Are investors motivated by more than two emotions?

Are investors motivated by more than two emotions?

Greed, fear, and “gut feelings” can strongly impact investors. Rules-based strategies can help eliminate the poor results of emotional investment decision-making.

Whether you are talking to portfolio managers, researchers, financial advisors, or marketing experts in the financial-services industry, the conventional wisdom seems to be that investors are motivated primarily by two emotions: greed and fear.

During the more than 40 years since I founded Flexible Plan Investments, I’ve seen how fear and greed (as well as a third factor—intuition, or “gut” feelings, which we’ll discuss later) can cause investors to make poor financial decisions that jeopardize their long-term financial objectives.

Of course, we can’t simply turn off our emotions when considering our finances. We can, however, analyze their impact and figure out how to keep them from impeding our life goals.

Let’s look at how greed, fear, and following your “gut” may be affecting investment decisions—and how an investment approach can help take emotions out of the equation, allowing investors to more easily stick to their financial plan no matter what the market brings.

Greed can lead to big losses

Greed seems to be a natural motivator for investors. Everyone seeks to profit from their investments. And in today’s culture, “Wall Street” is almost synonymous with the word “greed.” Movies like “The Bonfire of the Vanities,” “Wall Street,” and “The Wolf of Wall Street” perpetuate the association.

If only investing were simply about greed. If only all an investor had to worry about was seeking profits, everything would be much simpler.

Of course, there is no way to know with absolute certainty which stock is going to “go up.” We know this to be true, yet investments and investment strategies are often sold as if they are infallible.

The hard truth is that there is no holy grail of investing. Even the best investment strategies fail to gain some of the time.

Still, greed does motivate investors. No one makes an investment without believing that it is going up. Yet this pursuit of profit can lead to big losses.

When the crowd is all betting one way, that’s when trouble can strike. This opens up the subject of bubbles: bond bubbles, gold bubbles, and stock bubbles. They all have one thing in common—all are optimistic. The sentiment indexes are at the top of their ranges. Everything looks positive, and headlines talk about nothing but success. At the top, it seems that everyone is buying, and this buying is fueled by greed.

Then, sure enough, the bubble bursts. Reality sets in. Prices plunge.

When fear causes flight

That’s when we learn about the second investor motivator: fear.

When prices fall, it is easy to be fearful. Sometimes it is even wise to be fearful.

Yet, just as greed can cause us to buy at precisely the wrong time (near the top), fear can lead us to sell when it is inopportune.

Often, we see investors selling when fear is at its height, which is usually near when prices are bottoming. Similarly, they give up on an investment strategy not when it deviates from what it normally does, but simply when it is down or at a low point. Then they watch in dismay as it catches fire again.

This happens over and over throughout the typical bull and bear cycle. Why? Because, although greed is a terrific motivator, financial behavioral researchers have discovered that investors are twice as motivated by fear of loss as they are by a desire for gain. So, while it might take a $100,000 profit potential to cause an investor to buy, it generally will take just a $50,000 loss to cause an investor to sell.

Fear is one of the major reasons why buy-and-hold investing as a strategy is a failure. Holding when fear is in the air is counter to human nature. Combine that with the 2-to-1 weighting of fear over greed as a motivator, and one realizes that it is easy to sell too soon and buy too late as a general rule.

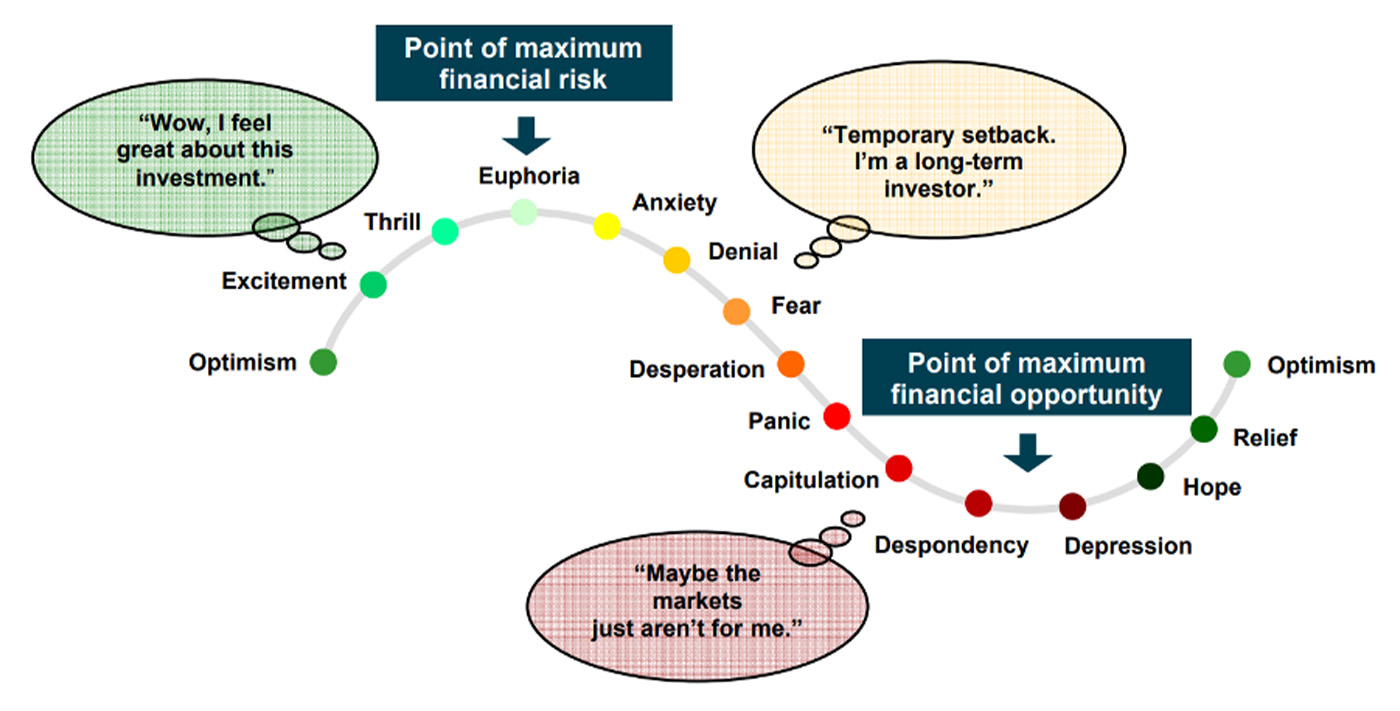

Unfortunately, there is a lot of truth evident in the following illustration that depicts the emotional context of bull and bear cycles for many investors.

CYCLE OF MARKET EMOTIONS

Sources: Westcore Funds/Denver Investment Advisers LLC, 1998; CI Investments

Good investing takes discipline. Generally, discipline is only achievable when investors follow a plan or strategy that acknowledges that simple truth—holding when it is prudent but selling before fear is at its height. An actively managed strategy that is well tested and follows rules, rather than emotion, to determine when to sell is more in tune with human behavior than a simple buy-and-hold approach.

Following your ‘gut’ can turn sour

I believe there is another motivator at work that has not been examined to the same extent as fear and greed: making financial decisions based on “gut” or intuitive feelings.

I see this happening regularly with investors and even financial advisors. They buy a strategy based on the return over many years and then exit the strategy after one bad quarter or year.

Worse still is the investor that buys a strategy based on concerns over losses they sustained in a bear market only to sell it when it doesn’t keep up in a bull market.

Similarly, intuitive decision-making is evident when an investor buys a combination of strategies to strategically diversify their portfolio and then sells the one or two strategies that don’t go up when everything else does. Why is this a problem? Hint: The portfolio wouldn’t be diversified if everything went up together.

These are all examples of intuition at work rather than critical thinking.

In his 2005 bestseller, “Blink,” Malcolm Gladwell set out the case for intuition, or split-second appraisals, as a sound basis for decision-making.

A year and a half later, a new book hit the shelves, “Think.” It made a case for the contrary proposition. Its author, Michael LeGault, maintained that it’s a mistake to rely on emotion and instinct instead of reason and facts.

Leave it to Nobel Prize–winner Daniel Kahneman to sort out the apparent conflict. In his excellent book “Thinking, Fast and Slow,” Kahneman presents the academic research supporting the proposition that we do make faulty decisions using both approaches, but that both types of decisions are largely successful.

“Fast,” automatic, intuitive decisions not only made it possible for humankind to survive its beginnings, but they are also “the origin of most of what we do right—which is most of what we do.”

Dr. Kahneman points out, however, that they are also “the origin of much that we do wrong.” This arises from the fact that our ability to respond quickly means we always have a “ready answer,” whether it is the right one or not.

Unfortunately, to gain such speed, we have developed shortcuts that can take us to the wrong answer. While this occurs in many types of decisions, based on the research cited, it appears that some of the areas where we most often jump to the wrong conclusions are those involving probability and statistical decision-making. Amazingly, this is almost equally the case for mathematicians and statisticians as it is for the general population.

In such circumstances, “slow,” deliberate thinking, using reasoning and facts, does result in more “right” decisions. Yet it is somewhat ironic that research has shown that when this approach is wrong, it is usually because we are lazy in its use and often rely on shortcut information derived from faulty information obtained from our intuitive side.

One of the chief culprits for this is our intuitive tendency to make decisions based on too short of a time period. This “narrow framing” leads us to make decisions earlier in a financial relationship than reason would suggest.

Taking emotion out of the decision-making process

Dr. Kahneman suggests several different ways to correct for this intuitive tendency that I believe address the problems associated with letting emotions dictate your financial decision-making.

The primary way is being slower to arrive at financial decisions.

Using larger organizations, which tend to be less susceptible to such mistakes because they are slower and more deliberate in making decisions, can also help.

Finally, removing emotion from decision-making by using investment strategies that are computerized and based on rules rather than human discretion (such as those available from Flexible Plan Investments) may reduce the possibility of behavioral error as well.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

RECENT POSTS