Examining the key factors of socially responsible investing (SRI)

Is it possible to “do good” and “do well” with a socially responsible investing (SRI) strategy? Empirical evidence suggests that funds using quantitative analysis of environmental, social, and governance (ESG) factors can produce very competitive investment performance.

When the idea of environmental, social, and governance (ESG) investing began, it was primarily values-based, meaning investor beliefs and values were considered when identifying a universe of investable securities. Today, values-based investing is rapidly expanding and includes a broad array of new concerns; yet, the main focus is still on considering ESG factors before an ESG mutual fund or ETF selects a company for inclusion. This type of investment focus is also known as socially responsible investing, sustainable investing, or impact investing. A growing amount of empirical evidence suggests a move toward quantitative incorporation of ESG ideals can not only promote such ideals but also lead to superior investment performance.

When the idea of environmental, social, and governance (ESG) investing began, it was primarily values-based, meaning investor beliefs and values were considered when identifying a universe of investable securities. Today, values-based investing is rapidly expanding and includes a broad array of new concerns; yet, the main focus is still on considering ESG factors before an ESG mutual fund or ETF selects a company for inclusion. This type of investment focus is also known as socially responsible investing, sustainable investing, or impact investing. A growing amount of empirical evidence suggests a move toward quantitative incorporation of ESG ideals can not only promote such ideals but also lead to superior investment performance.

The principles behind socially responsible investing were originally used as a screen to exclude certain securities from an investable universe based on the type of business they were involved in or the amount of revenue they derived from a specific activity. Businesses typically excluded might include those with poor environmental records; involvement in alcohol, tobacco, gambling, or adult entertainment; issues with human-rights protection; or those engaging in weapon sales or manufacturing. Additionally, these screens were used to include industries—such as clean or alternative energy—that were perceived as contributing to socially desirable ends, such as a clean environment.

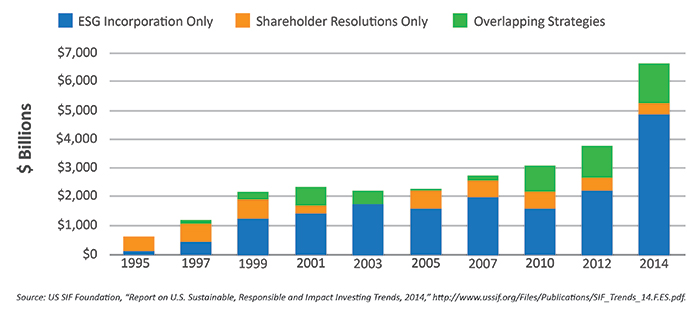

The growth of SRI has been impressive in recent years, as shown in Figure 1. A broad shift in investor attitudes has been supporting this growth. A 2016 U.S. Trust survey of high-net-worth investors (over $10 million in investable assets) found that 58% of respondents either “currently owned” or “were interested in adding” investments with positive social or environmental impacts.

FIGURE 1: SUSTAINABLE AND RESPONSIBLE INVESTING IN THE UNITED STATES, 1995–2014

The ESG field is now moving toward an investment analysis process that considers many factors, but also weighs them against industry peers. ESG funds and ETFs that include ESG factors in the investment evaluation process give investors exposure to companies that are working to do what’s right for their future by doing what they believe is right for the world.

ESG factors can have a direct impact on a company’s bottom line

Funds or “funds of funds” actively invest in forward-thinking and sustainable companies, avoiding those companies that profit from activities deemed counter to humanistic and environmental values. But, ultimately, this comes down to the initial screening of potential stocks on a company-by-company basis.

Using ESG analysis in all aspects of the investment process is important to help avoid potential corporate missteps. Often, ESG issues come to light when corporate events or policies directly affect the public, employees, or shareholder value. Examples include the Enron scandal, the Deepwater Horizon oil spill disaster at British Petroleum (BP), and many issues related to employee rights at Wal-Mart.

In the case of Enron, it’s said that poor governance standards allowed the company to use a complex business model, opaque financial statements, and unethical business practices. This combination allegedly resulted in the largest corporate bankruptcy at the time, with shareholders losing over $11 billion.

Oil spewing from the Deepwater Horizon disaster in 2010, which caused massive environmental damage, was reported to have resulted from BP’s lackluster health and safety record. It has been said that leading up to the spill, BP’s focus on its environmental impact lagged industry peers by most metrics. Following the spill, shareholders lost more than 50% of per share value as the stock plunged from over $55 to under $30. Since then, BP has reportedly focused on improving its environmental impact to reduce the future likelihood of a disaster (to both the environment and its share price).

Mega-retailer Wal-Mart is no stranger to negative news. Its ability to handle social issues such as labor relations has given rise to YouTube hits like, “Friends with Low Wages,” a parody of the Garth Brooks song, “Friends in Low Places.” Wal-Mart even has its own Wikipedia entry specifically about its so-called weak labor practices. Wal-Mart is working to overcome the bad publicity by promoting its record of internal employee growth and advancement. According to Wal-Mart’s website, 75% of its management teams started as hourly associates and now earn between $50,000 and $170,000 per year.

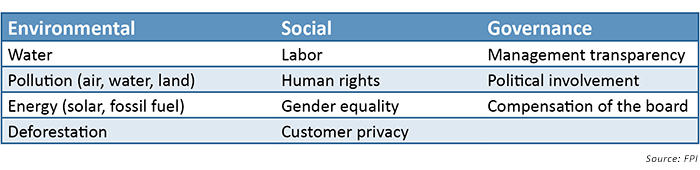

Activities companies engage in can directly relate to their bottom line. Current ESG evaluation efforts focus on the positive economic benefits derived from companies being aware of more than just a positive earnings release. Rather than focusing simply on the environment, as was the case 20 years ago, ESG investing has evolved to include a much broader scope of factors. The examples shown in Table 1 are representative of factors that could potentially cause large swings in financial performance via a negative event or long-term outcome.

TABLE 1: EXAMPLES OF ENVIRONMENTAL, SOCIAL, AND GOVERNANCE ISSUES

Companies that perform well on ESG factors are reaping both societal and financial benefits—reflected in their share prices and increased exposure within SRI funds.

Investors and investment firms that focus on ESG issues are realizing a need to be compensated for the extra due diligence. As a result, performance is coming under scrutiny and research is starting to follow. In a recent paper, the University of Oxford and Arabesque Partners found that, “88% of the operational performance studies show that solid ESG practices result in better operational performance.”

Positive performance research isn’t new in the ESG world. In 2003, Harvard and Wharton researchers published a paper called “Corporate Governance and Equity Prices.” Using a combination of 24 governance rules, they found that, “An investment strategy that bought the firms [with strongest rights] and sold firms [with the weakest rights] would have earned abnormal returns [of] 8.5% per year during the sample period [1990s].” Another paper on corporate social responsibility (CSR), by Caroline Flammer of Boston University found that, “[adopted] CSR proposals lead to a significant increase in shareholder value by 1.77%.”

As these reports come out, a new data industry is emerging. Data analytics providers such as Morningstar are making a conscious effort to provide investors with relevant ESG information. Morningstar is well-known for its five-star rating system for mutual funds, and in early 2016, it launched an ESG rating system based on “globes.” Now, along with a star rating, mutual funds are given a sustainability score of one through five globes. (According to Morningstar, their globe rating methodology is “portfolio-based, quantitative, and analyzes the environmental, social, and governance [ESG] scores and controversies of companies held in the portfolio.”)

Using the Morningstar sustainability score, investors can compile a portfolio of mutual funds that focus on ESG factors. Our firm uses this data to sort through thousands of mutual funds on a yearly basis and to select monthly best-in-class funds that maintain a high “globe” rating. The results are cross-referenced using other public ESG data sources, such as the Forum for Sustainable and Responsible Investment (US SIF). After filtration is complete, we use a proprietary allocation system to actively manage ESG-only investments throughout the year.

Our active, risk-managed ESG strategy has essentially been a growth strategy for separately managed accounts. Since inception in 1998, our ESG strategy has achieved very competitive GIPS-based returns compared to the S&P 500 by managing equity and fixed-income volatility using a dynamic risk-allocation methodology with ESG mutual funds.

The number of investors interested in ESG-based investing is growing

Using active, risk-managed strategies with ESG funds and ETFs as a prospecting tool has benefited advisor marketing efforts by appealing to socially conscious investors concerned about market risk. These investors seek to express their views about the future of the world as a whole and still exhibit the historical investor concern for investment performance in all market environments.

No longer restricted primarily to a niche group of investors, the demographics for ESG investors range from young professionals to folks in retirement, and from people with average incomes to high-net-worth individuals. These investors are beginning to see that not only can their values be reflected in their investments, but that these strategies can also have a positive impact on their portfolios.

We used to think that only environmentalists or human-rights activists were interested in ESG investing. As the field has developed, ESG is expanding far beyond its foundations. Recent research reports continue to show that ESG investing isn’t just perceived as “good for the world,” but it’s good for investors as well.

When companies do things that are seen as bad, like in the cases of Enron, BP, and Wal-Mart, investors take note and stock prices change dramatically; however, when companies do what’s viewed as positive, research shows shareholder value rising over the long term. Mutual funds, ETFs, and the strategies made up of them create diversified portfolios of such companies, saving individuals and advisors from having to devote time and resources to do so originally and during the length of the investment.

US SIF in its biennial report perhaps summarizes the attractiveness of this type of investing best:

“What’s in a name? ESG, Ethical, Green, Impact, Mission, Responsible, Socially Responsible, Sustainable and Values are all labels that investors apply today to their strategies to consider environmental, social and corporate governance criteria to generate long-term competitive financial returns and positive societal impact. While the variety of labels can sometimes be confusing, the core message is clear. A growing number of investors, institutions and financial professionals are deploying and managing capital to build a more sustainable and equitable economy.”

Since 1981, Flexible Plan Investments (FPI) has been dedicated to preserving and growing wealth through dynamic risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine FPI’s many risk-managed strategies within a single account. FPI’s fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. FPI also offers advisors the OnTarget Investing tool to help set realistic, custom benchmarks for clients and regularly measure progress. flexibleplan.com