Unemployment to rise into 2024

Unemployment to rise into 2024

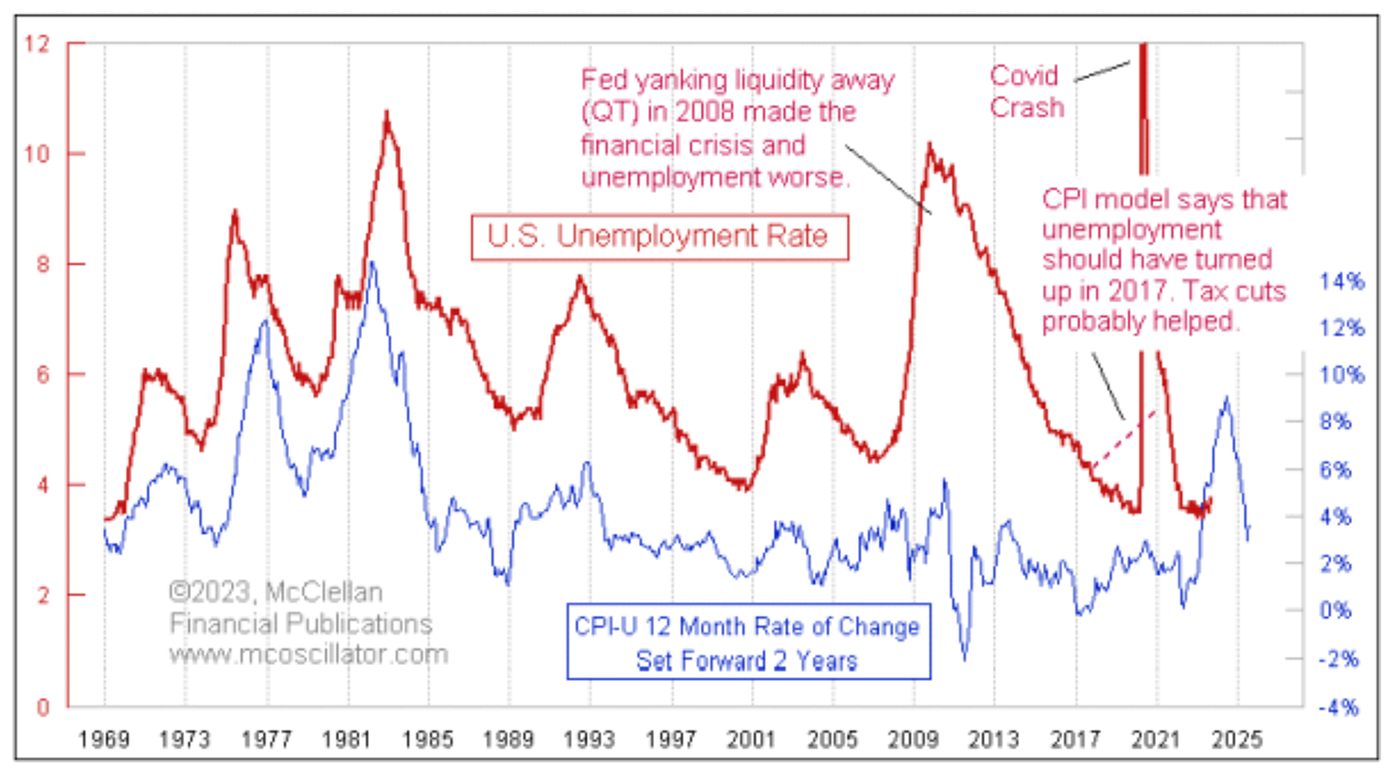

In March 2023, I wrote a piece titled “Three Signs Employment Is Going to Take a Hit.” It looked at three different leading indication relationships that were all calling for a rise in the unemployment rate. This week’s chart (Figure 1) takes a closer look at one of those, the message from the inflation rate.

The key insight for understanding this relationship is that the plot of the consumer price index (CPI) inflation rate has been shifted forward by two years to reveal how the unemployment rate tends to follow in the same footsteps after that lag time. This chart frustrates a lot of classical economists who believe what they were taught about the Phillips curve, which hypothesizes that high unemployment leaves people with less money to spend, and so the economy slows, which brings prices down, curing inflation. That is the operating philosophy of the Federal Reserve, and it is wrong.

FIGURE 1: U.S. UNEMPLOYMENT RATE PLOTTED AGAINST CPI-U 12-MONTH RATE OF CHANGE (SET FORWARD TWO YEARS)

Source: McClellan Financial Publications

The real relationship is that high inflation brings high unemployment, and low inflation leads to lower unemployment two years later. So if you were in charge of the economy and wanted to ensure maximum employment, what you should do is somehow arrange for 0% inflation and then just wait two years.

There have been instances when this model did not work as well. The COVID crash is an obvious example. That event, and the government’s overwhelming stimulus response, broke a lot of economic models, and understandably so.

We can also see that the 2008–2009 economic depression that followed the so-called “Great Financial Crisis” brought unemployment at a much higher rate than hinted at by this model. This was due to the Fed’s overly aggressive approach to counteracting the excesses of Alan Greenspan’s final years as Federal Reserve chair. During that time, Greenspan kept rates too low, which fueled the housing bubble. Congress piled on by mandating “mark to market” accounting of distressed assets, which had a positive feedback effect exacerbating the economic damage.

Even though the magnitude of the 2009 unemployment rate peak was higher than suggested, it did arrive on time according to this model. So did the economic recovery, which matched the waning rate of inflation two years before.

Another interesting anomaly came in 2017 when this model said that the unemployment rate was supposed to have bottomed and turned upward. Instead, it kept declining until February 2020 when the COVID crash disrupted the nice correlation. The tax cuts that were implemented in 2017 arguably had a big effect on business confidence. They allowed the unemployment rate to keep falling despite inflation’s message, but at a cost of seeing the total federal debt rise between $600 billion to $800 billion per year in 2017–2019. It rose a lot more in 2020 with all of the COVID spending.

Now in 2023, the CPI spike two years ago is saying that we should be expecting a rise in the unemployment rate, but it is slow in getting started. The latest numbers for August showed a rise to 3.8%, off the low of 3.4% in January 2023. The CPI inflation rate peaked at 9.1% in June 2022. If the two-year lag time works perfectly, it would mean a peak for the unemployment rate in June 2024. You can bet that unemployment will be a big topic in the presidential debates ahead of the November 2024 election.

The unknown part of this is how much response we will see in the unemployment rate, which is thus far slow to start its rise. The extra post-COVID stimulus may have been responsible for keeping companies full of cash to keep on their employees, albeit at a cost of having the total federal debt rise by more than $2 trillion versus the year before.

The latest CPI data released on Sep. 13, 2023, showed CPI rising 3.7% versus a year ago. This is not good news for the future employment prospects two years from now, once the two-year lag time goes by. The Federal Reserve is not even reaching its “illegal” mandate of 2% inflation, despite raising rates so high that they have effectively killed the real estate market.

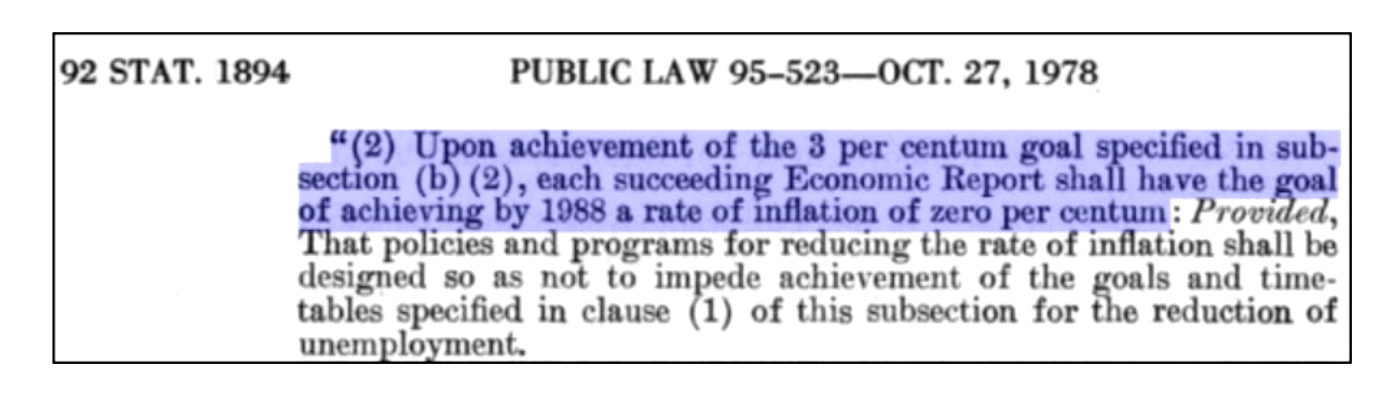

I am not speaking lightly when I say that the Fed’s 2% inflation target is illegal. Most people, including Federal Reserve staffers, seem unaware that Congress passed a statute back in 1978 mandating that once the inflation rate got back down below 3%, then the Fed’s inflation target rate would be “zero per centum.”

Now admittedly, it is tough to expect the Fed to achieve a “zero” inflation rate using the limited tools it has, especially when Congress goes throwing around so much deficit spending to “help” the economy. In that circumstance, it is not the Fed’s proper role to adjust its own target illegally to 2% (which it is still not meeting). If Congress is mandating a target that the Fed cannot meet because of Congress’ own deficit spending, then the proper action is for the Federal Open Market Committee members to either ask Congress for a different target or tell Congress that they cannot comply with that law and must resign. I don’t expect that to happen any time soon.

The next time you hear anyone talking about “the Fed’s 2% inflation target,” please kindly inform such people that, by statute, the Fed’s statutory target is actually zero. And if we could get inflation down to 0%, that would be good for the jobs market two years later.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

This is an edited version of an article that first appeared at McClellan Financial Publications on Sept. 13, 2023.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

RECENT POSTS