Have the Roaring ’20s returned?

Have the Roaring ’20s returned?

While recent economic news is encouraging, no one has a crystal ball as to the market’s future performance. There is no better time to make sure clients’ risk-management plans are in place.

In a recent Proactive Advisor Magazine article, the author (a successful financial advisor) wrote about a behavioral finance issue affecting several of his clients.

As opposed to the typical fear seen in severe market declines, these clients are fearful about the sustainability of the massive market rally since March 2020. Whether you call it fear or greed, they do not want to see their current portfolio gains diminished.

I suspect they are influenced by at least three of the 10 key behavioral influences that behavioral finance expert Jay Mooreland says lead many people to poor investment decision-making:

“The media often causes us to focus on short-term events and makes it difficult to differentiate important news from noise. …

“Our decisions are often influenced by reference points such as our profit/loss on an investment and past performance.

“We detest loss, and may make unwise decisions in an attempt to avoid loss.”

I understand where they are coming from.

Some months ago, I was thinking about the “willing suspension of disbelief” that might be required for investors to reconcile how the equity markets could rally so strongly in the face of the bad news resulting from the ongoing pandemic.

It is still hard for me to totally buy into how far the markets have rallied.

Though vaccination progress in the U.S. is highly encouraging and most states are in the final stages of fully “reopening,” we are still exposed to the statistics each day on new COVID cases, hospitalizations, and deaths. While we are thankful that those have decreased dramatically since the major spike in January, there is still uncertainty as to what the future holds next fall and winter.

We also see headlines about new strains of the COVID virus, the human tragedy unfolding in other countries, and doubts in the scientific community about whether the U.S.—let alone the world—will ever achieve true “herd immunity” status.

I also continue to see discouraging economic reminders where I live in the Northeast.

Several national retailers have shut down for good in nearby towns. There is no shortage of “For lease” signs on empty storefronts. Ridership on the commuter rail to New York City (which at peak times was often standing room only) is still down close to 70% from pre-pandemic levels. Cities (and therefore schools) around the state of Connecticut continue to face budget challenges. The unemployment rate in our state, while improving, stands at 8.1%, versus 3.8% in March 2020.

The good news is the businesses still standing are showing signs of recovery, and select ones grew their business during the pandemic. Highways are continuing to get more crowded (good and bad news). And we are all optimistic about live events, sports, dining out, travel, and the 2021–2022 school term getting back to some semblance of normal.

The market is a future-looking and forward-discounting mechanism, and “good news” has been priced in for some time.

The question is, “How good will it get?” And how sustainable is the current bull market?

Another author for Proactive Advisor Magazine, First Trust, outlined its bullish case recently:

“With real GDP growth of more than 6% this year and S&P 500 earnings expected to grow by at least 27%, we think stocks will easily bust through our original target by year-end. …

“While the market won’t move in a straight line, and a correction is always possible, as the economy opens up, those sectors of the market that fell behind in the past year (because of shutdowns and limited global trade) will be a source of strength.

“The Fed remains highly accommodative, there are trillions of dollars of cash on the sidelines, vaccines have reached over 50% of Americans, and the economy is expanding rapidly. Some valuations have been stretched, but the market as a whole remains undervalued. …”

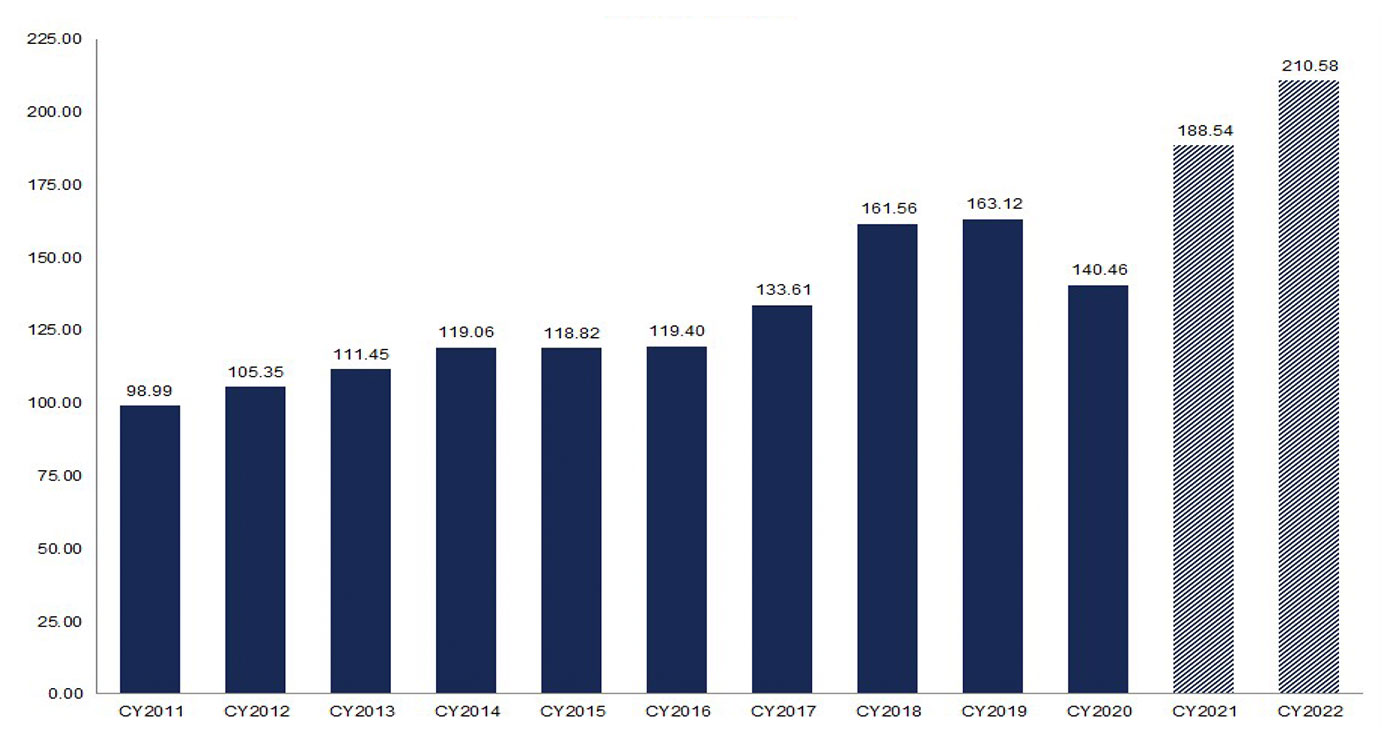

Source: FactSet

While the fundamentals for the market in 2021 might look favorable, compared to the distressed levels of 2020, I am also intrigued by the longer-term trends and how they might play out.

McKinsey & Company and other thought leaders see vast growth and efficiency potential in what is being called “The Fourth Industrial Revolution.” And, aside from manufacturing and supply-chain improvements, enhanced use of technology has allowed companies to find new and more efficient ways of employing their workforces during the pandemic. MarketWatch noted recently, “In all aspects, the growing financial strength and powerful effects on the economy from Big Tech cannot be ignored.”

Then there is the consumer side of things, which has led to much of the talk about a return of the Roaring ‘20s. While there are many aspects of the 1920s that probably should not be emulated, the core comparative theme here is really about the U.S. population emerging from a dark period with abundant enthusiasm and pent-up demand.

Recent figures on personal income, spending, and consumption are already showing signs of this, though they are influenced to some degree by stimulus checks. And according to The Conference Board, “After rebounding sharply in recent months, U.S. consumer confidence was essentially unchanged in May. … Consumers’ assessment of present-day conditions improved, suggesting economic growth remains robust in Q2.” In the prior report, they had noted that consumer confidence “is now at its highest level since February 2020.”

Segments of the economy related to discretionary retail, travel, automotive, entertainment, dining out, conferences and events, personal services, and many other areas should see greatly increased demand. This should help considerably with employment prospects for many people previously employed in some of the hardest-hit industries.

It is not hard to find many bearish arguments for the market, especially in a typically weaker seasonal period for equities.

Barron’s made an interesting point recently:

“Don’t be surprised if earnings—or at least the expectations around earnings—become a bigger problem for the stock market. Earnings are expected to grow by 43% during the second quarter, 55% during the third, and 75% during the fourth, according to Ned Davis, senior investment strategist at Ned Davis Research.

“But the stock market has gained just 2.4% a year when expectations for profit growth have been 20% or higher. ‘By the time really good … or bad … earnings are reported … the good or bad news has been largely priced in,’ he writes.”

However, no one has a crystal ball as to the market’s future performance, despite intensive analysis of the market’s past performance.

The financial advisor mentioned earlier had this advice for other advisors and their investor clients,

“The point is to remind you that there is no better time to prepare your defense (your risk-management plan) than when your offense is on the field—especially when there is so much fear about the offense turning the ball over! … Proactive advisors have access to many ways to build a prudent, intelligent, and defensible risk-management plan.

“We must help our clients understand that they are going to have to take risk to earn the returns they need over the long term. But that means that it’s up to us to help effectively manage that risk, and we can do so by prioritizing investing policy that strives to produce competitive risk-adjusted returns.”

That is sound guidance for any decade.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.