The Best of Proactive Advisor Magazine

Volume 11

Have you missed any of our recent top articles? Here’s your chance to catch up with Proactive Advisor Magazine’s “Best of Volume 11,” as chosen by our editor, readers, and followers on social media.

<br>

<div id="editor"></div>

Editor Picks

<p style="text-align: center;"><strong>Chosen by our editor</strong></p><br>

|

Helping clients ‘choreograph’ their financial future (Advisor Interview: Joshua Hernandez) | Volume 11, Issue 1 | “The one overriding objective that I stress for each client is building in some form of downside protection for their portfolio.” |

|

Can managing market volatility really be simple? by Linda Ferentchak | Volume 11, Issue 1 | A recent study from Yale University says your emotions may be right: avoiding risk in periods of high market volatility can be a winning strategy. |

|

Investing in election-year markets by Guggenheim Investments | Volume 11, Issue 3 | The market impact in presidential election years can be significant. We take a historical look at how markets have behaved during election cycles. |

|

5 top concerns faced by financial advisors in 2016 by David Wismer | Volume 11, Issue 6 | From the U.S. presidential election to global terrorism to market volatility & more, here are the top concerns faced by financial advisors in 2016. |

|

A case for active tactical investing by Dennis Yamasaki | Volume 11, Issue 7 | A close look at both the behavioral arguments for risk-managed strategies and a unique mathematical perspective on active tactical investing. |

<br>

<div id="viewed"></div>

Top Viewed

<p style="text-align: center;"><strong>Chosen by our audience</strong></p><br>

|

The case for mechanical trading strategies by Thomas Krawinkel | Volume 11, Issue 2 | When it comes to implementing trading strategies, there are many compelling reasons to rely on computers rather than human discretion. |

|

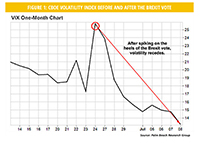

Does the market-volatility collapse warn of a pullback? | Volume 11, Issue 3 | After the surprise Brexit “leave” vote in June, traders saw an increase in the VIX, followed by an overall market volatility collapse. |

|

Evaluating an investment in gold for today’s diversified portfolios by Flexible Plan Investments | Volume 11, Issue 4 | The role of gold in investment portfolios: Part 1 | Should an investment in gold be a key element of effectively diversified and risk-managed portfolios? |

|

Can investing in gold create a more optimal portfolio allocation? by Flexible Plan Investments | Volume 11, Issue 5 | The role of gold in investment portfolios: Part 2 | Updated analysis supports an optimal portfolio allocation to gold of 25%. |

|

Helping clients achieve a quality lifestyle in retirement (Advisor Interview: Janice Hammond) | Volume 11, Issue 6 | “Ideally, we would like to see clients meet or better their current lifestyle during retirement.” |

<br>

<div id="social"></div>

Trending on Social

<p style="text-align: center;"><strong>Determined by Social Media interaction</strong></p><br>

|

Client development in an unprecedented ‘season of complacency’ by Greg Gann | Volume 11, Issue 8 | American investors are conflicted by feelings of complacency, distrust, inertia, hope, fear, and skepticism—how can advisors connect with them? |

|

Active investment strategies as a practice differentiator (Advisor Tips and Tools: Robert Pugh) | Volume 11, Issue 9 | “Active investment strategies, with their emphasis on risk management, have become a major part of how I position our firm’s services and investment philosophy.” |

|

Coaching clients as they prepare for their financial future (Advisor Interview: Mark Thompson) | Volume 11, Issue 10 | “At the end of the day, the client is the owner of their financial plan, and I am their coach throughout the entire process.” |

|

Examining the key factors of socially responsible investing (SRI) by Flexible Plan Investments | Volume 11, Issue 10 | A growing amount of empirical evidence suggests socially responsible investing can lead to competitive investment performance. |

|

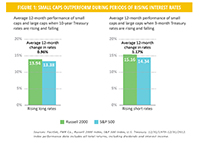

What a rising interest-rate environment means for small-cap stocks by John Reese | Volume 11, Issue 10 | Rising interest rates can have a negative impact on small-cap stocks, though they tend to perform better than large-cap stocks during these periods. |