Skip the resolutions: Goal setting that works for clients’ financial futures

Skip the resolutions: Goal setting that works for clients’ financial futures

Advisors can more effectively help clients meet their investment objectives if they incorporate risk-managed, goals-based strategies—minimizing behaviors that can derail an investment plan.

They say New Year’s resolutions are meant to be broken. By now, some readers of this article may feel frustrated by their inability to follow through on some of their well-intentioned resolutions for 2025—if they made them at all.

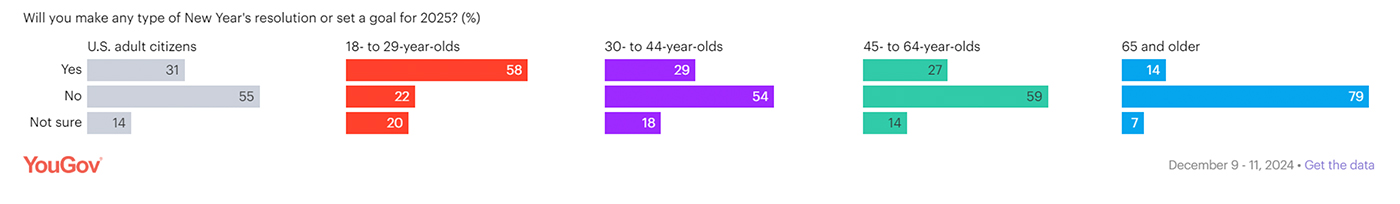

According to research conducted by research firm YouGov:

- Only 31% of Americans plan to make New Year’s resolutions or set goals for 2025.

- 58% of adults under 30 plan to make resolutions, while only 24% of older Americans say they will do so. Just 14% of adults 65 and older say they intend to make resolutions.

FIGURE 1: MOST ADULTS UNDER 30 PLAN TO MAKE NEW YEAR’S RESOLUTIONS

Source: YouGov

The same research says the most common resolutions focus on saving more money (26%), improving physical health/exercising more (22%), being happier/improving mental health (22%/17%), eating healthier/losing weight (20%/17%), learning something new/reading more (15%), and improving relationships with friends or family (14%).

According to YouGov, confidence in keeping these goals isn’t very high. Only 40% of respondents say it is “very likely” they will keep their resolutions throughout the year.

Even this figure may be overly optimistic. Prior research shows that only about 25% of resolution-setters achieved at least some success in their efforts. And Gallup reports that by mid-February, “80% of the people who set New Year’s resolutions will have abandoned them”—a trend so common that it has earned its own unofficial observance on the second Friday of each January: “National Quitter’s Day.”

If you’ve set a resolution for 2025, good luck to you—though luck really has nothing to do with it!

Forget New Year’s resolutions: How about October reassessment?

Some people are rethinking the tradition of New Year’s resolutions, opting instead for goal setting in October. According to a 2024 article in The Wall Street Journal, a movement called “October Theory” is gaining traction, encouraging people to reflect and set goals during the final three months of the year.

The article highlights a couple of reasons why October is appropriate for self-reflection and goal setting:

- The changing seasons and start of the academic year inspire a sense of renewal.

- The year’s impending end creates urgency but leaves enough time for achieving some life changes or following through on aspirations from earlier in the year.

“This is a great time, 90 days from the new year, from the holidays, to reassess, see where you are with things,” adds Laurie Kramer, a licensed clinical psychologist and a professor of applied psychology at Northeastern University.

Setting achievable and continuous long-term goals for an investment portfolio

Rather than setting resolutions tied to a specific date—whether Jan. 1, October, or on one’s birthday—it makes much more sense for investors to consider adopting a goals-based approach to their financial future. Breaking larger objectives into smaller milestones fosters a more sustainable and flexible framework than the “all or nothing” mentality of traditional resolutions.

In the interviews we have conducted with successful financial advisors, the majority employ some version of goals-based financial and investment planning. One article on this topic combined advisor insights with a research-based perspective. Here is an edited excerpt:

“Goals-based investing has two meanings in today’s retirement planning environment:

“1. The practical notion that an investment plan should be based on achieving realistic goals customized to an individual’s (or couple’s) overall financial-planning requirements … —not some far less relevant market benchmark. … It starts with a financial plan that attempts to identify realistic levels of returns that will help a client meet their financial goals. …

“2. The philosophical idea that investment success should be measured on how it helps clients achieve the lifestyle goals they desire. Those goals could be the most basic, such as attaining a comfortable retirement. … Or, they could also be more ambitious, such as helping fund a grandchild’s college education, buying that [long-desired vacation home or condo], making a significant contribution to a favored charity, or going back to school to jump-start a new career. …”

Why choose goals-based, risk-managed investing over traditional passive asset allocation?

For decades, investment and financial advisors have applied the principles of modern portfolio theory (MPT), the capital asset pricing model (CAPM), and the efficient frontier theory when constructing client portfolios. These principles were largely based on the work of American economist and Nobel Prize recipient Harry Markowitz.

MPT theory retains strong advocates, and it generally served investors well during the last few decades of the 20th century. Says Investopedia, “Modern portfolio theory has had a marked impact on how investors perceive risk, return, and portfolio management. The theory demonstrates that portfolio diversification can reduce investment risk.”

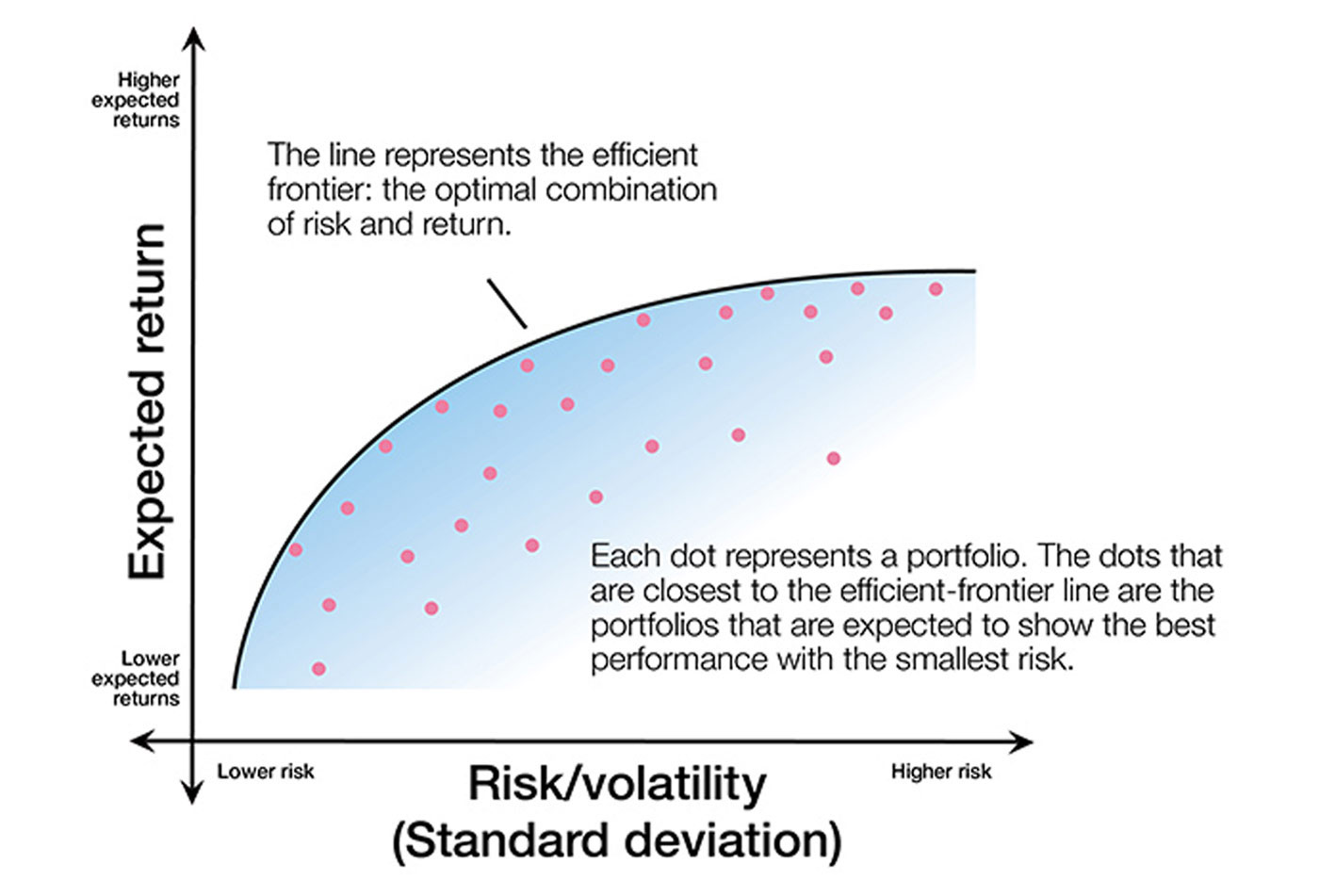

There is little doubt that focusing on the relationship between risk and return was, and is, a compelling and positive tool for investors and their advisors as they consider investment options. Efficient frontier theory took this to a new conceptual level, identifying “the portfolio composition(s) that provide one with the maximum return for a given degree of risk (or alternatively, the least amount of risk for a given return).”

On a theoretical level, this sounds vastly superior to selecting investment vehicles and portfolio composition with little regard to risk. And it is. MPT and efficient frontier theory still have valuable roles to play in examining portfolio alternatives.

FIGURE 2: THEORETICAL VIEW OF THE EFFICIENT FRONTIER CURVE

Note: This graph is an example of what the efficient frontier equation looks like when plotted. The purpose of the frontier is to maximize returns while minimizing volatility.

Source: smart401k.com

But the broad and deep market downturns of the 21st century exposed some serious weaknesses in the theory of classic asset-allocation strategies and MPT, especially as they relied on a passive approach to investing. Advisors and their clients witnessed several “real-world” effects on markets and investor behavior in times of severe stress, such as that seen during the dot-com meltdown of the early 2000s and the credit crisis of 2008–2009:

- MPT/efficient frontier theory was severely challenged by traditional asset-class correlations not behaving as expected, which was explored in Proactive Advisor Magazine’s article, “A more efficient (and profitable) frontier.”

- The sequence-of-returns “dilemma” undermines even very capable application of MPT for client accounts. As numerous studies have shown, when clients are in the distribution phase of retirement, the sequencing of their investment returns can have disastrous effects on the long-term viability of generating an income stream.

- Classic passive asset allocation according to MPT, while perhaps “maximizing” return relative to risk, does not mean risk is totally mitigated. As one experienced financial advisor told Proactive Advisor Magazine, “I was a firm believer in modern portfolio theory up until the financial crisis of 2008–09. I always thought it was sufficient to have client portfolios that were optimized as much as possible for risk and return. However, while a portfolio might beat the worst of the market’s performance in a severe crash, it is still unacceptable to see portfolio declines of over 20% or 30%.”

- To the point above, the most troubling aspects of client behavior can surface when markets crash—despite having “well-constructed” portfolios. The herding mentality can come to the forefront when investors perceive “the investment world is coming to an end,” and emotional panic dominates decision-making. For investors—especially those nearing or in retirement—using strategies designed to dynamically manage risk can help mitigate losses during downturns.

Applying the objectives of goals-based, risk-managed investing

Goals-based investing is not an investment plan that seeks to duplicate broad market results or build comparisons to popular market benchmarks.

It starts with a financial plan that attempts to identify realistic levels of returns that will help a client meet their financial goals, usually prioritizing the core objectives of (1) producing income (along with other sources) for retirement and (2) seeking longer-term portfolio growth.

By its very nature, a goals-based investment plan will not see returns anywhere near those of the best bull markets. But, importantly, through the use of dynamic risk-management tools, it should also not suffer the worst drawdowns seen in severe bear markets. In general, the objectives of a goals-based investment plan are to smooth out volatility, achieve steadier returns, and project a range of returns for a client that is consistent with their risk profile and has a reasonably strong mathematical probability for success over time.

By incorporating goals-based and risk-managed strategies, financial advisors can better tailor investment approaches to meet clients’ specific needs and desires. Combined with the behavioral finance benefits of this process, clients are more likely to have realistic and achievable expectations, enabling them to stay the course to meet—or even exceed—their stated goals.

Financial advisors seeking new solutions for clients’ long-term investment plans have reached similar conclusions without needing in-depth academic analysis. Many have turned to a combination of goals-based investing and outsourced investment management, working with investment managers who provide more active and risk-mitigating strategies.

Ashvin Chhabra, former chief investment officer at Merrill Lynch Wealth Management and author of the book “The Aspirational Investor: Taming the Markets to Achieve Your Life’s Goals,” said it well in a CNBC interview. In discussing aspirational goals, he noted, “At the end of your life, saying ‘I beat the S&P by 3 percent’ doesn’t mean anything. But if you say, ‘I invested well, I had a nice house, my kids went to a good school,’ that’s something.”

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

This article was originally published in Proactive Advisor Magazine on Feb. 16, 2022 (Volume 33, Issue 7). Some information and sources have been updated.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

RECENT POSTS