The value of personal advice: Wealth management through the pandemic

The value of personal advice: Wealth management through the pandemic

The 10th annual PriceMetrix report examines an unprecedented year for North American wealth management.

In 2020, North American wealth-management clients dealt with fear and uncertainty in their portfolios, amid the fear and uncertainty that defined so many other parts of their lives due to the human tragedy of the COVID-19 pandemic. Relationships between financial advisors and their clients were put to the test, and the value of advisor-to-client advice was on full display as advisors achieved record client and asset retention.

However, the road ahead is uncertain. Total asset growth continues to be market dependent as new client additions have stagnated. In addition, revenue growth has not kept pace with asset growth. Demographic changes are having an impact on client composition at an unprecedented rate, and client perception of value for advice remains under a microscope. That, along with the growing prevalence of low-cost hybrid advice models, continues to put downward pressure on pricing.

In this edition of our annual report, The state of North American retail wealth management, we will unpack this unexpected year. How resilient were business models in 2020? What was the impact of the pandemic on client relationships and pricing? How did trading patterns change? And how prepared are wealth managers for the next test, particularly given recent market performance? The answers to these questions have implications not just for individual advisors but also for the executive leaders of wealth-management firms who rely on advisor growth to help build shareholder value.

This report is based on our comprehensive and proprietary dataset1 collected from more than 20 North American wealth-management firms. Our data is refreshed continually and is built from detailed client-holdings and transaction information from roughly 70,000 financial advisors. This offers an unmatched view not only into the behaviors and characteristics of wealth-management clients but also into how advisor decisions impact client outcomes as well as the economic performance of their institutions.

Highlights for 2020 include the following:

- continued asset and revenue growth per advisor, driven by market performance

- record-high client retention, but commensurate stagnant performance in the number of new client additions

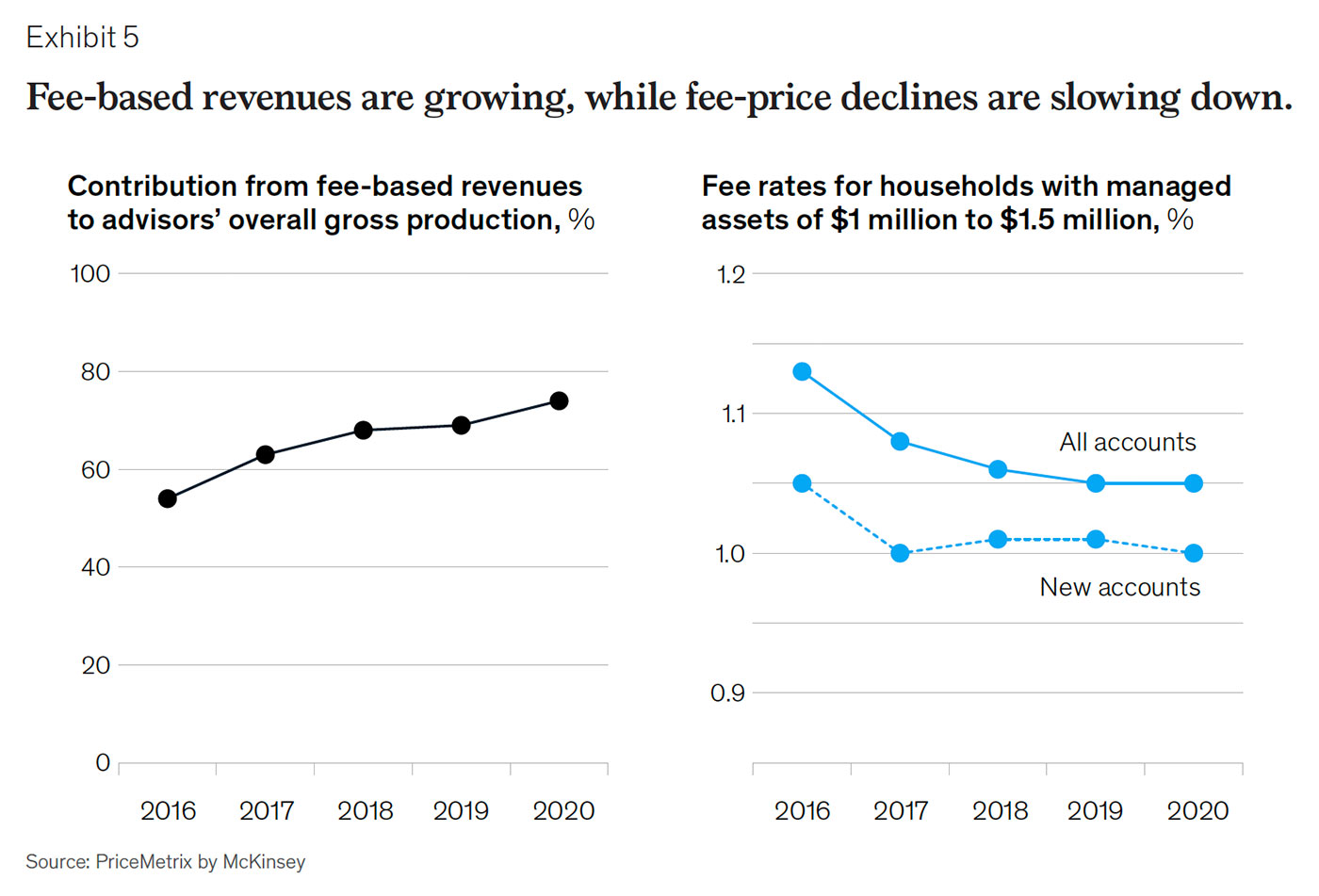

- continued growth in fee-based revenues, offset by continued decline in fee pricing

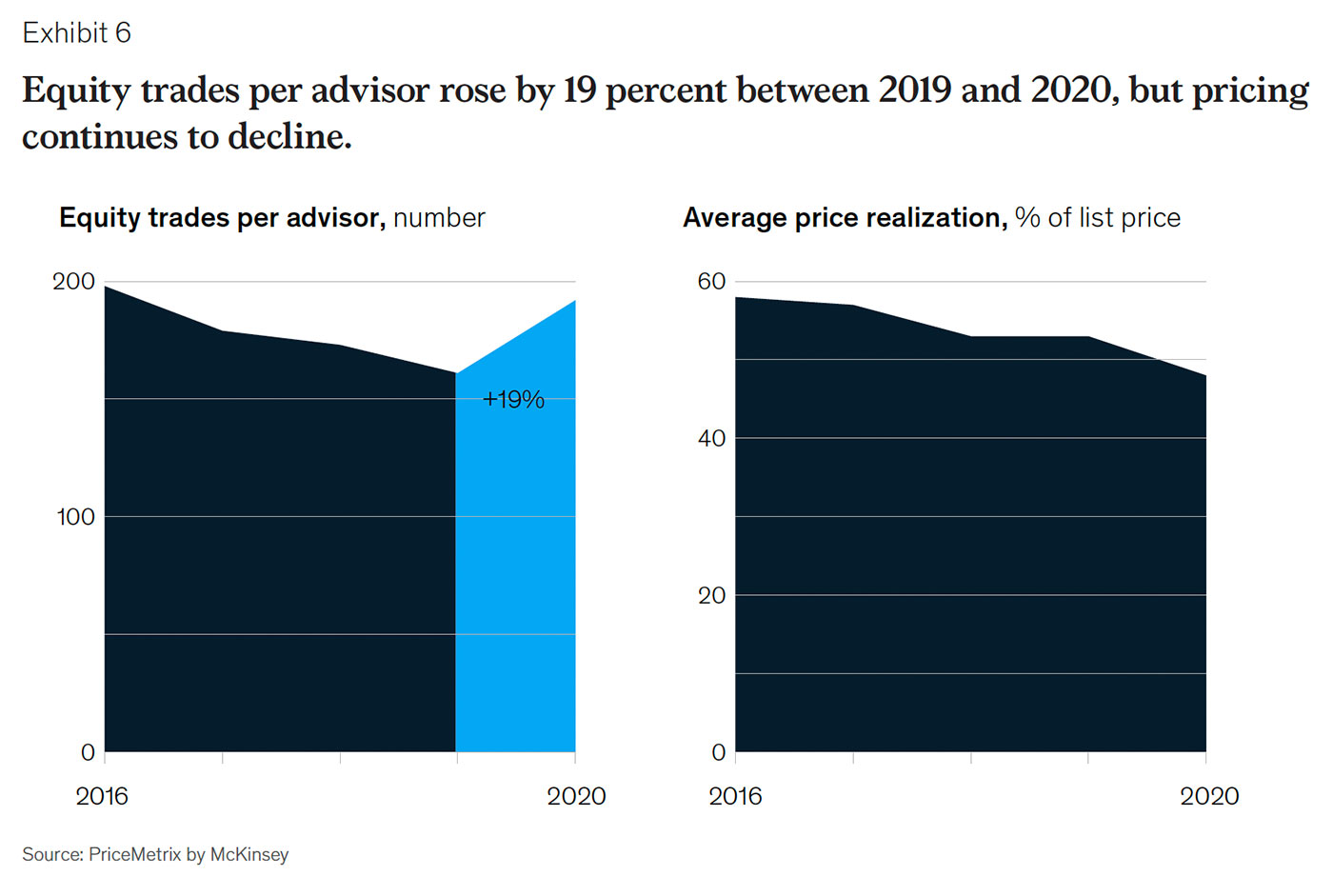

- a resurgence in trading activity putting pressure on per-transaction fees

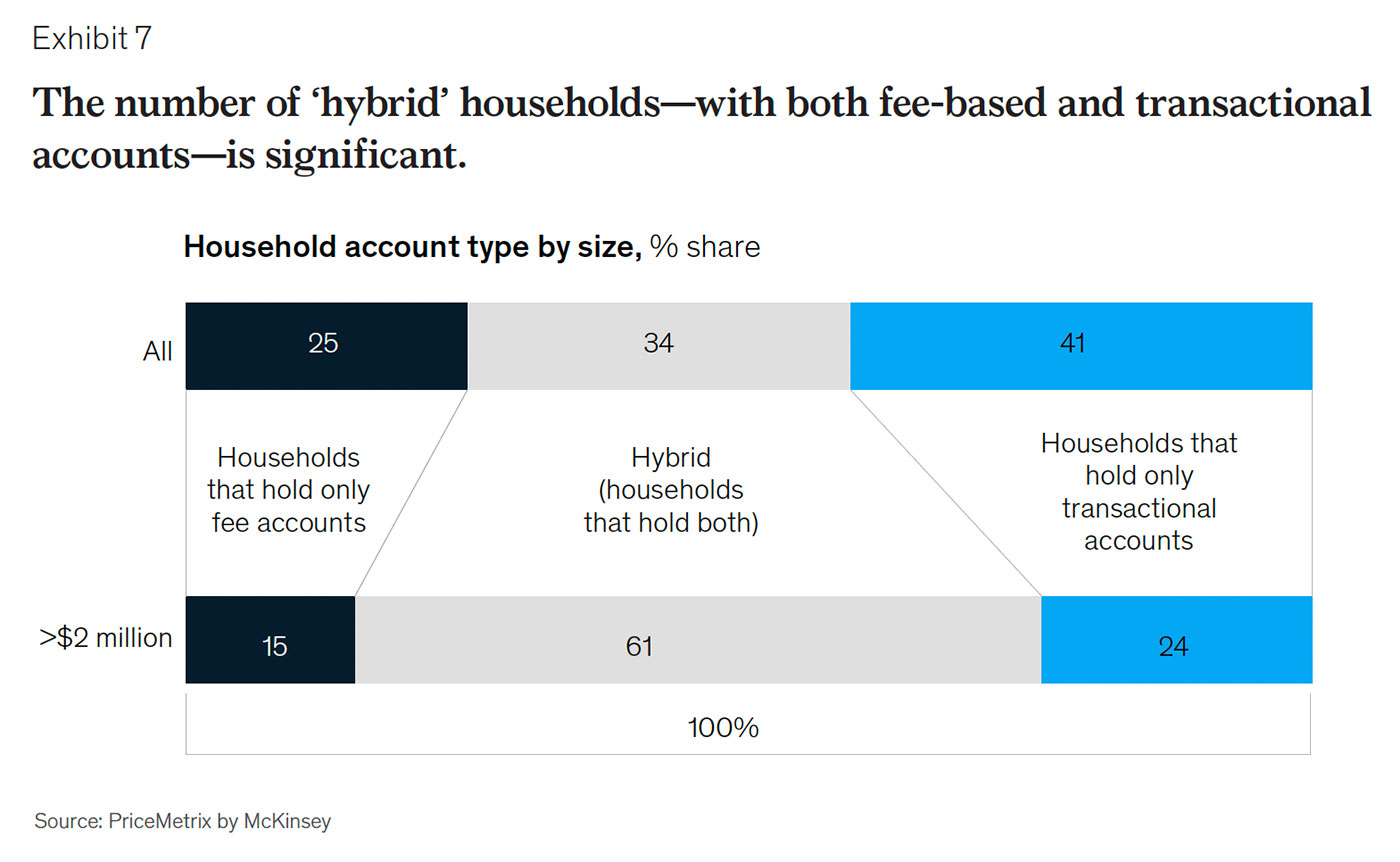

- growing complexity in how clients pay—with increased use of multiple products within the same household relationship

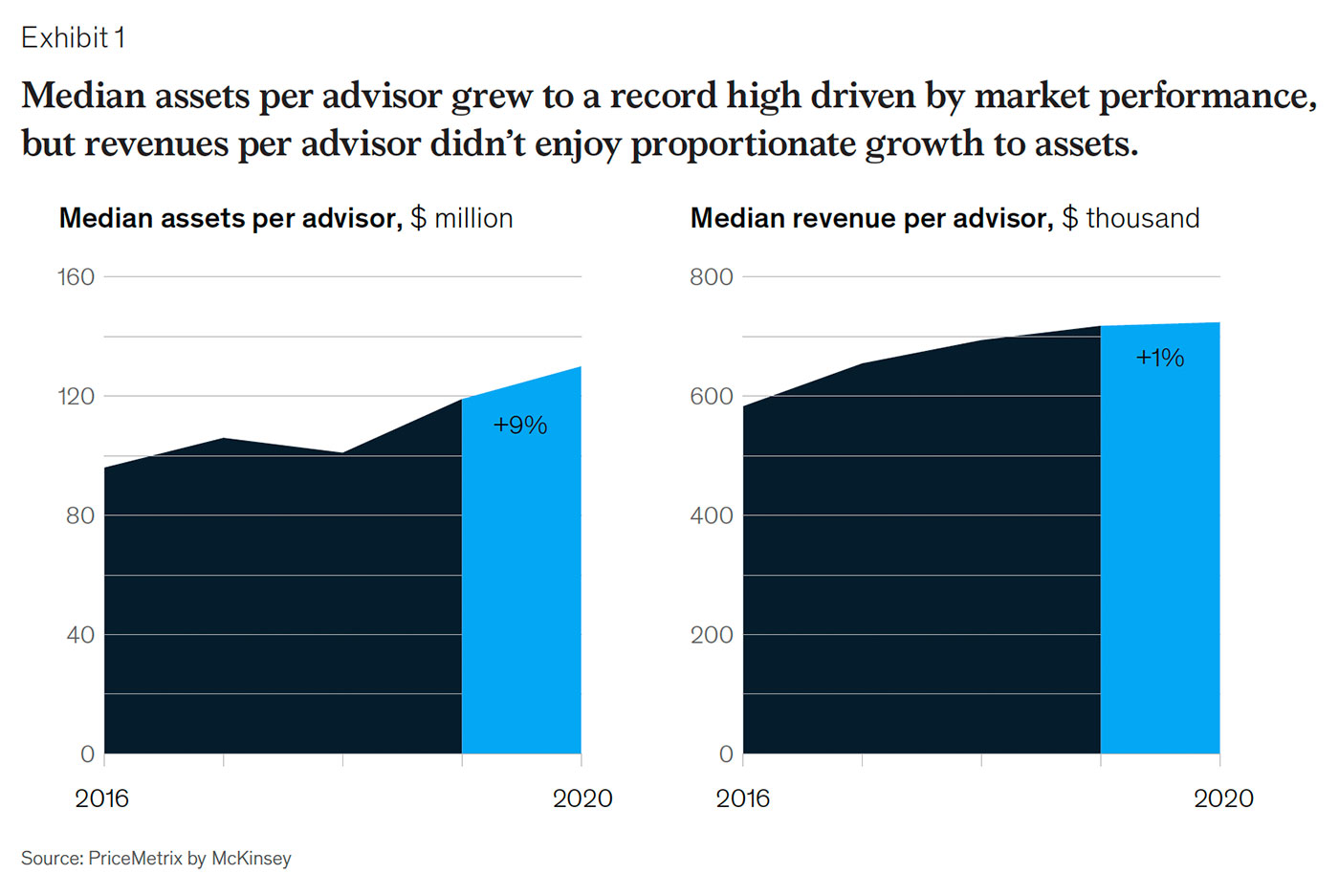

Median assets per advisor grew to a record high of $130 million, up 9 percent over 2019, though three-quarters of this increase was driven by market performance. Revenues per advisor also saw record levels but didn’t enjoy proportionate growth to assets, increasing only 1 percent year over year. Median revenues per advisor now stand at $724,000, up from $718,000 in 2019 (Exhibit 1).

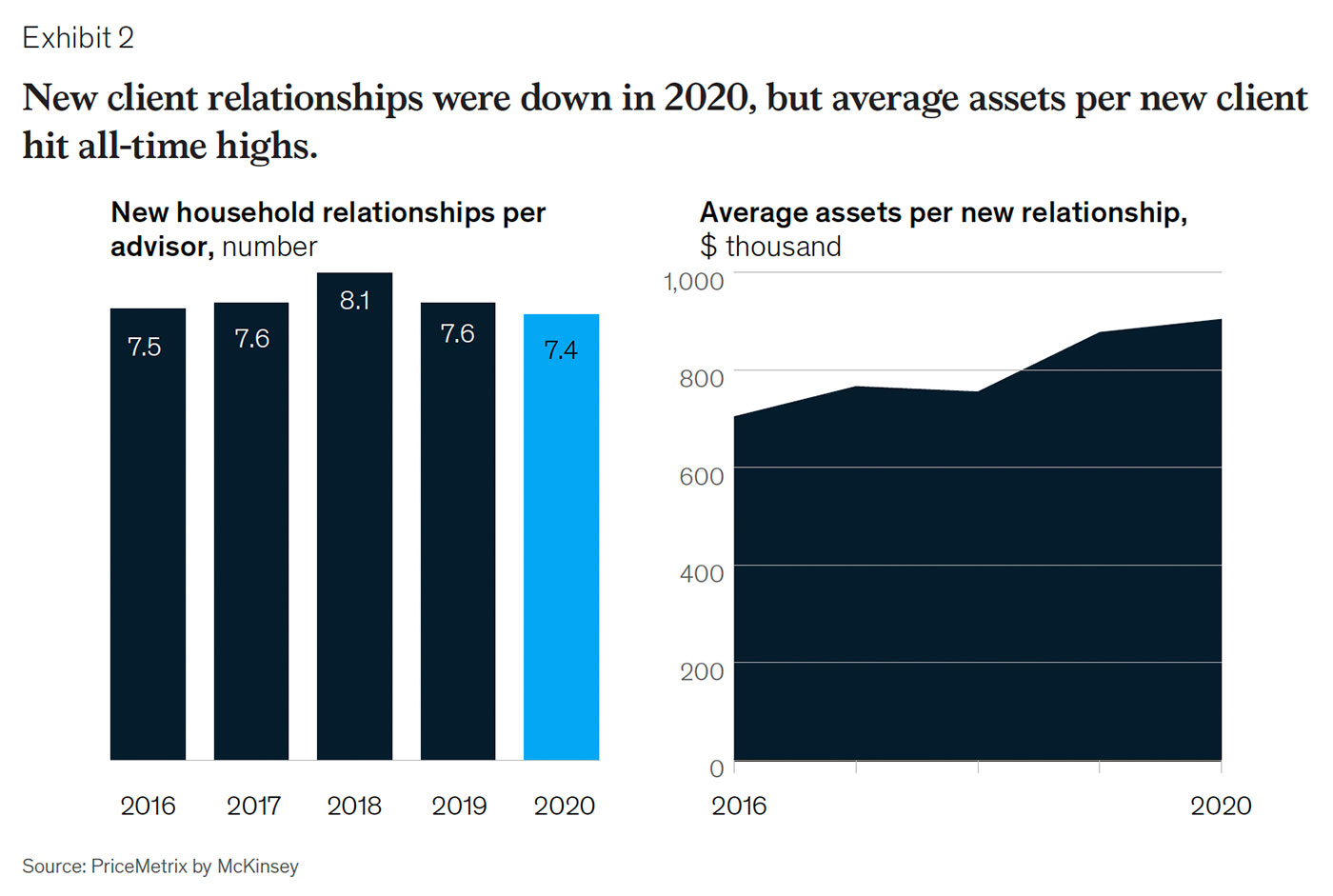

The period that followed the market crash of 2008 saw a spike in client attrition. There were winners and losers during this period of increased money in motion, as some advisors opportunistically pursued new clients who were in search of better advice. So far, the economic impact of the COVID-19 pandemic has not had the same effect. In 2020, advisors opened 7.4 new client relationships, a modest decline from 2018’s high of 8.1.

Advisors have seen only modest growth from new client relationships, but the clients that have been acquired during this period had greater assets. In 2020, the average assets per new client reached an all-time high, growing steadily from $705,000 in 2016 to $905,000 in 2020 (Exhibit 2).

One reason that advisors are struggling to find growth from new relationships is that clients are now less likely to leave their existing advisors. In fact, client retention achieved an all-time high in 2020, rising from 94.4 percent in 2019 to 94.6 percent in 2020.

As stated in last year’s edition of the report, client relationships were healthier going into 2020 than they were in 2008, with fewer clients serviced per advisor (more service!) and deeper relationships than ever (as measured by accounts per household and households with retirement accounts). An optimistic take would be that the depth of relationships, as well as the importance of human advice during the pandemic, led to higher levels of client retention. Realistically though, clients haven’t had to endure any significant portfolio downturns—yet.

A recent McKinsey publication on North American wealth management2 illustrates the importance of being the primary financial advisor to a household as more and more clients exhibit a preference for consolidating assets with fewer providers. The role that an advisor plays in the financial lives of clients can help determine if they will be net winners or losers with more consolidation and more money in motion.

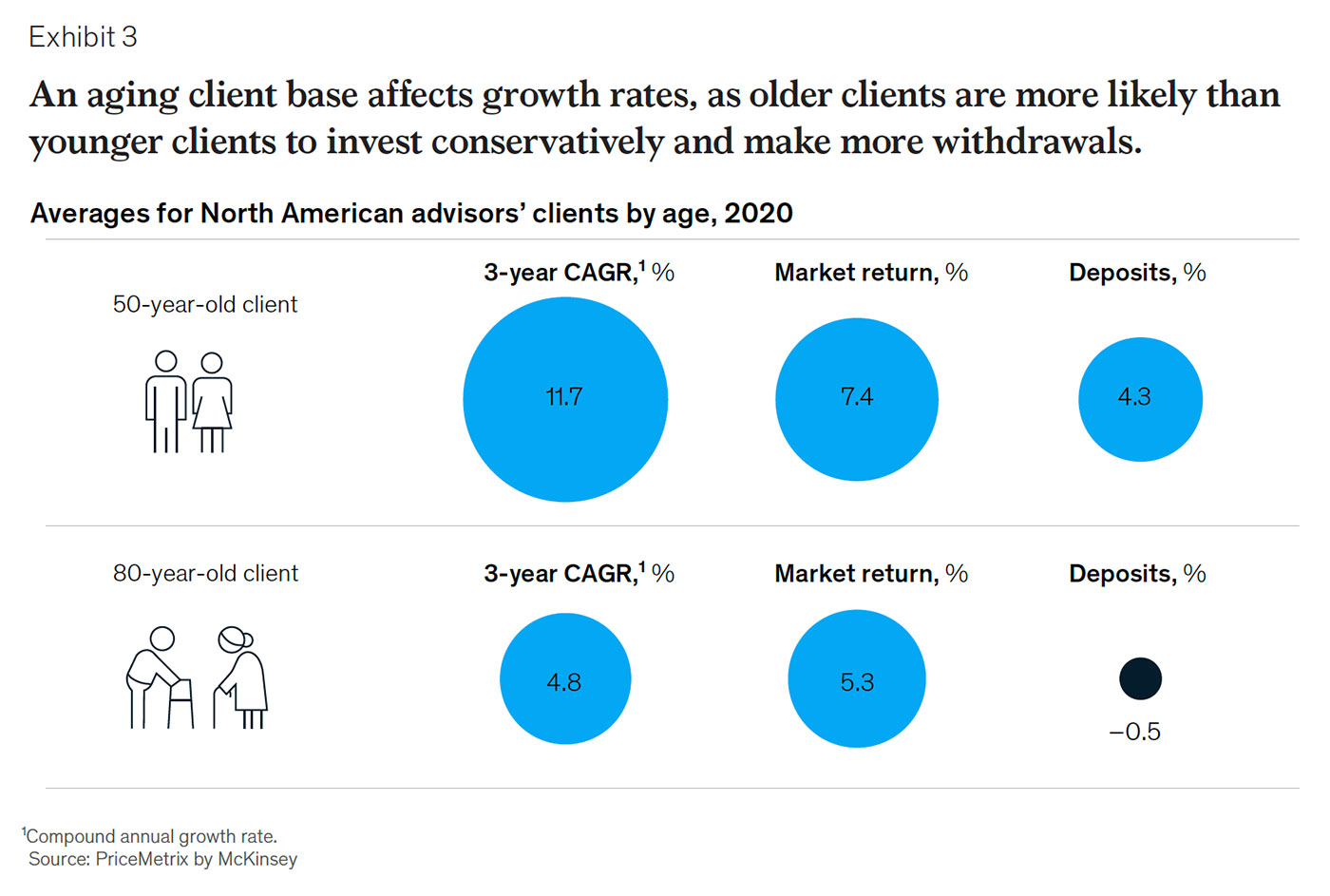

Recent market performance explains 75 percent of asset growth for advisors. Taking market performance out of the equation, the 7.9 percent annual growth that advisors have seen since 2015 looks more like 2.0 percent. While inertia in adding new clients plays a role in this stagnant growth, so does the changing client demographics.

An aging client base puts tremendous pressure on the growth rate of advisors themselves. Older clients are not only more conservatively invested but also less likely to adopt fee products (which previous PriceMetrix research3 has shown is a key driver of growth), and they are more likely to be net drawers from their account rather than net contributors. All these factors add up and affect growth (Exhibit 3).

Think of every client as a “cell” that makes up the whole of an advisor’s practice. Some grow quickly, some grow slowly, and some shrink over time. The resulting whole grows very differently based on the cellular makeup. The goal for advisors should not be to serve younger clients exclusively (as older clients will tend to have larger portfolios) but rather to pursue a balance of younger and older clients, just like a well-diversified investment portfolio.

The demographic composition of an advisor’s business can also have a significant impact on how resilient they are to market corrections and prolonged recessions. Clients who are in or just entering their retirement years may experience much more significant uncertainty and stress during bear markets. Younger clients may be more affected by a downturn in the immediate term, based on their portfolio orientation, but because they have longer time horizons and are still contributing and accumulating wealth, they are more resilient to short-term swings. Many advisors have found success in segmenting their service strategy across demographic lines, allowing them to target certain communication strategies and products to different groups.

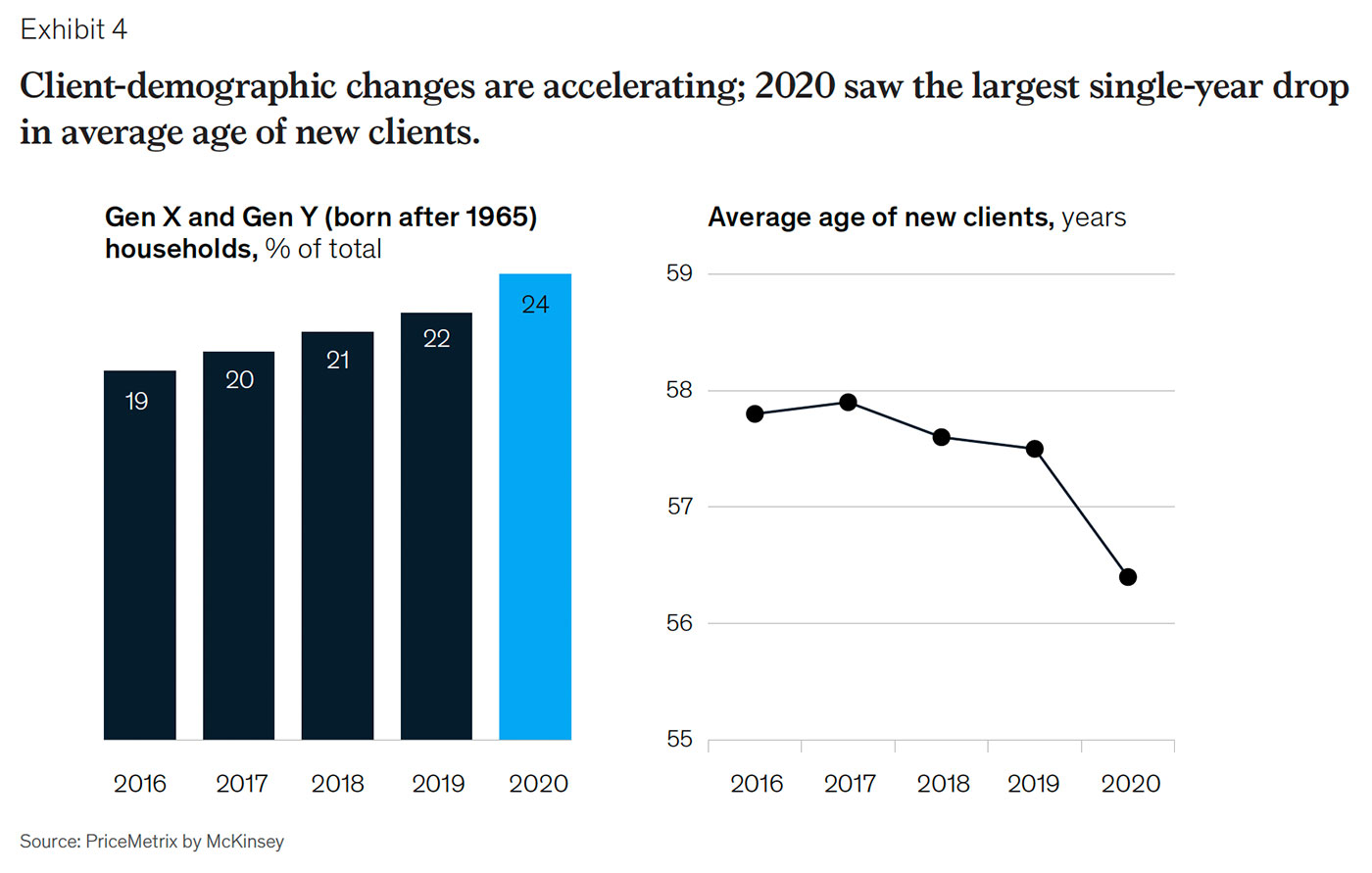

Clients born after 1965 (predominantly Generations X and Y) are growing to represent a more substantial part of the wealth-management client base. These “next gen” clients now represent 24 percent of wealth-management clients, up from 19 percent in 2016.

The drop in the average age of new relationships is evidence that advisors are choosing to work with a greater number of younger clients, an accelerant to the overall change in client-demographic composition. Average new-client age dropped from 57.5 in 2019 to 56.4 in 2020, the largest single-year decline (Exhibit 4).

Adding younger clients, while critical to future advisor growth, will be an increasingly challenging endeavor. While new-client-acquisition rates for full-service advisors were stagnant, technology-led wealth platforms experienced significant new-account growth in 2020.4 Many investors start out as “self directed” and switch to human advisors as their needs become more complex, but with online offerings becoming more sophisticated and adding additional service options, enticing clients to switch may become a taller order.

More and more clients and their advisors continue to adopt the asset-based fee model. Revenues from fees now contribute almost three-quarters of overall gross production for financial advisors, up from 54 percent in 2016. Fifty-eight percent of client relationships now have fee-based accounts, up from 43 percent only four years ago.

The decline in fee pricing, which was at its steepest five years ago, is slowing down. Pricing on newly opened fee accounts (for relationships with $1 million to $1.5 million invested) dropped a mere one basis point in 2020, and for the first time in a decade, there was no change in price level for the overall portfolio of fee accounts (Exhibit 5). We expect the pricing on all fee accounts to drop over time, as new fee relationships are priced lower (by six basis points) than existing relationships.

One thing that 2020 brought about was a resurgence in equity-trading activity. After a long period of decline, equity trades per advisor rose 19 percent (from 161 in 2019 to 192 in 2020), as clients and advisors looked to take advantage of volatility in the market and rebalance portfolios.

This increase in activity, though, was offset by a continued decline in pricing. For transactional accounts, the average amount charged per trade (as a percentage of list price) dropped from 53 percent in 2019 to 48 percent in 2020 (Exhibit 6). Advisors now charge less than half of the list price. An increase in trade size is responsible for some of the increased discounting, as larger trades are more likely to attract discounts. (Average trade size has increased steadily, up from $16,200 in 2016 to $19,600 in 2020.) But the larger influences are likely, first, a lack of attention paid to transaction business (with advisors increasingly moving to asset-based fees) and, second, accelerating price pressure from the discount brokerage “race to zero” commission trading model.

As wealth-management relationships grow in complexity, so does pricing. An emerging trend affecting price dynamics is the proliferation of “hybrid households.” Clearly, more clients and advisors are choosing fee-based accounts. However, 41 percent of households remain transactional only, and 34 percent of households have both fee-based and transactional accounts—hence the term “hybrid.” Affluent clients are even more likely to be hybrid, with 61 percent of households with $2 million or more in assets holding both account types (Exhibit 7).

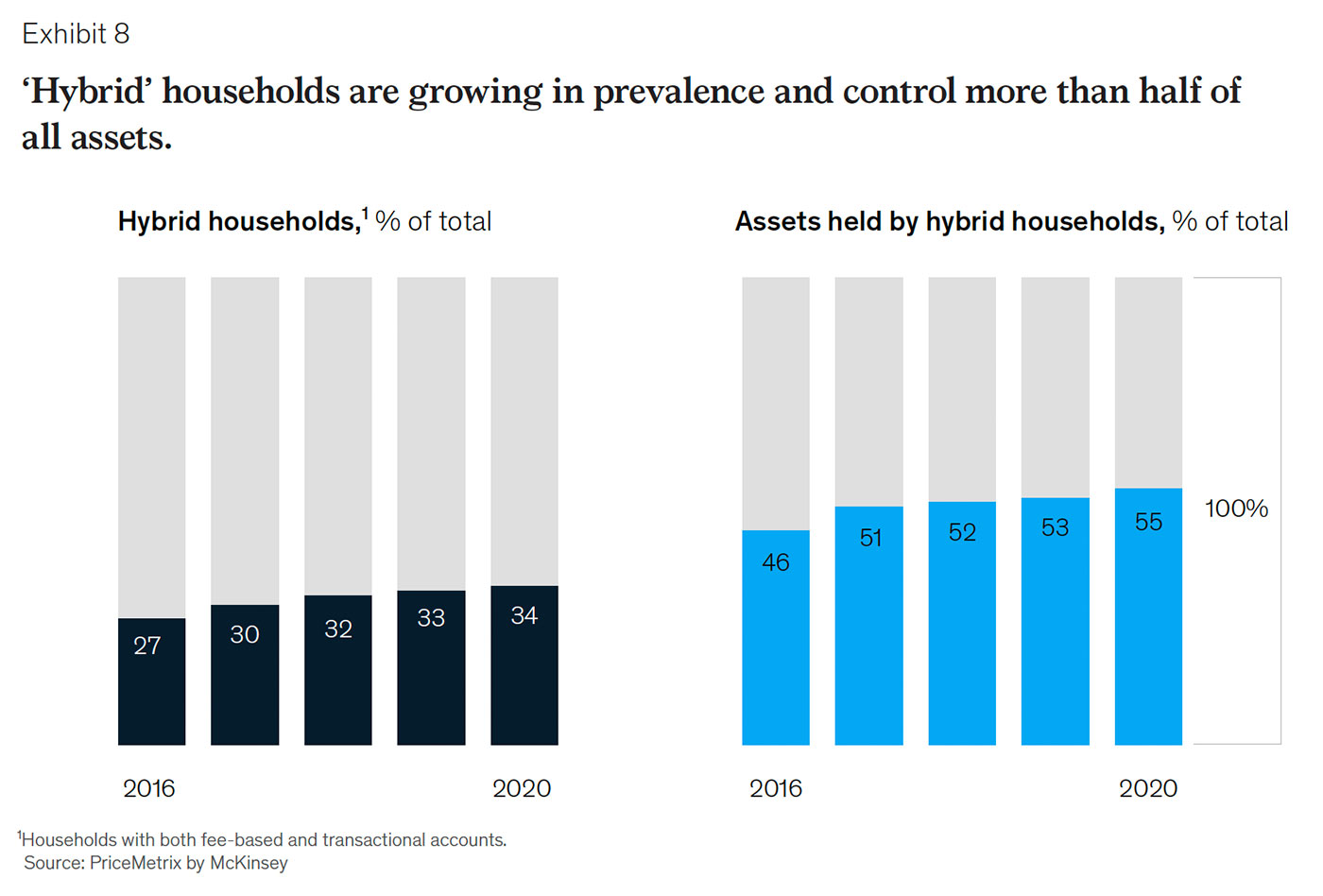

The prevalence of hybrid households is increasing. In just four years, the percentage of hybrid households has grown from 27 percent to 34 percent, and the percentage of assets controlled by hybrids now stands at 55 percent, up from 46 percent in 2016—which means that more than half of all assets are in hybrid households (Exhibit 8).

There are several reasons why clients may have multiple account types. In some cases, certain products or investments can’t be held in specific fee-based account types. Often, though, clients who are transitioning from transaction-based accounts to fee-based ones may only transition assets that are more actively traded, as a means to keep overall household fees lower.

Overall, the revenue over assets (ROA) of fee-based accounts is much higher than that of transaction-based accounts. As expected, the ROA of hybrid households is higher than transaction-only households but lower than fee-only households.

Whether a cause or effect of an increasingly complex pricing world, the changing dynamics of product use presents a serious challenge to advisors and firms. Most firms continue to set and manage pricing policies within product lines, but those lines are clearly blurring. Advisors need tools and policies that help them consider the entire relationship when determining and communicating price with clients.

The past decade, rising out the 2008 financial crisis, has been prosperous for both individual investors and the wealth managers that serve them. Client portfolios are larger than ever, relationships are deeper, and, as a result of both, client-retention rates are at an all-time high. Advisor revenues are more tightly linked to client outcomes, with asset-based fees emerging as the clear economic model of choice. And pricing, while it has been tested in recent years, seems to be settling into a new equilibrium.

The emergence of “robo advice” in the past several years has helped shine a light on the importance and value of human financial advisors. That personal touch was on full display helping clients navigate the fear and uncertainty of a global pandemic (see sidebar, “Personal advice—just not in person”).

For most financial advisors, the pandemic changed where they serve clients, but it hasn’t yet materially changed how they serve clients. As advisors and clients become more comfortable with videoconferencing and other remote interactions, new opportunities have emerged. Firms have the opportunity to think about real estate differently and can potentially match managers with different cohorts of advisors. Advisors themselves can think about growth in different ways. As one example, advisors who specialize in a specific type of client can now find those clients with fewer geographic boundaries (licensing requirements, of course, being a consideration). Firms that want to take full advantage of these opportunities should consider further investments in lead-generation tools and digital-service capabilities.

Looking ahead, the threats and opportunities that face advisors are growing in scale. One thing clients have not had to endure in the past decade is a prolonged market pullback. Advisors who have not prepared their clients well, both mentally and financially, for this inevitability may see a spike in client attrition. With more money in motion, there will be winners and losers. In the period that followed the 2008 bear market, advisors who were opportunistic in pursuing new relationships outperformed defensive advisors by 12 percent in revenue growth.5

Demographic changes, too, represent both a threat and an opportunity. Client age is a powerful driver of organic growth, which many advisors are already benefiting from. Advisors who are putting in the work to make connections with clients who are now in their 40s and 50s will reap those rewards over the next two decades.

Pricing has stabilized in the near term, but the fundamental equation of paying based on assets is being challenged, and there exists great instability in the pricing gap between transactional and fee-based accounts. In the years to come, effective pricing will require advisors and firms to think about price at the whole household level, given the increasing complexity of client relationships.

Firms can unlock significant growth by investing in their advisors—in both their growth capability and their growth mindset. Investments should be made in field leadership (capability building and compensation), practice-management analytics and coaching, and advisor compensation. Hungry advisors will find growth on their own, but the effective sales leader of the future will find ways to motivate advisors who have become stagnant.

***

For the North American wealth-management industry, the winds of change are picking up speed, with increased competition, unpredictable markets, and the pace of demographic change accelerating. Growth is likely to be more elusive than in the past ten years and more heavily influenced by the decisions and actions of advisors themselves, not just broad market returns. As challenging as 2020 was, it has served as a clear reminder of the importance and value of advisor-to-client wealth-management advice and elevated the role that many advisors play in their clients’ financial lives.

- Unless otherwise noted, all data are reported as of December 31, 2020.

- Pooneh Baghai, Vlad Golyk, Agostina Salvo, and Jill Zucker, North American wealth management: Money in motion, but not always to the bottom line, December 17, 2020, McKinsey.com.

- PriceMetrix by McKinsey, Moneyball for advisors, PriceMetrix Insights, October 2012, Volume 7.

- North American wealth management, December 17, 2020.

- PriceMetrix by McKinsey, The anatomy of outperformers, PriceMetrix Insights, December 2011, Volume 5.

Proactive Advisor Magazine would like to thank PriceMetrix and McKinsey & Company for permission to republish the article “The value of personal advice: Wealth management through the pandemic.” The article appears in its original form.

We would like to especially thank all of the authors of this article. Kieran Bol and John Vervoort are managers of solution delivery, Patrick Kennedy is a solution associate partner, and Ryan Lee is a senior solution delivery analyst at PriceMetrix, a McKinsey company.

This article was originally published by McKinsey & Company, http://www.mckinsey.com. Copyright © 2021 McKinsey & Company. All rights reserved. Reprinted by permission.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

PriceMetrix by McKinsey is a provider of data-driven insights for wealth-management advisors and executives. It has been serving a range of wealth-management firms since 2000. PriceMetrix combines the power of industry data and advanced business intelligence into one integrated platform. Financial advisors and wealth-management firms partner with the company to improve productivity, client experience, and decision-making, while identifying and pursuing growth opportunities.