Will California drop a liquidity bomb on the stock market?

Will California drop a liquidity bomb on the stock market?

A big liquidity problem will hit the financial markets later this year. If you can believe the media, it is all due to climate change, since these days they think that any weather phenomenon is proof of climate change.

Starting on Jan. 8, 2023, much of California experienced flooding and mudslides due to greater-than-normal rainfall. As a result of those weather events, the IRS announced that an extension would be granted to most Californians (ones who live in affected counties, which was most of them) not only for filing their Form 1040 tax returns but also for paying any remaining 2022 taxes. See the IRS statement here.

This is a big deal financially for the U.S. Treasury Department because California is by far the largest taxpaying state. According to MoneyRates, Californian taxpayers account for 15% of total tax receipts, despite having just under 12% of the U.S. population. California has more millionaires and billionaires than any other state. So if some portion of Californians get to delay paying their 2022 taxes, that can amount to a lot of money.

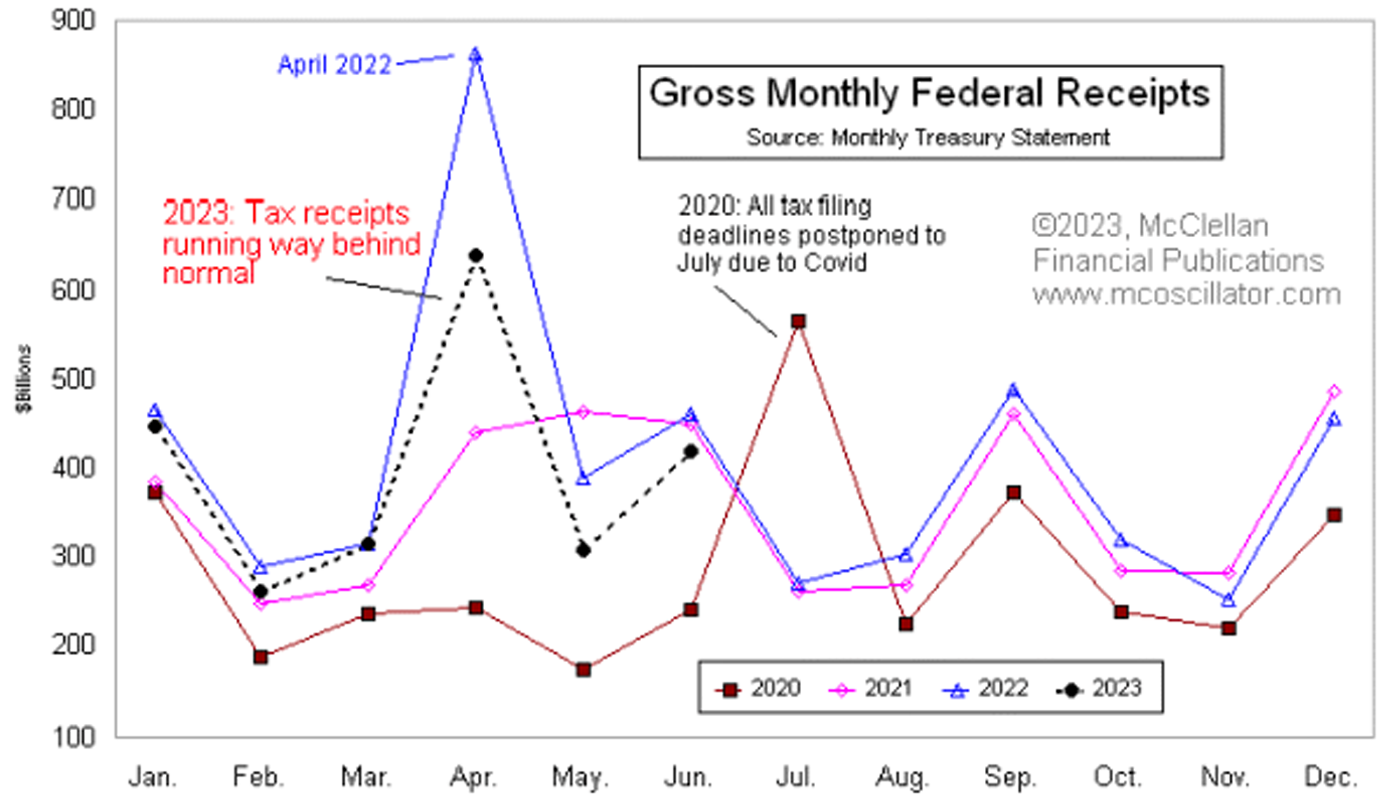

You can see that effect in this week’s chart (Figure 1). April is typically the month with the highest federal tax receipts, as it marks the deadline for taxpayers to remit taxes owed from the previous year. Those payments get added to the normal payroll deductions that wage earners have taken from their pay every month.

FIGURE 1: MONTHLY FEDERAL TAX RECEIPTS (2020–2023)

Sources: Monthly Treasury Statement (Bureau of the Fiscal Service), McClellan Financial Publications

April 2022 saw a big surge in tax payments, in part because of the stock market’s strong performance in 2021, which resulted in substantial capital gains taxes. However, the Federal Reserve’s quantitative tightening in 2022 knocked down stock market performance. That led to potentially lower capital gains taxes being paid in April 2023 in general. In addition, because of the IRS extension, April 2023 also saw that Californians who owed taxes for 2022 were able to sit on that money instead of sending it to Uncle Sam. Consequently, the total collected by the federal government in April 2023 was $638 billion, a 26% decrease from April 2022.

In some recent years, when interest rates were almost nothing, it did not matter much if you paid early or late. But now when investors can earn more than 5% in annual yield on T-bills, it pays a lot more to refrain from sending your money to the IRS. And Californians who can manage such a delay appear to be doing so.

Additionally, those Californians that were able to delay filing their 2022 taxes were also able to delay the calculation of their 2023 quarterly estimated payments. According to the IRS announcement, “The Oct. 16, 2023, deadline also applies to the quarterly estimated tax payments, normally due on Jan. 17, April 18, June 15, and Sept. 15, 2023. This means that individual taxpayers can skip making the fourth quarter estimated tax payment, normally due Jan. 17, 2023, and instead include it with the 2022 return they file, on or before Oct. 16.”

So an unknown number of Californian tax filers are facing a big tax bill due on Oct. 16, 2023. This will encompass both their 2022 returns and the accumulated quarterly estimated payments they have not had to make during 2023. That is going to be one giant windfall for the Treasury Department in October 2023.

Here is why this event matters to the rest of us. Those California late payers will need to raise the money to make sure that their big October 2023 checks to the IRS clear. That is going to mean selling some stock, cashing out of money-market funds, shifting money from savings to checking, and otherwise generally sending waves through the banking system to get their money organized so that they can cover those deferred payments. Writing a check to the IRS means that a bank then has to cover that check and move money all around the system as the IRS cashes those checks.

The entire financial system has grown accustomed to that type of turbulence in April every year. But this anomalous Oct. 16 date for taxpayers in the most populous state—particularly wealthy taxpayers—is a nonstandard type of ripple in the liquidity stream.

It is not clear exactly when this liquidity wave is going to go through the banking system, because different taxpayers have different needs for selling stock or otherwise moving money around. But the effect of these money movements is going to be amplified by the seasonal weakness in the equity market that typically takes place in late summer to autumn.

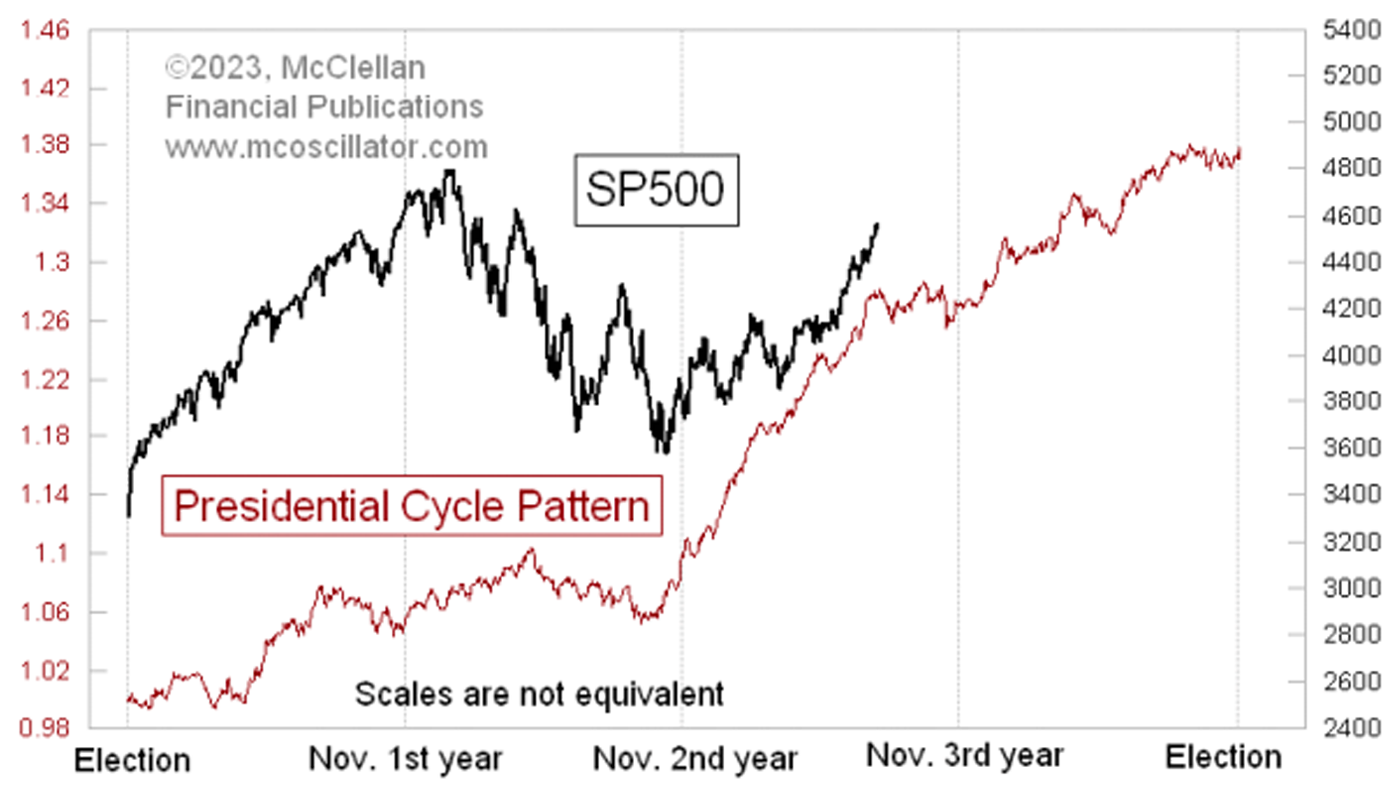

Even in the bullish third year of a presidential term, which is what we are in now, there is a period of seasonal weakness lasting from July to October (Figure 2). How weak the market is during that period varies among the past presidential terms. But those California taxpayers may start to see their July gains slipping away during the slide into October. They may decide to sell stocks early to raise the money they need for their big upcoming tax payment by Oct. 16.

FIGURE 2: PRESIDENTIAL CYCLE PATTERN FOR S&P 500

(CURRENT VS. HISTORICAL)

Source: McClellan Financial Publications

There is no way to quantify how much of an effect this will have, as we cannot see into the hearts and the bank accounts of all of those delayed filers in California. However, this situation will introduce an irregular feature to the usual banking and liquidity calendar. By late October, the dust should have settled, and all of the money movement to cover tax payments will have simmered down. Stocks can then get back to their normal seasonal strength starting by late October.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

This is an edited version of an article that first appeared at McClellan Financial Publications on July 21, 2023.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

RECENT POSTS