Do markets predict recessions?

Do markets predict recessions?

We can expect continued market uncertainty—imminent recession or not. A disciplined, rules-based investment process can help guide clients through a variety of market and economic conditions.

In a 1966 article for Newsweek, Nobel Prize-winning economist Paul Samuelson joked that Wall Street indexes had predicted nine out of the last five recessions.

The stock market is indeed an unreliable predictor of recessions, as Samuelson so cleverly put it.

A recent review of the data shows that the stock market’s prediction record has stayed fairly consistent with Samuelson’s observation, in that it has now predicted 13 out of the last seven recessions!

Was the market decline from January to October of 2022 another false signal?

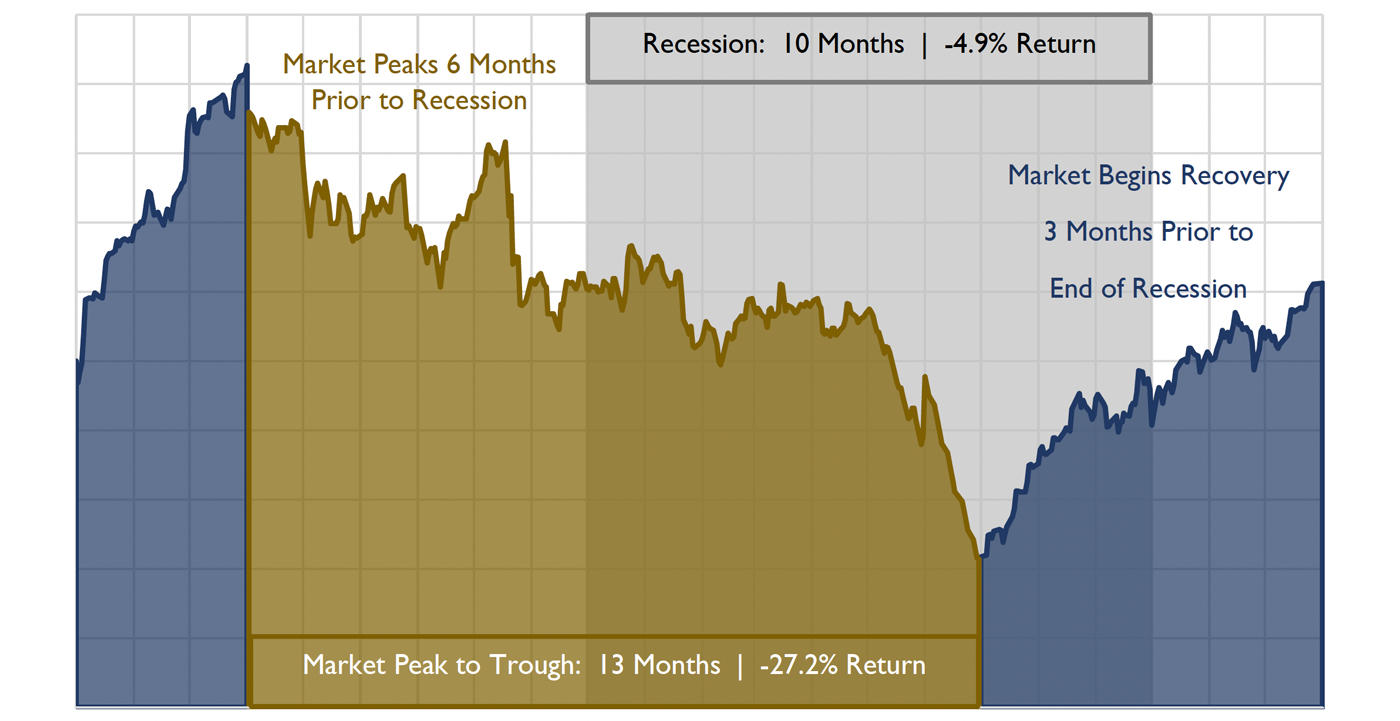

The following chart shows the average relationship between the stock market and the 13 U.S. recessions since 1945.

AVERAGE EQUITY MARKET PERFORMANCE ASSOCIATED WITH U.S. RECESSIONS (1945–2020)

Note: This chart is an illustrative composite of market movements in and around U.S. recessions and does not depict any specific time period.

Source: Dow Jones Indices LLC

The 2022 market peak-to-trough decline of 25.4% does closely match the longer-term average 27.2% decline prior to the end of a recession.

But the usual timing of most recessions does not match the current situation. The typical 10-month recession begins six months after a market peak and ends three months after the market trough. This means if the 2022 market decline were a recession signal, the economic downturn would have begun around June 2022 and ended earlier this year. Since there has been no recession declared by the National Bureau of Economic Research (NBER), last year’s market decline may be another failed signal. This conclusion is reinforced by the recent strong GDP growth reported for Q3 of this year.

Many market participants have anticipated a recession, primarily due to the impact of the Federal Reserve’s fast and steep interest-rate hikes. However, even with the stock market’s 2022 decline, a recession has not materialized as of early December 2023.

Interestingly, in the current environment, the market often views bad news as good news. For example, some believe a weakening economy could increase the probability that the Fed will cut interest rates in 2024. Despite the GDP’s relative strength, Barron’s recently reported the following on planned remarks by Federal Reserve Governor Christopher Waller:

“He said that recent economic data indicates the U.S. is finally starting to experience a cooling labor market, slowing consumer spending, and a significant moderation in economic activity. Those are key signs that the Fed’s restrictive monetary policy is working appropriately and that inflation is continuing to move in the right direction, albeit gradually.”

Whether a recession will occur in the future remains uncertain. The point is that, like many things, the relationship between the media, the economy, and the stock market is not particularly useful in the short run. Over the long run, staying invested in a disciplined manner is often the best path regardless of headlines, economic conditions, and short-term market gyrations.

What is going on from a behavioral perspective?

- Bad news sells! There is a bias toward predicting market and economic declines rather than successes. Actual stock market declines turbocharge this bias, leading to an availability cascade of negative news, making it difficult to grasp the actual relationship between the stock market and the economy.

- Investors are subject to loss aversion, which means they feel losses more strongly than gains. When the market experiences declines, investors exhibit transference, in which negative feelings are projected onto the economy.

- Investors are overwhelmed by the complexity of the stock market. We want to believe the stock market is informationally efficient and driven exclusively by fundamentals. It turns out that these only explain a small portion of volatility.

What can financial advisors do when working with their clients?

- The stock market’s accuracy in predicting recessions is only a bit above 50%. The daily flood of market and economic information is great for stirring up emotions, but it is of little help in making sound investment decisions. Financial advisors should educate their clients about the fallacies of overreacting to the latest “news.”

- Use needs-based planning to separate short- and long-term investments. This can insulate a client’s emotions from short-term market events while allowing long-term investments the time they need to mature.

- Build a strategy-diverse portfolio that can be resilient in a variety of market conditions and is designed for the long run. Have a disciplined, data-driven, and rules-based investment process to drive out emotional decisions.

- Use your experience through many different market environments to provide a valuable perspective and coaching that can help an investor stick to the plan and stay focused on long-term goals. Provide access to a variety of investment solutions that can be customized to client needs. Consider working in concert with third-party investment managers who can develop disciplined, risk-managed portfolio approaches.

We believe in the value of professional, rules-based active investment management

Trying to react to and profit from short-term conditions are the hallmarks of traders and speculators. Getting in and out of the market often leads to significant underperformance for self-directed investors (or advisors) because it requires impeccable timing on both exit and reentry decisions. It also requires the emotional fortitude to sell when everything seems fine and buy when the markets are in turmoil.

These behaviors are not only at odds with our nature, but they are also at odds with what it takes to be a successful investor, namely patience and discipline. Sticking with a carefully developed risk-management approach and investment plan can help avoid these costly errors. While professionally managed strategies may adjust market exposure based on market conditions or choose to over- or underweight certain sectors at any given time, these moves are ideally dictated by preexisting tactical “rules,” not spur-of-the-moment or headline-driven reactions.

Many investment managers, in our opinion, could improve performance by developing such objective buying and selling rules, preferably before a stock or index-based fund/ETF is even purchased. This reduces the potential for cognitive errors around the buying/selling decision and can improve fund performance. Some managers grow attached to their equity decisions and cling to them to the point of smothering their initial hard-earned alpha. Managers should become as deliberate about selling as they are about buying.

Given the scale of this century’s economic and market disruptions, we can expect heightened uncertainty for some time—imminent recession or not. This makes determining a stock’s fundamental value—or the market’s overall direction and prevailing trend—a challenge that favors expert, heavily resourced professional equity teams.

We also believe that behavioral price distortions in the market are the norm rather than the exception. Behavioral finance research finds that, despite conventional wisdom, an overwhelming preponderance of investment decisions are driven by emotion—at times even by professionals who rely primarily on discretionary strategies. Over the long term, rules-based, disciplined active management can take advantage of market opportunities created by behavioral price distortions—in bull or bear markets alike.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

RECENT POSTS