How a diversified money-management approach reinvigorated my practice

How a diversified money-management approach reinvigorated my practice

Why combining strategic investment management, tactical trend following, and active portfolio management was a game changer for my practice.

I’ve learned a lot of lessons throughout my career. I could write a book about those lessons—and maybe I will someday if I find the time. But there’s one significant lesson about investment management that I wish I could’ve shared with my younger self.

I’ll get to that, but first, let me take you through my journey as a wealth manager since it informs how I came to learn this lesson.

I became a financial advisor when I was just 21. My first day on the job was 10 days before the World Trade Center was attacked on Sept. 11, 2001.

Somewhat ironically, in discussions with veteran advisors before 9/11, I was often told how lucky I was to be starting so young—and, more importantly, right after a market crash. At that time, the market was still recovering from Y2K and the dot-com bubble, but the climate was beginning to calm down. Then Sept. 11 arrived like a nightmare, and things went quickly from bad to worse … much worse, as many of you probably recall.

So I started my career as a young, green financial advisor in a rapidly declining market; trying to convince people 20 to 40 years older than me to trust me with their life savings, business assets, and legacies; and pitching “buy and hold” to everyone I met, because, well … that’s what we were all taught.

Finding my footing

The good and bad news was that things got better.

The good news was obvious: People were making money again, portfolios were going up in value, and most of my clients (especially new clients) were happy.

The bad news was that not everyone was happy. The clients who had hired and trusted me back in 2001 and 2002 had a different perspective. Instead of celebrating the market’s recovery, they were asking, “Well, are we back to even yet?”

And just when I thought things were truly better—and we were back in the black with these clients—I’d hear, “It’s nice that we’re in the black now, but what’s our annualized return since we started with you?”

It was exhausting. I felt like I could do nothing right. In time, though, things did improve to the point where every client was relatively happy.

But then, the early signs of the next financial crisis were starting to appear.

Around the time the market was declining from its 2007 peak, I was on a conference call with a renowned, Barron’s Top-10 mutual fund manager. Despite the manager’s expertise, the funds were losing money—not due to poor management but because of restrictions in their prospectuses’ investment policies.

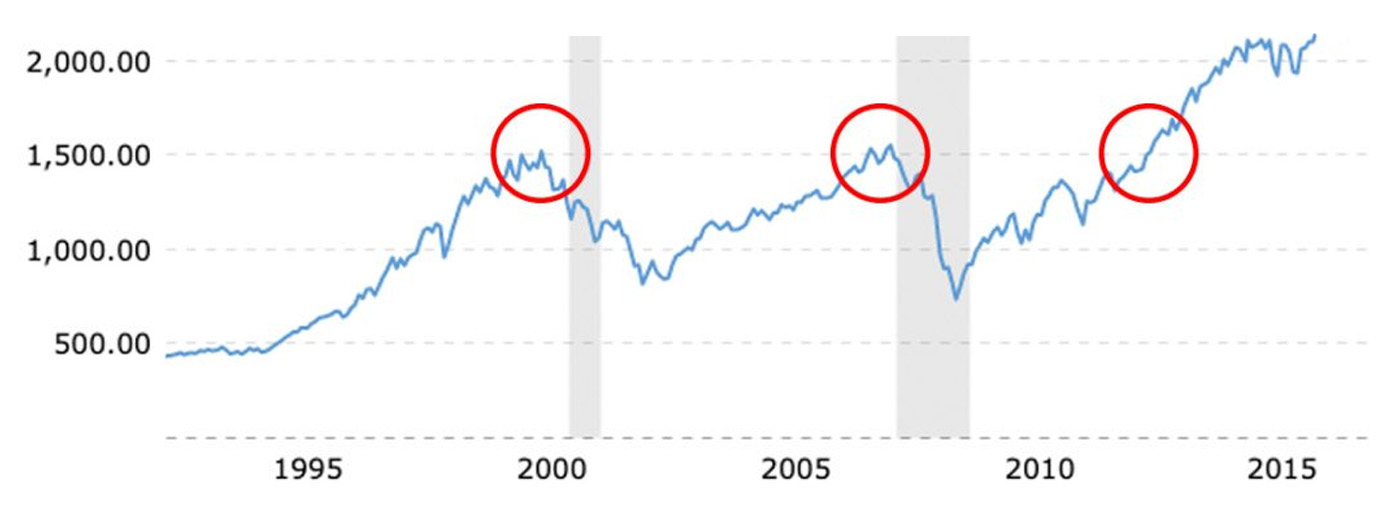

CHALLENGING MARKETS TO BEGIN THE 21ST CENTURY—S&P 500 CRASHES AND RECOVERIES

Note: Shaded areas are recessions.

Source: MacroTrends

Regardless of how skilled these portfolio managers were, they weren’t allowed to get out of the market, and this issue still hasn’t been addressed in the mutual fund industry today. Instead, investors (and advisors) are often misled into believing they are getting “active” portfolio management when, in reality, the vast majority of mutual funds must remain largely invested in the market at all times.

Mutual fund managers use catchphrases like “style specificity” to defend their position when there’s a hole in the bottom of their metaphorical ship. However, even the best mutual fund manager isn’t going to have a bucket big enough to get the water out before fund owners start gasping for air.

The point being, I knew I couldn’t endure another 9/11-type market crash like the one I faced at the start of my career—no way.

A career-defining change in direction

As I saw it, I had two choices at that time:

- Sell my wealth-management business and change careers.

- Change how we managed portfolios at Libertas to a methodology that made more sense and provided greater consistency and risk management for clients.

I chose the latter. I consulted with several high-profile mentors in the industry; earned the Chartered Market Technician certification; and for many years after, exclusively implemented a technical-analysis-based, tactical portfolio-management approach, with a strong emphasis on trend following and relative strength.

How did it go? Awesome … at first.

In 2008, as the market continued to collapse, I felt like a hero. In 2009, our investment performance versus the market was the best it had ever been.

But in 2010, I let the success go to my head, and I violated a couple of my rules. Those of you who implement a rules-based approach know that one of two things happens when you break your own rules:

- You get lucky, and the trade works in your favor.

- You get slaughtered and learn a lesson.

My friend, technical analyst J.C. Parets, once called this type of loss “tuition”—and it’s a loss you’d better learn from. I did.

Although this self-imposed mistake didn’t kill our performance in 2010, it did cause our portfolios to swing from outperforming the market by a couple of percent to slightly underperforming it. Clients were still happy, but I wasn’t. There’s nothing quite like an unforced error, and it took me a while to move past it.

That said, this isn’t the major lesson I referred to at the start of the article.

Learning how to effectively implement investment strategies that use technical analysis and trend following changed my life—and while most of our clients don’t know it, it made their lives easier as well.

However, I had become somewhat rigid. I was obsessive about reaching perfection, which is, of course, impossible.

Do I think technical analysis is a superior method of portfolio management to others available in the industry? Yes. But, whether you are a financial advisor or wealth manager, treating your money-management philosophy as an inflexible and omniscient science is not the answer.

The market conditions I experienced during the first six years of my career, combined with my growing passion for technical analysis, blinded me to the fact that managing every single portfolio model exclusively using technical analysis was not always going to work.

I learned this the hard way.

There were many times in the past 14 years when technical-analysis-based strategies struggled compared to traditional “buy and hold” strategies. For instance, 2015–2016 were two of the most difficult years for trend following in the last two decades. The market peaked in May 2015, corrected twice over the following 20 months, and ultimately declined throughout the entire cycle.

The 2020 COVID crash was even more challenging, with stocks dropping 34% in 22 days—only to recover 34% just 29 days later. This kind of market action can only be described as a whipsaw from hell.

The big lesson: Diversify your portfolio-management approaches by strategic and tactical styles

What I learned is this: It’s OK to be passionately aligned with an investment strategy you truly believe in—one backed by facts, studies, and proven methods that suggest you and your clients will come out on top in the long term.

What’s not OK is to be so rigid as to think there is only one portfolio-management strategy for all market environments, individuals, businesses, and ages.

So, when I re-launched our strategic models from pre-2008 (after a hefty overhaul in analysis), my life—and the lives of our clients—changed once again.

It wasn’t like 2008, when I was ready to sell my company and walk away from wealth management. This time, instead of feeling like I was “fighting the market,” I felt at peace. Managing a strategic sector-rotation strategy is far easier than managing a trend-following model through those wrenching whipsaws.

Furthermore, blending the two strategies created an optimal strategic approach that could be weighted more toward tactical or strategic, depending on a client’s age, risk tolerance, financial-plan objectives, and “financial personality.”

This solution resulted in a better, dual-pronged, all-encompassing strategy. It not only offers clients the option to have a portion (or all) of their portfolio invested in a strategy that attempts to avoid catastrophic market crashes when bear markets inevitably arrive (and with them the thought, “Ugh, I wish I would’ve gotten out of the market”), but it also provides the flexibility to respond effectively to quick market recoveries, such as those experienced during COVID (when we look back and think, “Ugh, I wish I would’ve just stayed in the market”).

Almost every portfolio manager, wealth manager, and financial advisory firm offers “buy and hold” strategic models that diversify by asset class, sector, country, market cap, and style. But what if you could offer both strategic and active investment management, providing an additional layer of diversification by “management style?” Tactical strategies, combined with more strategic portfolio approaches, can offer the potential for lower drawdowns and volatility, multiple layers of diversification, and enhanced risk-adjusted returns.

And the best part? You don’t have to tackle this task on your own (as I tend to do). Several experienced and reputable third-party investment managers exist that can handle all or part of this wealth-management solution for your clients and your firm—with you providing due diligence and comprehensive portfolio review and oversight. These managers can offer access to multiple modern analytical strategies, emphasis on risk mitigation, and the ability for client portfolios to be more responsive to changing market conditions over full market cycles.

How much could this addition to your overall investment philosophy improve your clients’ portfolios (and your business)? I think the answer is clear—at least to me. And perhaps this approach will help you avoid some of the sleepless nights and self-doubt I experienced over many years while coming to this conclusion.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

Adam Koos, CFP, CMT, CFTe, CEPA, is the president and portfolio manager at Libertas Wealth Management Group Inc., a NAPFA-affiliated, fiduciary registered investment advisor firm in Columbus, Ohio. Since founding the firm in 2001, he has earned local and national recognition, including being named one of the Top 100 Most Influential Financial Advisors in the U.S. by Investopedia and receiving the Torch Award for Ethics and Trust from the Better Business Bureau. Mr. Koos holds B.S. degrees in finance and behavioral psychology from The Ohio State University. www.libertaswealth.com

Adam Koos, CFP, CMT, CFTe, CEPA, is the president and portfolio manager at Libertas Wealth Management Group Inc., a NAPFA-affiliated, fiduciary registered investment advisor firm in Columbus, Ohio. Since founding the firm in 2001, he has earned local and national recognition, including being named one of the Top 100 Most Influential Financial Advisors in the U.S. by Investopedia and receiving the Torch Award for Ethics and Trust from the Better Business Bureau. Mr. Koos holds B.S. degrees in finance and behavioral psychology from The Ohio State University. www.libertaswealth.com

RECENT POSTS