Expect rates to stay ‘higher for shorter’

Expect rates to stay ‘higher for shorter’

We have talked a lot about the following two themes this year, which have played out and may set the stage for a drop in U.S. Treasury (UST) yields.

1. The soft-landing appears to be the worst-case scenario

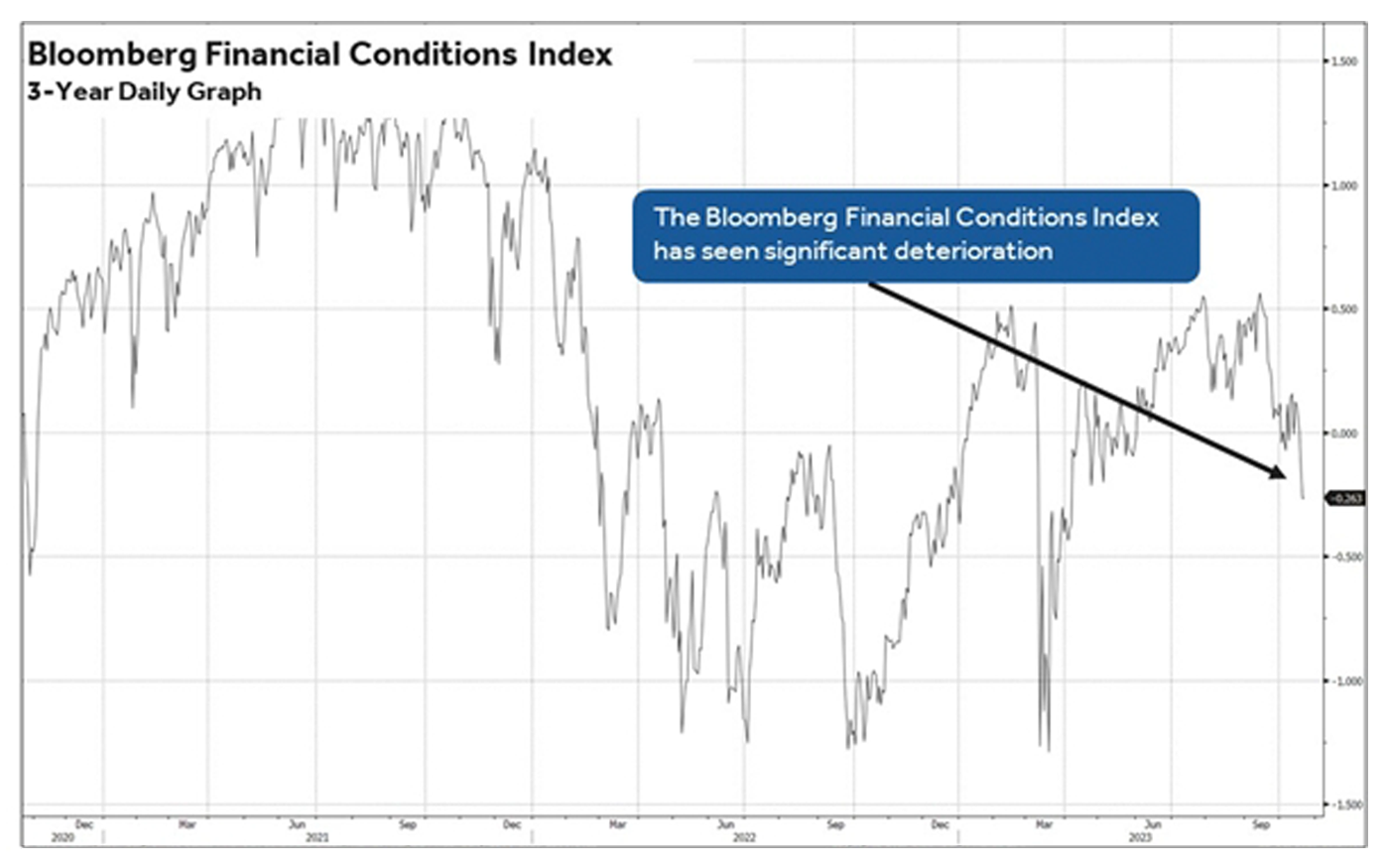

The soft-economic landing may be the worst-case scenario because it keeps the Federal Reserve holding interest rates “higher for longer.” The recent rise in rates associated with a few better-than-expected economic releases helped the market believe the Fed would have to hold rates high for an extended period. We disagree and believe this rate spike in U.S. Treasurys (UST) ensures a coming recession given the additional jump in mortgage and corporate yields and tightening in financial conditions, as seen in the Bloomberg U.S. Financial Conditions Index (Figure 1).

FIGURE 1: BLOOMBERG FINANCIAL CONDITIONS INDEX HAS BEEN RAPIDLY WORSENING

Sources: Bloomberg, Canaccord Genuity

2. New Treasury issuance a key factor

The rapid rise in U.S. Treasury yields may be a function of a supply/demand imbalance rather than a reflection of the economic outlook. The peak in the S&P 500 (SPX) and the beginning of a rapid rate rise in UST yields came with the Treasury announcement on July 31 that issuance for the third quarter would be just over $1 trillion, which was $274 billion more than the previous third-quarter guidance. That is key because even before this issuance, gross interest payments on federal debt had already reached 15% of government spending.

Higher yields reinforce our recession call

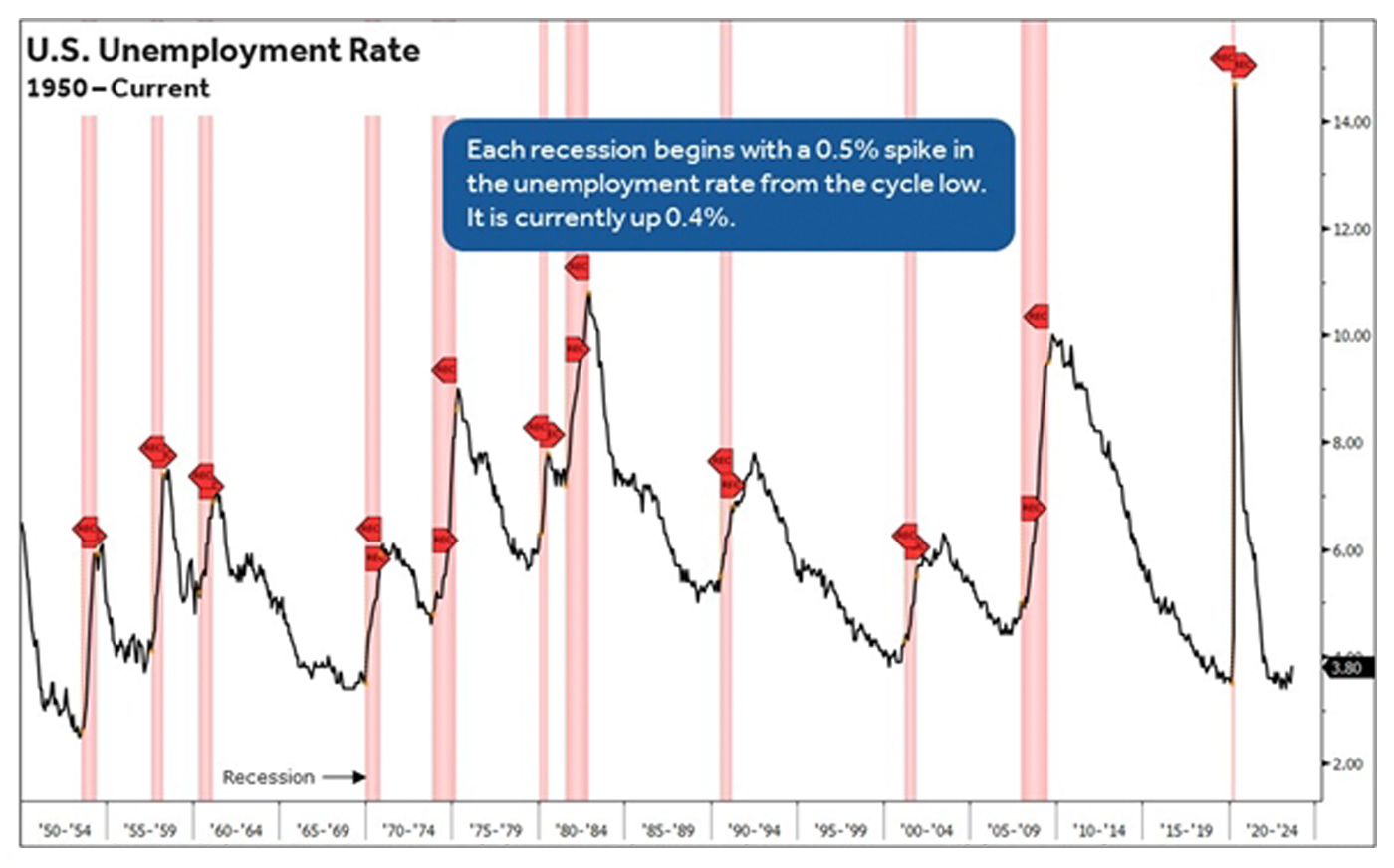

In our view, the rapid rise in U.S. Treasury, corporate credit, and mortgage yields since the July 31 announcement of Treasury issuance should accelerate an already weakening economic picture that is masked by higher rates. Unemployment is up 0.4% from the cycle low and one-tenth of a percent away from signaling a recession (Figure 2).

FIGURE 2: THE UNEMPLOYMENT RATE IS VERY CLOSE TO SIGNALING RECESSION

Sources: Bloomberg, Canaccord Genuity

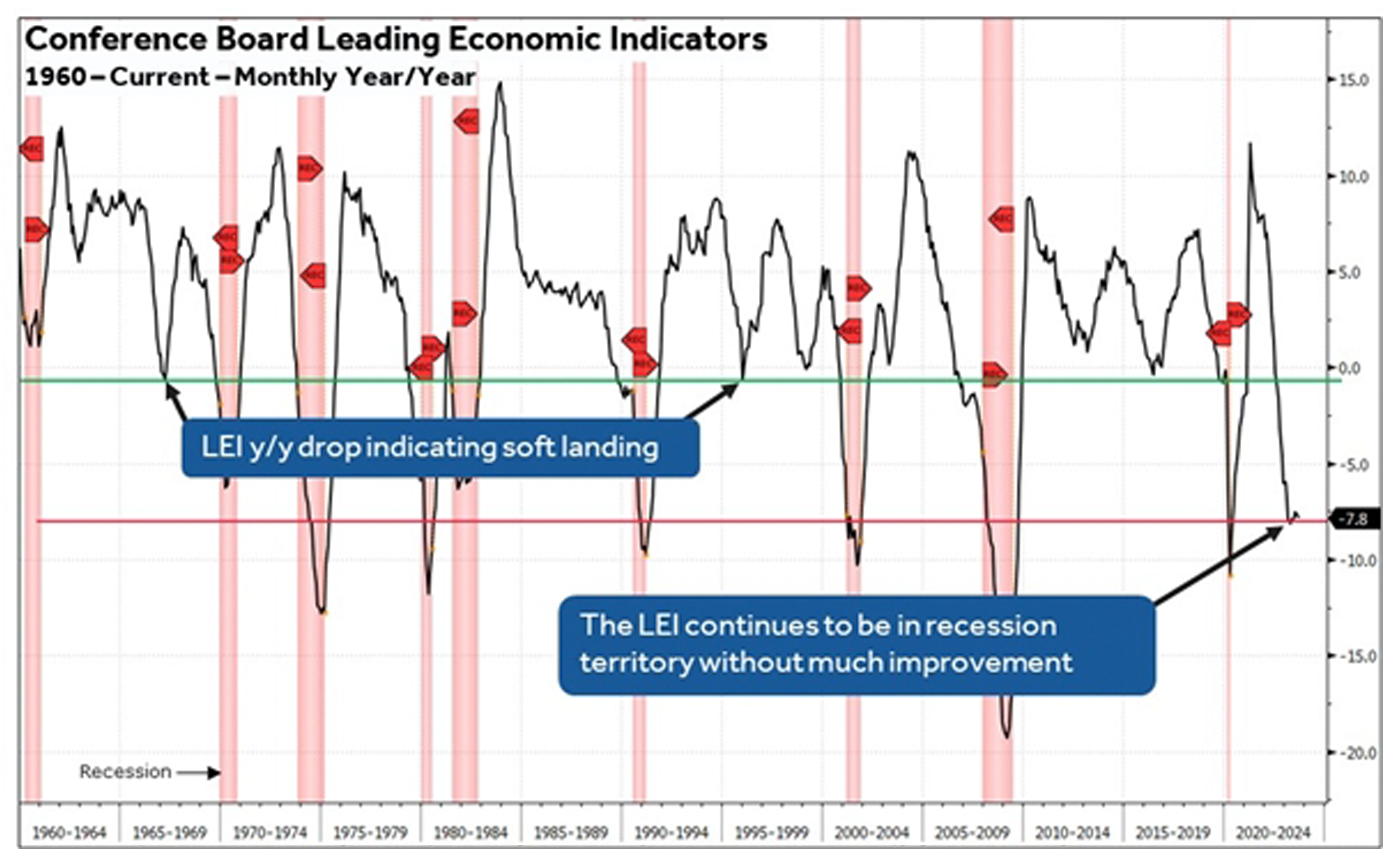

The Conference Board Index of Leading Economic Indicators has never been at this level without signaling recession (Figure 3). In addition, the money supply remains historically negative, and there are rising auto and credit card delinquencies.

FIGURE 3: THE INDEX OF LEADING ECONOMIC INDICATORS IS STRONGLY SIGNALING RECESSION

Sources: Bloomberg, Canaccord Genuity

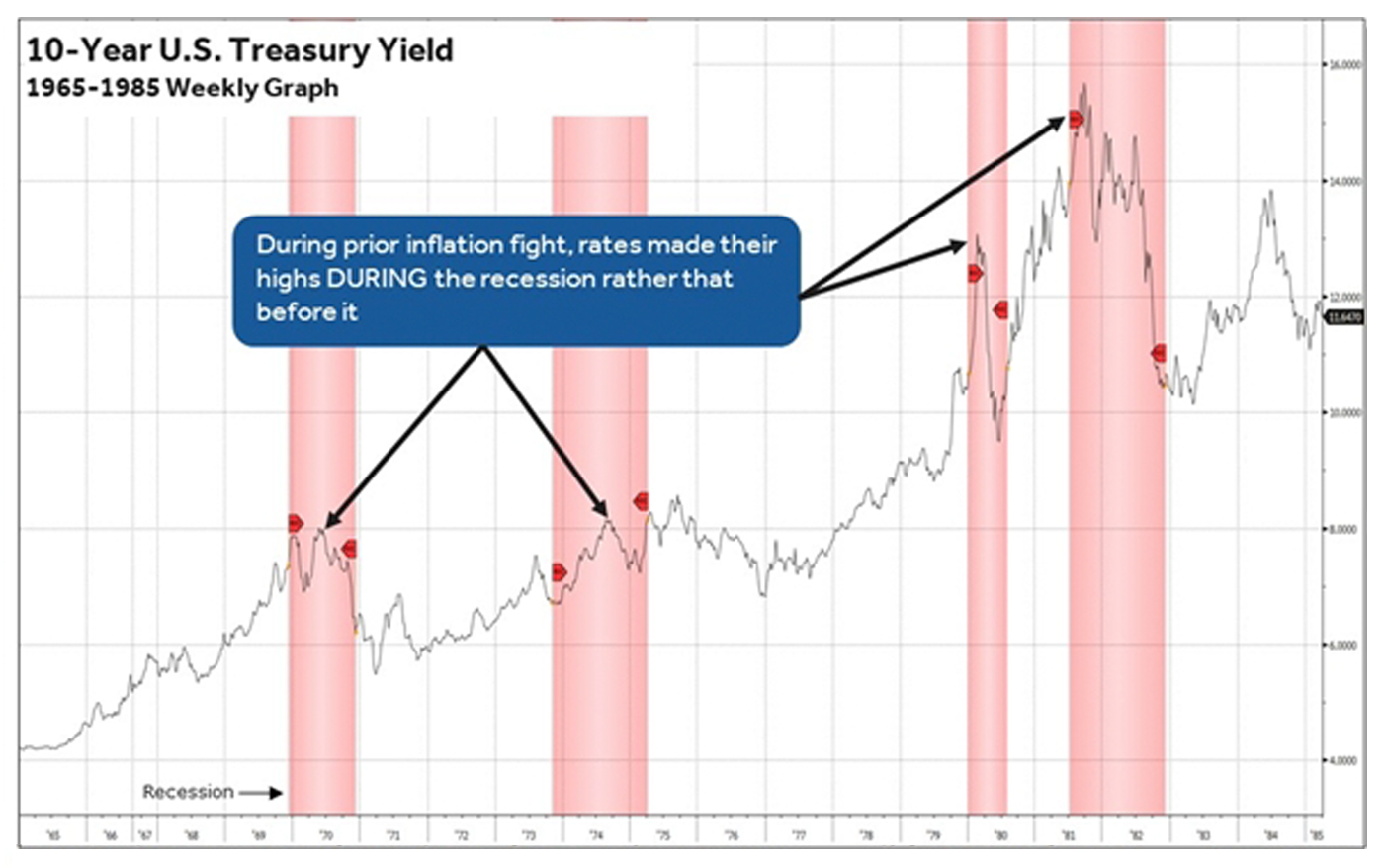

Many suggest that the rise in rates means we are further from recession, but all we must do is look at the history of the 10-year U.S. Treasury yield to know that isn’t true. During the last inflation fight from 1968 to 1982, the 10-year UST yield was making new highs during each of the four recessions (Figure 4). We don’t know if we are in a replay of that period, but there is a precedent of higher interest rates during the initial part of recessions.

FIGURE 4: 10-YEAR UST YIELD MADE NEW HIGH DURING THE 1965–1985 RECESSIONS

Sources: Bloomberg, Canaccord Genuity

Expect rates to stay ‘higher for shorter’

We expect that given the generationally high debt to GDP and the previously mentioned indicators, the higher rates go now, the greater the resulting economic impact and subsequent drop in yields. In short, we expect intermediate-to-long-term rates to be “higher for shorter,” and as such, we would expect lower rates and defensive sector relative outperformance. Ultimately, such a dramatic change in the bond market tone is only likely to come from either a financial market event or extreme weakness in the economic data and, more specifically, the employment indicators. In the current instance, it may prove to be a combination of the two for “bad news to become bad news” to create a historic opportunity.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

This is an edited version of an article first published by Canaccord Genuity U.S. Equity Research on Oct. 23, 2023.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

RECENT POSTS