On May 3, the Federal Reserve hiked rates another 25 basis points, the 10th hike since March 2022.

Is the latest rate hike great news? In terms of short-term market and economic impact, it likely is not. But if it gets the Fed closer to a pause, it could be good news over the long term.

In the Fed’s inflation fight, this cycle of rate hikes is one of the fastest and largest in ages. It appears to be achieving its goals: We are seeing signs of a softening labor market, falling inflation rates, and recent weaker-than-expected GDP growth.

However, rising rates have produced large paper losses in bond portfolios, as bond prices move opposite to bond yields. Estimated mark-to-market losses within the banking sector exceed over $620 billion, according to Bloomberg. This partially explains the three bank failures over the past several months.

This mini banking crisis is leading to credit tightening. Fed Chairman Jerome Powell has acknowledged that this tightening is sure to slow the economy and is equivalent to a small rate hike by itself. Others think the impact will be larger, equivalent to a hike of a half point or even 1.5 percentage points.

That doesn’t sound like good news for stocks. However, if the Fed pauses after the May hike, four decades of history suggests that should be very good news.

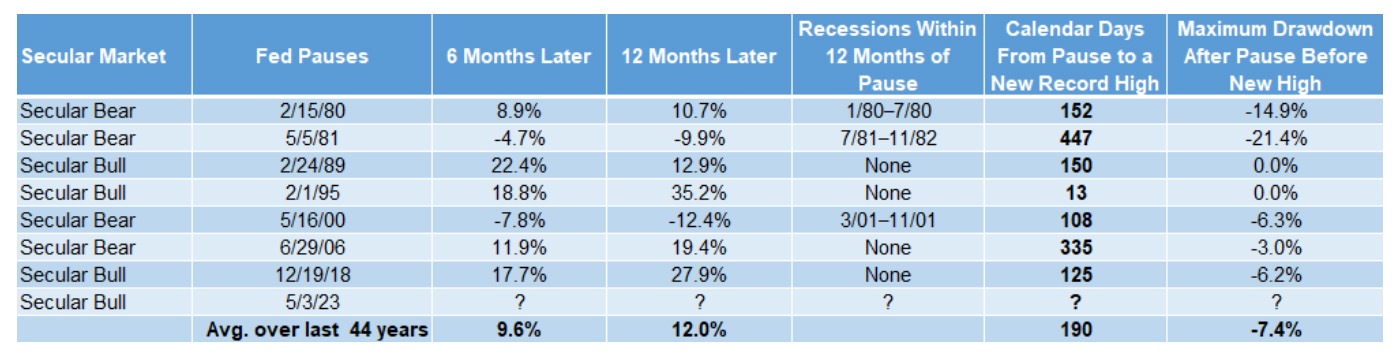

TABLE 1: S&P 500 PRICE CHANGE AFTER FED PAUSE

Sources: STIR Research, Ned Davis Research

Observations on the data in Table 1:

- On average, stock prices after a Fed pause were higher by almost 10% six months later and show a 12.0% gain one year later.

- 71% of the time, a Fed pause was followed by six- and 12-month gains.

- Recessions occurring within 12 months of a Fed pause were problematic. In those three cases, the average six-month return went from a gain to a loss of 1.2% and a loss of 3.9% for the following 12 months.

- Pauses not followed by a recession averaged healthy six- and 12-month gains of 17.7% and 23.9%, respectively.

- While pauses can be bullish, that hasn’t prevented stocks from continuing to fall over the short term. Looking at the last column of Table 1, the maximum drawdown after a pause and before a new high shows an average decline of 7.4%. In two cases, the declines were double digits. In 1981, the decline qualified as a bear market.

- But what really stood out was the market reaching a new high or matching an old high (as in 2000) in all cases following a Fed pause in hiking rates. This includes pauses followed by a recession.

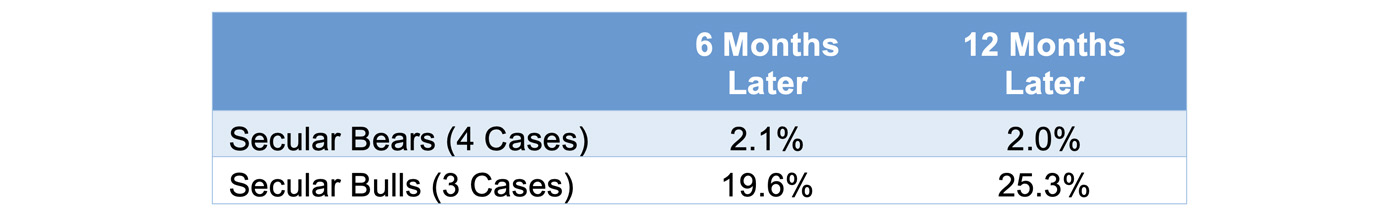

If we sort the data between secular bear markets and secular bull markets (Table 2), the results are startling different between the two cases. Our research indicates that a stock market that is already in a secular bull market before a Fed tightening cycle remains in one. Although the number of cases is very small, past results indicate that if the market could experience a 19.6% gain over the next six months, the S&P 500 would trade above 4,950 and at record highs.

TABLE 2: S&P 500 PRICE CHANGE AFTER FED PAUSE—SECULAR BEAR AND BULL MARKETS

Sources: STIR Research, Ned Davis Research

We believe investors should stay flexible at the current time. We think it would be wise to use any short-term market weakness as an opportunity to get portfolios in position, adopting strategies that can participate fully in the next bull market.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com