Using behavioral finance to better guide clients

Using behavioral finance to better guide clients

Advisors can benefit from using behavioral finance when working with clients—specifically when educating about risk, investment expectations, managing emotions, and the importance of sticking to a long-term financial plan.

Financial-services veteran Richard Lehman, now a professor in behavioral finance (and a frequent contributor to this publication), wrote in his article “Investing is about managing stress—as well as performance,”

“In my 35-year career in and around Wall Street, I have seen the markets exact a personal toll on many investors, both retail and professional. Driven by subliminal inner forces, many people have allowed the markets to push them to extremes and, unfortunately, have done harm not only to their portfolios but also to their health and well-being as a consequence.

“A focus on investment strategies that avoid, minimize, or mitigate these extremes can provide more advantages—both in realized long-term performance and behavioral benefits—than a completely passive portfolio. It does so in part by eliminating the negative actions people (including advisors) often take under stress.”

Jay Mooreland, MS, CFP, is a widely recognized coach and speaker. He founded The Behavioral Finance Network “to help financial advisors increase their value and coach their clients to make better financial decisions,” he says.

He cites a classic quote from famed investor, professor, and author Benjamin Graham in his presentations: “The investor’s chief problem—and even his own worst enemy—is likely to be himself.”

Mooreland says that the key to overcoming this issue is more strategic and anticipatory communication on the part of financial advisors with their clients. “It’s not about talking your clients off the ledge,” says Mooreland. “It’s about making sure they never get there to begin with.”

He says that behavioral-finance research shows that psychological influences on economic and investment decision-making are far stronger for most people than rationale or objective factors. Similarly, client retention is often more influenced by interpersonal factors in communications and service than pure “performance.”

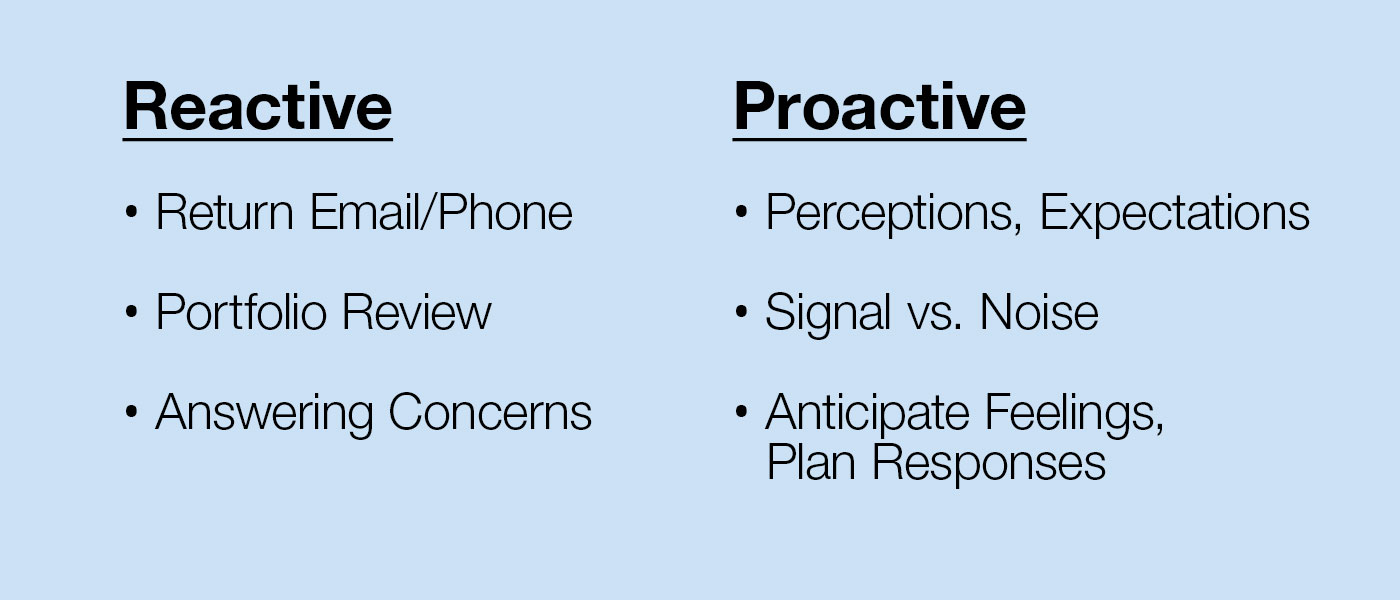

In his coaching program, he works one-on-one with financial advisors to help them move from the often-required “reactive” nature of their role to a position with clients where they are communicating far more proactively in several key areas. He provides the following short examples to illustrate this point.

Source: Jay Mooreland, The Behavioral Finance Network

There is little doubt that many advisors would benefit from becoming more knowledgeable about behavioral-finance principles in onboarding, guiding, and retaining clients.

A 2019 white paper from Charles Schwab says, “Advisors cite strengthening trust with clients, improving investment decisions, and better managing client expectations as the greatest benefits of incorporating behavioral finance into their practice.”

FIGURE 2: GREATEST BENEFITS TO ADVISORS OF INCORPORATING

BEHAVIORAL FINANCE (2019)

Note: Respondents were asked, “What are the greatest benefits of incorporating behavioral finance into your practice?” Respondents were allowed to select more than one response.

Sources: Charles Schwab Investment Management, “The Role of Behavioral Finance in Advising Clients,” 2019. Cerulli Associates, in partnership with the Investments & Wealth Institute (formerly IMCA) Analyst

“In the midst of what has now been the longest market expansion on record in the U.S., advisors need to be hyper-focused on keeping their clients’ emotions in check with the prospect of increased volatility and lower returns on the horizon. In this type of environment, an advisor’s role is to help clients maintain a focus on their long-term goals, and to help them tune out the noise of short-term market swings.”

***

Proactive Advisor Magazine has interviewed many successful financial advisors who have successfully adopted core behavioral-finance principles—and strong risk management—within their practices.

For this issue, we looked to several advisors for their reply to the question:

Arnie Beck, EA, JD, AIFA • Folsom, CA

Arnie Beck, EA, JD, AIFA • Folsom, CA

Financial Management Associates

Read full article: “A wealth of experience in addressing clients’ financial-planning needs”

“In addition to the hard data-gathering that is part of our overall financial-planning process, we also spend a lot of time on qualitative and behavioral-finance issues.

“We ask questions such as ‘What are the things that are most important in their lives now? What would they like their retirement to look like from an aspirational perspective? How have they behaved during various market periods in the past, especially during bear markets? Were they willing to wait out the market during the credit crisis, or did they give in to fear and sell their investments in a panic? How much volatility are they willing to accept for their investment portfolio?’

“Along with this kind of probing conversation, we use risk-analysis software to get another perspective on their feelings toward risk. It is interesting that often what clients say they are willing to do and what analysis shows can be quite different. This is often a surprise, and we try to help clients re-evaluate their thinking process, identify the level of risk their portfolio might take on, and explore suitable investments that can match up well with their risk profile.”

“We also get into a 360-degree look at their lives, family situation, health concerns, hobbies and interests, organizations they belong to, and many other areas. Understanding these factors can tell you a lot about what is truly important in a client’s life. I like to recommend to clients that they read Carl Richards’ book ‘The Behavior Gap—Simple Ways to Stop Doing Dumb Things with Money.’

“There are many great concepts in the book that can help anyone think about their finances in a fresh way. Perhaps the most important is that individuals can take steps to control their emotions and deal with their finances in a smart and more rational way. Clients cannot control the markets, but they can manage their own behavior and feelings. I am there as their coach to help them do that. That fits right into our firm’s investment philosophy of managing risk first and helping clients find the appropriate investments that can help them work toward their long-term goals.”

Steve Deppe, CMT • San Diego, CA

Steve Deppe, CMT • San Diego, CA

AlphaCore Capital

Read full article: “Financial guidance that produces tangible results”

“We operate under the perspective of ‘ideas don’t move mountains—bulldozers do.’ Successful financial planning to us is not all about illustrating where someone might be 10 to 20 years from today. Accurately predicting the myriad variables that influence this illustration, and the turns one’s life might take, can be an exercise without a lot of true value. Instead, helping someone save more money in the present and implement a more disciplined and prudent investment management philosophy will improve where they are likely to be financially in the future. … We are strong proponents of the use of technical analysis in our investment approach and understanding the behavioral aspects of markets as a leading indicator.

“Risk management is a vital component of our process since it helps encourage behavioral adherence to the underlying strategy. Everyone wants the S&P 500’s current trailing 10-year annualized returns, but few can behave through the hard times—the 10 years before this period—in a way that would have allowed their portfolio to prosper. Prudent risk management optimizes the likelihood of behavioral adherence, which, in turn, optimizes the likelihood of investing for success over the long term.

“The foundation of our discretionary investment management services is the goal of helping to optimize all ‘active’ decisions a long-term investor makes: what asset classes to own, when to rebalance the portfolio, what to rebalance the portfolio to. Our philosophy falls in the ‘tactical asset allocation’ camp, so our client’s asset allocation will change as the opportunities and trends in the investable universe change. This is done to optimize the likelihood of achieving the minimum return necessary to achieve financial objectives over the full market cycle, which is generally the result of minimizing substantial portfolio drawdown during unfavorable climates for various asset classes.”

Adam Koos, CFP, CMT • Columbus, OH

Adam Koos, CFP, CMT • Columbus, OH

Libertas Wealth Management Group, Inc.

Read full article: “Defense first: Helping clients manage risk”

“One of our most important client principles relates to our overall investment philosophy and client education. When it comes to managing money, we focus first on defending portfolios from losses, and only then seeking competitive returns. We do not believe that strong risk management and portfolio growth are incompatible, and we spend a lot of time educating clients on our philosophy. … We stress that we are not overly conservative, but that on a mathematical basis, avoiding loss is more important than capturing gains for client portfolios. Without a strong defense, any offense is not going to prevail in the long run.

“Technical analysis and quantitative decision-making are at the foundation of our philosophy. We tell clients that our portfolio strategies are not meant to identify absolute bottoms of the market or absolute tops. That is extremely difficult to do once in a lifetime, and almost impossible to do consistently over many years.

“Rather, we aim to conservatively buy on the way up the hill, when markets are advancing. Further, we want to start selling after a market peak has already occurred, pursuing a defensive stance as a market decline begins. We use a variety of strategies and principles of diversification, and our strategies are actively managed. Many are in the trend-following—or momentum—category. I tell clients to imagine the concept of ‘maximum up-capture, minimum down-capture.’

“What we don’t do is adopt a ‘set it and forget it’ approach to money management. We do not want to leave our client portfolios exposed to the volatility of markets without defensive actions and tactics to avoid wherever possible the worst-case scenarios. Does this work perfectly at all times? Of course not. But we tell clients that we always want to know where to sell an investment before we even buy it. I like to say, ‘I manage risk more than I manage investments.’

“By raising the probabilities of avoiding deep losses, we believe client portfolios have a better chance of growing productively over the long term. We tell clients it is not good enough to make a profit, you have to keep the profit and build upon it also. We believe that by maintaining a non-emotional, rules-based, technical approach to money management, we can help clients outperform ‘buy-and-hope’ portfolios over the course of a full market cycle.”

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.