How advisors articulate the benefits of financial planning

How advisors articulate the benefits of financial planning

Individuals and families guided through the financial-planning process see wealth-building benefits, as well as an enhanced sense of financial security. It is critical for advisors to clearly articulate their specific financial-planning approach in working with clients.

An article in our publication, “The power of planning: A behavioral perspective,” presented both a quantitative and behavioral perspective on the benefits of financial planning.

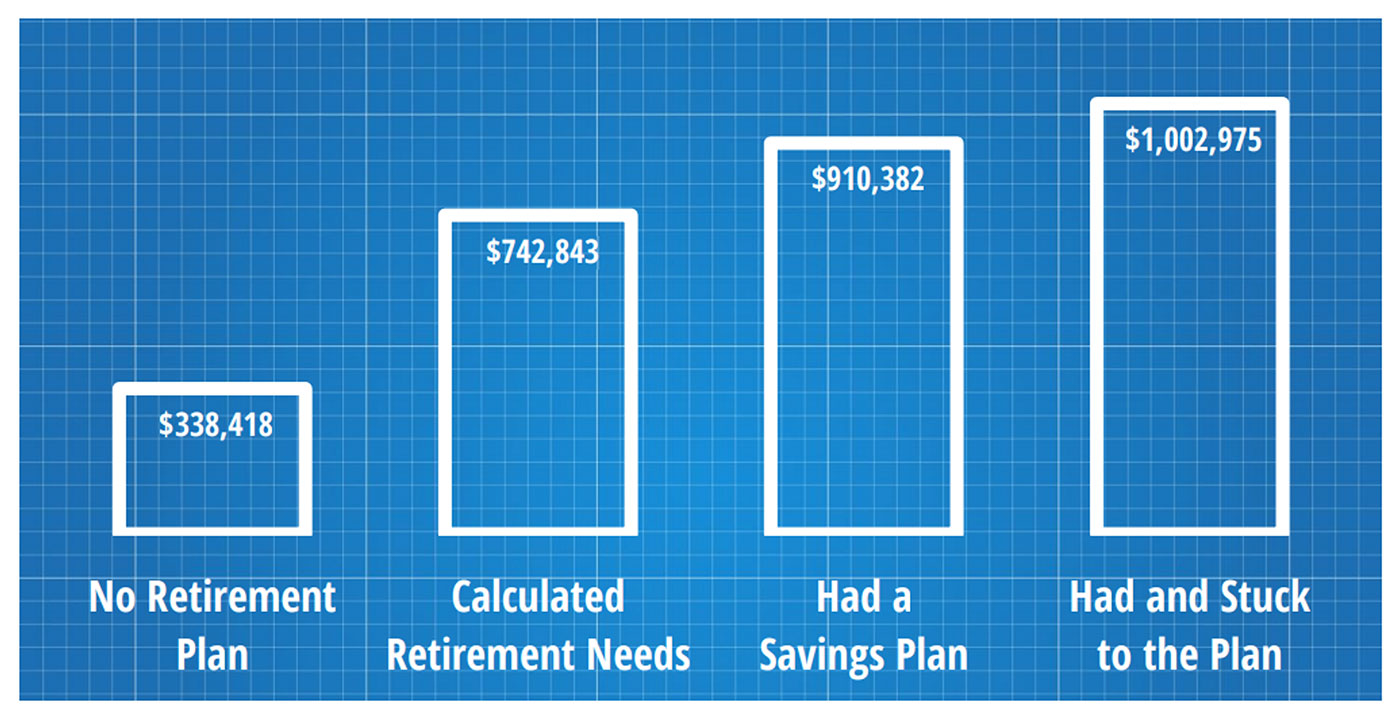

C. Thomas Howard, Ph.D., a thought leader in behavioral finance, shared the results of a study that looked at four categories of planning, ranging from “no planning” to faithfully “sticking to a plan.”

Figure 1 highlights the impact of planning on the net worth of individuals or families taken from the study, which focused on retirement planning among Americans over age 50—in a wide range of market conditions.

Source: Annamaria Lusardi and Olivia S. Mitchell, “Financial Literacy and Planning: Implications for Retirement Wellbeing,” working paper, National Bureau of Economic Research, May 2011

Dr. Howard offered the following observations,

“It is not surprising that having and sticking to a plan generates the best outcome. What may be surprising is the magnitude of the impact of planning and that any amount of planning results in two to three times the wealth. Even just calculating the amount of money needed for retirement improves results dramatically.

“Having a plan simplifies investing and allows investors to focus on things they can control. Contributions, withdrawals, and the amount of time invested are all drivers of long-term wealth. These actions are enabled by planning, which creates financial awareness, establishes realistic and achievable goals, and combines long-term thinking with consistent action over time.”

Another study, the 10th annual PriceMetrix by McKinsey report on North American wealth management, discussed the post-pandemic landscape facing financial advisors and wealth-management firms.

The report notes,

“In 2020 … relationships between financial advisors and their clients were put to the test, and the value of advisor-to-client advice was on full display as advisors achieved record client and asset retention.

“However, the road ahead is uncertain. Total asset growth continues to be market dependent as new client additions have stagnated. In addition, revenue growth has not kept pace with asset growth. Demographic changes are having an impact on client composition at an unprecedented rate, and client perception of value for advice remains under a microscope.”

Specific to the issue of changing demographics, PriceMetrix found that Generations X and Y “are growing to represent a more substantial part of the wealth-management client base.”

But, according to PriceMetrix, these younger individuals need to be educated on the value proposition of personalized financial guidance and planning:

“Adding younger clients, while critical to future advisor growth, will be an increasingly challenging endeavor. While new-client-acquisition rates for full-service advisors were stagnant, technology-led wealth platforms experienced significant new-account growth in 2020. Many investors start out as ‘self directed’ and switch to human advisors as their needs become more complex, but with online offerings becoming more sophisticated and adding additional service options, enticing clients to switch may become a taller order.”

According to recent research by The Ensemble Practice, a consulting firm focused on the advisory space, 44% of high-income individuals have never worked with a financial advisor. This illuminates not only a tremendous business opportunity but also the importance of how advisors position their philosophy, services, and value proposition in initial meetings with potential clients.

For this issue, we asked several financial advisors, “How do clients benefit from your approach to customized financial and investment planning?”

Luis Padilla • Sparks, MD

Read full article

“It is paramount that the client’s needs come first. My philosophy over the years has been that if you make the relationship highly valuable to clients, not only will they benefit, but your business will grow.

“My operating philosophy was developed to help define and attract the type of clients we would like to work with. My ideal clients sincerely want to improve their financial future, value building a long-term relationship with their advisor, and are open to education and guidance. …

“Our financial-planning process is consistent with our mission as a firm; we call it ‘relationship-based financial planning.’ It starts with an extensive discovery process. We get to know a client or client couple on a personal basis and discover what might be keeping them up at night, what their long-term financial priorities are, and how they might rank those priorities. …

“I view financial planning as an ongoing process that is always subject to revisions and refinements. I want to know if the client is satisfied with the results and progress toward their objectives, and if they perceive any outstanding pain points. I always want to grow and strengthen the relationship, and feedback is essential to the process.”

Emrich M. Stellar Jr. • Bethlehem, PA

Read full article

“We fully communicate to prospective clients our qualifications, process, and attitudinal perspective on what they can expect in working with our firm. These are outlined in our initial discussions and reinforced in formal engagement proposals. We have a strong record of growth and success, and our clients report a high degree of satisfaction with our services. We are never looking to rationalize our performance on behalf of clients; we always want to be transparent and proud of our recommendations, service, and continuing commitment to client needs.

“Our ultimate goal for all clients is to help them make informed decisions on how they can best optimize the wealth and business success they have achieved over the years. Importantly, their financial strategies should reflect their personal goals, values, and life objectives. We know it is about the life they can actualize and the people they love and care about.”

Pamela Mayfield-Kizzee and Moses LaCour • Houston, TX

Read full article

Moses: “We provide comprehensive wealth management, which includes financial planning, asset management, retirement-distribution strategies, college-funding and insurance strategies, and legacy planning, among other services. I work in a highly consultative role, helping people who have a sincere desire to grow and protect their financial assets over the long term.

“My background is in engineering, a discipline centered on analysis, attention to detail, breaking down problems, and developing sound solutions. It is not all that different in terms of financial planning, with the major difference being the added complexity of dealing with people’s mindsets and their unique circumstances. It is extremely important to be a good listener, drawing out of people what their most important goals are, their attitudes toward risk, and helping them prioritize their immediate and longer-term financial objectives.”

Pamela: “I agree that we view ourselves as financial consultants. We both also want to work with clients who are seeking a more empowered approach to life and their finances. I am willing to consult with clients on any aspect of their financial decision-making, beyond the more formal construct of a financial or investment plan.

“I tell them if they are thinking of buying a car, or investing in real estate, or considering any major life decision that involves their money, they should feel free to speak with me. If I am not the correct resource, I can point them in the right direction. I am especially attuned to the particular needs of clients who are going through changes in their lives, including dealing with career issues, the loss of a loved one or a serious illness, an addition to their family, or the stress of elder care or planning for their kids’ educations. Our goal is to make sure clients know we are there for them, in good times or bad, and will help them address life’s financial challenges and opportunities.”

Eric McGough • Greenwood Village, CO

Read full article

“The way we articulate our firm’s vision to clients is ‘Partnering with you to protect, grow, and enjoy what matters most.’ We want to make sure our clients’ financial needs are met with care, expertise, and an understanding of their unique circumstances and individual goals.

“Each word of that statement has meaning. We want to partner with clients who value our guidance highly. The language ‘protect and grow’ reflects our emphasis on risk management through all areas of a financial plan, while seeking prudent opportunities for long-term asset growth with investments. I believe in a hybrid active/passive investment approach because it strives to take advantage of the benefits of each type of strategy.

“The concept of ‘enjoying what matters most’ speaks to our ability to help clients embrace a planning philosophy whereby they can have a strong level of confidence in their financial future, while addressing the personal goals that are most important to them. We want clients to view our efforts as transparent; highly collaborative; and delivered in a professional, confident, and straightforward fashion.”

David J. Wood • Royersford, PA

David J. Wood • Royersford, PA

Read full article

“Everything we do starts with the financial-planning process, which is one of the main things that attracted me to our firm. St. Pedro has a specific planning methodology that we share with prospective and current clients. It’s called the ‘Four Cornerstone Approach.’

“I often tell clients that our approach is similar to building a new home. No one would approach a project of that magnitude without first understanding what the homeowners expect from the home in terms of its utility, space requirements, protective features, construction methods, style considerations, and so forth. That process has to be a joint effort between the builder and the homeowner. …

“The Four Cornerstone Approach specifically addresses four areas of importance: (1) addressing cash-flow management and analyzing financial strengths and weaknesses; (2) identifying the role in a plan for fixed-income investments and any other future guaranteed sources of income; (3) conducting a needs-based analysis of appropriate protection and risk-management strategies; (4) determining the client’s risk tolerance in the context of a suitable portfolio allocation recommendation, balancing growth requirements with an appropriate level of risk assumption.

“The bottom line is we strive to provide unbiased, objective financial-planning and wealth-management guidance while working as a team with clients throughout our comprehensive planning process.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This article first published in Proactive Advisor Magazine on Nov. 18, 2021, Volume 32, Issue 7.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.