The case for managed futures in active strategies

Why managed futures—an often misunderstood tactical tool—can play an important role in portfolio construction, either as a stand-alone strategy or as a key strategic element.

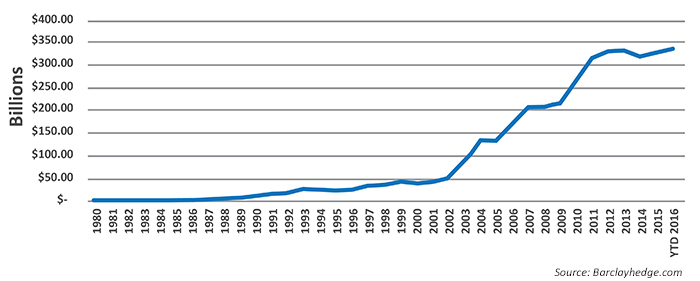

FIGURE 1: ASSETS IN MANAGED FUTURES

Professional portfolio managers may use managed futures as part of an alternative investment strategy to enhance diversification and potentially reduce risk to the overall portfolio. Major liquid futures markets traded on regulated futures exchanges throughout the world offer a wide variety of asset classes that include stock indexes, interest-rate instruments, petroleum-related markets, agricultural markets, and precious and industrial metals such as gold, silver, and copper. A managed-futures program can employ many of these asset classes in its strategy or strategies, using futures contracts either alone or in combination with other investment vehicles.

Many retail and institutional market participants haven’t tapped into this area as much as might be expected, despite the rapid growth of assets in managed-futures programs. This may have to do with some commonly held assumptions many investors have regarding managed futures:

1. They come with “higher fees.” Most hedge or alternative investment products have a management fee and incentive fee associated with them. However, if a manager produces an above-average rate of return over the long term, then it’s worth the fees, in my experience.

2. There can be considerable volatility of returns. In general, higher returns usually come with higher levels of volatility. It’s the price you pay to potentially earn a higher-than-average rate of return. However, managed futures can also potentially reduce overall portfolio volatility when used correctly.

3. There can be extended periods between new performance highs. Most of the larger and more successful managed-futures managers tend to use a longer-term approach in their investment time frames. A longer-term approach may extend periods between new performance highs.

4. The majority of money is managed with quantitative, rules-based trading programs. When it comes to constructing portfolios that use any degree of leverage—that also includes short selling—it is my belief that a thoroughly researched, rules-based approach has a better chance of performing over the long term compared to a discretionary approach.

5. The larger managers in the managed-futures industry tend to use trend-following methods that are long term in nature. The longer the time frame, the greater the tendency for an investment program to be able to use a larger degree of capital capacity. The larger managed-futures managers operate with billions of dollars under management, which is why they tend to also be long term in their investment time frame.

Most well-diversified managed-futures investment programs tend to be counter-cyclical to traditional stock and bond portfolios. Historically, this has meant that managed-futures programs can perform relatively positively when either stocks and/or bond portfolios experience negative performance.

Those advocating the use of managed-futures portfolios will often recommend allocating a portion of a traditional portfolio of stocks and bonds into a fully diversified managed-futures strategy to reduce portfolio risk. As a specific example, during 2008, an allocation of approximate 20% in one of the more reliable managed-futures programs could potentially have offset the approximate 20% to 30% loss the average stock and bond portfolios experienced in that year.

(Editor’s note: A recent analysis by Direxion Investments shows that during the 2007–2009 credit crisis, specifically from Oct. 2007 to March 2009, the Barclay CTA Index (managed futures) was up 18.3% while the S&P 500 Index experienced a -55.3% drawdown.)

Employing managed futures for portfolios

In addition to the more than 60 different markets that are available in a well-diversified managed-futures portfolio, these portfolios may be able to take advantage of opportunities associated with both falling market prices and rising prices. Short selling is typically included as an integral part of an overall managed-futures investment strategy, as required by market conditions. This is one of the reasons managed futures can perform positively while stock or bond prices are falling.

Due to the nature of the futures markets and holding positions on margin, there is an element of leverage in working with managed-futures products. The degree of leverage used in a managed-futures product is determined by each manager. Therefore, the performance returns and the usage of leverage are better analyzed through the techniques of a given manager and not necessarily for the industry as a whole. Assume that the degree of leverage and how it impacts performance volatility will vary from firm to firm.

Additional issues of entering and exiting market positions, along with managing risk and money-management techniques, as with many stock and bond managers, are all a part of how a managed-futures firm approaches the markets. The aggregate results of all decisions that go into a comprehensive approach to a portfolio using futures markets will determine the degree of alpha in the returns, as well as their consistency and quality.

Most traditional stock and bond portfolios will use little to no leverage with their market vehicles because they are essentially working with “cash” instruments. Consequently, poor market decisions that employ traditional stock and bond portfolios often take longer to reveal themselves when there is no leverage involved in their implementation. In a cash instrument, it just takes longer to lose money when no leverage is involved in the portfolio.

In market strategies that do use a degree of leverage, such as managed futures, inexperience or a lack of extensive knowledge in employing leverage will usually produce undesirable results. It can take many years of experience in working with leverage in order to fully understand how to use it within a diversified portfolio in a manner (and degree) that can potentially generate value-added alpha over the long term.

An insider’s view: 6 tips to consider when using managed futures

1. Industry concentration. The managed-futures space is relatively small compared to products available from industry professionals who use traditional portfolios consisting of stocks or bonds. The total number of investment programs number less than 600 and are available from an even fewer number of management firms. The largest 100 firms in the managed-futures industry control the vast majority of assets in the industry.

The larger firms tend to absorb new allocation money when it enters the industry, while the smaller firms will generally remain small or eventually go out of business, regardless of their returns, due to a lack of critical mass.

2. Caution on attrition rates. Because the number of total managed-futures firms is relatively small, it is fairly easy to monitor the attrition rate of these investment programs using firms that rank industry performance. The time-tested programs/managers tend to be around for the long term. Historically, approximately 50% of managed-futures programs are no longer trading after five years of implementation. This attrition rate tends to climb to approximately 80% when looking at a 10-year time frame.

3. Larger is not always better. Investors of all sizes tend to want to work with the larger firms, but the larger firms don’t necessarily generate better returns. In general, “better returns” (compounded returns over longer time frames) are generated by managers with $50 million to $750 million in dollars under management. There are, of course, exceptions to this, with successful firms who manage more than $1 billion.

4. Respect for leverage. Because of the leverage that exists in portfolios that only use futures markets, time-tested managed-futures managers have learned to control the quality and level of potential returns by taking a rules-based approach to developing and executing their investment products. Most of these managers have thoroughly researched and tested all of their investment decisions before implementing them into the markets. This, in my opinion, is a significant advantage versus the majority of investment decisions made on a discretionary basis in the stock and bond world.

5. The importance of track records. Managed-futures managers with a track record of more than 10 years who have at least $100 million under management have probably acquired the necessary skill sets to do more than just survive. They are likely producing a more predictable result over time, with a higher degree of probability, than those managers with fewer assets under management and a shorter track record.

Managed futures are not only used as a hedge against risk with traditional stock and bond portfolios, but they are often marketed as a diversification tool as well. When studying managed-futures programs with track records going back to the year 2000, some have outperformed the accumulated performance of the S&P 500 Index by as much as 400%–500%.

6. Extended time frames work best. When determining if a prospective client would be a good fit for managed futures, I always recommend that they consider their investment decision to have a time frame of at least three to five years. I have this view because we are probably going to do our best work in a period beyond a single year. Unless a potential client is prepared to make this type of time commitment to a managed-futures program, it is probably a waste of everyone’s time to consider an allocation.

I have spent much of my career not only researching strategies that use the futures markets, but also extensively studying investment strategies that primarily use stocks, bonds, options, and ETFs. After evaluating many investment vehicles, I have always come back and used a portfolio that solely consists of futures contracts. When properly packaged and employed in a managed-futures program, I personally believe there are no other market approaches that offer the same level of adaptability to changing market environments.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

K.D. Angle was introduced to the markets while watching his father successfully navigate the gold market in 1979. He began trading the futures markets in 1979 and developed his first rules-based trading strategy in 1984. He has founded asset management firms that have generated over 150 performance awards from a leading ranking service. Mr. Angle has been featured on CNBC and Reuters TV and been quoted in several notable books on trading. A new book by Mr. Angle will be released in 2017: “Guillotine Investing—Keeping Your Head While Others Are Losing Theirs.” anglecm.com

K.D. Angle was introduced to the markets while watching his father successfully navigate the gold market in 1979. He began trading the futures markets in 1979 and developed his first rules-based trading strategy in 1984. He has founded asset management firms that have generated over 150 performance awards from a leading ranking service. Mr. Angle has been featured on CNBC and Reuters TV and been quoted in several notable books on trading. A new book by Mr. Angle will be released in 2017: “Guillotine Investing—Keeping Your Head While Others Are Losing Theirs.” anglecm.com