Advisors embrace values-based investing and financial planning

Advisors embrace values-based investing and financial planning

Advisors explain how they are meeting the growing client desire for values-based planning, as well as the rise of risk-managed socially responsible and faith-based investment strategies.

Over the past decade, financial advisors have been increasingly embracing the rising trend of values-based investing and financial planning for their clients.

For many advisors, this starts with their personal philosophies and fundamental beliefs about how they would like to work with and serve clients.

Financial advisor Ted Moyer, whose firm is located in Center Valley, Pennsylvania, expressed his thoughts on the topic in a 2018 interview with our publication,

Financial advisor Ted Moyer, whose firm is located in Center Valley, Pennsylvania, expressed his thoughts on the topic in a 2018 interview with our publication,

“From a potential client’s very first exposure to our advisory firm, whether that is through a direct referral or having attended one of our financial education seminars, I want them to know about our values-based philosophy in working with clients. … I believe that a foundation in humanistic principles is critical to our advisory firm’s success and can help define clients’ interactions with our firm.”

Lem Kornegay, of Glendale, Colorado, said in an interview with Proactive Advisor Magazine this year,

Lem Kornegay, of Glendale, Colorado, said in an interview with Proactive Advisor Magazine this year,

“There are characteristics I look for in potential clients. Do they see the value in long-term relationships? Do they want to make a difference in their family and community? Are they highly optimistic? Do they see themselves as having something of value to share? … When I see these characteristics, I am confident that we can work well together. Their needs and expectations will match well with what I can offer and deliver.”

Linda Persechino of New Hartford, Connecticut, says she wants to “continue the advisor-client relationship for years” with her current clients, their children, and hopefully their grandchildren. She believes that “the most successful advisor-client relationships in our business are when there is good chemistry between people and some shared values.”

Linda Persechino of New Hartford, Connecticut, says she wants to “continue the advisor-client relationship for years” with her current clients, their children, and hopefully their grandchildren. She believes that “the most successful advisor-client relationships in our business are when there is good chemistry between people and some shared values.”

Jason Palmer, CFP, of Cottonwood Heights, Utah, says of his practice philosophy,

Jason Palmer, CFP, of Cottonwood Heights, Utah, says of his practice philosophy,

“I selected the name ‘Resonant Financial Planning’ for my business after a lot of careful consideration. I believe that when professional, process-driven financial advice resonates with clients’ values, people can become empowered to make decisions with clarity and confidence.”

While these advisors and others work to incorporate a values-based approach throughout their working relationships, many clients are looking to take that to the next level in terms of investment implementation. They would like their investment strategies to reflect, to the degree possible, their personal beliefs, whether those are in the areas of socially responsible investing or faith-based investing.

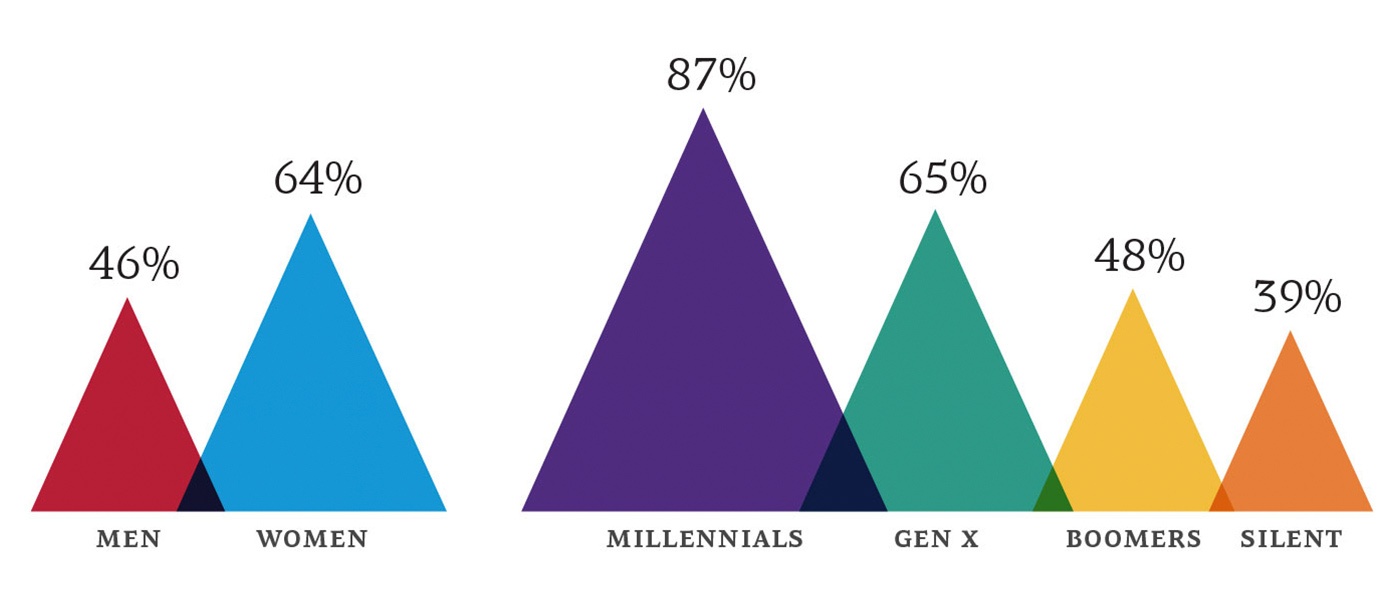

Percentage of respondents who agree that ‘social, political, or environmental impact is important in investment decisions’

A majority of millennials, Gen X, and women believe that a company’s track record in environmental, social, and governance is an important consideration for investing. 37% of high-net-worth investors are reviewing their portfolios for impact investments.

Source: Bank of America, Insights on Wealth and Worth, 2018.

Many advisors are working with third-party investment managers who can offer investment strategies that meet their clients’ desire for more values-based investing in two areas: (1) portfolio strategies that uniformly invest in companies whose products and services align with core religious values, and (2) portfolio strategies that actively invest in forward-thinking and sustainable companies, while avoiding those companies that profit from activities deemed counter to humanistic and environmental values.

In this way, advisors can help their clients achieve their financial goals while also contributing to a long-term, positive impact on the world.

‘Doing good’ and ‘doing well’ don’t have to be mutually exclusive when it comes to meeting investment objectives for clients

Research shows that organizations that adopt solid ESG (environmental, social, governance) practices reap better operational performance. Another study shows that the incorporation of corporate social responsibility proposals can lead to increased shareholder value. In fact, according to research conducted by the Global Impact Investing Network, 89% of “principled investors” said their financial performance was in line with or outperformed their expectations.

Further, select third-party investment managers offer principled, actively managed investment strategies that use cutting-edge technology to seek superior returns, manage for risk, and adjust to the market—allowing investors to participate during strong market growth and provide protection during downturns.

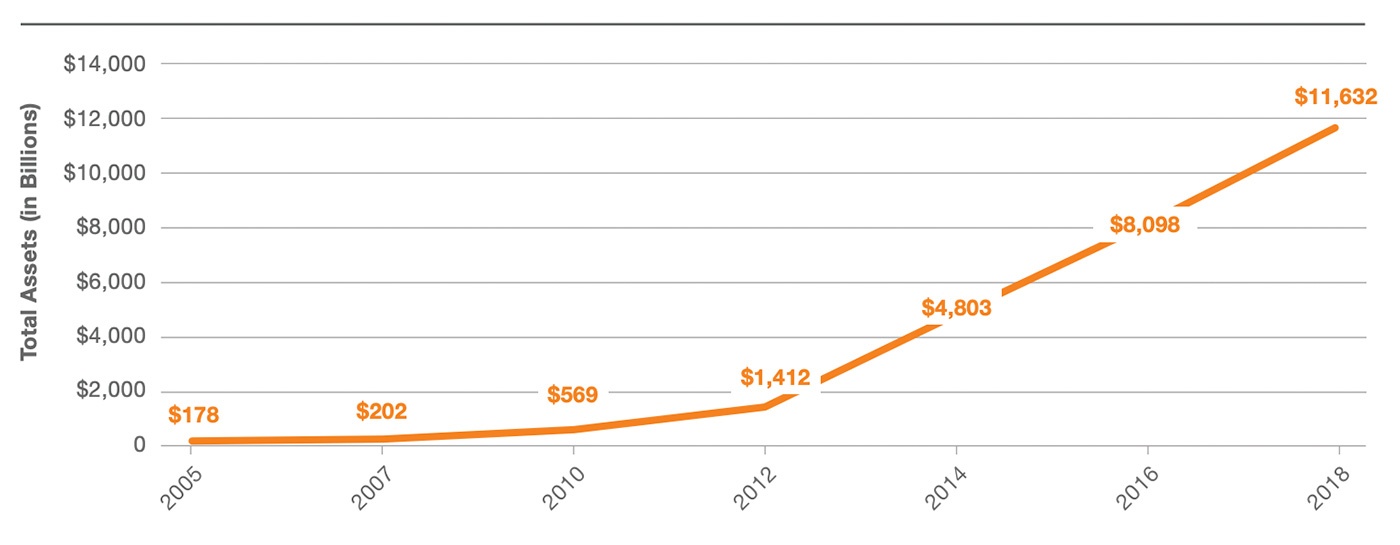

Source: US SIF Foundation’s 2018 Report on US Sustainable, Responsible and Impact Investing Trends

Jeffrey Scrimenti • Salem, OR

Jeffrey Scrimenti • Salem, OR

Read full article

“I am very excited about the third area (of my practice’s recent growth), as are many of my clients. I like to call this life-affirming or values-based investing, which consists of socially responsible investing (SRI) and faith-based investing strategies or funds. Many clients are concerned with the types of companies their investment dollars are supporting and would like their portfolios better aligned with their principles.

“In my experience over the years, the feeling in the investment community was that this would mean sacrificing investment performance. I believe that is not the case. Companies that perform well on environmental, social, and governance factors can produce very competitive investment returns. One of the investment managers I work with offers actively managed strategies in the SRI and faith-based areas. This means clients can have investment strategies that are both risk-managed and values-based working in their portfolios.”

Michael Mandarino • Apollo Beach, FL

Michael Mandarino • Apollo Beach, FL

Read full article

“In 2012, I rededicated my life to the Christian faith, which has been a huge blessing. Our firm strives to empower our clients to focus on what is most important in their lives—their faith, family, finances, personal freedom, and philanthropy.

“I started working with a new broker-dealer in 2017, G.A. Repple and Company. They are a full-service broker-dealer and support our firm as we provide investment guidance and tax-advantaged strategies, asset management, planning for generational wealth distribution, retirement planning, and planning for charitable giving. They also have a commitment to helping advisors and their clients to align faith, family, and financial planning. This fits perfectly with my personal mission in working with clients. …

“Through one of our third-party investment managers, we can offer clients access to faith-based investment strategies. This firm also provides for 10% of its net advisory fees collected for the strategy to be distributed to a client-designated charity, church, or religious institution.”

Timothy Lay, CFEI, AIF • Sisters, OR

Timothy Lay, CFEI, AIF • Sisters, OR

Read full article

“I have two ‘titles’—investment advisor representative and trusted principal advisor—but informally I like to think of myself as a ‘servant leader.’ That simply means using my skills, experience, and knowledge to educate, influence, and guide people during the process of improving their personal and financial futures. It means actively showing clients patience, respect, confidence, and transparency. …

“Working with several third-party investment firms, we have access to over 100 actively managed strategies and combinations of strategies. Depending on the client’s risk tolerance and investment objectives, I may use multiple active strategies to create a blended approach. We have access to strategies that may serve very different client needs: some are designed to provide real income, others focus on market sector rotations, and some might be more geared to overall market trend following. We might also use a managed government bond strategy or faith-focused or environmentally conscious strategy options. No matter what manager or combination of managers I may recommend, the key objective is delivering a customized investment solution designed to meet the financial goals of each investor.”

Mark Tevebaugh • Indian Harbor Beach, FL • Sonoma, CA

Mark Tevebaugh • Indian Harbor Beach, FL • Sonoma, CA

Read full article

“My views on investment management have changed over the years. I was brought up in the business on the basic principles of asset allocation, modern portfolio theory, and diversification. These were the cornerstones of a buy-and-hold approach to investing.

“I believed that these core ideas, combined with investments in quality companies and funds, would allow clients to weather the ups and downs of the markets. For a long time that was largely true. But the dot-com crisis in the early 2000s, and then the financial crisis of 2008, changed my way of thinking. …

“This led me to a search for another way to combine values investing with a stronger portfolio approach to risk management. I was able to find several money managers who offer actively managed portfolios that do exactly that. They will have pre-screened portfolios in both the faith-based and socially responsible areas. We are interested in avoiding companies that do not meet certain criteria, such as companies that are connected in some way to pornography, animal testing, human trafficking, or have improper relationships with enemies of the U.S. We are, however, also interested in being with companies that are cutting edge, best in class, and have strong corporate governance. …

“I find that if clients understand what they are investing in, and how those investments align with their passions and values, they have a much better chance of sticking with the plan and being successful.”

Cathy Jackson, CKA • East Fallowfield, PA

Cathy Jackson, CKA • East Fallowfield, PA

Read full article

“My faith is an integral part of my life, my family, and how I relate to people in all ways. It is only natural that this perspective carries through to my advisory practice. I am a Certified Kingdom Advisor, which means I have been trained in delivering financial advice from a biblical worldview and helping people responsibly steward their financial resources. …

“Risk management is important not only to investment planning but for the client’s overall financial plan. I educate clients on several of the most relevant types of risk during the planning process, including longevity risk, inflation risk, market risk, and income-shortfall risk. … I may use third-party investment managers for several elements of a client’s investment plan. They are highly experienced in their field and have extensive resources, including full-time research groups, portfolio managers, and their own proprietary methodologies for strategy development. …

“I think my time is best spent in helping clients develop financial plans, creating a fundamental asset-allocation structure for them, and serving their overall financial needs, not trying to micromanage client portfolios on a daily, weekly, or monthly basis. The programs of third-party managers are very turnkey and free up my time to build relationships and provide top-notch service to clients.”

Jay Kready • Mount Joy, PA

Jay Kready • Mount Joy, PA

Read full article

“We provide a full-service approach to financial planning and investments. … We put a lot of emphasis on stewardship, life planning, and a values-based approach, which is a somewhat different approach than you might normally find in the industry. However, we take the financial side of the equation very seriously and provide top-notch due diligence, products, services, and strategies across the board. …

“It all depends on the client’s needs: their risk profile, their goals, and their time frame. I will often use a blend of passive, longer-term strategies, some of our own proprietary portfolio approaches, and more active strategies provided through third-party managers. So whether it’s tactical, trend following, or technical, there are all kinds of different strategies that we may use to complement a client’s core holdings. For clients that are interested in more of a values orientation to investing, we also have several ways to apply social screens to investment selections or use third-party funds that also do this.”

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.