Why outsourced investment management works: Insight from top advisors

Why outsourced investment management works: Insight from top advisors

Outsourced investment management offers financial advisors several important benefits: access to innovative investment solutions, enhanced focus on client relationships, and more time to build their businesses.

Outsourced investment management has become a strategic game-changer for financial advisors, offering many advantages that empower them to thrive in a competitive landscape. As advisors take a broader and more holistic approach to their client’s overall financial planning, the need to strike a balance between client engagement and investment management has never been more critical. The evolving landscape of fee-based practices and the growing reliance on turnkey asset management platforms (TAMPs) have propelled the trend of delegating investment-management and back-office tasks to third-party money managers.

An article from The Wealth Advisor on the value of finding the “right” TAMP said,

“Advisors are expected to be financial planners, psychologists, confidantes, and keepers of client goals—packaged into one. Advisors make the greatest impact on the front lines with clients. That is what drives retention, loyalty, and referrals—and ultimately business growth. …

“To remain competitive, advisors can’t afford to spend most of their time managing investments and tedious back-office systems. Independent advisors, many of whom are small-business owners, face increasing demands from clients and need to find a way to offboard non-client-facing tasks to focus on meeting client needs and business development functions.”

Several research studies have shown that more advisors are (1) moving a greater percentage of their book of business to a fee-based practice model, (2) increasingly using the services of TAMPs or other third-party money managers, and (3) supportive of active investment strategies with a strong risk-management focus. (See our December 2021 article for further discussion of these trends.)

While estimates vary on the percentage of financial advisors who outsource investment management—either in whole or part—the consensus is that it is an accelerating trend. To this point, the Impact of Outsourcing study, conducted in 2021 by an independent research firm states,

“Why are 4 out of 5 advisors planning to increase the percent of outsourced assets over the next 3 years? The top factors include:

- 98% of advisors report they deliver better investment solutions as a result of outsourcing.

- 95% said they have a better work-life balance due to outsourcing.

- 91% experienced increased growth in total assets as a result of outsourcing.”

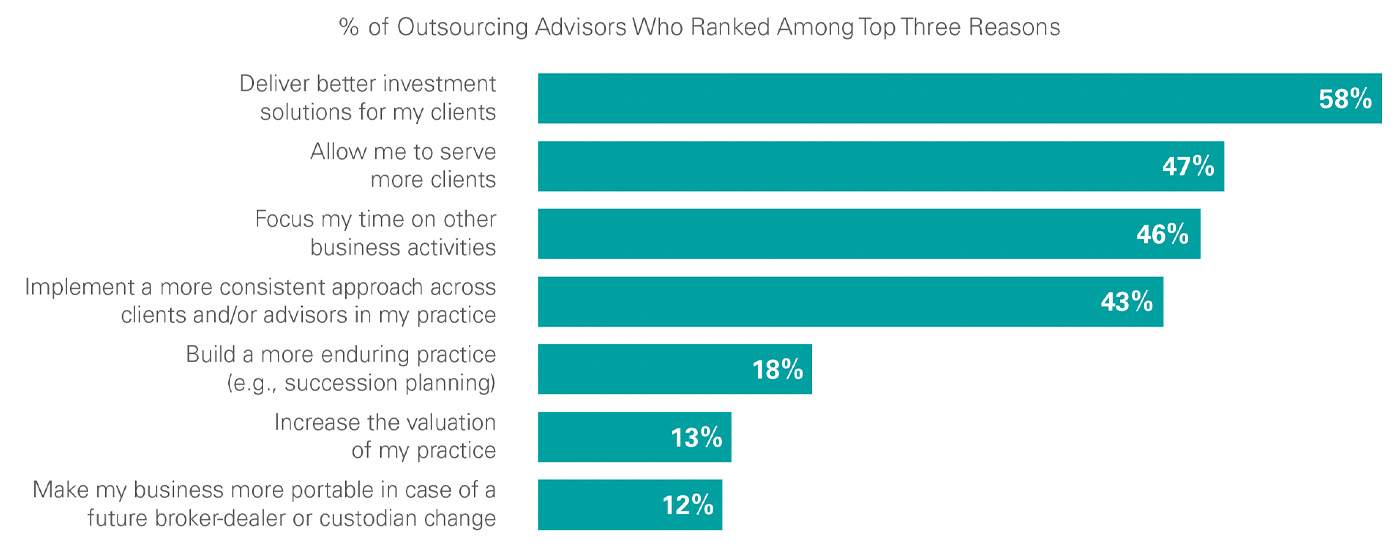

Among many findings, the study looks at the specific benefits financial advisors see as most compelling for using outsourced investment management.

TOP-RANKED REASONS FOR OUTSOURCING INVESTMENT MANAGEMENT

Source: “The Impact of Outsourcing” study, conducted in 2021 by independent research firm 8 Acre Perspective in partnership with AssetMark

The 2023 edition of “America’s Best TAMPs” cites the following specific benefits to advisors of outsourcing investment management:

“The TAMP facilitates investment selection and management, allowing you to offload time-consuming back office functions—investment research, manager due diligence, portfolio construction, rebalancing, reconciliation, performance reporting, tax optimization and statement preparation—and enabling you to focus more on gathering assets, acquiring new clients, and servicing your existing accounts.”

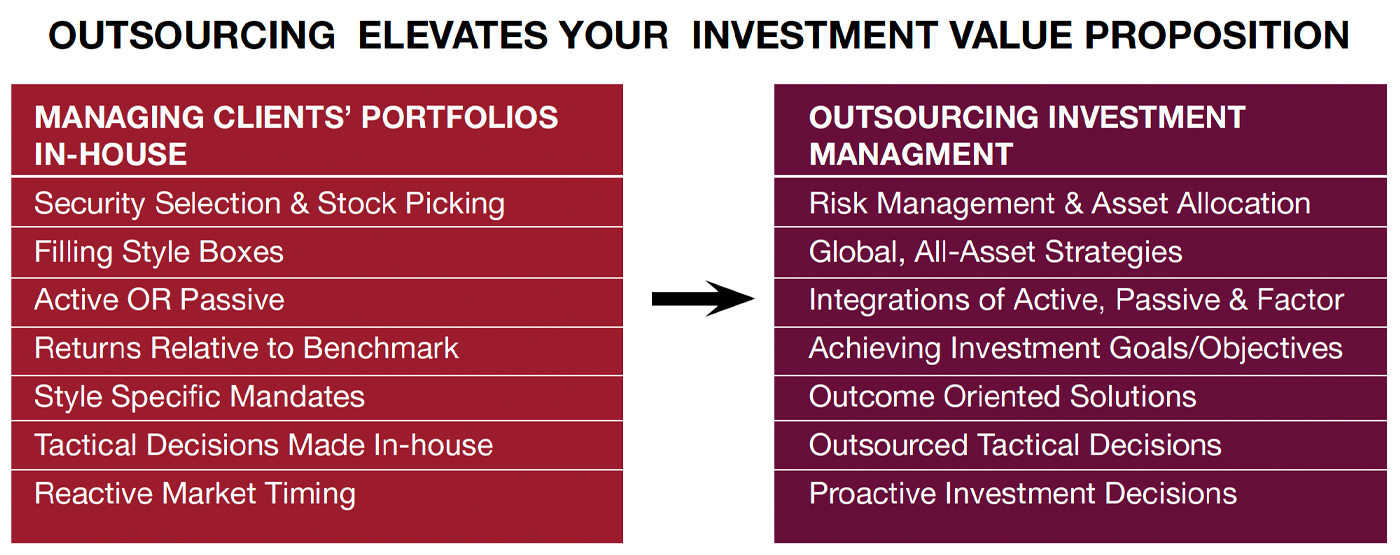

A companion piece illustrates graphically how outsourcing can “elevate” a financial advisor’s or wealth manager’s value proposition for clients and prospects.

Sources: Wealth Advisor: 2023 Model Portfolio & SMA Strategists, Envestnet

For this issue, Proactive Advisor Magazine asked several experienced financial advisors to discuss what they see as the advantages of outsourcing investment management.

What are the benefits of outsourced investment management for your firm?

Brian Carden is a financial and insurance advisor based in Brentwood, Tennessee. He says that his philosophy about developing and executing an investment plan can be summed up simply: “I use as many tools and strategy and product experts as I need to build the best plan possible for each client.”

Brian Carden is a financial and insurance advisor based in Brentwood, Tennessee. He says that his philosophy about developing and executing an investment plan can be summed up simply: “I use as many tools and strategy and product experts as I need to build the best plan possible for each client.”

He adds, “I am agnostic when it comes to specific product or strategy recommendations. Once I have completed the due diligence, I place a great deal of value on the very informed recommendations of specialists in each discipline.”

He finds the process and results of working with TAMPs (turnkey asset management programs) particularly rewarding, citing several benefits, summarized below:

- Asset management by dedicated professionals who have access to sophisticated research and quantitative analysis.

- The ability to provide clients with highly diversified portfolios. This includes diversification by asset classes, different strategic approaches, and management styles.

- Consultative wholesaler and research teams that provide valuable strategic and asset-allocation guidance in structuring client portfolios.

- Back-office support and technology that facilitates client onboarding and performance reporting, as well as integration with other technology platforms.

- Speed, liquidity, and efficiency in making portfolio adjustments, if needed.

- Constant portfolio monitoring and reliable execution that he says “allow me to spend more of my time with clients.”

Tara Nolan is a co-founder of Nolan Financial Partners, a full-service financial-planning and advisory firm located in Colorado Springs, Colorado. She is an entrepreneur, financial advisor and coach, professional speaker, author, and Air Force pilot.

Tara Nolan is a co-founder of Nolan Financial Partners, a full-service financial-planning and advisory firm located in Colorado Springs, Colorado. She is an entrepreneur, financial advisor and coach, professional speaker, author, and Air Force pilot.

She says of her partner, Kris McKinney, “Kris and I both have extensive military backgrounds in planning, logistics, and leadership. We know firsthand the importance of contingency planning—examining multiple scenarios and planning for the worst case. This is very relevant to investment management. Our clients’ financial futures should not be at constant risk from an unknown market outcome. We want to help our clients achieve dependable income in retirement, as well as risk-managed growth of their overall assets.”

She says that for most clients’ investment plans, her firm uses the services of third-party investment managers who employ rules-based and algorithm-driven strategies. These strategies, she adds, “are designed to adapt to changes in the market environment and the relative strengths and weaknesses of different asset classes and sectors.”

She continues, “The benefits of this approach include downside protection for client portfolios while seeking competitive returns, mitigating sequence-of-returns risk for those near retirement, and the behavioral benefit of having an investment plan built for the long term—one that helps alleviate emotional ups and downs for clients and increases the likelihood that they will stick with their plan. As we look at the entire approach for a client, active money management adds value and builds synergy—that’s where success lies. Like everything we do, it is all about empowering clients and helping them build a sense of control over their money and their financial futures.”

David Schmidt is the founder of Promillennial Wealth Guidance, located in Kansas City, Missouri. Mr. Schmidt’s firm offers a variety of financial-planning, investment, insurance, and risk-management services. He also is developing a new brand, 401KUSA, which provides sophisticated investment management to eligible 401(k) plan participants.

David Schmidt is the founder of Promillennial Wealth Guidance, located in Kansas City, Missouri. Mr. Schmidt’s firm offers a variety of financial-planning, investment, insurance, and risk-management services. He also is developing a new brand, 401KUSA, which provides sophisticated investment management to eligible 401(k) plan participants.

Mr. Schmidt says that for participants there are many benefits of using professional investment management for retirement accounts. He has relationships with third-party investment management firms that specialize in investment management for 401(k) participants. He says the strategic approach of these firms, unlike the approach of traditional target-date funds, can provide the following:

- Strategies that are not only age appropriate but also actively managed.

- Strategic diversification that responds to shifting market environments in real time.

- A customized strategic blend of investments based on the participant’s risk profile, reflecting their individual suitability.

- Personalized investment objectives and an investor-friendly visual process for tracking investment progress over time.

- Sophisticated quantitative models that help remove emotion from the investment process.

- A team of experienced investment strategists that monitor strategy performance versus stated objectives.

- A turnkey investment experience for the plan participant.

Related Article: Why advisors continue to favor risk-managed strategies![]()

Steven Heiman is an investment advisor representative with Cooper Malone McClain Inc., a financial advisory firm and registered investment advisor headquartered in Wichita, Kansas. He has over 27 years of experience serving the needs of clients through financial, investment, and retirement-planning guidance.

Steven Heiman is an investment advisor representative with Cooper Malone McClain Inc., a financial advisory firm and registered investment advisor headquartered in Wichita, Kansas. He has over 27 years of experience serving the needs of clients through financial, investment, and retirement-planning guidance.

Mr. Heiman says, “I have an extensive background in sports, both as a sports official and as a pretty fair baseball player. I tell clients that the most successful baseball and football teams have both a strong offense and a strong defense. I also say that on offense, winning teams need to have a balanced approach.”

He adds, “I think there are strong parallels to investing, where the consistency of approach and achieving competitive risk-adjusted returns over the years is preferable to having a series of big up or down years. The mathematics of bear market losses is central to this concept, and I explain to clients how difficult it can be to recover from very steep portfolio losses in any given year.”

Mr. Heiman says that his investment approach for clients includes having a well-defined, actively managed, and high-quality core portfolio element that can weather the market’s ups and downs. He says that he was introduced to a third-party investment manager several years ago with a philosophical approach that was highly compatible with the broad investment principles he was looking to employ for most of his clients.

He says, “I use their strategies for many clients’ core portfolio allocations. In general, their strategies, when used in combination, seek to smooth out volatility, achieve steadier returns, and project a range of returns for a client that is consistent with their risk profile. They have an extensive track record of performance and a very sound management and research team. …

“… Unlike mutual funds, many of their strategies can adjust market exposure up to 100% cash, can rotate to opportunities in different asset classes or sectors, can go inverse the market if that is appropriate, or even use leverage. This provides a lot of tactical flexibility in addressing changing market conditions and risk management at different levels. I believe this gives clients a higher probability of meeting their investment goals over the long term—and the psychological benefit of knowing that portfolio risk is continually being managed.”

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

RECENT POSTS