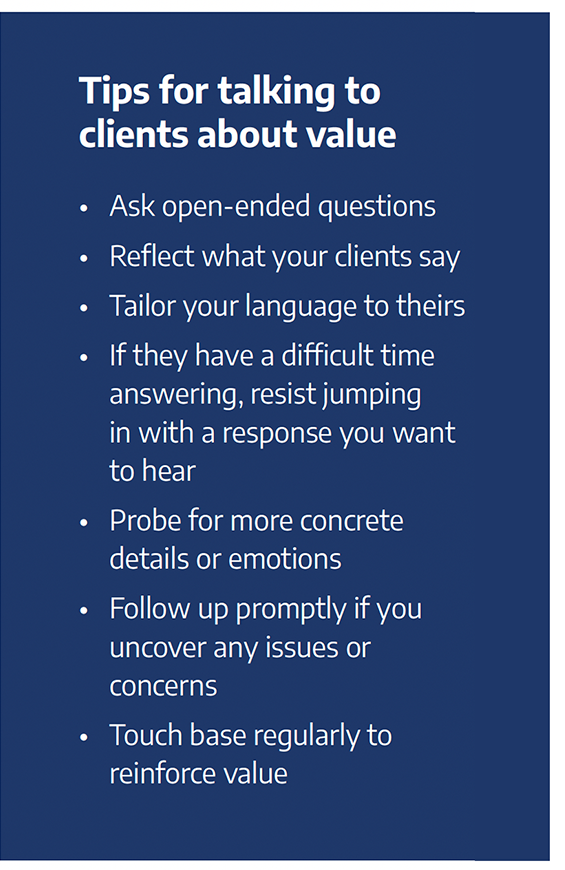

Client interviews are a powerful way to learn about clients, while also testing your value proposition. To start, offer to buy lunch for each of the clients you identified in the previous step. Let them know you’re working to strengthen your service proposition and would like their feedback on how you’re doing and what you could do better.

Give your clients a chance to talk about what’s on their minds and try to keep the discussion open-ended. While clients may want to talk about their portfolio performance, try to explore what motivates them beyond investment returns. Pay attention to broad emotional statements, such as “you help me feel more confident” or “you reassure me.” Then ask follow-up questions to uncover what concrete things you did to spark these feelings.

Step 4: Draft your value proposition statement

Once you’ve done your legwork, you’re ready to draft your value proposition statement, incorporating what you’ve learned. This statement should include various elements, such as:

- What you offer.

- Which clients you aim to serve.

- What unique benefits you provide these clients.

- What emotional needs you support.

- Why you do what you do.

You can then work at combining these elements into a value statement that includes a logical argument—connecting what you offer with what your ideal clients need—as well as an emotional touchpoint.

In drafting your statement, you may also think carefully about the language you use, making it as concrete, specific, and evocative as possible. Where possible, shift the focus from who you are and what you can do to what difference you can make in people’s lives.

What clients want to know:

- How will working with you change my life?

- What goals are we pursuing together?

- How will you keep me on track to meet my short- and long-term goals?

- How can you help me reach financial freedom?

- How will you help me make the best choices and maximize my opportunities?

Consider a market niche. As you think about your ideal clients, it may make sense to target a specific market niche, such as doctors, tech professionals, or small business owners. You might also explore underserved niches such as millennial investors. By focusing on a niche, you can better tailor your message.

Step 5: Test your value proposition

Once you’ve drafted your value proposition, the next step is to run it by staff members or key clients to get their feedback.

Client satisfaction surveys are a good way to test various elements of your value proposition. They can also help you check in regularly with clients to make sure your message is breaking through and is consistent with their experience. Aim for sending out a regular client satisfaction survey at least once a year.

While 85% of advisors in a Financial Planning Association study ranked client satisfaction as a top contributor to long-term value, only around half tracked this information over time, and less than half shared this information with their staff.7

- Track results over time. Client satisfaction rankings not only help you measure how well you’re delivering on your value proposition, but they can also identify gaps between what you believe you deliver and what clients perceive. To maximize the value of this information, incorporate these measurements into your key performance metrics. You might pick a few key issues—such as “responds in a timely fashion” or “listens to and understands my concerns”—as focuses for improvement.

- Share results with your staff. Client satisfaction rankings are an important metric for measuring the efficiency and responsiveness of your entire organization, from client onboarding through client reviews. You can help make this a practicewide initiative by building employee incentives and compensation around improvement in key metrics.

- Offer surveys in person to boost response rates. According to SurveyGizmo, mail-in surveys may expect only a 10% to 15% response rate.8 You may be able to boost this by asking clients to complete a survey in person or by offering a small token of appreciation for returned surveys.

Sample Value Proposition Statement

Try filling in the blanks:

Through our [unique skill or qualification], we help [ideal client] achieve [client goal] by offering [specific offering]. We are committed to helping clients feel [emotional hook].

or

Tapping into our [passion or commitment to investing] we support [ideal client] in reaching [client goal]. We provide [unique skill] and [unique skill] to help clients feel [emotional hook].

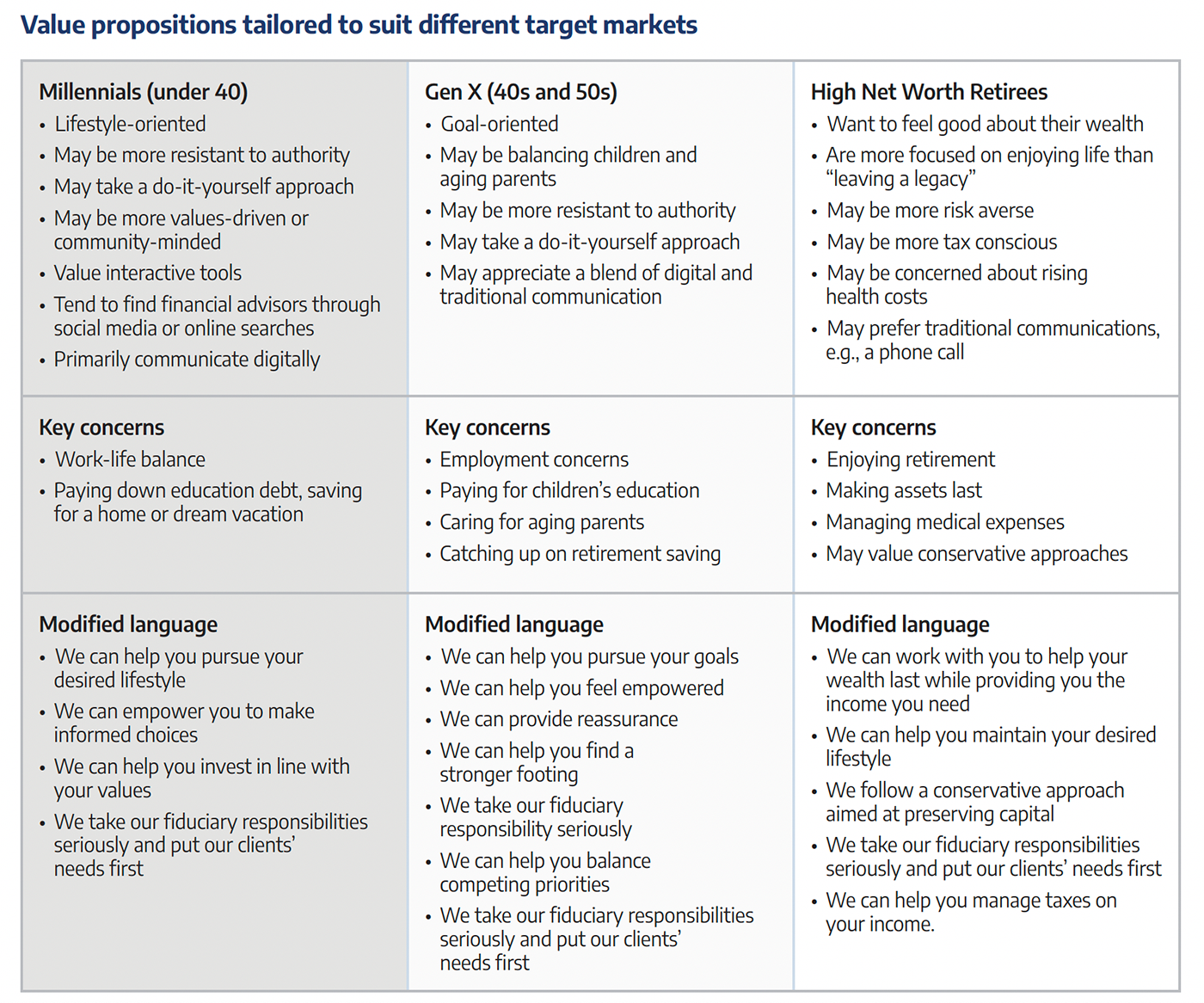

Step 6: Tailor your value proposition to the relevant audiences

Your value proposition statement provides a starting place for communicating your value, but this statement becomes even more powerful when you tailor it to different audiences, channels, or even individuals. The more you learn about what motivates the specific groups you’re targeting, the more personal you can make your value messaging.

If most of your clients are retirees in their 70s and 80s, for example, you may also consider reaching out to younger investors to position your practice for future growth. Advisors who start now to establish relationships with these younger investors may be better positioned as Gen X and millennial investors accumulate assets and inherit wealth from their parents and grandparents.

More than $50 billion in wealth is expected to pass from one generation to the next by 2061.9

While studies have found that Gen X and millennial investors aren’t necessarily averse to retaining their parents’ financial advisors, these relationships can’t be taken for granted. Younger investors have different life experiences and communication styles, and advisors who don’t adapt their language and client approach to younger investors may have less success in winning their loyalty.

Communicating your value proposition

Developing your value proposition is only half the challenge. You also need to think of ways to communicate it effectively to your clients and prospects while keeping it fresh and meaningful.

Work with your team. The value proposition should act as the guiding principle of everything you do—from marketing and client onboarding to annual reviews, client engagement, and client appreciation events. Work with your team to identify key metrics to measure client satisfaction and loyalty, including revenue growth, survey results, client engagement, and referrals. You might target one area for improvement each quarter, such as onboarding efficiency or increasing the number of client touchpoints.

Work with your clients to co-create value. Delivering value to your clients is an iterative process that involves a partnership and frequent communication.

- Collaborate with clients to set the agenda ahead of each client review.

- Check in with clients on a personal level at the start of client reviews: Take the conversation beyond “how did your investments do” to “how are you doing.”

- Relate market performance to personal goals: Focus your discussion less on performance relative to market benchmarks and more on progress toward client goals.

- Build accountability into the process: Create metrics to measure your value, and keep clients informed on how you measure the progress you are making together.

- Seek feedback on an ongoing basis, both through annual client satisfaction surveys and periodic mini polls that can test individual aspects of your value proposition.

Build success stories. To support your unique value proposition, start to collect stories of how you helped clients reach their goals. The more you can build your value proposition around client stories and concrete examples, the more powerful it will be. Of course, sharing stories in communicating your value proposition will have to be done carefully, in step with your compliance guidelines.

Frame referral requests around your value proposition. When asking clients about referrals, remind them why you are unique and what you have done to help them. Tell them specifically what kinds of clients you are looking for and what unique value you offer.

Communicating value to prospects

You can use your value proposition in prospecting seminars and presentations. You may want to create a streamlined “elevator pitch” to introduce yourself to people, telling people exactly who you are, who you serve, and what benefits you provide.

Only 21% of advisors have a clear plan for attracting younger clients, according to a Financial Planning Association study.10

Create messaging around life events. Prospects may first reach out to a financial advisor when they face a crisis or life event. Consider creating messaging or resources related to financial planning for new couples or parents, navigating an employment change, or dealing with the death of a parent.

You might also investigate marketing collaborations with professionals such as employment counselors or senior-care specialists who might interact with clients during important life events.

Website. Make sure your website clearly communicates your value proposition, including what kinds of clients you’re looking for and why you are different. While the majority of advisors in a Financial Planning Association study believed their websites did an effective job of communicating the products and services they offered, far fewer were confident that their website communicated their unique value proposition.11

Social media. A 2018 Putnam Social Advisor survey found that 92% of advisors who use social media say it has helped them gain new clients, 94% who use social media report they use it to make initial contact with referrals, and 86% say they use it to connect with existing clients’ adult children and heirs.12 If you’re using social media, you’ll want to make sure your value proposition extends to your social media messaging.

Editor’s note: Proactive Advisor Magazine would like to thank Axos Advisor Services for permission to republish an edited version of the white paper “Your value proposition: How to effectively communicate your unique offering.”

Axos Advisor Services wants to help advisors make developing or updating their value proposition easier. They have developed a convenient advisor resource guide called “Communicating Your Unique Value Proposition.” You can use this workbook to profile your ideal client and craft an effective value proposition statement for your business. To get this advisor resource guide, email [email protected] or call 866-776-0218.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Investment Products: Not FDIC Insured – No Bank Guarantee – May Lose Value.

Axos Advisor Services is a trade name of Axos Clearing LLC. Axos Clearing LLC provides back-office services for registered investment advisors. Neither Axos Advisor Services nor Axos Clearing LLC provides investment advice or makes investment recommendations in any capacity. Securities products are offered by Axos Clearing LLC, Member FINRA & SIPC. Axos Clearing LLC does not provide legal, accounting, or tax advice. Always consult your own legal, accounting, and tax advisors. © 2021 Axos Clearing LLC. Member FINRA & SIPC. All rights reserved.

1 Satter, Marlene. “‘Client-Centric’ Advisors Have 93% Bigger Accounts: Cerulli.” Think Advisor, December 20, 2018. Retrieved May 17, 2019, from https://www.thinkadvisor.com/2018/12/20/advisors-focused-on-client-experience-have-93-bigg/.

2 “2016 Trends in Practice Management: Understanding and Driving Client Value.” Financial Planning Association Research and Practice InstituteTM, 2015.

3 Littlefield, Julie. 2016 Trends in Practice Management: Defining and Communicating Your Value (2015). Financial Planning Association Research and Practice InstituteTM, 2015.

4 Ibid.

5 Ibid.

6 “INVESTMENTS & WEALTH INSTITUTE High-Net-Worth Investor Research.” Investment & Wealth Institute, 2019. https://investmentsandwealth.org/getattachment/50d51618-813b-466f-a022-17b38d0d7270/HNW-report2019-FINAL.pdf?lang=en-US.

7 Littlefield, Julie. “Operationalizing the Delivery of Your Value: 2016 Trends in Practice Management.” 2016.

8 Fryrear, Andrea. “What’s a Good Survey Response Rate?” SurveyGizmo, July 27, 2015. Retrieved May 28, 2019, from https://www.surveygizmo.com/resources/blog/survey-response-rates/.

9 Vincent Gauthier, Sean Cunniff, and Jared Goldstein. “10 Disruptive Trends in Wealth Management.” Deloitte, 2015.

10 “2016 Trends in Practice Management: Understanding and Driving Client Value.” Financial Planning Association Research and Practice InstituteTM, 2015.

11 “Communicating Your Value: 2016 Trends in Practice.” Financial Planning Association Research & Practice InstituteTM.

12 “The Social Advisor Survey,” Putnam Investments, 2018.

Axos Advisor Services is an RIA custodian that delivers individualized attention, intuitive technology, and knowledgeable consulting support. As a hybrid custodian and financial-services company, Axos Advisor Services provides powerful, integrated custodial and banking solutions that enable RIAs to offer a wider range of services to their clients. Advisors have access to the intuitive Liberty Platform, designed and built specifically for RIAs. Axos Advisor Services is offered by Axos Clearing LLC, a licensed broker-dealer.

RECENT POSTS