What is the McClellan Oscillator showing for investment grade bonds?

What is the McClellan Oscillator showing for investment grade bonds?

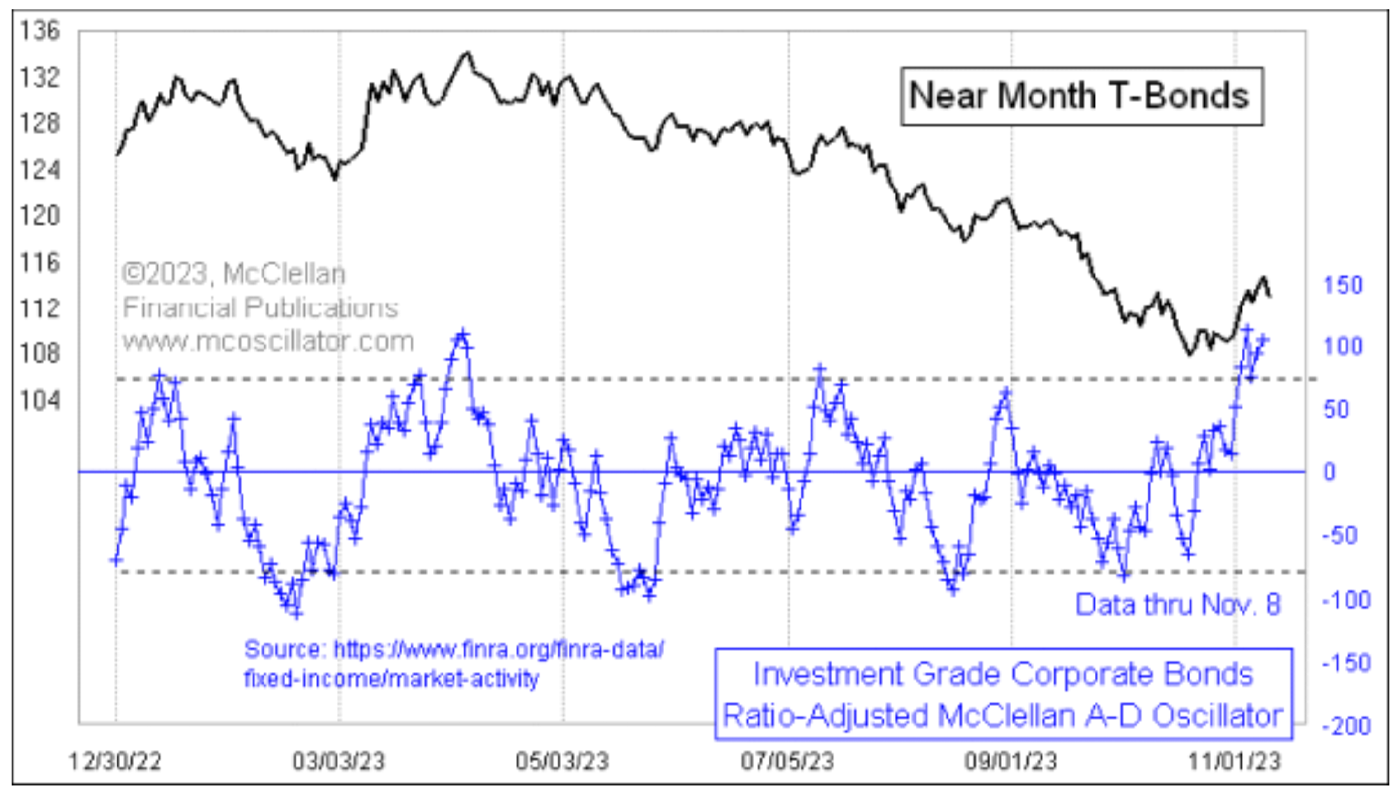

Treasury bond prices fell on Nov. 9, 2023, on news of an auction of $24 billion in new 30-year T-Bonds that did not go very well. The setup for this drop was already there, based on the recent run up in bond prices, which has also affected the corporate bond market.

FINRA publishes data for each trading day on how many corporate bonds went up or down (advances and declines). They separate out the data into investment grade, high yield, and convertible securities. This week’s chart (Figure 1) shows a Ratio-Adjusted McClellan Oscillator (RAMO) for the advance-decline (A-D) data on the investment grade category. These bonds tend to behave a lot like T-Bond prices, whereas the high yield (or “junk”) bonds tend to move more like the stock market.

FIGURE 1: RATIO-ADJUSTED MCCLELLAN A-D OSCILLATOR FOR INVESTMENT GRADE CORPORATE BONDS

Source: McClellan Financial Publications

The recent rally in T-Bond prices has pulled investment grade bonds up in sympathy, resulting in a lot of days with many more advances than declines. And that condition has brought about an overbought reading for this RAMO.

When the NYSE’s McClellan A-D Oscillator gets up to an overbought level, that can sometimes be a signal of strong initiation of a new uptrend, and a promise of more buying to come. But it does not seem to work that way for this McClellan Oscillator for corporate bonds. The message of a high reading is more uniformly one of an overbought condition that needs to be addressed by a pause or a pullback.

Here is where I traditionally remind readers that overbought is a “condition,” and not a “signal.” An overbought or oversold condition does not have to matter right away just because we notice it. But they do tend to matter eventually. The implication now is that corporate bonds and T-Bonds should pull back in price.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

This is an edited version of an article that first appeared at McClellan Financial Publications on Nov. 9, 2023.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

RECENT POSTS