As of October, the bear market is the longest since the bear of 2007–2009, the second one in three years, and the second deepest in over a decade. Headlines and articles abound about how deep and long this bear will be:

- Worst case, many analysts argue that the bear will not end until after the first rate cut, which may not occur until 2023—or even 2024.

- Others point to history where market bottoms typically occur three to four months before the end of a recession but rarely before the recession starts. That raises a complicated problem. The GDP contracted for two consecutive quarters, Q1 and Q2 2022, before showing positive growth again in Q3. Technically, that met the standard definition of a recession—but officially a recession call was not made. Many experts argue the “real” recession will not come until 2023 when the impact of rising rates hits consumers and the economy.

- To date, the drop in the S&P 500 has been due to a contraction in the price-earnings (P/E) ratio. Prices fell, but earnings held up. That is partially true. But without the blowout earnings in the energy sector, S&P 500 earnings would be flat or show a small dip. The next leg down in the market may come from lower earnings as the economy goes into an actual recession. How much earnings decline depends on the extent of the recession, but certainly a decline of 20% or more is normal.

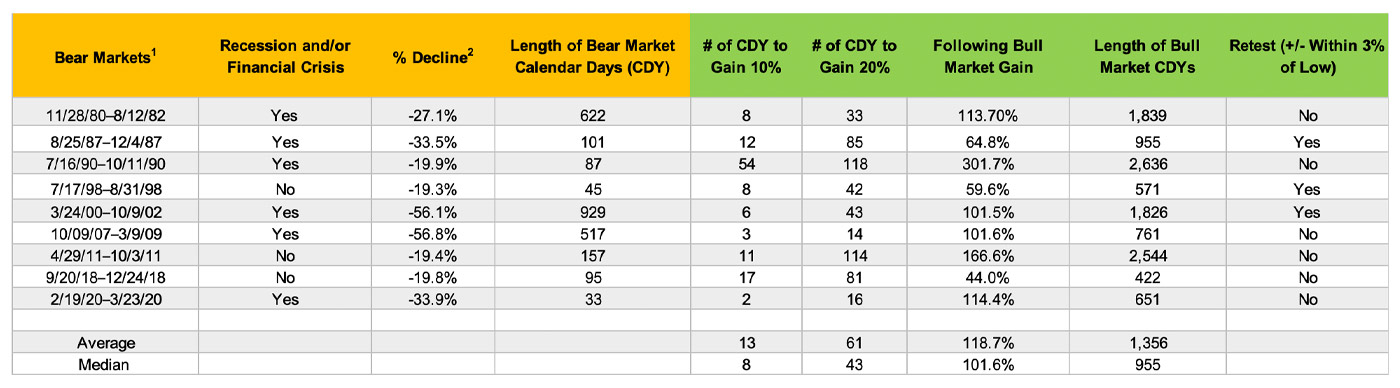

Reviewing data on the last nine bear markets over the past 40 years should shed light on what to expect from the current bear market.

TABLE 1: ANALYSIS OF LAST NINE BEAR MARKETS

1Bear Markets: Any decline over 20% in the S&P 500, including from intraday high to low.

2Decline based on closing prices for the S&P 500.

Source: STIR Research

The most glaring conclusion is bear markets with recessions and/or financial crises are deeper, averaging a loss of 37.9%. They also last longer, typically over a year. Bear markets that do avoid a recession tend to be shallower, averaging around 20% losses, and shorter, only three months.

As of this writing, the bear market has lasted nine months, and the S&P 500 has had periods of drawdown over 25%. The magnitude of those declines was beginning to push it into the “bear market with a recession” camp. That would suggest that more pain could be on the horizon and a new bull market is still in the distance.

Some short-term Q4 optimism

One bullish argument is that sentiment levels hit lows in June, and again in October, that matched the sentiment lows last hit in the 2008–2009 bear market. The S&P 500’s June price low was 3,660, and recent closing lows of 3,585 on Sept. 30 and 3,577 on Oct. 12 would qualify as retests.

Also, not shown in the bear market data above are two nice rallies of more than 20% that occurred in the two longest and deepest bears, 2000–2002 and 2007–2009. Both rallies occurred in the fourth quarter. The 24.2% rally during the 2007–2009 bear market occurred in Q4 2008, which was a midterm election year. Historically, Q4 in the midterm election year is the second-strongest quarter out of the 16 quarters within the presidential cycle (historically, only surpassed by the performance of the following quarter, Q1 in a pre-election year). If somehow you have not been watching the news, this is a midterm election year. That could provide some tailwinds for the market while it fights the headwinds brought on by rising rates.

After experiencing over a dozen bear markets since 1967, I have never found or heard of any single indicator that can pinpoint a bottom. It is a fool’s errand to try. It is more profitable to have adopted a risk-management strategy to protect your principal before the bear market began, one that will raise cash and protect your gains.

While a Q4 rally could be occurring, if you have not adopted a risk-management strategy with a strong defense, this could be a window to do that. Do not assume that the worst is behind us. While a 37% loss is the average bear market decline associated with a recession, on two occasions the losses were over 50%.

Prepare now for the next bull market

As important as having a risk-management strategy in place before a bear market is, it is just as crucial to focus on preparing for the next bull market. Table 1 highlights in green the data on the bull markets following each of the bear markets.

Study the columns on the number of calendar days for the S&P 500 to gain either 10% or 20% off its ultimate low. Fast! In a matter of a week or two, the market has gained 10%, and within a little over a month, the gain is 20% or more. Do not wait for the bull market to start before putting your offensive strategy in place.

A big element of an offensive strategy should be leverage. You will likely not buy at the exact bottom, and will probably still be in defensive mode at that time. Part of the initial bull market rally will likely be missed. But let the long term work for you. The average bull market gains over 100% and lasts more than 2.6 years. This is the time to build real wealth.

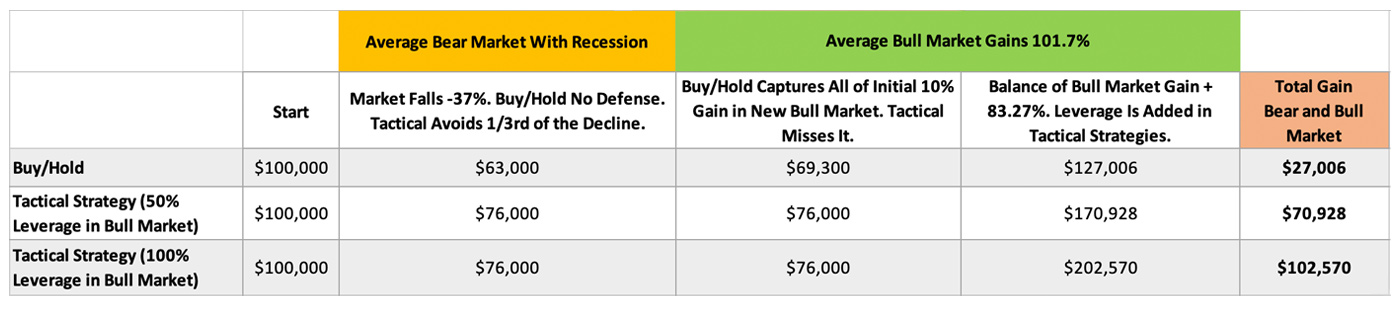

As shown in two examples in Table 2, a tactical strategy can take some of the sting out of a bear market. But when the new bull market starts, a tactical strategy will miss out on the initial gains because it is on defense. Assume the tactical strategy misses out entirely on the first 10% gain before its offense kicks in. For the balance of the bull market, leverage is employed, 50% or 100%, in the examples given in Table 2.

TABLE 2: COMPARING BUY & HOLD WITH TACTICAL LEVERAGED APPROACHES (HYPOTHETICAL EXAMPLE)

Source: STIR Research

The result? A tactical strategy with a defensive component and an offense that employs leverage has a multiplier result on the final return.

Our conservative assumption is that a well-designed tactical strategy can avoid one-third of the bear market decline. But we also assume it will miss the first 10% gain in the new bull market. It will, however, add 50% in leverage for the balance of the bull market.

The total gain is $70,928 for the 50% leveraged tactical strategy with these assumptions versus $27,006 for a buy-and-hold strategy. That gain is 160% greater. With the same assumptions, but employing 100% leverage during part of the bull market, the total gain is $102,570 versus $27,000 for buy and hold—an improvement of 280% in total return!

If you have a tactical strategy already, great. If not, maybe a Q4 rally will be an opportunity to add one. But add one regardless. Most importantly, be prepared for the next bull market. Have a tactical strategy that can employ leverage. That is when the big gains will be made.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com