Trading the seasonal heating oil–gasoline spread

Trading the seasonal heating oil–gasoline spread

We have been trading this seasonal spread annually every year since 1994, except for 1995. Last year, we were stopped out—but still with a gain.

In the trade’s current form, we buy RBOB gasoline futures and sell heating oil futures, with both contracts expiring in February of the following year. The spread is entered in late November and is normally exited in late December or early January. We do not use options in the spread. We have looked many times at trying to incorporate options, but the time value premium of February options bought in November is just too damaging to the results of the spread. If you were to use deeply in-the-money options to simulate the results with futures (and to minimize the expense of the time value premium), you would actually be harming the rate of return—because the futures have a favorable spread margin.

From a fundamental point of view, the spread seems counterintuitive. Why would one want to buy gasoline and sell heating oil heading into the winter? Shouldn’t the demand for heating oil increase while the demand for gasoline decreases during that period? Yes, it probably should, but markets tend to discount such things in advance. I can’t say why they discount it so early in the season, but the track record of the spreads says that markets do.

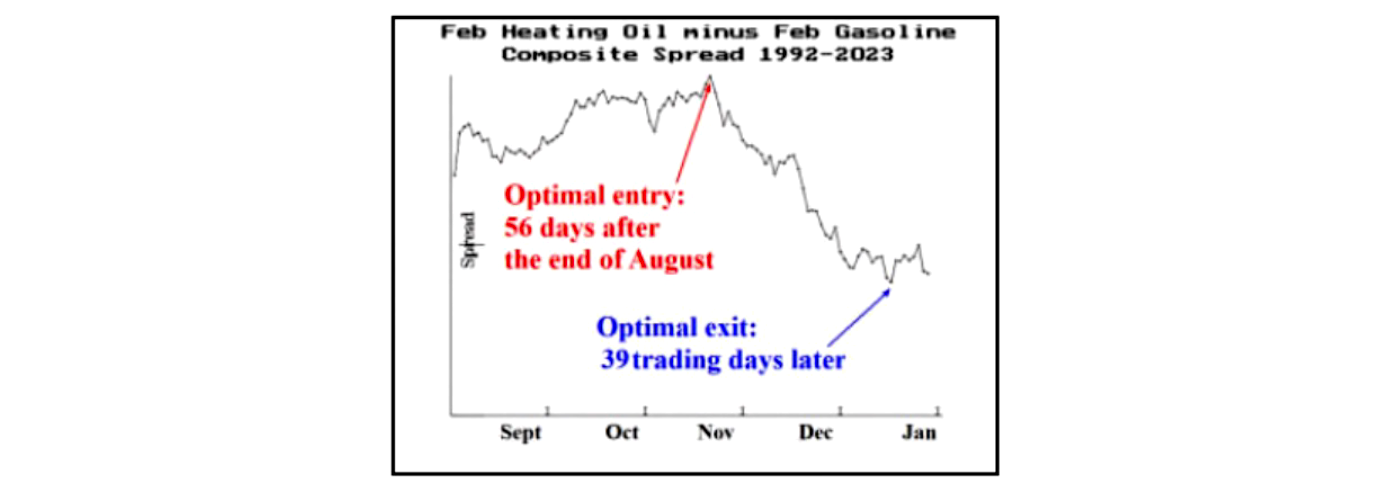

Figure 1 shows the composite spread (each year’s daily prices averaged over all the years going back to 1992). Our spread makes money as the line on the graph declines. You can see that it “floats” higher through September, October, and about two-thirds of November. Heating oil is outperforming gasoline during that time. Then in late November through December and into early January, the spread shrinks as gasoline starts to outperform heating oil.

FIGURE 1: COMPOSITE TREND OF HEATING OIL–GASOLINE SPREAD BY MONTH

Source: McMillan Analysis Corp.

The results in individual years can vary somewhat from the composite pattern. Last year, there was an immediate decline in the spread, which gave us a quick unrealized profit. We lowered the stop as that was happening. Then a quick rebound in the spread stopped us out after only 14 trading days.

The optimal entry date is 56 trading days after the end of August, toward the end of November.

Position: Heating Oil–Gasoline Spread

Buy 1 Feb. RBOB Gasoline Futures (/RB G24)

and Sell 1 Feb. Heating Oil Futures (/HO G24)

One-point move = $420 per contract

The actual spread price varies from year to year, but we don’t care about the absolute level of the spread when it is established. We will merely want the spread to shrink once we have established it. Stop yourself out if the spread settles 12 points against you (from your entry point) on any day.

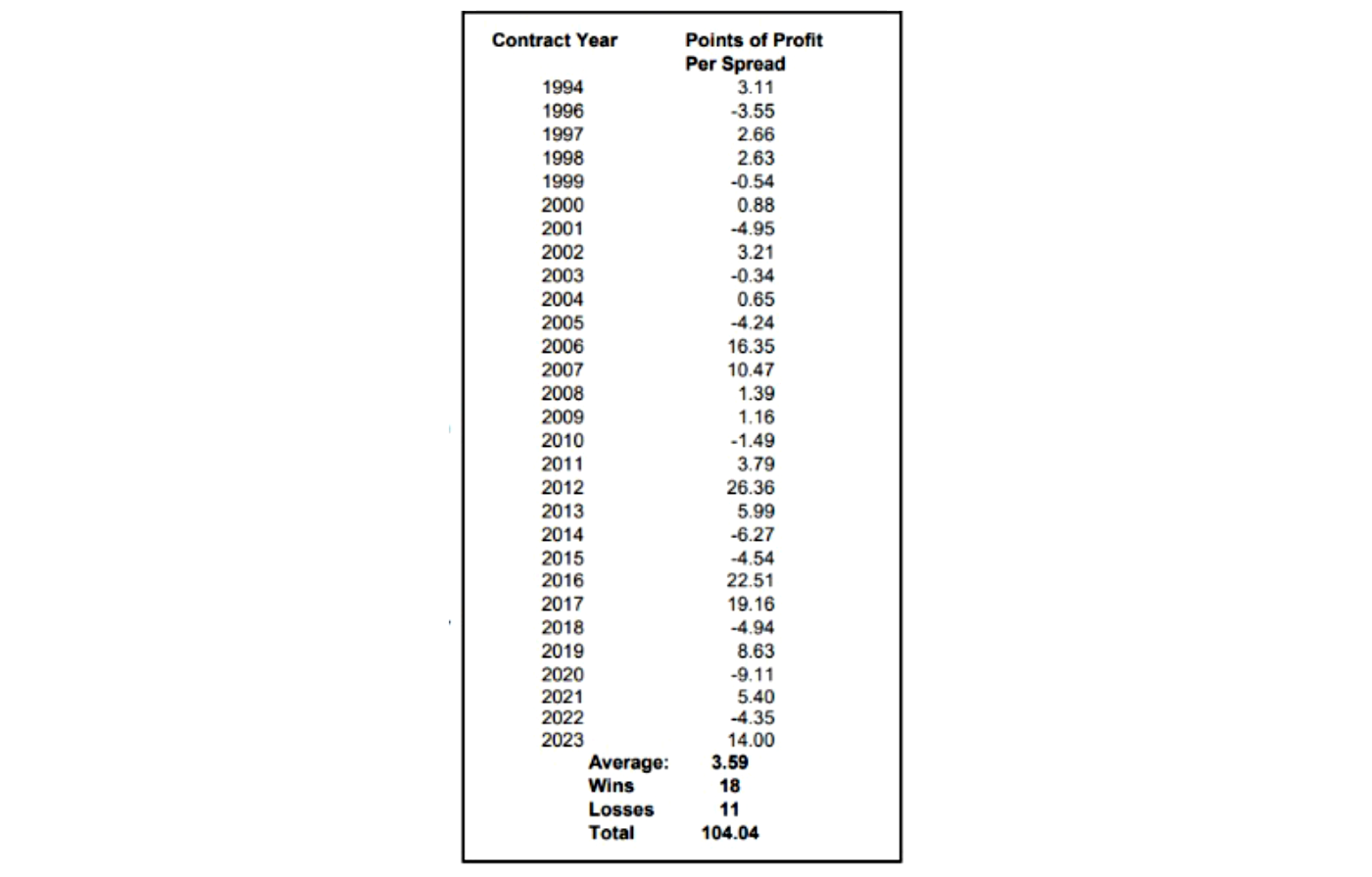

Table 1 shows the results year by year. These are the actual results of our recommendations and not the results as determined by optimizing the chart. Hence, it includes partial profits, placement of stops, and so on—things that may have helped or harmed the results as compared to the optimal results.

The results are in points. In the “big” contracts, a one-point move is worth $420. So the average gain of 3.59 points is $1,507.80 for one spread. As you can see, the “win” ratio stands at about 62%. But perhaps more importantly, the results of the most successful trades are highly profitable, while losing trades are stopped out with relatively low losses in most cases.

TABLE 1: HEATING OIL–GASOLINE SPREAD

ACTUAL RESULTS OF RECOMMENDATIONS

Source: McMillan Analysis Corp.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com

RECENT POSTS