Successful advisors on the top benefits of outsourced investment management

Successful advisors on the top benefits of outsourced investment management

Outsourced investment management offers financial advisors several important benefits: access to innovative investment solutions, enhanced focus on client relationships, and more time to build their businesses.

A recent article from The Wealth Advisor on the value of finding the “right” TAMP (turnkey asset management platform) said,

“Advisors are expected to be financial planners, psychologists, confidantes, and keepers of client goals—packaged into one. Advisors make the greatest impact on the front lines with clients. That is what drives retention, loyalty, and referrals—and ultimately business growth. …

“To remain competitive, advisors can’t afford to spend most of their time managing investments and tedious back-office systems. Independent advisors, many of whom are small-business owners, face increasing demands from clients and need to find a way to offboard non-client-facing tasks to focus on meeting client needs and business development functions.”

To this point, several recent research studies have shown that more advisors are (1) moving a greater percentage of their book of business to a fee-based practice model, (2) increasingly using the services of third-party money managers, and (3) supportive of active investment strategies with a strong risk-management focus. (See our December 2021 article for a full discussion of these trends.)

Going hand in hand with the upward trajectory of fee-based revenues is the continued growth of outsourced investment management among financial advisors. While estimates vary on the percentage of financial advisors who outsource investment management—either in whole or part—the consensus is that it is an accelerating trend.

Michael Kitces, a noted commentator on the advisory space, quoted a study from research firm Cerulli Associates in a 2018 article on the subject:

“While Turnkey Asset Management Platform (TAMP) solutions were first launched in the 1980s, they have grown dramatically in the past decade … accentuating a rising trend of financial advisors outsourcing their investment management, which a recent Cerulli study found is now being done by the majority (54%) of CFP professionals. And as advisors increasingly focus on giving financial planning advice (and not just providing insurance or investment solutions), this trend seems likely to only continue further, as more and more CFP professionals adopt some combination of TAMPs and technology tools to minimize the time they spend implementing portfolio management for their clients. In other words, notwithstanding their recent growth, TAMPs and the world of outsourced investment management is about to get a whole lot bigger than it is even today!”

The Impact of Outsourcing study, conducted in 2021 by an independent research firm, makes Mr. Kitces’ comments three years earlier appear prescient. An introduction to the study states,

“Why are 4 out of 5 advisors planning to increase the percent of outsourced assets over the next 3 years? The top factors include:

- 98% of advisors report they deliver better investment solutions as a result of outsourcing.

- 95% said they have a better work-life balance due to outsourcing.

- 91% experienced increased growth in total assets as a result of outsourcing.”

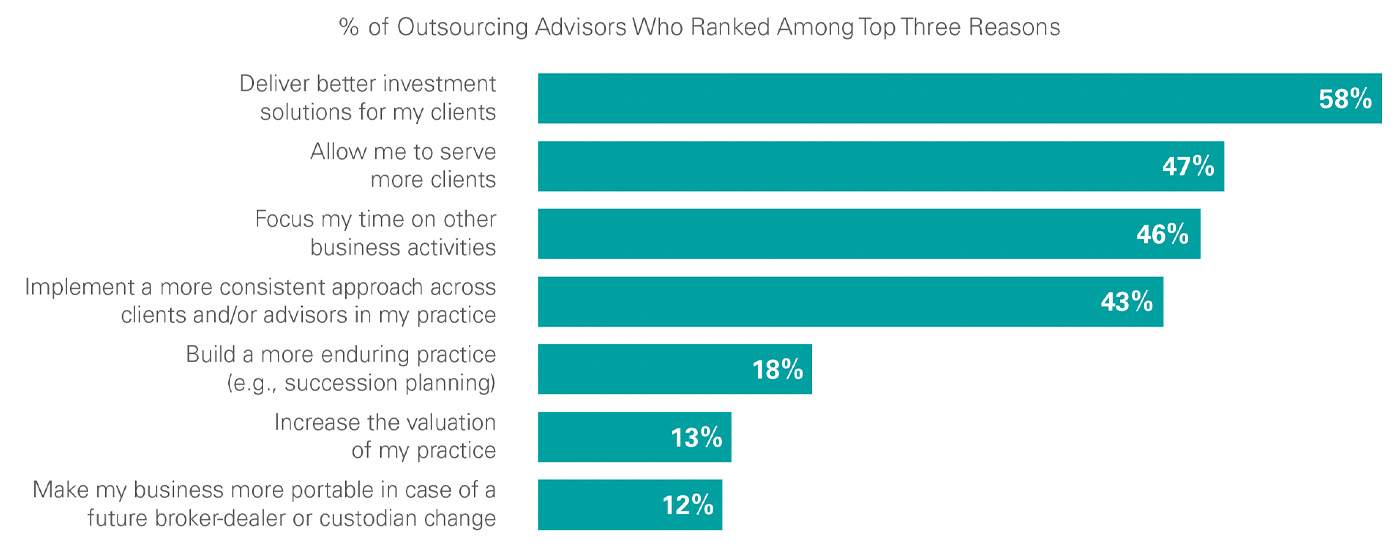

Among many findings, the study looks at the specific benefits financial advisors see as most compelling for using outsourced investment management.

TOP-RANKED REASONS FOR OUTSOURCING INVESTMENT MANAGEMENT

Source: “The Impact of Outsourcing” study. Conducted in 2021 by independent research firm 8 Acre Perspective, in partnership with AssetMark.

For this issue, Proactive Advisor Magazine asked several experienced financial advisors:

What do you think are the strategic benefits of outsourced investment management?

Parker Molitor • Chad Molitor • Murfreesboro, TN

Parker Molitor • Chad Molitor • Murfreesboro, TN

Read full article

“We believe in the many benefits of managed money accounts. We have access to third-party managers who have sophisticated risk-managed strategies that seek to minimize drawdowns in poor market environments and to capture upside market moves in favorable environments.

“We saw both types of periods in 2020 and were very pleased with how these strategies performed. It is not only the benefits of risk management or a defensive posture with active strategies. Many of these strategies can seek to optimize performance through sector rotation or the use of leverage. We see investment managers as close partners. We provide broad, big-picture oversight and set client allocations, and the managers execute on all elements of their strategies.”

Shannon LaRosse • Birdsboro, PA

Shannon LaRosse • Birdsboro, PA

Read full article

“We use the services of third-party investment managers for active, risk-managed strategies. These managers have been carefully vetted and have robust strategy, research, and management teams. Their sole responsibility is the daily management of their firm’s investment strategies. We carefully examine their performance in different types of market environments. We look to see if they can produce competitive returns in positive markets and—importantly—strive to mitigate losses in poor market conditions.

“We believe in approaches that take advantage of market trends, not ‘market timing.’ And, even in volatile markets, we believe our managers can find growth opportunities. From the point of view of a client’s long-term portfolio growth, we believe it is not always about trying to outperform an index. It is also about mitigating losses. Many people erroneously think that taking on more risk will lead to higher returns. Occasionally, that is true. But for less volatile, long-term portfolio growth, we think actively risk-managed strategies can play an important role. Our investment managers can provide risk-managed strategies that should be suitable for any of our clients, from those with conservative risk profiles to clients who want a fairly aggressive approach.”

David J. Wood • Royersford, PA

David J. Wood • Royersford, PA

Read full article

“In my 20-plus years in financial services, I have seen the investment industry change dramatically. Using the traditional tools and investment platforms of the last century, in my opinion, is like using a pager to communicate with someone. We use modern investment platforms that can provide alternative asset classes, and we have the ability to employ world-class research and investment strategies.

“We conduct thorough due diligence on third-party investment managers. If appropriate to their objectives, we can offer clients active, risk-managed strategies that can help mitigate drawdowns in volatile market environments while also seeking upside opportunity and growth where appropriate. In the past, Main Street investors rarely had access to these types of platforms and strategies, which traditionally were reserved for high-net-worth investors.”

Luis Padilla • Sparks, MD

Luis Padilla • Sparks, MD

Read full article

“About 80% of our client accounts have investment strategies managed by third-party professionals. I work with two other advisors within our broker-dealer reviewing our broker-dealer’s vetted universe of managers. The important factors we look at are performance history, the management and stability of the firm, and the end-user experience.

“When clients are closer to retirement, we look especially closely at the risk-mitigation capabilities of outside managers, for both income and growth-oriented strategies. They will usually have a manager-based risk-mitigation strategy or an algorithm-based approach. I tell clients that these strategies are like the bumpers placed on a bowling lane for inexperienced bowlers. They don’t guarantee that you are going to get a strike, but they are geared to preventing ‘gutter balls,’ or large portfolio losses in times of market stress. We tell clients we are not trying to predict absolute market lows or sell at market tops. We want portfolio management that will help smooth out volatility, have a goal of achieving competitive returns over full market cycles, and strive to avoid steep portfolio drawdowns.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.