Still in post-crisis relief

The market continues to show resilience amid a sense of relief that the recent banking crisis didn’t lead to a broader systemic failure. This sentiment was reinforced by better-than-expected Q1 2023 earnings in the biggest banks. In a previous commentary, “The psychology behind current bounce then trounce,” we noted that the relief rally in the S&P 500 (SPX) following bank-driven systemic fears is a median 8.8% over a month. This suggests the rally may have a bit more to go but is long in the tooth. After the KBW Bank Index (BKX) weakness signaled a high likelihood for an oversold bounce on March 9, the SPX was up 6% and 7.7% from the low two days later [as of 4/18].

Our issue with the market is economic, not systemic

The obvious fear coming out of a bank failure is that it could be a sign of systemic risk in the broader banking system. In our view, the banks were not at risk for broader failure—they were at risk of creating further economic weakness by tightening their lending standards and restricting money availability. According to the Federal Reserve, that became evident as the last two weeks of March showed the largest two-week decline in commercial banks’ loans and leases since the early 1970s. The last week showed a bit of stabilization, but clearly the confidence of those providing the money was damaged.

What allows investors to look through the malaise?

An improved outlook for money. When the economy is weakening and layoffs are rising following an inversion of the yield curve and tightening of financial conditions, the mechanism that causes investors to look through the weakness toward a robust recovery in the financial markets and economy is the Fed. In our view, it is essential for monetary policy to lower short-term interest rates enough to re-steepen the yield curve, which (1) incentivizes an increased willingness of money providers to lend while (2) making interest expense manageable enough to incentivize households and businesses to refinance or take on more debt— thereby improving the outlook for spending. Improvement in the outlook for money doesn’t happen when the vast majority of U.S. Treasury yield curves remain inverted.

Could it be different this time?

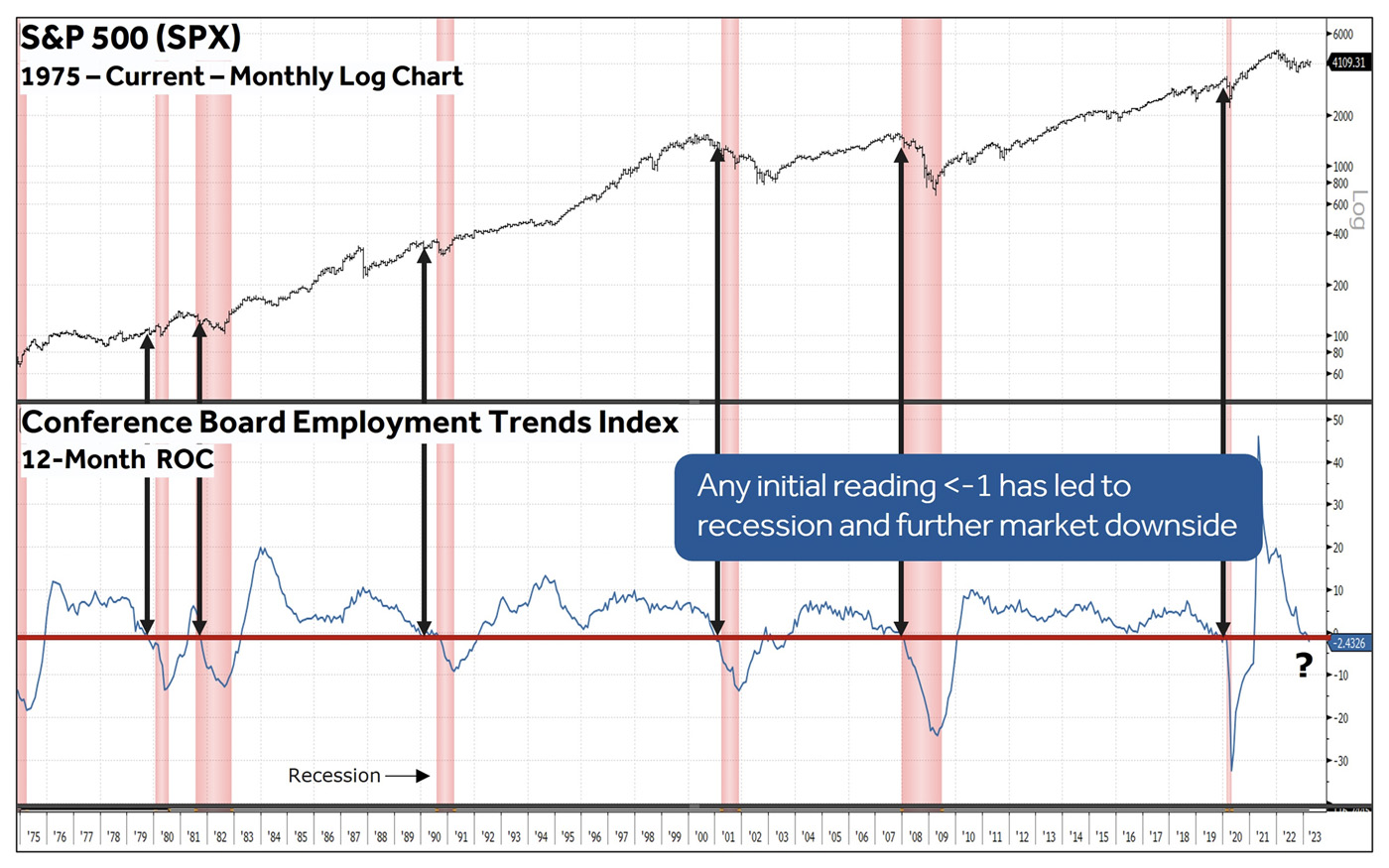

We doubt it. The current (1) U.S. Treasury yield-curve inversions, (2) indicators making up The Conference Board Leading Economic Index, (3) Commercial & Industrial lending standards, and (4) Employment Trends Index (Figure 1) are all at levels associated with being in or near recession. Our game plan remains the same: Stay lighter in exposure and slightly defensive in sector allocation, and stand ready to take advantage of any weakness if/when bad news becomes bad news.

FIGURE 1: LEADING EMPLOYMENT GAUGE POINTS TO RECESSION

Sources: Bloomberg, Canaccord Genuity

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This is an edited version of an article first published by Canaccord Genuity U.S. Equity Research on Apr. 18, 2023.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com