2024 forecast: A mild recession and S&P 4,500

2024 forecast: A mild recession and S&P 4,500

In early 2023, our economics team got a pleasant surprise: Consensus Economics, which collects forecasts from roughly 200 economists around the world, rated us the most accurate forecasters of the United States for 2022, based on our forecasts for the gross domestic product (GDP) and consumer price index (CPI). Unfortunately, we don’t expect a repeat award for 2023.

For 2022, we saw inflation and continued moderate growth. We were right. In 2023, we anticipated economic weakness late in the year and put our S&P 500 target at 3,900. Instead, the economy remained resilient (Figure 1) and stocks rallied much more than we thought. As we said a year ago, “If it turns out that Chairman Powell and the Federal Reserve have engineered a soft landing–no recession in 2023 and with the market ending 2023 confident of not having a recession in 2024–then stocks should rally substantially in 2023 and easily beat our S&P 500 target of 3,900.” Today, that’s what most stock market investors are thinking: a soft landing has been achieved and they should therefore be optimistic about the future.

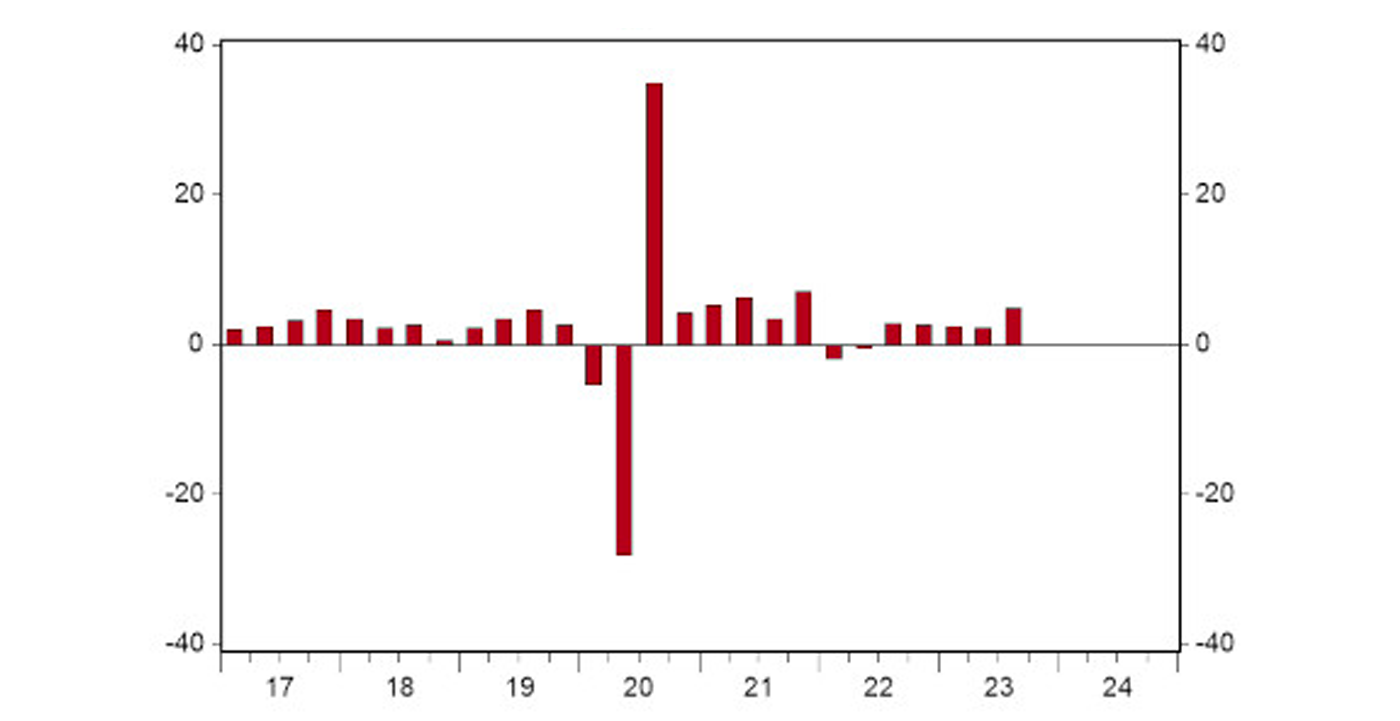

FIGURE 1: % CHANGE IN U.S. REAL GDP GROWTH—ANNUAL RATE

Sources: Bureau of Economic Analysis, Haver Analytics

But we don’t think the economy is out of the woods yet (Figure 2). The consensus among economists now is that the economy will continue to grow in 2024, with a soft landing and no recession. We think that’s too bullish and see a mild recession with a -0.5% real GDP print on the way for 2024.

FIGURE 2: ISM MANUFACTURING—PMI COMPOSITE INDEX

Note: Seasonally adjusted. 50+ reading indicates economic expansion.

Sources: Institute for Supply Management, Haver Analytics

The yield curve has been inverted for more than a year and is likely to remain so well into 2024. And the M2 measure of the money supply is down 3.3% from a year ago, while commercial and industrial loans have also declined. Commercial construction has been temporarily and artificially supported by government subsidies in the past couple of years and should soon start faltering. Payrolls have grown very fast in the past year even with an unusually low unemployment rate, suggesting that businesses have overhired.

Meanwhile, consumer spending looks set to slow. Government payouts, rent and student loan moratoriums, and temporary tax cuts during COVID led to bloated overall savings for many consumers. In turn, they could relax in 2022–2023 and save a smaller part of their ongoing earnings than they normally would. But the artificial boost from these government actions is likely to finally run out this year, which suggests to us consumer spending will moderate significantly in 2024.

It’s also important to realize how much the federal budget deficit expanded last year. The official deficit was about $1.7 trillion in fiscal year (FY) 2023 but would have been $2.0 trillion if it hadn’t been for the Supreme Court striking down much of President Biden’s plan to forgive student loans. But that decision didn’t change the government’s cash flow; the Department of Education just wrote up the value of its loan portfolio. In other words, the underlying cash-flow situation for the federal government was no different than if we had run a deficit of $2.0 trillion, or about 7.4% of GDP. For FY 2022, excluding the student loan scoring, the deficit was about 4.0% of GDP. That’s a huge one-year spike in the deficit, which temporarily lifted spending.

But this won’t continue. Given the stock market rally in 2023 and the anticipated large tax payments coming due (which takes away the temporary stimulus effect), the budget deficit is not likely to grow again in 2024.

What will happen to inflation? We think it will keep heading down in 2024 and may even finish the year at, or perhaps even temporarily below, the Federal Reserve’s 2.0% target. However, if we do hit 2.0% don’t expect to stay there for long. The Fed is likely to cut rates about as aggressively as the futures market now projects, about 150 basis points in 2024. And, unless the money supply keeps falling, inflation is likely to move back up in 2025 (and beyond), above the Fed’s 2.0% target.

What does this mean for stocks? The good news is that if the economy is weaker than expected and inflation keeps heading down, long-term interest rates will tend to decline as well. That’s important because our Capitalized Profits Model takes nationwide profits from the GDP report and discounts them by the 10-year U.S. Treasury yield to calculate fair value.

If we use a 10-year Treasury yield of 3.50%, the model says the S&P 500 is fairly valued, with current profits at about 4,450. In other words, for the first time in many years, the U.S. stock market is very close to fair value. However, the path of both profits and 10-year Treasury yields in the next year is uncertain.

We expect profits to be weaker than the consensus expects in 2024. And with Fed rate cuts of 150 basis points, we also anticipate the 10-year Treasury yield to end the year around 3.5%. All of this, in addition to the fact that the S&P 500 closed on Dec. 9, at 4,754, leads us to believe that it will end 2024 at 4,500 or lower.

Remember, this is not a trading model, and it doesn’t mean investors should run out and sell all their stocks. It just means investors need to be selective. The past few years have been the most difficult time to forecast in our careers. The U.S. economy has never gone through COVID lockdowns and reopening before, nor has it experienced such massive peacetime fiscal and monetary stimulus. We understand many think we can do all this with little, or no, significant impact on the economy. We don’t believe this conventional wisdom. 2024 will be a tough year.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

First Trust Portfolios LP and its affiliate First Trust Advisors LP (collectively “First Trust”) were established in 1991 with a mission to offer trusted investment products and advisory services. The firms provide a variety of financial solutions, including UITs, ETFs, CEFs, SMAs, and portfolios for variable annuities and mutual funds. www.ftportfolios.com

RECENT POSTS