Editor’s note: Tony Dwyer, U.S. portfolio strategist for Canaccord Genuity, and his colleagues author a widely respected monthly overview of market conditions, technical factors, and future market outlook called the “Strategy Picture Book.” The following provides an excerpt from their Feb.7, 2022, report on the macro market outlook.

The tumultuous market action continues as the combination of Federal Reserve policy uncertainty and economic transition remains in focus. Unfortunately, this is the environment we are going to be in for a while as the monetary and economic midcycle transition unfolds.

There is no question that continued inflationary pressure creates a much more hawkish tone at the Fed despite the likelihood of slowing economic growth over the coming months. This remains an impossible situation for the Fed given the current level of historically high inflation coupled with the potential for slowing growth as the economy transitions from “buying stuff” to “doing stuff.”

Our game plan heading into the year was for a tumultuous first half that would create a year-end opportunity as we should have clarity over Fed policy and the economic outlook. There is nothing that has taken place to change our view.

Current assessment

Our fundamental core thesis continues to suggest a year of digestion at this point in the cycle. Let’s review our fundamental core thesis given the current market focus on inflation, growth, margins, and valuation.

Core inflation remains historically high

The highest level of core inflation in a generation should continue to reinforce the Fed’s more hawkish tone and plan to wind down the balance sheet. Two items appear hopeful on inflation:

-

The year-over-year change in unit labor costs (ULC) remains elevated but has turned lower over recent months. The ULC has a very high correlation to the core personal consumption expenditures (PCE) at 0.87 and suggests the core PCE should begin to ease as the supply-chain constraints and economic pause unfold over the coming months.

-

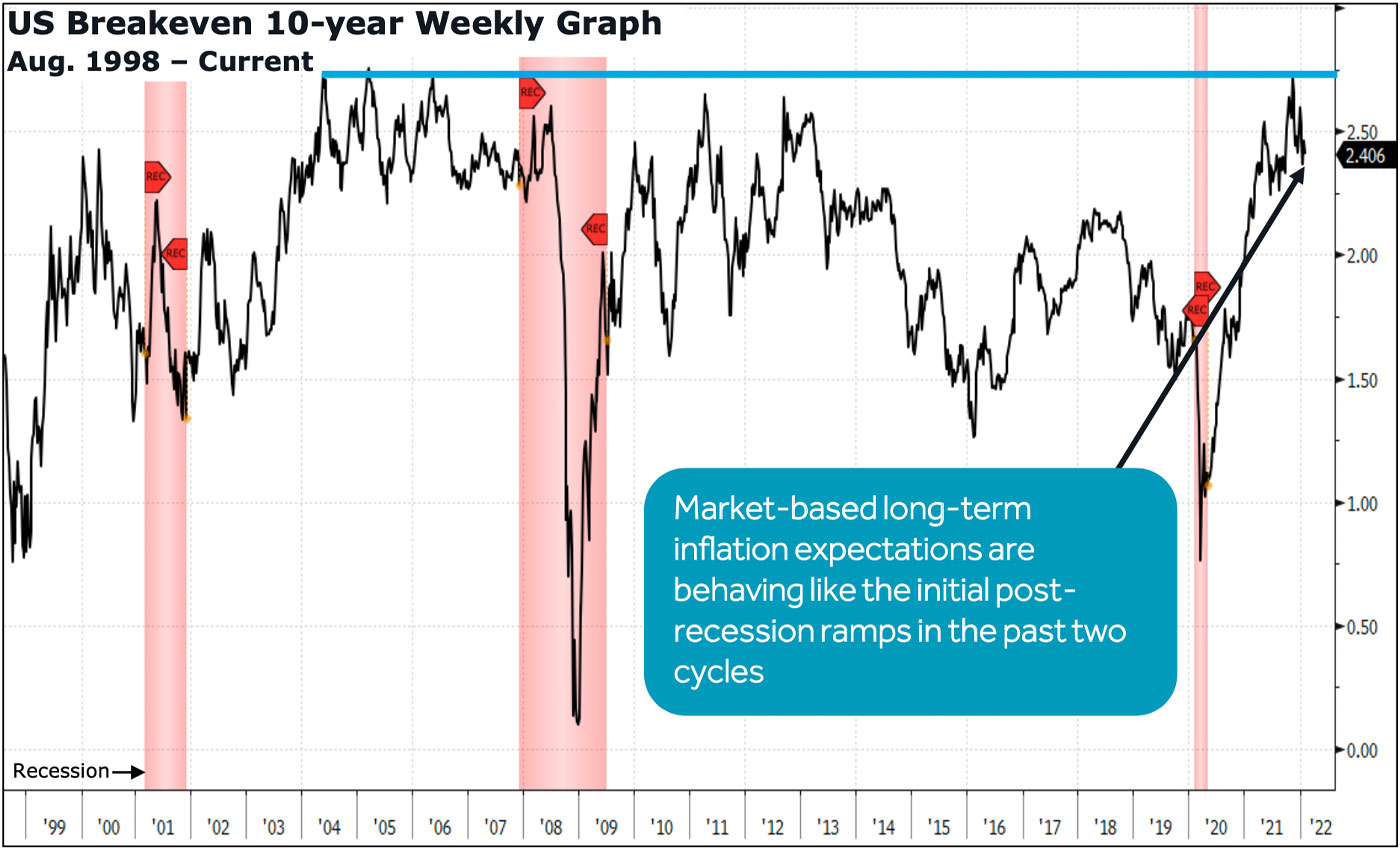

The long-term inflation breakevens remain anchored near the Fed’s goal despite the rise in U.S. Treasury yields. This suggests the market believes the Fed should be successful in containing inflation.

FIGURE 1: INFLATION OUTLOOK—LONG-TERM INFLATION EXPECTATIONS ANCHORED (SO FAR)

Sources: Bloomberg, Canaccord Genuity

Fed policy and real interest rates remain historically accommodative even on an uptick

Although higher interest rates and slowing inflation would turn real rates higher, there is a very long way to go before the Fed or financial conditions would be considered “tight.”

As the Fed embarks on a tightening cycle, let’s hope they have noticed the peak fed funds rate is lower every cycle due to historic expansion of credit following a recession.

FIGURE 2: CREDIT OUTLOOK—THE FED REMAINS HISTORICALLY ACCOMMODATIVE

Note: Shaded areas indicate U.S. recessions.

Sources: Board of Governors of the Federal Reserve Systems, fred.stlouisfed.org

The economy should transition from ‘buying stuff’ to ‘doing stuff’

We expect economic growth to slow from the recent high due to excess inventories and uneven global indicators, but the combination of historically low interest rates (even on an uptick), higher incomes, and still-ample liquidity should keep the engine moving at the household, manufacturing, and global level.

FIGURE 3: ECONOMIC OUTLOOK—GDP GROWTH SUPPORTED BY LABOR IMPROVEMENT

Sources: Bloomberg, Canaccord Genuity

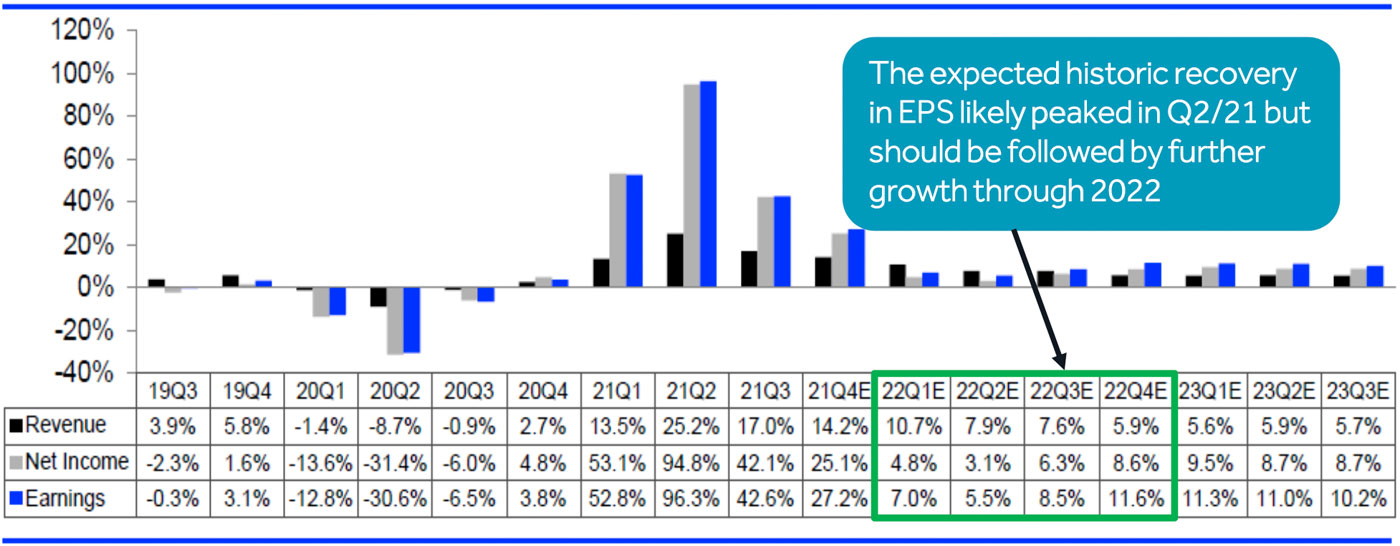

EPS direction should remain positive

The market correlates with the direction of earnings per share (EPS), which should remain soundly positive over the coming quarters despite the impact of higher costs, economic transition, and an uneven global economy.

FIGURE 4: EARNINGS OUTLOOK—EPS DIRECTION (SPX) CONTINUES TO LOOK POSITIVE

Source: I/B/E/S data from Refinitiv

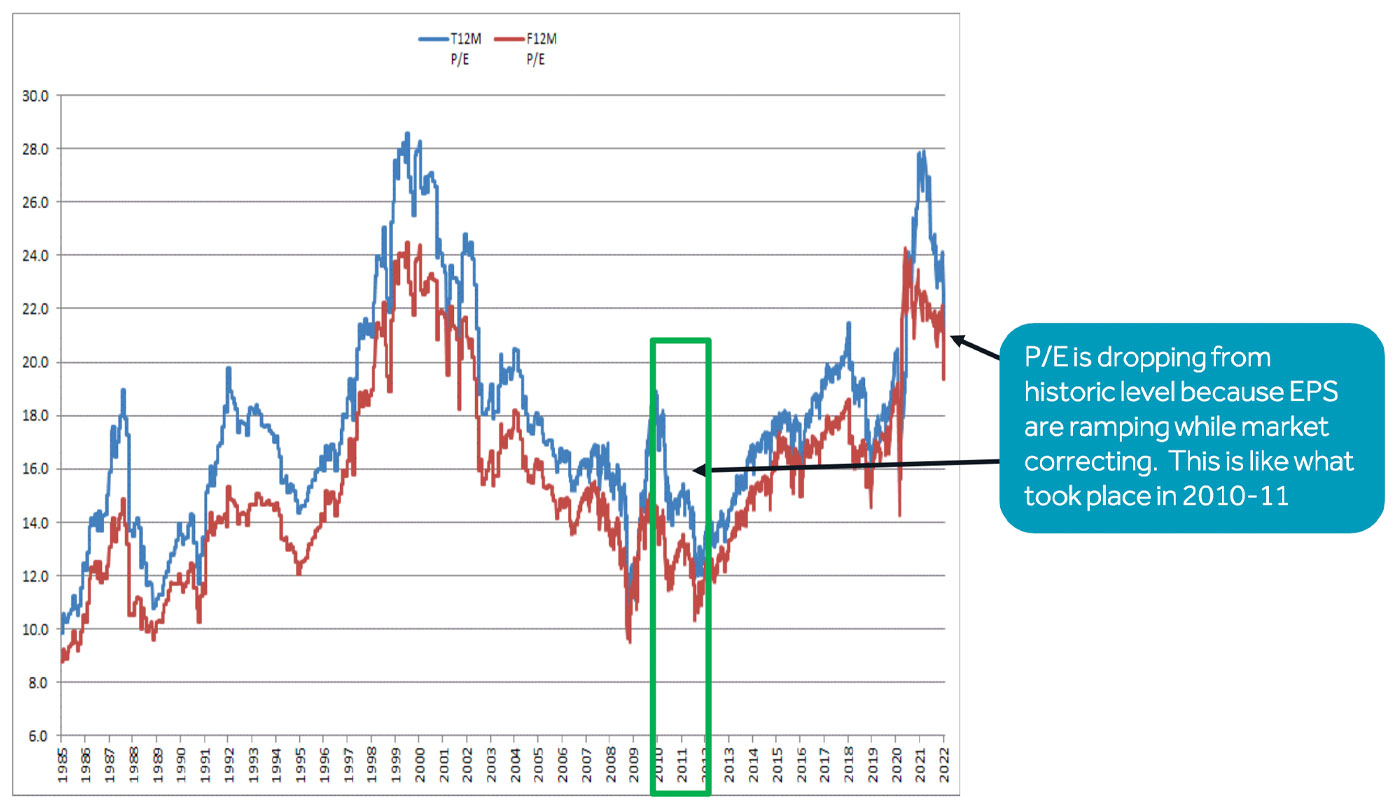

Valuation is fair

The combination of strong earnings growth and correction in the market has allowed valuations to become more attractive, similar to what took place in 2010–2011.

FIGURE 5: VALUATION OUTLOOK—AT LEAST 20X P/E IS APPROPRIATE

Source: I/B/E/S data from Refinitiv

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com