Wealth-management trends: The benefits of third-party active investment management

Wealth-management trends: The benefits of third-party active investment management

Several studies assess advisor attitudes about outsourced portfolio management and risk mitigation for clients. They show a continued preference for actively managed strategies as a major component of a blended investment allocation approach.

“Index funds clearly have won the hearts and minds of many investors. Are there any reasons to even consider actively managed funds these days?” So said The Wall Street Journal in an article published Feb. 8, 2015.

However, this opening salvo was quite misleading. The Journal article later acknowledged that the support for active management among professional investors and financial advisors was often much stronger than the massive funds flow statistics at that time might suggest.

In addition, it must also be noted that there has historically been a great deal of confusion in the business press when discussing “the active management debate.” The Journal article, and many others over the years, frequently equate “actively managed mutual funds” with the entire universe of “active management.” This is simply not the case, as those mutual funds are usually restricted in their techniques/charter, stock universe, and tracking requirements, while holistic active portfolio management is not. The latter is usually primarily concerned with employing strong risk-management techniques in portfolio strategies while seeking favorable opportunities among a wide range of diversified asset classes.

That distinction noted, the Journal did cite many instances where actively managed funds could have an advantage versus passive funds:

“Many advisors still believe that at certain times, and for certain strategies, actively managed funds are superior to index funds. That is particularly true, they say, if the active fund has a good long-term track record. The lesson here? Historically, active managers have lagged behind benchmarks during long, strong bull markets. But they tend to make up lost ground when markets level off or suffer corrections.

“‘Active managers have more ways to play defense,’ says Tim Clift, chief investment strategist for Chicago-based Envestnet Inc., a firm that guides advisers on using active and passive funds. ‘They [active managers] don’t have the pedal to the metal when the markets are going up, and they put the brakes on more quickly when markets are going down.’”

This has proven somewhat prophetic over the ensuing years—during a lengthy secular bull market that was interrupted by the pandemic-induced, and short-lived, cyclical bear market of 2020.

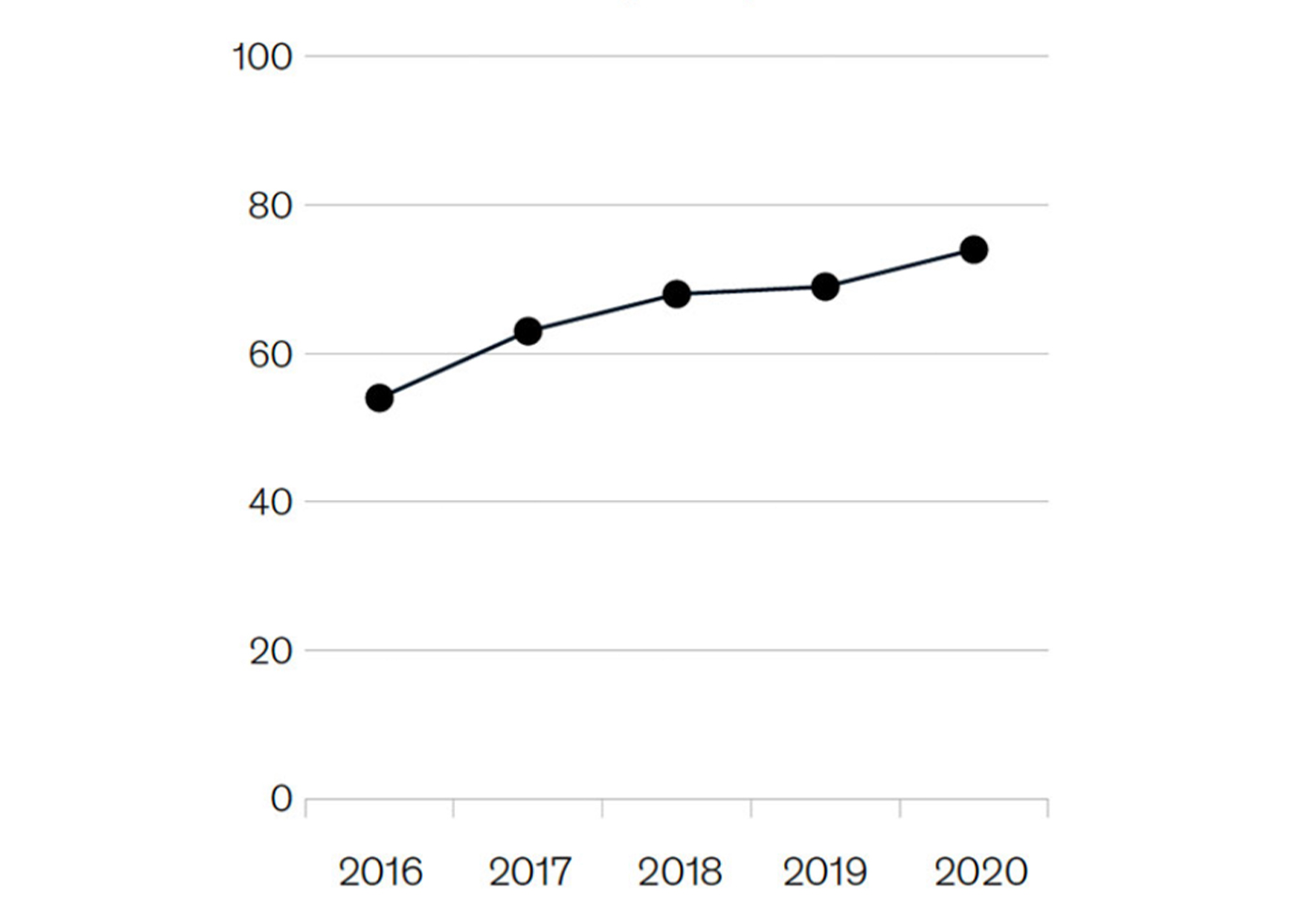

In fact, several recent research studies have shown that more advisors are (1) moving a greater percentage of their book of business to a fee-based practice model, (2) increasingly using the services of third-party money managers, and (3) supportive of active investment strategies with a strong risk-management focus.

According to the 10th annual PriceMetrix by McKinsey report on North American wealth management published this year,

Source: PriceMetrix by McKinsey

Going hand in hand with the upward trajectory of fee-based revenues is the increased use of third-party investment management among financial advisors. While estimates vary on the percentage of financial advisors who outsource investment management—either in whole or part—the consensus is that it is a growing trend.

Michael Kitces, a noted commentator on the advisory space, quoted a study from research firm Cerulli Associates in a 2018 article on the subject:

“While Turnkey Asset Management Platform (TAMP) solutions were first launched in the 1980s, they have grown dramatically in the past decade … accentuating a rising trend of financial advisors outsourcing their investment management, which a recent Cerulli study found is now being done by the majority (54%) of CFP professionals.

“And as advisors increasingly focus on giving financial planning advice (and not just providing insurance or investment solutions), this trend seems likely to only continue further, as more and more CFP professionals adopt some combination of TAMPs and technology tools to minimize the time they spend implementing portfolio management for their clients.

“In other words, notwithstanding their recent growth, TAMPs and the world of outsourced investment management is about to get a whole lot bigger than it is even today!”

Similarly, in 2018, PlanAdviser published an article, “Advisers Increasingly Turn to Third-Party Asset Managers,” that noted,

“Advisers are outsourcing 57% of client assets. … The top three reasons they give for doing so are to ‘free up time in my practice’ (61%), to ‘gain access to institutional quality due diligence/monitoring’ (47%) and to ‘gain access to a variety of investment product strategies’ (43%). …

“Ninety-seven percent of advisers who outsource some or all of their assets are satisfied with the service. … Sixty-two percent said that by outsourcing investment management, they have grown their client base, and 30% have seen their revenue increase.”

Reflecting changing advisor attitudes during the pandemic, Wealth Management wrote in 2021,

“The percentage of nonoutsourcing respondents saying their opinion of outside investment management ‘won’t change’ has dropped dramatically—to 30%, down from 52% in 2010.

“Furthermore, the pandemic has encouraged firms that do not currently outsource to reassess their approach. When firms that handle investment management in-house were asked whether their opinion of outsourcing has changed as a result of the pandemic, 15% of respondents said they planned to increase usage of outside managers and 85% said they plan to reconsider the use of external management.”

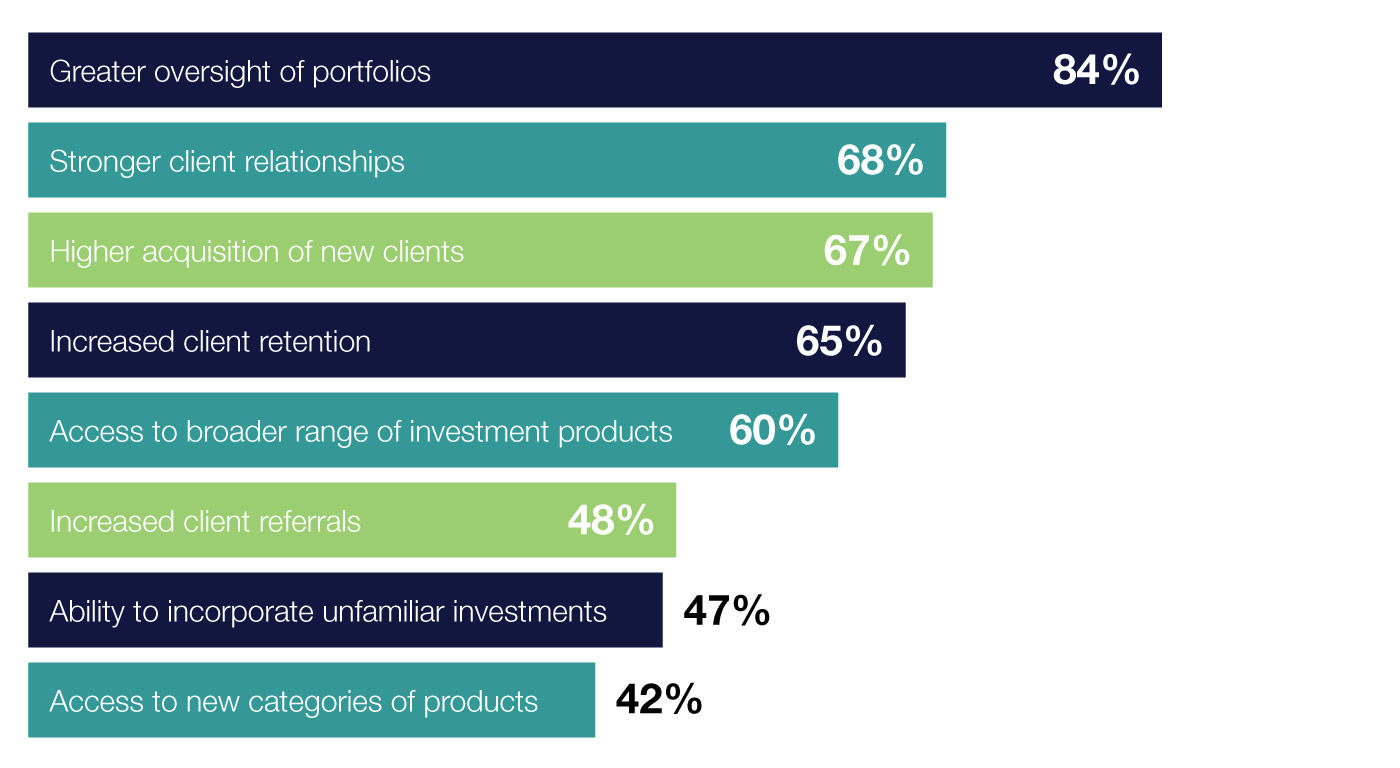

The 2019 Impact of Outsourcing Study, conducted by Q8 Research, looked at the benefits financial advisors find in using outsourced investment management.

Some of the highlights are included in Figure 2.

FIGURE 2: PERCENTAGE OF ADVISORS WHO SAY OUTSOURCING DELIVERS SPECIFIC BENEFITS

Source: Q8 Research, AssetMark 2019 Impact of Outsourcing Study

One of the study’s major summary points said,

“Admittedly, investment management outsourcing is not right for every advisor’s practice. Some advisors are skilled investment managers and the time they spend researching and creating portfolios delivers real value to their practice and their clients. For other advisors, outsourcing can be a powerful tool to help create discipline, drive scale and gain time and capacity for other activities. …

“Given the benefits of outsourcing, it is no surprise our study shows that 95% of advisors who outsource investment management were at least somewhat likely to recommend outsourcing to other advisors. We believe this trend will only accelerate as more advisors become aware of the benefits of outsourcing and the demands on advisors increase in the ever-changing investment advisory landscape.”

Closely related to the trends toward fee-based advisory practices and outsourced investment management, several recent research reports have found that financial advisors are turning increasingly to active investment strategies for their clients—particularly those with a strong risk-management focus.

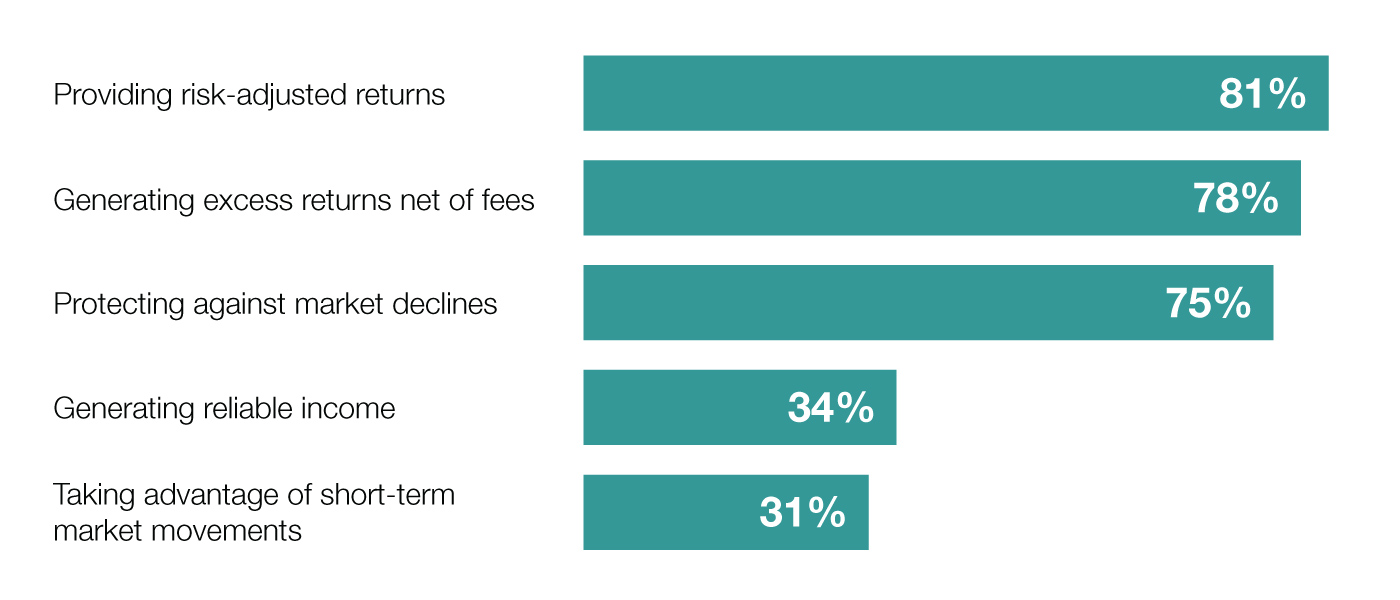

An independent research study sponsored by PGIM Investments and published in 2021 explored advisor concerns and trends in portfolio construction in the current investment environment. This has helped inform their overall conclusion that “advisors are relying heavily on active strategies in guiding clients through this period—particularly when investing in equity and fixed income outside the U.S.—as they seek to capture outperformance opportunities and mitigate portfolio risk. … As we move forward, advisors are aiming to build flexibility and resilience into client portfolios through a diversified mix of active and passive strategies.”

Their topline findings include the following:

- “Market volatility remains advisors’ greatest concern for client portfolios. Stock market volatility remains the top concern (68%) for advisors today, along with the potential impact of an economic slowdown (43%) and a low-return environment (41%). …

- “The COVID-19 pandemic is influencing portfolio construction. Most advisors (76%) say COVID-19 has impacted portfolio construction in 2021, specifically when it comes to how they think about economic/macro trends, asset allocation strategy, and sector preferences.

- “Advisors say managing risk is their biggest portfolio construction challenge. They prioritize managing risk over generating returns, maximizing income, or determining appropriate asset allocation strategies. …

- “Advisors rely on active management but say passive strategies have their place. They largely agree that certain segments of the equity and fixed income markets favor active management. The majority of client assets are allocated to actively managed investments (62%), with a third (34%) in passive investments and the remainder (4%) in cash or cash equivalents.”

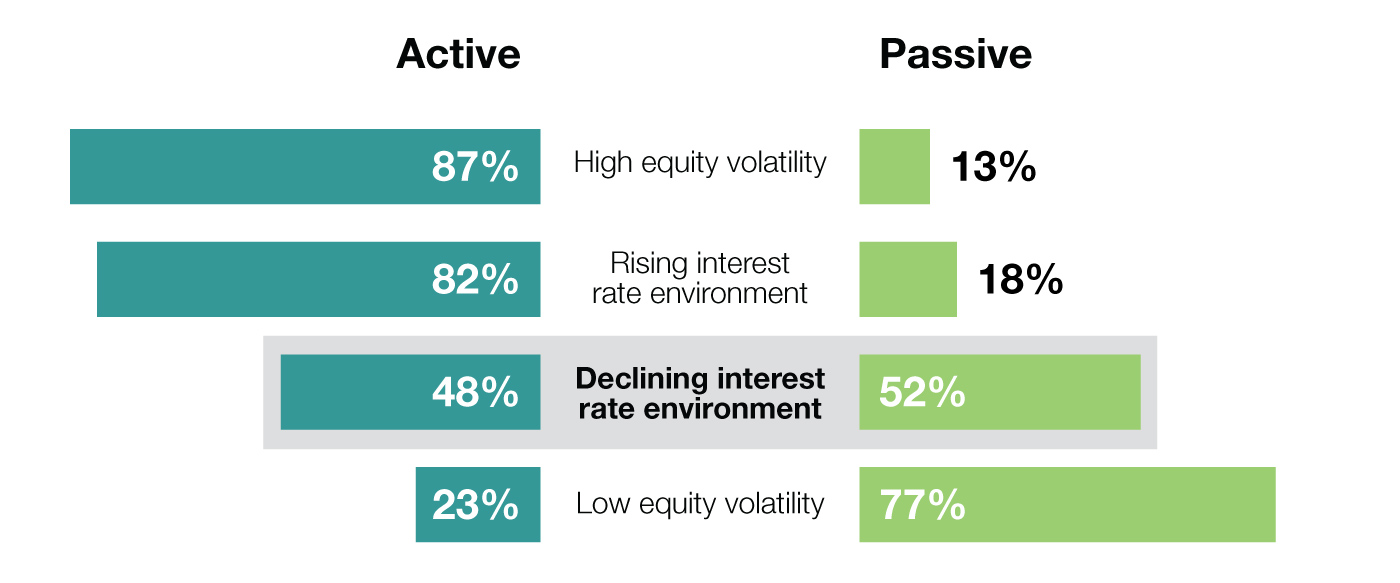

The following two figures, based on the study’s findings, examine (1) key success factors for active managers in the eyes of financial advisors and (2) the types of market environments that favor either a more active or more passive approach.

FIGURE 3: TOP DEFINITIONS OF SUCCESS FOR ACTIVE MANAGERS

Source: Independent research company Escalent, on behalf of PGIM Investments

FIGURE 4: STRATEGY PREFERENCE FOR DIFFERENT MARKET CONDITIONS

Source: Independent research company Escalent, on behalf of PGIM Investments

Three key takeaways for financial advisors, according to the study, are the following:

- “Acknowledge that market volatility is here to stay. There is no escaping market volatility, so advisors need the right investment tools, research, and management strategies to access new asset classes and opportunities and help mitigate portfolio risk.

- “Lean into active strategies that deliver on expectations. Active management can help navigate through choppy markets, capitalize on opportunities created by market inefficiencies and create long-term value for clients. Fee reductions have made skilled active managers who have consistently outperformed their benchmarks even more attractive.

- “Evaluate new strategies for helping clients reach long-term goals. Whether expanding into additional active and passive ETFs or pursuing thematic investing opportunities, modern approaches to portfolio construction can play a role in asset growth.”

Consistent with the themes of the PGIM report, a study conducted by The Journal of Financial Planning and the Financial Planning Association (FPA) showed that 76% of advisors’ clients actively contacted them about market volatility in 2020, and 52% have done so in 2021.

The net effect of this, according to that same FPA study, has been a shift toward considering different portfolio approaches. In the March 2021 study, 74% of advisors said they had reevaluated the asset allocation they typically recommend or implement within the prior three-month period. This was largely driven by concerns about the state of the economy and/or market volatility experienced over the prior year.

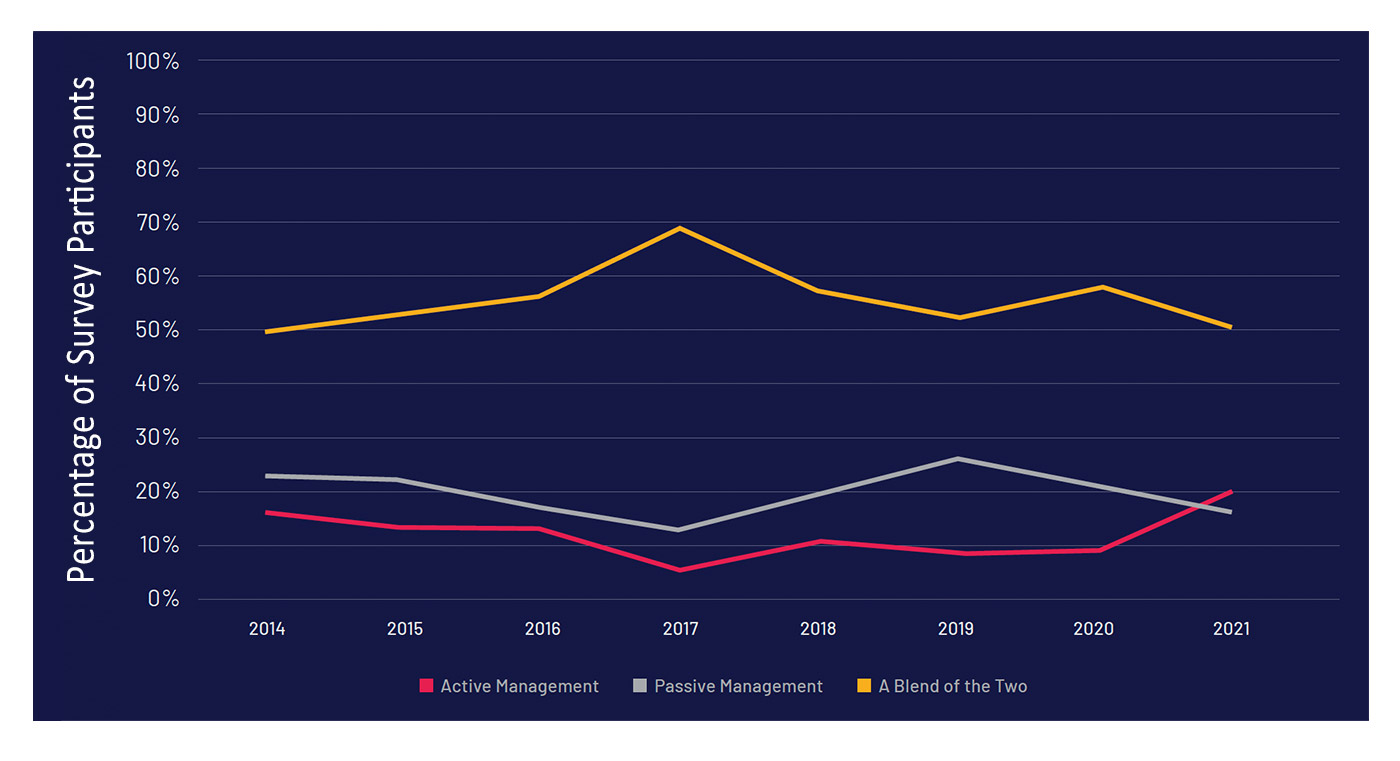

The study concluded, “The majority of advisers (58 percent) continue to favor a blend of active and passive management, as has been the trend for the past several years. However, the 2021 results show a continued decline in a purely passive approach.”

FIGURE 5: WHICH TYPE OF MANAGEMENT DO YOU THINK PROVIDES THE BEST OVERALL INVESTMENT PERFORMANCE (TAKING INTO CONSIDERATION ASSOCIATED COSTS)?

Source: 2021 Trends in Investing Survey, conducted by The Journal of Financial Planning and the Financial Planning Association (FPA), March 2021.

In an October 2021 article from Morgan Stanley titled “A New Take on the Active vs. Passive Investing Debate,” the author, a senior investment strategist, provided the following perspective:

“In my work at Morgan Stanley Wealth Management, I spend a lot of time thinking about how to construct investment portfolios—and these days, a big part of that conversation centers on the role of active and passive styles of investing, an ongoing (and sometimes quite heated!) debate in the financial industry.

“This isn’t just an academic conversation: It has the potential to affect your investment results in a real and meaningful way. …

“Active strategies have tended to benefit investors more in certain investing climates, and passive strategies have tended to outperform in others. For example, when the market is volatile or the economy is weakening, active managers may outperform more often than when it is not. Conversely, when specific securities within the market are moving in unison or equity valuations are more uniform, passive strategies may be the better way to go.

“Depending on the opportunity in different sectors of the capital markets, investors may be able to benefit from mixing both passive and active strategies—the best of both worlds, if you will—in a way that leverages these insights. …”

In general, financial advisors we have interviewed for Proactive Advisor Magazine tell us that third-party money management has provided the following benefits for their practice and their clients:

- Enhanced risk management/diversification.

- Mitigation of market volatility.

- Sophisticated, rules-based strategies that take emotion out of the investment equation.

- A turnkey approach to strategy implementation and execution.

- Professional investment management that frees up their time for client planning and service.

Specific to the benefits of active portfolio management, one senior financial advisor put it particularly well: “It is my belief and experience that clients are far more willing to stick with an investment plan if a significant percentage of their portfolio incorporates active, or tactical, risk-managed strategies.”

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.