Encouraging a long-term investment perspective

Encouraging a long-term investment perspective

Applying behavioral concepts can help clients develop a long-term investment perspective and “stay in their seats” when being bombarded by highly emotional news.

In an earlier Proactive Advisor Magazine article, I presented a framework, based on five concepts, for implementing behavioral finance throughout the advising and investment-management process. A follow-up article discussed how selecting and evaluating funds based on manager behavior is predictive of future returns where past performance is not. This article is intended to help avoid client behavioral mistakes and facilitate discussions during emotionally charged times.

In this unprecedented year of COVID-19, many advisors have been challenged to keep clients on course with their long-term investment plans and avoid costly panic decisions. An important aspect of behavioral coaching is providing education and perspective. In this article, I discuss how historical perspective, combined with behavioral concepts, can help clients develop and keep a long-term perspective for the growth portion of their portfolio, as well as avoid emotional mistakes during turbulent times. These behavioral concepts, combined with the supporting data, provide a tool kit for shaping investors’ long-term expectations and help them “stay in their seats” when markets turn volatile.

This article makes the case for clients “staying the course” with their plan in the growth-oriented portion of their portfolio. There are, of course, many ways for advisors and their investment managers to construct a portfolio of diversified strategies. This could include a combination of both passive and actively managed funds.

Well-known Wharton finance professor Jeremy Siegel has often made the convincing argument that stocks are one of the best investments for building long-horizon wealth. Yet many investors see equities as short-term investments like a house they would buy and flip for profit. Warren Buffett, renowned for his success in stock investing, is quoted as saying, “If you aren’t thinking about owning a stock for 10 years, don’t even think about owning it for 10 minutes.”

At AthenaInvest, we believe in the long-term power of equity markets and the active pursuit of behavioral price distortions to build superior equity portfolios. What follows is a series of charts, and accompanying analysis, to help advisors encourage clients to take a long-term perspective with their growth-oriented investments. I also present a few behavioral concepts and suggest client dialog that can be used when presenting this material.

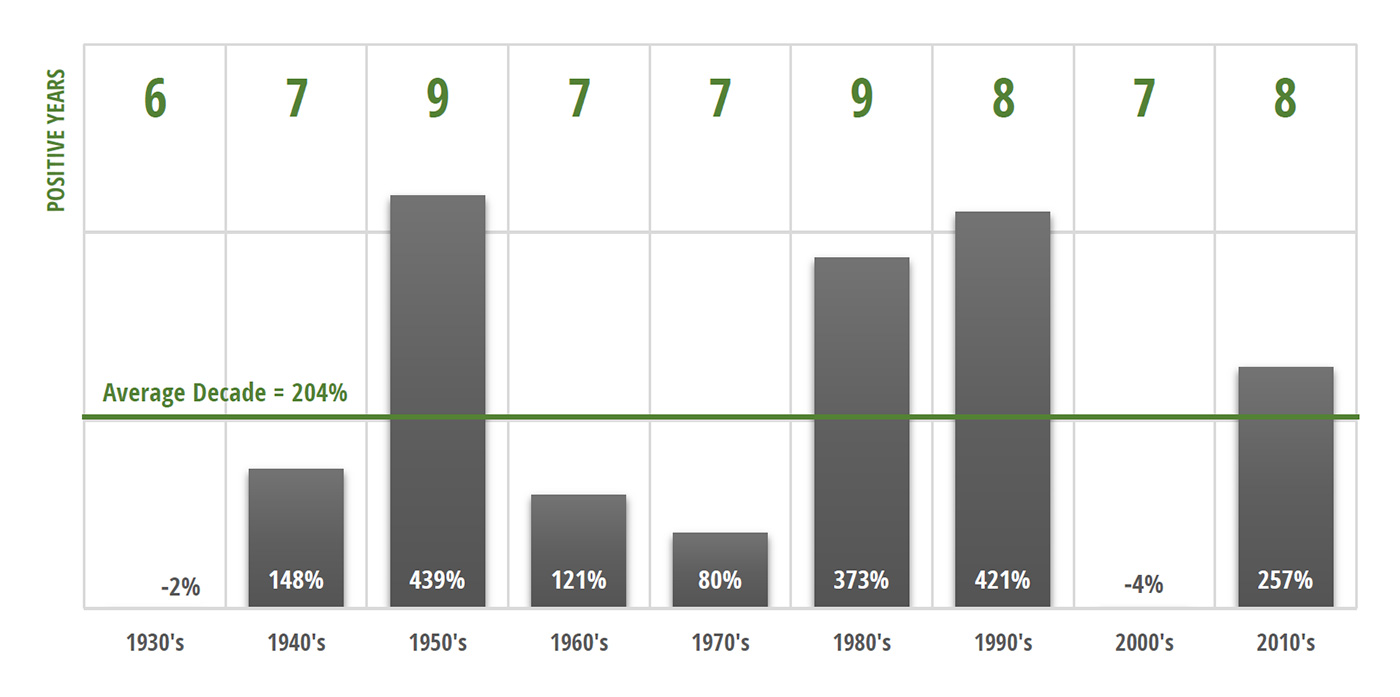

There are floods of 2020 commentaries on how COVID and the government responses to it will impact the economy and the market. For long-term investors, it is hard to know what to make of them all. Taking a deep breath and stepping back by reframing with a longer-term perspective can help investors avoid costly mistakes. Every decade has its challenges, but even with myriad setbacks, the average decade-return over the period below was 204%, so advisors and investors should tune out the noise and stick to their investment plan.

Source: AthenaInvest, market data

Equities appreciated 257% and advanced in eight of 10 years in the 2010s. For some historical perspective on the subject, we look at the past nine decades. Remarkably, the 2010s represent the most average decade of any over the 90 years. Investors tripled their money (204% unannualized return) and experienced 7.5 positive index return years in an average decade for the period.

Decade returns range from a low of -4% to a high of 439%. Negative returns are rare, with only two decades closing with negative returns: the Depression-era 1930s and the 2000s, which saw tech-bubble deflation and the Great Recession. After the market declined in the 1930s, it took six decades to experience another negative decade. The 2010s was the fourth-best investment return decade following the postwar-era ’50s, the dot-com ’90s, and the Reagan-era ’80s.

For most investors, there is little need to try to predict the future based on the constant flow of information and opinion regarding the recent unexpected events and current investing landscape. Successful investors have a long-term perspective and dedicate a portion of their assets to growth and invest based on long-term return expectations.

When this perspective is taken, the largely random and unpredictable stream of yearly events, headlines, and subsequent results lose their significance. While there are always plenty of things to worry about, often the best course of action is to stay invested and stick to your plan.

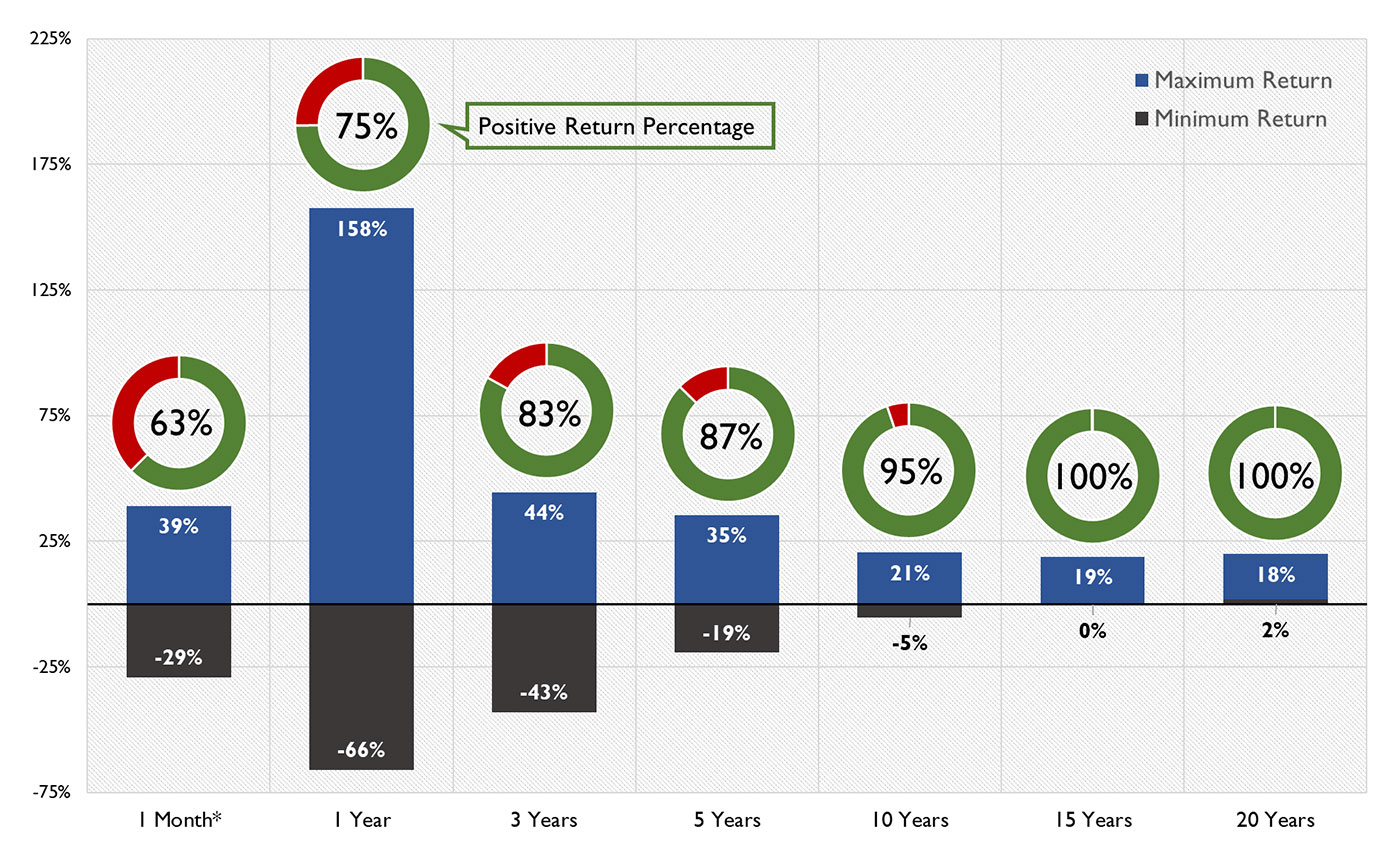

While stocks deliver unpredictable returns in the short term, stocks are the least risky choice to build wealth over longer time periods. As the investment horizon increases, loss of purchasing power becomes the main risk facing an investor. One way to offset this risk is investing in stocks, as the chance of a positive return approaches near certainty in the long term. Investing in stocks generates a positive return 63% of the time for any calendar month, 75% of the time for any 12-month period, and a greater than 95% chance for any 10-year period.

Note: One-month returns are not annualized. Figures include dividends and are compounded by geometrically linking monthly returns.

Source: Fama-French Market Return Series, June 1, 1926–Dec. 31, 2017

Most of the extreme minimum and maximum returns in Figure 2 occurred during the Depression era, when the world was a much different place. One thing that hasn’t changed, however, is the average stock market returns over these rolling periods. Regardless of the period examined, each of the rolling time periods return on average between 10% to 12% annually. This is because periods of low returns are followed by periods of high returns, and vice versa. Stock market returns regress to the mean over time. Simply staying invested improves results with every year invested, regardless of the conditions.

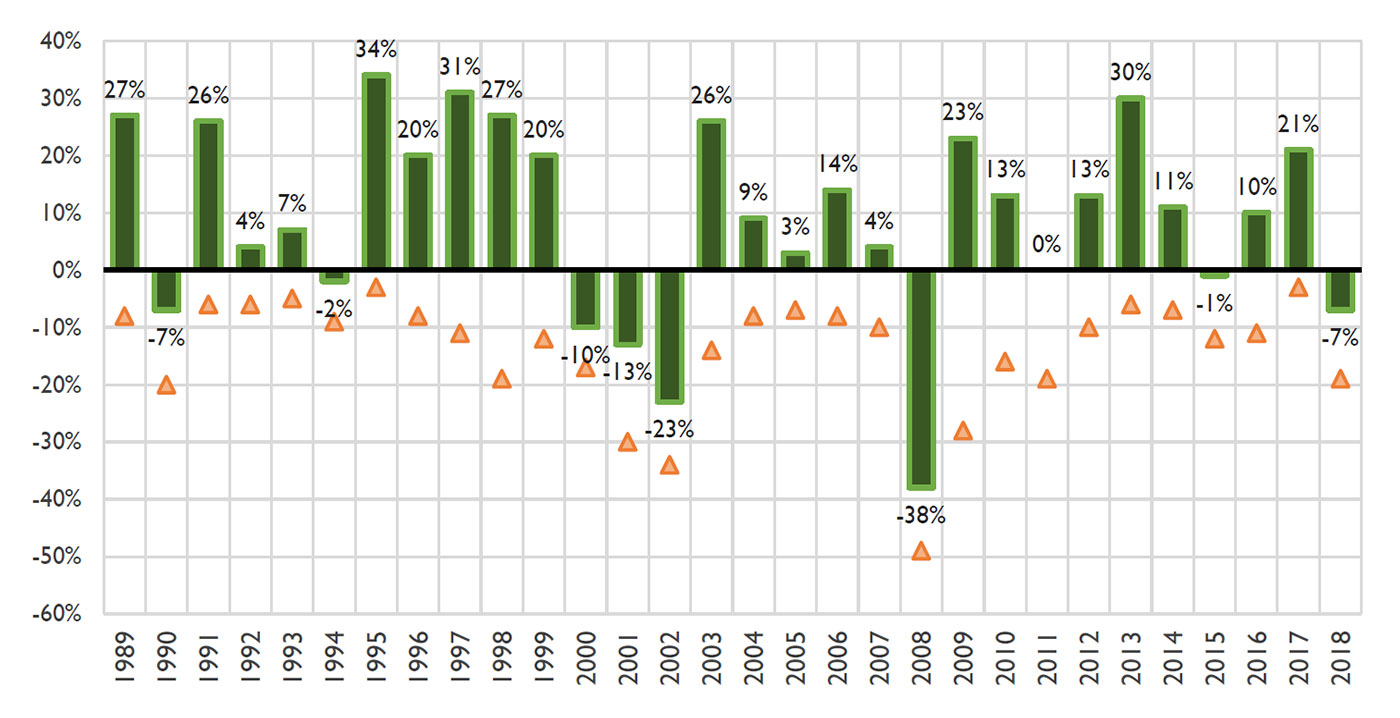

Even though we all know market fluctuations are a normal part of equity investing, large market declines can be scary because they often happen rapidly and feel random. What investors lose sight of is that equity market returns over the past 30 calendar years have been mostly positive, despite significant market declines in each calendar year. This is true in 2020 as well, with a return of roughly 10% through October even though the market took a 35% dive in February and March.

The following chart demonstrates this point by examining market activity over the past 30 years. The lowest point of the stock market during each calendar year is shown by the orange triangles, compared to the market’s return for the full year, as shown by the green bars.

FIGURE 3: CALENDAR YEAR RETURNS AND INTRA-YEAR DRAWDOWNS

OF S&P 500 PRICE INDEX (1989–2018)

Source: Dow Jones Indices LLC, December 2018

The average intra-year pullback in the Standard and Poor’s 500 Index (S&P 500) since 1989 has been roughly 14%, a little less since 2009. Despite the 14% intra-year decline, the S&P 500 has closed positive in 21 out of 30 years, or 70% of the years in that period.

Figure 3 provides a visual perspective of “normal” yearly market movement with equity investing. Yet for the typical investor, emotional behavior can often lead to selling during market declines. Inevitably, many investors sold during the declines and missed out on the upside as the market recovered. Unfortunately, stock market returns rarely come evenly, and large positive returns often closely follow large negative returns. Setting expectations, understanding behavior, and establishing plans about how to react to inevitable market movements can help investors stay invested and improve their long-term investment results.

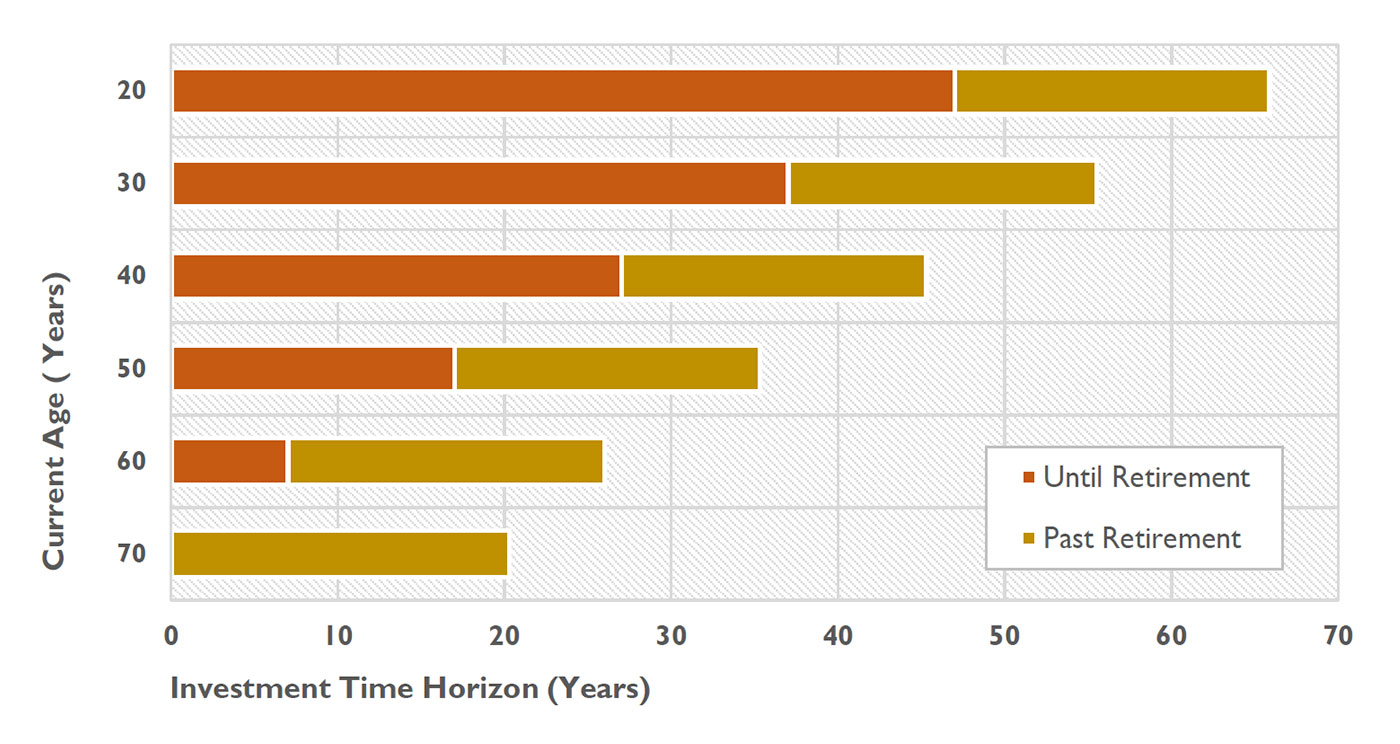

Investment time horizon is a critical concept in building wealth. During periods of volatility and uncertainty, one of the biggest challenges for investors is sticking to their long-term plan. Every up and down creates strong emotional reactions and second-guessing.

Most investors have very long investment time horizons, typically decades or more. Investment managers also typically require long time horizons and full market cycles to deliver on their investment thesis. As a result, developing patience and a long-term perspective are key to building wealth.

We are living longer and need to invest appropriately. Even at age 70, the investment time horizon can be more than 20 years.

Source: SSA, Life Expectancy Calculator, https://www.ssa.gov/planners/lifeexpectancy.html

Figure 4 shows the number of years until retirement and the number of years past retirement for different ages, based on life expectancy and retirement at age 67. Successfully funding a long life into retirement requires consistent action, which includes making regular contributions while working and staying with a disciplined investment plan.

Even in retirement, it remains important to stay adequately invested in growth-oriented investments. The focus on short-term investment performance and the associated micromanagement of portfolios is counterproductive to building long-term wealth.

Investing is a long-term exercise that requires patience and stamina. Unfortunately, we are hardwired to react to our emotions in the present at the expense of our future selves. Like becoming a marathon runner, becoming a long-term investor takes time, effort, and discipline. The challenge is not only to find better investments or strategies but also to become a better investor.

Availability bias, in the form of access to daily market returns, monthly performance fact sheets, quarterly statements, annual reviews, and taxes, all create constant emotional stimulus. Processing the emotional response to this information is exhausting and the need for relief overpowers our logic and often results in poor decisions. Because investors often feel the need to act on this information, encouraging them to avoid frequent balance inquiries and to ignore media hype can help with long-term wealth creation.

Short-term volatility and performance reporting generate strong emotions in the form of myopic loss aversion by putting more weight on losses than on equivalent gains. The resulting short-term conservatism can drive clients away from a disciplined approach to investment decisions. Educating clients about potential loss from behavioral mistakes can help protect their wealth.

With fallacy of control, we attempt to micromanage long-term investments as a series of short-term activities, seeking to manage 10 one-year investments, rather than one 10-year investment. This usually translates into performance chasing, buying and selling the wrong investments at the wrong time. Reinforce to clients that active equity strategies are designed to do well in different market cycles, which calls for a truly strategy-diverse portfolio (see discussion in this article).

Delayed gratification requires a conscious effort to trade off a current benefit for some long-term value, but it also requires confidence in that long-term value. It is important to remind clients that the benefit of becoming a better long-term investor comes years down the road.

The investment planning process can be another way to help clients see the importance of a long-term perspective. Taking a needs-based planning approach allows investors to think of long-term holdings differently and likely accept more short-term volatility with these investments.

Separate short-term investments to ensure that funds are available for liquidity needs that are one to five years out. This requires a systematic way of assessing and replenishing this short-term fund as it is often the crux of investor fear. Where income is needed, focus on solutions that protect and grow investment cash flow. For long-term growth, we recommend holding a strategy-diverse set (5 to 8) of active managers and plan on staying invested for an extended period. Measure progress toward established goals and needs and revisit the plan regularly to ensure it reflects evolving circumstances and events. Both advisors and their clients also need to stay vigilant about the sequence of returns, where planned or unplanned investment portfolio withdrawals at the wrong time in a market cycle can have a significant long-term impact.

Investors find market ups and downs unnerving, particularly when dramatic events occur, such as the recent COVID-induced market drop and bounce back. No doubt, advisors saw, as we did, that some investors fled the market at the worst possible time, locking in large losses and, in turn, missing the historic market rebound. Making it a priority to educate clients so they not only understand but appreciate the positive impact of a long-term perspective will lead to satisfied clients and a rewarding experience for the advisor.

Editor’s note: Proactive Advisor Magazine wants to thank Dr. Howard and AthenaInvest for contributing this article to our publication. Please visit AthenaInvest to register for a monthly “Behavioral Viewpoints” article.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.