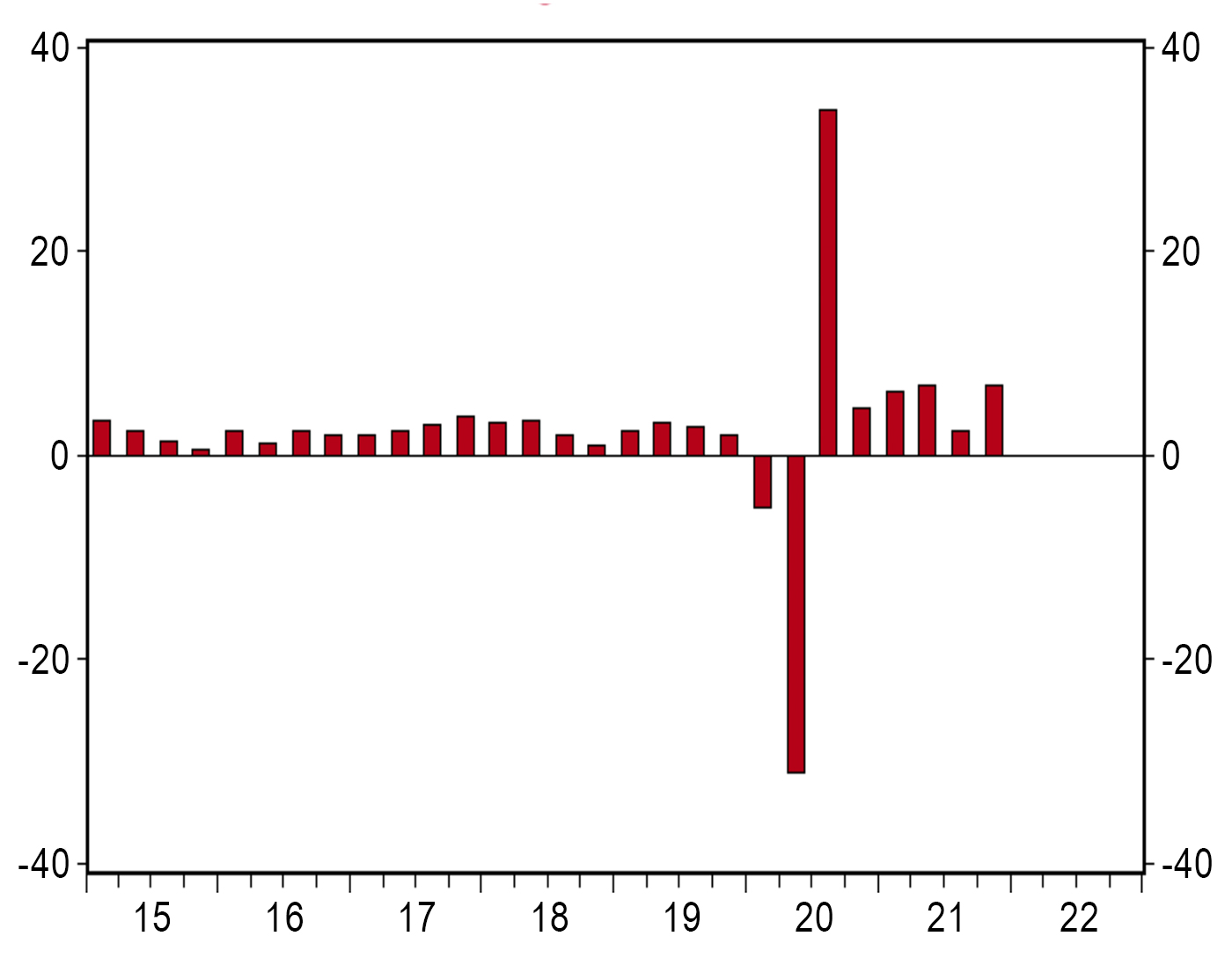

Real GDP grew at a 6.9% annual rate in the fourth quarter, easily beating the consensus expected 5.5%. As a result, real GDP was up 5.5% in 2021 (Q4/Q4), the fastest growth for any calendar year since the Reagan boom in 1984.

FIGURE 1: REAL GDP GROWTH—% CHANGE IN THE ANNUAL RATE

Source: Bureau of Economic Analysis, Haver Economics

However, these data were not all unicorns and rainbows. Most of the growth in Q4 itself was due to a much faster pace of inventory accumulation, which will not be repeated in 2022.

And despite rapid growth in 2021, real GDP growth finished the year at an annual rate of 1.6% since the end of 2019, which is slower than the pre-COVID trend. In other words, the U.S. economy is still smaller than it would have been if COVID and the related lockdowns had never happened.

Unlike the Reagan boom or other periods of robust economic growth, the growth in 2021 was artificially boosted by massive government spending and a recovery from the most draconian period of COVID restrictions in 2020.

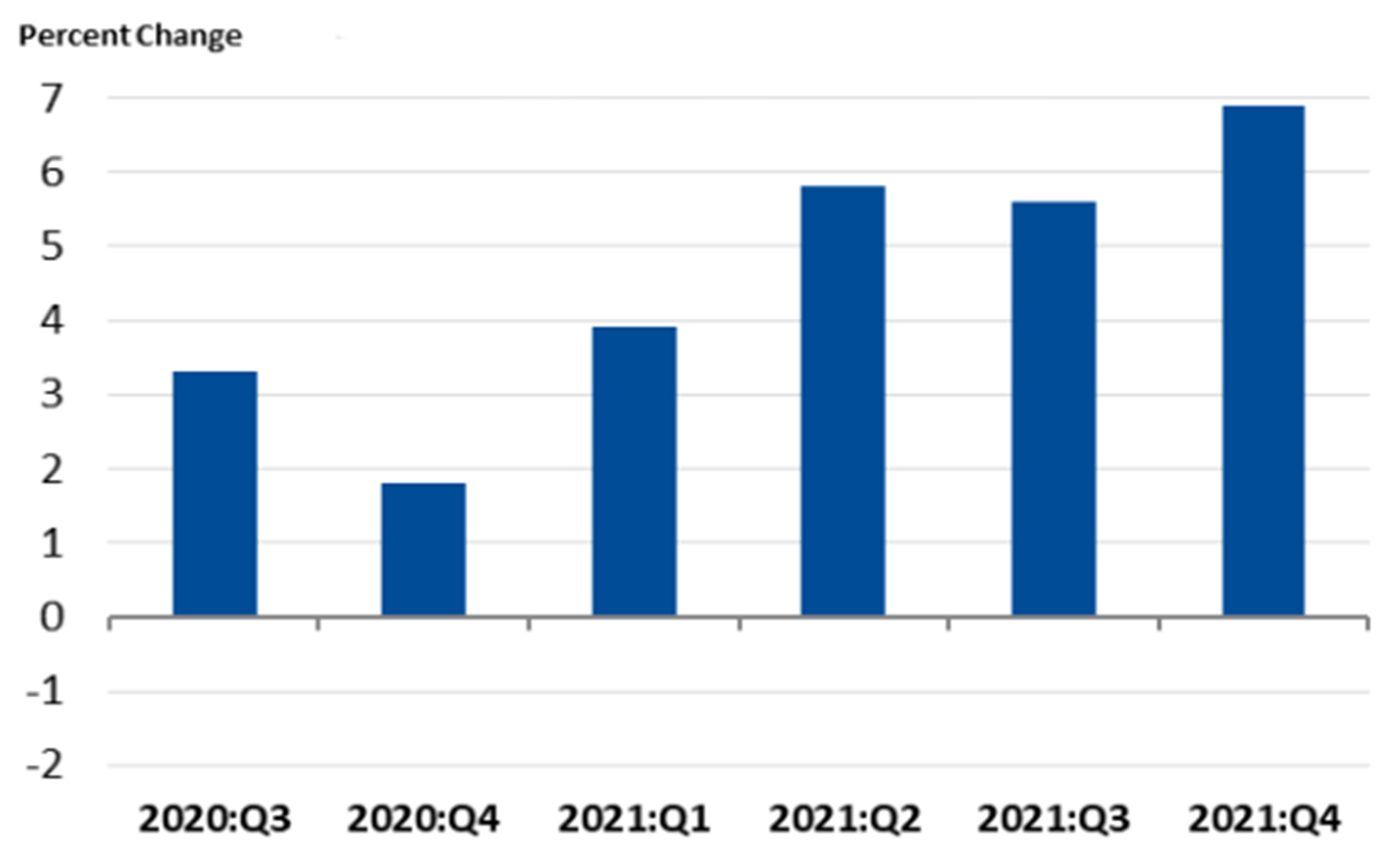

But do you know what’s clearly higher than the pre-COVID trend? Inflation. GDP prices rose at a 6.9% annual rate in Q4 and prices rose 5.8% in 2021 (Q4/Q4), the largest gain for any calendar year since 1981. GDP prices are up 3.6% annualized since right before COVID hit, which, unlike real GDP, is clearly above trend.

FIGURE 2: QUARTER-TO-QUARTER PERCENT CHANGE IN GROSS DOMESTIC PURCHASE PRICES

Note: Seasonally adjusted annual rates

Sources: Bureau of Economic Analysis

Combining real GDP growth and inflation gives us nominal GDP, which is up at a 5.2% annual rate since right before COVID, very close to the pre-COVID trend. Nominal GDP rose at a 14.3% annual rate in Q4 and is up 11.7% from a year ago.

This year will be marked by transitions for the U.S. economy, including slower economic growth, slower (but stubbornly high) inflation, and a liftoff for short-term interest rates.

Look for real GDP growth of around 2.5% in 2022 while GDP prices rise around 4.0%. Why slower economic growth? Because massive government spending in 2020–2021 artificially covered up economic pain like an opioid given to a crash victim.

But more doses of opioids are becoming less likely, meaning growth is heading back toward a more normal level. In terms of the details of the Jan. 27 report, consumer spending was bolstered by growth in spending on services, while government purchases and commercial construction both contracted for the quarter. The big issue for the next few years is whether the government will get enough out of the way so entrepreneurs and businesses can maintain solid growth to compensate for the economic headwinds the government has created.

Editor’s note: Brian Wesbury is chief economist at First Trust Advisors LP. He and his team prepare a weekly market commentary titled “Monday Morning Outlook,” as well as frequent research reports. Proactive Advisor Magazine thanks First Trust for permission to republish an edited version of this commentary, which was first published on Jan. 27, 2022.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

First Trust Portfolios LP and its affiliate First Trust Advisors LP (collectively “First Trust”) were established in 1991 with a mission to offer trusted investment products and advisory services. The firms provide a variety of financial solutions, including UITs, ETFs, CEFs, SMAs, and portfolios for variable annuities and mutual funds. www.ftportfolios.com