How does today’s stock market compare to the 2000 tech bubble?

How does today’s stock market compare to the 2000 tech bubble?

Many investors are wondering if the current stock market resembles the 2000 tech bubble, especially with the growing focus on new technologies such as artificial intelligence (AI).

In 1985, the emergence of personal computers, software, semiconductor materials, integrated circuits, telecommunication, and internet technology fueled the great bull market that peaked in 2000.

Today, several technological advancements are close to being introduced to the market or achieving widespread acceptance, including the following:

- Digital and crypto technologies: advanced phases of distributed ledger technology (DLT) that could support the decentralization of industry, finance, and monetary systems.

- Robotics and automation: assembly lines, robots replacing human workers, and business hyperautomation.

- Sensing and AI innovations: sensors, image sensor technologies, integrated artificial intelligence, advanced machine learning, voice user interface (VUI), machine vision, facial recognition, advanced language and audio interpretation, scent recognition, and pressure recognition.

- Data and connectivity: advanced dark data mining, enhanced connectivity technologies, 5G, personalization internet technologies, and the Internet of Behaviors (IoB).

- Virtual and augmented realities: the metaverse and extended reality (XR).

- Health and biotechnologies: personalized health care, humanoid robots for health care, and integrated wearables like smart clothing and implants.

- Sustainable and advanced materials: integrated solar technologies and second-phase nanotechnology.

- Logistics and transportation innovations: supply-chain reinvention and platooning.

These new technologies will soon come into wider use. A few, like artificial intelligence, are already rapidly advancing toward mass market adoption. Others, like business hyperautomation, remain unfamiliar to the average investor.

Historically, new technologies have driven great bull markets. The more new technologies that emerge at any one time, the longer and stronger the bull market tends to be. For example, the great bull market of 1920–1929 was propelled by the emergence of automobiles, gramophones, telephones, electricity, and home appliances.

One major similarity between that bull market and today’s stock market is that both were catalyzed by global pandemics. The Spanish flu pandemic from February 1918 to April 1920 helped spur the bull market of the Roaring Twenties as innovators found solutions for the problems of that era. Similarly, about 100 years later, the problems associated with the COVID-19 pandemic would give birth to and accelerate some of the most far-reaching new technologies yet. However, despite these parallels, the impact of pandemics on economic and stock market cycles requires careful consideration.

Pandemics profoundly disrupt traditional market dynamics, but they are also rare and result in unique conditions. For example, the COVID-19 pandemic produced anomalies such as the U.S. government’s stimulus checks, the Federal Reserve Bank’s quantitative easing, stay-at-home orders, supply-chain issues, global economic lockdowns, and massive health-care issues. Thus, data from 2020–2022 must not be used to forecast what will occur over the next decade or two. Including pandemic years skews the data and analysis, as those anomalies are unlikely to reoccur for a long time.

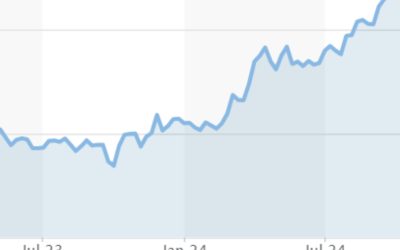

One advantage of being able to read stock charts is that it allows you to compare historical data with current data. This can provide clearer references and more specific information than other forms of analysis. It is also the easiest way to visually compare and understand what is going on today versus what occurred in previous eras.

Based on historical technical data, this new bull market is in its infancy and has the potential to extend into a longer-term bull market.

The following is a monthly chart of the NASDAQ 100, the benchmark index for new technology and thus the best indicator for assessing the potential of the next technology bubble. For accurate trend analysis, the chart is set to the Golden Rectangle Ratio standards.

Sources: TechniTrader

The technical analysis begins with the 2022 lows, which resulted from an intermediate trend correction during that year, following a period of extreme speculation from April 2020 to December 2021. This correction formed a significant trough between the end of 2022 and the start of 2023.

To sustain the long-term uptrend, the trend toward the current peak needs a minor correction, which is likely to occur this year. Presidential election years create uncertainty among the retail groups, although their impact on the stock market can be overstated.

Comparing the current trend of 2024 to the early 1990s after that first intermediate trend correction, it seems possible that this is the beginning of the next great bull market. The introduction of more new technologies now than during the 1990s only gives me more confidence in that possibility.

For now, the new bull market cycle is well formed at its earliest stages. The cycle peaks of a bull market tend to go higher after each intermediate trend correction. If you compare the 2000 peak to the current highs on the right-hand side of the chart, it becomes apparent from a technical perspective that this young bull has the potential for many years of growth. Further, with just a few of the 20-plus new technologies now in the mass market phase, there should be substantial fundamental support for further growth in new streams of corporate revenues and operating efficiencies across many industry sectors.

However, it is important to note that technical patterns do not predict anything. They merely show what is, what has been, and the probability of what the future may bring.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Martha Stokes, CMT, is the co-founder and CEO of TechniTrader and a former buy-side technical analyst. Since 1998, she has developed over 40 TechniTrader stock and option courses. She specializes in relational analysis for stocks and options, as well as market condition analysis. An industry speaker and writer, Ms. Stokes is a member of the CMT Association and earned the Chartered Market Technician designation with her thesis, "Cycle Evolution Theory." technitrader.com

Martha Stokes, CMT, is the co-founder and CEO of TechniTrader and a former buy-side technical analyst. Since 1998, she has developed over 40 TechniTrader stock and option courses. She specializes in relational analysis for stocks and options, as well as market condition analysis. An industry speaker and writer, Ms. Stokes is a member of the CMT Association and earned the Chartered Market Technician designation with her thesis, "Cycle Evolution Theory." technitrader.com

RECENT POSTS