While U.S. equity markets rebounded last week and the jobs report was very positive, two significant milestones were reached for oil prices and the U.S. national debt. Unfortunately, each carried some negative connotations for inflation and the overall health of the U.S. economy moving forward.

A positive jobs report—but inflationary implications

The employment report released last week by the Bureau of Labor Statistics was very positive, with nonfarm payrolls increasing by 467,000 in January and 709,000 more jobs added in November and December than previously reported. The unemployment rate rose slightly to 4.0%.

However, according to analysis from the Associated Press (Time Magazine), trends in wage growth will probably be another contributing factor to continued historically high inflation:

“The consumer price index probably jumped 7.3% in January from a year ago, the largest annual advance since early 1982, according to the median projection in a Bloomberg survey of economists. Excluding volatile energy and food categories, the CPI is projected to have risen 5.9%.

“The inflation data follow the government’s latest employment report, which showed newfound momentum in the labor market and faster wage growth that spurred bets that the Fed will be more aggressive in raising rates.”

(Post-publication note: The consumer price index for all items in January came in above estimates, rising 0.6% for an annualized inflation rate of 7.5%.)

Bespoke Investment Group added,

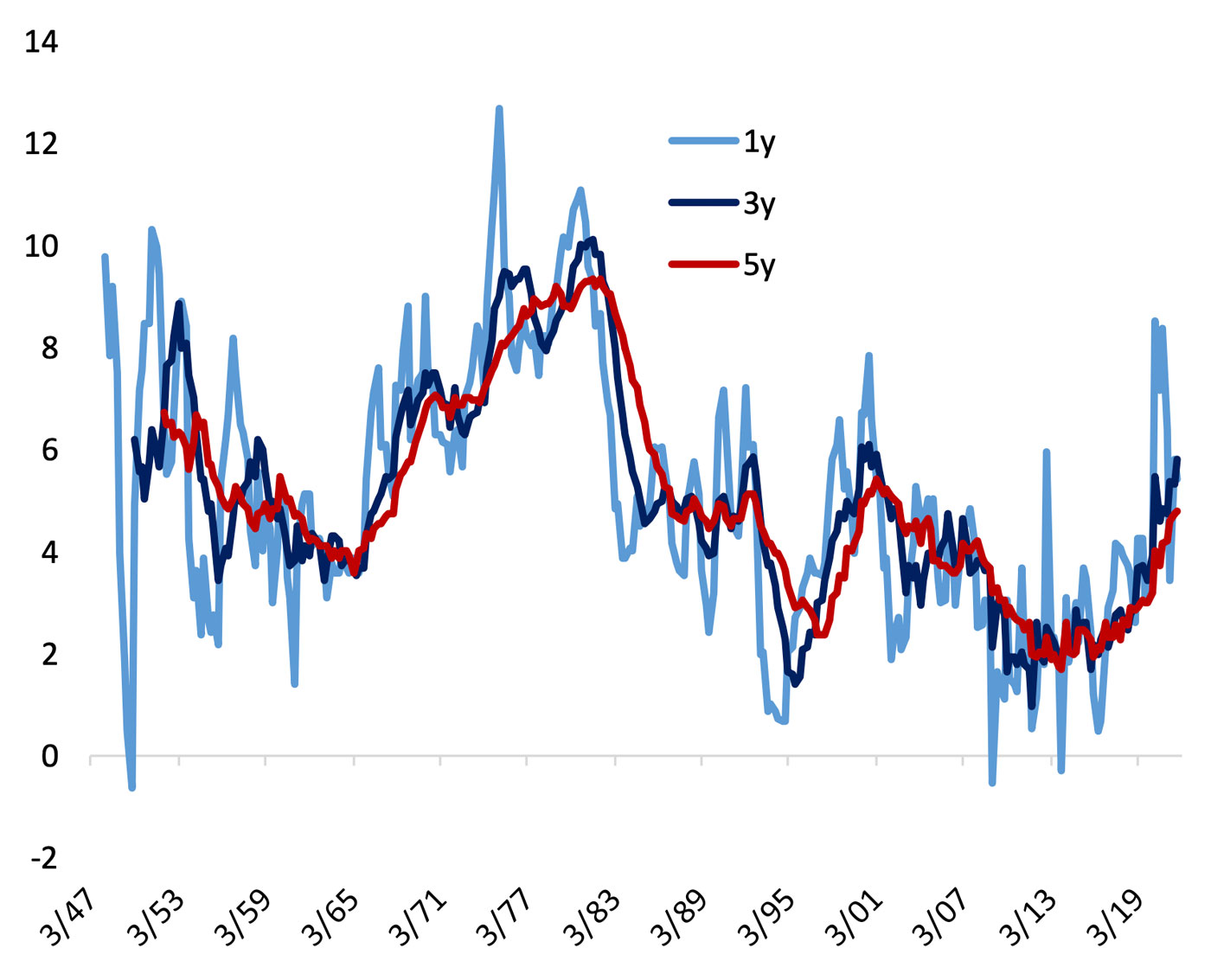

“The nominal cost of wages per unit of real output rose at the fastest pace since the 1970s on a YoY basis through Q3 of 2021, and while higher output softened the measure in Q4, wages are still rising versus output. …

“Looking at wages on a nominal basis only, total worker pay per hour across the economy is rising over 5% annualized on a 1 year and 3 year basis and was up 7% annualized in Q4.”

FIGURE 1: WAGE GROWTH TREND MOVES HIGHER (ANNUAL % CHANGE)

Source: Bespoke Investment Group

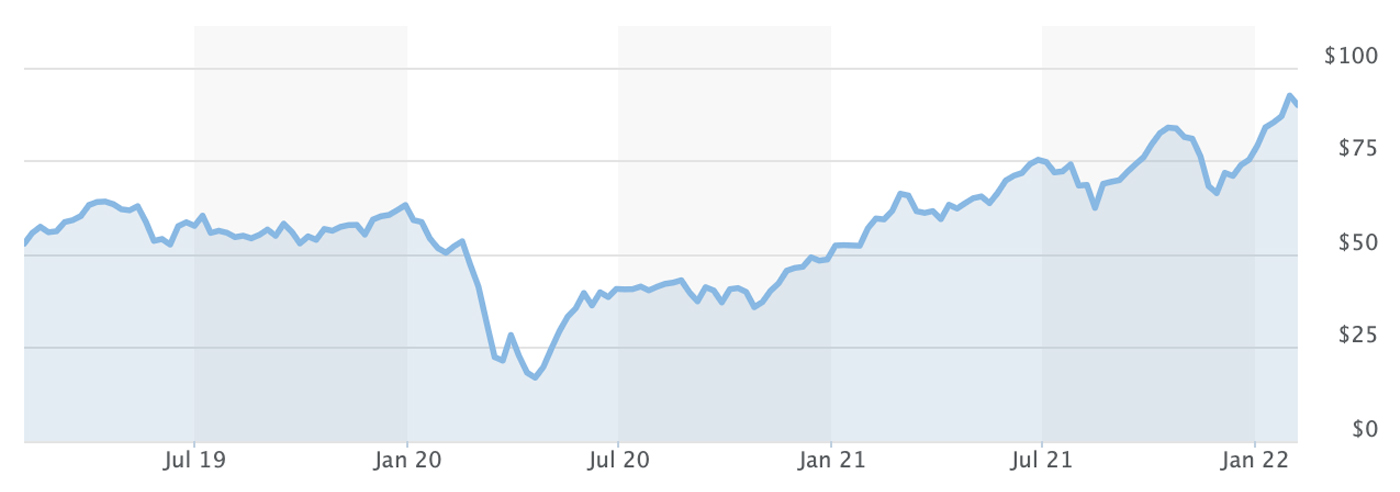

Oil prices surge past $90 per barrel

CNBC reported on February 3,

“U.S. oil crossed above $90 on Thursday for the first time since 2014 as demand for petroleum products surges while supply remains constrained. … The last time prices were above the $90 mark was October 2014. …

“Oil’s had a blistering rally since falling to record lows in April 2020—WTI briefly traded in negative territory—as demand has returned but producers have kept supply in check. Geopolitical tensions between Russia and Ukraine as well as in the Middle East have also sent jitters through the market. WTI is up nearly 20% for the year, building on 2021′s more than 50% gain. As oil prices push higher, a number of Wall Street analysts have forecasted $100 oil.”

On Friday, Feb. 4, West Texas Intermediate crude oil traded as high as $93.17 before retreating to close at $91.93. According to AAA, which closely tracks gas price trends, the national average for a gallon of regular gasoline increased by five cents last week to $3.41.

FIGURE 2: CRUDE OIL WTI (NYM $/BBL) FRONT MONTH

Source: MarketWatch

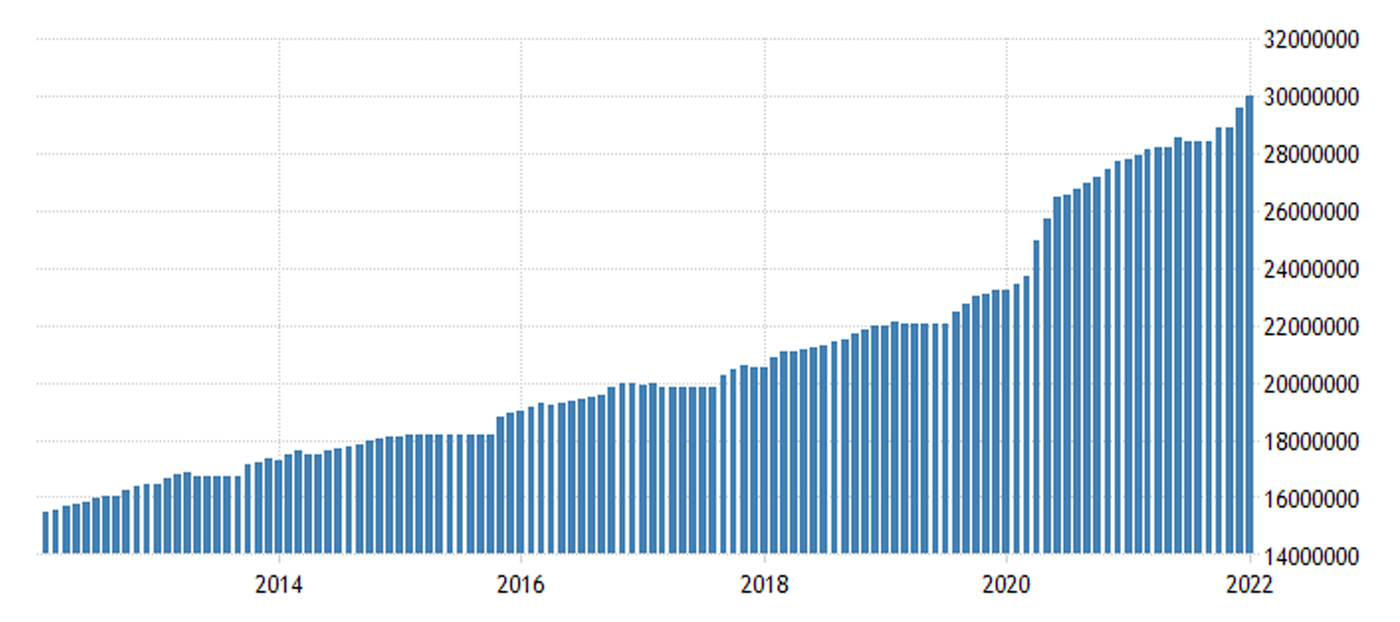

U.S. debt rises above $30 trillion for the first time

The Treasury Department reported last week that the total national debt of the United States surpassed $30 trillion for the first time in history. According to VOA News, this is an amount equal to nearly 130% of America’s yearly economic output (GDP).

The New York Post reported,

“The federal government exceeded the troubling threshold following a wave of borrowing and spending during the COVID-19 pandemic. The national debt has expanded by approximately $7 trillion since January 2020, weeks before the pandemic began, as the Trump and Biden administrations dispersed stimulus payments and took other measures to support the economy. …

“The staggering figure includes intragovernmental debt, or money the federal government owes to itself, such as through Social Security trust funds. It also includes debt held by public entities such as businesses, pension plans and insurance companies. More than $7.7 trillion is owed to foreign creditors, with Japan, China and the United Kingdom topping the list.

“The US government exceeded the $30 trillion threshold much faster than expected. In 2020, the nonpartisan Congressional Budget Office predicted it would not occur until 2025.”

FIGURE 3: UNITED STATES GOVERNMENT DEBT ($TRILLIONS)

Sources: Trading Economics, U.S. Dept. of Treasury

New this week: