How financial advisors can make a great ‘first impression’

How financial advisors can make a great ‘first impression’

Behavioral scientists say people can form first impressions in seconds—and that those impressions can affect beliefs about factors such as trustworthiness and competence. How can financial advisors tilt the odds in their favor in their initial contacts with prospective clients?

Advertising legend Bill Bernbach, one of the leaders of the “creative revolution” in advertising in the 1950s and ’60s, was also prolific in delivering oft-quoted remarks on topics related to communications, marketing, and the psychology of human behavior.

While our readers or the many financial advisors we’ve interviewed might say they are not really salespeople, Bernbach would probably disagree, based on a couple of his carefully crafted statements:

“It is one thing to have a selling proposition and quite another to sell it. … It is not just what you say that stirs people. It’s the way you say it. … We must not just believe in what we sell. We must sell what we believe in. …

“No matter what profession we may be in, we are all ultimately ‘selling something.’ Yes, a teacher, lawyer, physician, plumber, and writer are all salespeople in one way or another.”

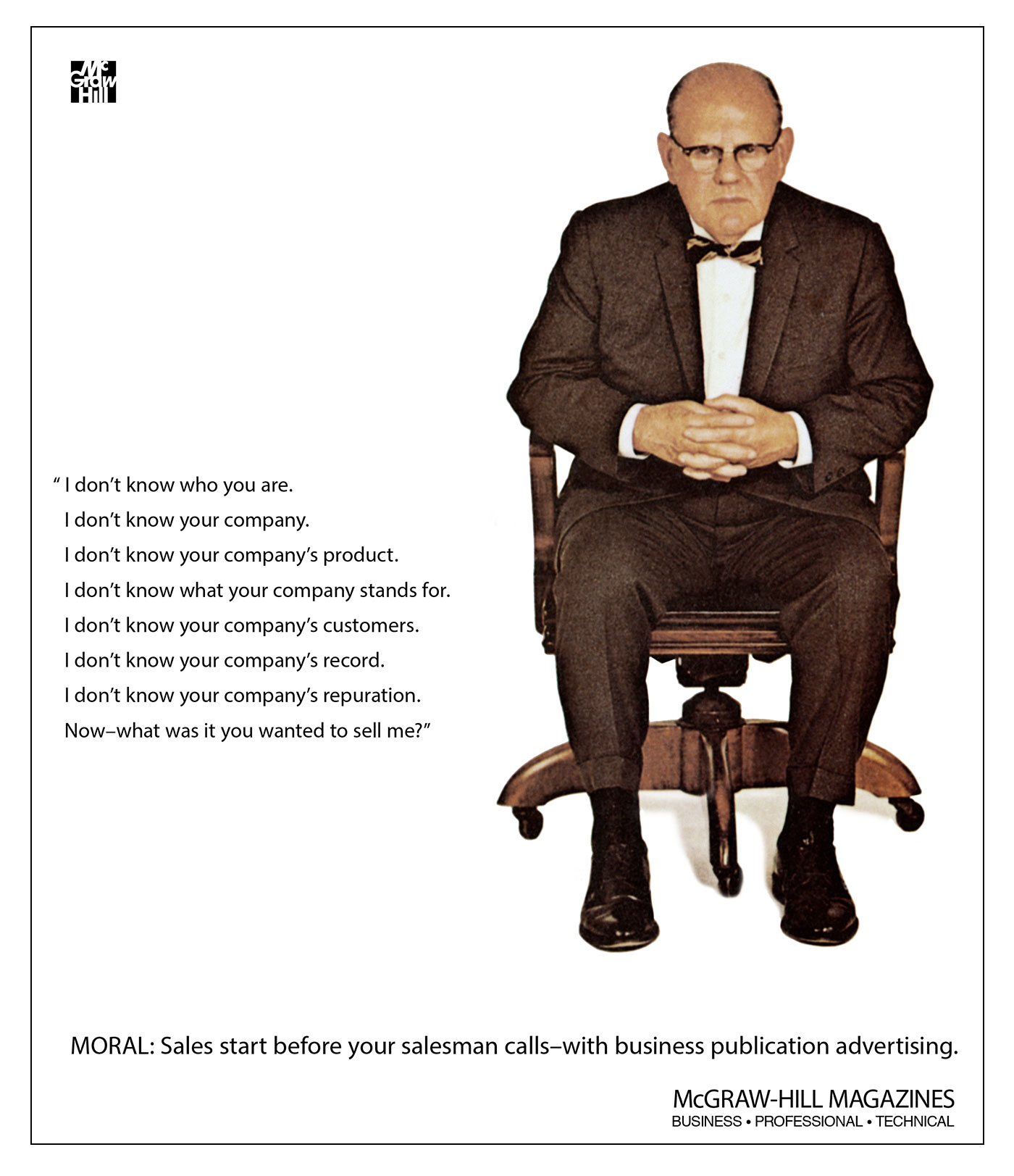

Thinking about advertising in the last century, and the idea of “selling” one’s services and capabilities, brings to mind a classic business-to-business advertisement developed in 1958 for McGraw-Hill’s publishing group (which included BusinessWeek) by the ad agency Fuller Smith & Ross.

The “I Don’t Know You” ad was honored over 40 years later by Advertising Age’s Business Marketing as the “Best Business-to-Business Ad of the 20th Century.”

The message of this advertisement still resonates today as a reminder of why target-market recognition, brand reputation, third-party recommendations, and “first impressions” are so important not only to mega consumer brands but also to any firm or practice that is seeking to cultivate new prospects.

Source: Reproduced by permission of S&P Global Inc., formerly known as The McGraw-Hill Companies.

Ray Sclafani is the founder of ClientWise, a premier coaching company exclusively serving the financial-services industry. In his 2016 book, “You’ve Been Framed,” Sclafani tackles the opportunities financial advisors have “to create change by the way in which they conduct their practices.”

The core thesis of the book explores how financial advisors are “framed.” According to the introduction to the book, “The frame is the perspective outsiders have of your company. It may be accurate or false. Positive or negative. But if you haven’t actively nailed down what your business stands for—and what differentiates it from competitors—you’re likely reducing profits, talent, and the longevity of your firm.”

Creating the “frame” for an advisory practice may take years of thoughtful effort and is reinforced by virtually every action advisors, their colleagues, or their affiliated third-party professionals take.

But it all starts with first impressions.

An article from Investment Advisor addressed the importance of making a positive introduction to an advisory firm:

“When it comes to how advisors market themselves, they shouldn’t neglect an obvious yet somewhat overlooked first step. ‘People size you up within 10 or 12 seconds of meeting you,’ notes Christopher P. Jordan, president & CEO of LEXCO Wealth Management, Inc. in Tarrytown, New York. ‘That’s just the world we live in. Why not tip all the odds in your favor?’ …

“‘You never get a second chance to make a first impression,’ warns Chris Holman, executive coach at ClientWise.’ … ‘Advisors have a lot of flexibility and leeway in what they can do,’ Holman says, and suggests presenting a very personal image to visiting clients and prospects that they will remember. …”

Investment Advisor adds,

“Independent advisors are first and foremost selling themselves, so clients and, especially prospects, are continually judging you. …

“With volatility in the markets, increased regulation, and constant competition for clients, there are many things advisors can’t control. So why not influence the things that you can? …”

Financial advisors can be proactive and help shape prospective clients’ first impressions of their personal attributes and those of their firm in a number of ways.

Several financial advisors interviewed for Proactive Advisor Magazine have shared their thoughts on placing their practices in a favorable light from the start.

We share a few of those approaches here.

How six advisors seek to create a favorable first impression for prospective clients

Mary Lyons • Dallas, TX

Mary Lyons • Dallas, TX

Read full article: Taking business networking to the next level

Advisor Mary Lyons of Dallas, Texas, says, “My entire practice has been built through networking, and I devote a lot of time to networking efforts.” She stresses that a goal she believes all advisors should have in networking is to “get people engaged in your success and you in theirs.”

“Whenever I have a meeting with somebody, my goal is to make two to five introductions for them that will help them either personally or professionally. Now, when I am talking to someone at an event, somebody else will inevitably walk up and say, ‘If you haven’t met with Mary, you should. She knows everybody! She’ll make introductions for you right off the bat, and she’ll be able to connect you to the people you need to know.’ Because of this, people are very willing to take a meeting with me.

“After spending a half-hour talking to somebody about what’s important to them and making introductions that will actually help them, the next question they will usually ask is, ‘How can I help you?’ My answer is always, ‘Spend an hour with me. Let me show you what I do, because I don’t want you to make introductions for me unless you know what I do and think it could help your contacts.’

“What happens then is they see exactly how my client process works. I would say 50% of the time, even if the purpose of the meeting was only to gather information, people ask me if I will look at their investment portfolio or their current financial plan to see if they should tweak something.”

Daniel Ruben • Westlake Village, CA

Daniel Ruben • Westlake Village, CA

Read full article: Addressing the mindset of physicians on their financial future

A former practicing physician, Daniel Ruben provides comprehensive financial guidance to clients in Westlake Village, California.

Dr. Ruben’s medical career began at Parkland Hospital in Dallas. In 1985, he founded a multi-specialty group practice in Sherman Oaks, California, which he successfully managed for 20 years. He says he was motivated to make a career change by a lifelong interest in the financial markets, the challenge of properly managing his own wealth, and the appeal of working closely with clients as a financial advisor. He founded Life Strategies Advisors in 2012.

He says, “It follows that when I started my second career as a financial advisor that one of my target client segments would be the physician community.

“On my website, I have what might be called an ‘open letter’ to physicians explaining my background and why I think they might benefit from working with our firm. I call our process of working with physicians ‘Physician Life Strategies.’ I believe in a holistic approach to helping people improve their financial lives, and therefore, their entire life.”

Dr. Ruben believes this letter to fellow physicians has been a very effective way to share his practice philosophy with a key target segment. You can read it here.

Steve Romano • Edmond, OK

Steve Romano • Edmond, OK

Read full article: What your financial firm’s core beliefs say to clients and advisors

Steve Romano is a strategic consultant with NFA Wealth Management in Edmond, Oklahoma, and has decades of successful experience in the financial-services industry. He places an emphasis on introducing prospective clients to the firm’s functional capabilities as well as its commitment to a “high-engagement service model” and client-focused culture.

Mr. Romano says, “I joined NFA for three fundamental reasons: (1) the strength and vision of their management team; (2) the unmatched resources the firm and its third-party partners can offer, especially in the areas of risk management and services for businesses; and (3) their strong values orientation and operating philosophy.”

NFA has captured its working philosophy in a statement called “Our Core Beliefs,” which Mr. Romano shares with clients as part of his introduction to the firm. You can read the statement here.

William Curry • Wilmington, DE

William Curry • Wilmington, DE

Read full article: Encouraging prospective clients to have a ‘transformative conversation’

William (Bill) Curry is the founder of Wealth Wisdom Group LLC, located in Wilmington, Delaware. Mr. Curry states that his firm provides financial guidance grounded in “intellectual capital amassed over 40 years of serving clients.”

He says, “On the individual client side, we primarily serve clients with one of the following characteristics: retirees or those about to retire, highly compensated executives, professionals, and business owners. These individuals normally have families and are interested in putting their financial lives in order. While we do not have an income or asset minimum, we want to serve clients who are serious about entering into the financial-planning process and seek information, education, and guidance.”

“In addition to receiving referrals from accountants and attorneys, we have a number of ways we develop prospective client introductions: through current client referrals, online marketing efforts, financial education seminars, and direct mail. In all of these efforts, we invite clients to have what we call a ‘transformative conversation’ about their financial-planning questions and concerns. To provoke their thinking in this area, we ask prospective clients several questions.” (See the questions here.)

Mr. Curry believes this method of engaging prospective clients with thought-provoking questions allows him to begin to assess their overall financial needs and suitability for his practice and allows them to see how he might be able to address their financial concerns. He says, “If they answer ‘yes’ to one or more of these questions, we invite them to set up a no-obligation meeting to get to know each other”—and become further engaged in the process of a “transformative conversation.”

Anthony DeRose • Chicago, IL

Anthony DeRose • Chicago, IL

Read full article: 5 ways to improve the quality of your advisory firm’s website

Anthony DeRose is a partner at DeRose Financial Planning Group (FPG), located in Chicago, Illinois. DeRose FPG has been serving the community for three generations. Mr. DeRose’s mother, Karen DeRose, serves as the firm’s managing partner. He joined the firm in 2012.

Mr. DeRose says, “Like many firms, the vast majority of our new prospect leads come from referrals. While these prospects may value the opinion of those who referred them, most will do some due diligence before contacting our firm. At the very least, they will take a look at our website to learn more about our team and what services we offer.

“An advisory firm’s website is a huge part of its public face. So when I joined the firm in 2012, one of the first tasks I took on was to improve our website, www.derosefpg.com. First, I researched other advisors’ websites. Frankly, the quality was all over the place. So I studied best practices for websites in general and for financial-services websites specifically. Here are five tips we have applied that made the biggest improvements to our firm’s website:

- Have a clear message.

- Include team bios that are complete, up to date, and personalized.

- Keep your content fresh.

- Have a point of view.

- Link to social media.

“We have received great feedback on our website, and I think the effort has been very worthwhile. The benefits go beyond introducing ourselves to referred prospects. We also have been able to generate productive leads through the website and social media. People tell us they like to use our website as an educational resource. Hearing that kind of feedback is very gratifying.”

Oscar Alvarez • Newport News, VA

Oscar Alvarez • Newport News, VA

Read full article: Developing financial resources for clients experiencing life transitions

Oscar Alvarez is an independent financial advisor and the founder of Pathway Financial Planning. He believes his firm’s initiative focused on helping people facing “life transitions” adds an additional and distinguishing factor to his practice—and is an excellent way to introduce the capabilities of his firm to potential new clients.

He says, “I started working with a practice-management and business coach last year who helped me analyze my client base, set goals for future growth, and create a focus on target segments that represent strong opportunities. During this process, I found nearly a third of my clients are widowed or divorced—both difficult life transitions that carry specific financial consequences.

“Working with my coach, we decided it would be a smart idea to develop financial resources for individuals who are going through significant transitions in their lives. There are many scenarios: the death of a spouse, divorce, a career change or re-entering the workforce, planning for retirement, planning for their children’s college education, resources for elder care, or coming into an inheritance.

“I am working on building relationships with the professional resources that people may need during these transitions. There are the obvious examples of estate-planning lawyers and CPAs. Beyond that, there are other professionals such as real estate or mortgage professionals, employment specialists, bereavement counselors, providers of group support systems, or individuals knowledgeable about the assisted-living process.

“I plan to offer educational workshops and will invite outside professionals to attend. The workshops may discuss other practical issues beyond life transitions, such as understanding various insurance options, planning for long-term care, budgeting, avoiding financial scams, or awareness of elder abuse. My goal is to bring value, providing information people can really use. The key is to be able to either help someone personally or lead them to the resources that can help them.”

He adds, “I want to provide valuable financial resources and become an advocate for trusted professionals in a variety of fields. I believe those attending the workshops and the professionals who present at them will ultimately become advocates for our firm.”

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

This article was originally published in Proactive Advisor Magazine on January 23, 2020 (Volume 25, Issue 3). It has been revised to reflect updated information.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.