Many analysts and commentators have been focused on evaluating the probabilities of the U.S. economy achieving a “soft landing,” despite the aggressive interest-rate hiking by the Federal Reserve.

But what exactly is a “soft landing”?

A recent post from the St. Louis Fed’s communications group provided some insights on this definition.

“It’s easy to picture a soft landing for something like a spacecraft. But what does it mean to have a soft landing for the economy? If you’ve seen that reference in the news, it was probably related to the Federal Reserve’s tightening of monetary policy and the potential economic impact. ‘Tightening,’ or contractionary monetary policy, is intended to restrain spending by consumers and businesses when there is higher-than-desired inflation. …

“When the FOMC tightens monetary policy, it can raise the question of whether the Fed can achieve a ‘soft landing’ for the economy. I consulted Paulina Restrepo-Echavarria, an economic policy advisor in the St. Louis Fed’s Research Division, about soft vs. hard landings and what data we might look at to get a sense of whether a soft landing is possible …

“’I would say that a soft landing is when we increase interest rates and we manage to decrease inflation, but without causing unemployment to go up drastically and GDP growth to go negative,’ Restrepo-Echavarria said. ’And a hard landing would be yes, we increase interest rates and we decrease inflation, but at the cost of a recession and high unemployment.’

“However, she noted that there isn’t an exact definition of a soft landing, as it’s possible to have a mild recession without very high unemployment …

“Asked whether there are still ‘long and variable lags’ in the time it takes for interest rate changes to affect the economy, Restrepo-Echavarria said the thought used to be that it takes about two years.

“’It’s hard to say if that’s the case anymore,’ she said. ‘And it’s very difficult to say how long it will take for us to figure out if there’s going to be a soft or hard landing.’”

What are analysts currently saying?

Market technician Tom McClellan recently noted that he believes peak unemployment is further away than most analysts expect and will not occur until the summer of 2024. He wrote,

“The CPI inflation rate peaked at 9.1% in June 2022. If the two-year lag time works perfectly, it would mean a peak for the unemployment rate in June 2024. You can bet that unemployment will be a big topic in the presidential debates ahead of the November 2024 election.”

For several months, analyst Tony Dwyer has warned that he still believes a recession is on the near-term horizon, saying in a recent article,

“The soft-economic landing may be the worst-case scenario because it keeps the Federal Reserve holding interest rates ‘higher for longer.’ The recent rise in rates associated with a few better-than-expected economic releases helped the market believe the Fed would have to hold rates high for an extended period. We disagree and believe this rate spike in U.S. Treasurys (UST) ensures a coming recession given the additional jump in mortgage and corporate yields and tightening in financial conditions, as seen in the Bloomberg U.S. Financial Conditions Index.”

FIGURE 1: BLOOMBERG FINANCIAL CONDITIONS INDEX HAS BEEN RAPIDLY WORSENING

Sources: Bloomberg, Canaccord Genuity

Barron’s column “Up and Down Wall Street” was firmly in the recession camp this past weekend, saying,

“Just as profits start growing again, the economy is starting to slow, leaving one thing abundantly clear: There’s no escaping a recession. …It would be a mistake to dismiss the possibility of a slowdown, as the preponderance of evidence begins to suggest that the odds of one are rising. Leading indicators continue to point to a recession, while the drop in M2 money supply continues at a pace that suggests one, too.”

Did the recent employment report support a more optimistic viewpoint?

Last week, business intelligence and data provider Statista reviewed the implications of the most recent employment report. Statista’s perspective was definitely more positive about the chances for a “soft landing” scenario.

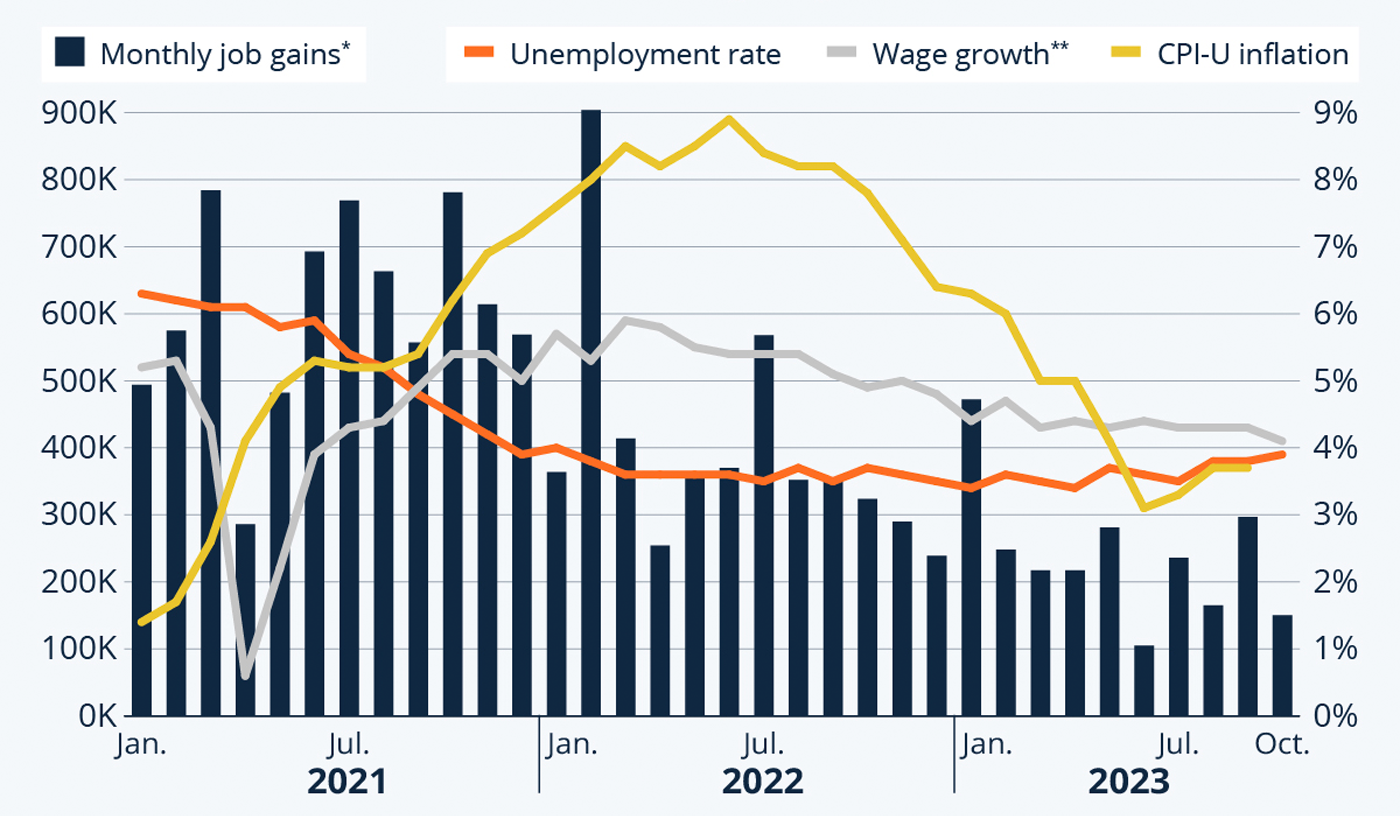

“According to last week’s employment report, U.S. job growth slowed down faster than expected in October, as strikes against Detroit’s automakers led to a decline in manufacturing jobs. The economy added 150,000 payrolls last month, marking the second lowest gain since January 2021. Economists had expected 180,000 new jobs, after the labor market had proven stronger than expected in the previous two months. Employment gains for August and September were revised down by 62,000 and 39,000, respectively, however, meaning that total employment going into October was 101,000 jobs lower than previously reported.

“These numbers along with a slight uptick in the unemployment rate, which stood at 3.9 percent in October, and a slowdown in nominal wage growth all point towards a cooling of the labor market, increasing the odds of the Fed refraining from further rate hikes for now. More importantly, the latest jobs report, which some described as ‘very Fed-friendly,’ fueled hopes of a so-called soft landing, i.e. a scenario in which the Fed manages to bring down inflation without plunging the economy into recession and a period of high unemployment. Pointing in the same direction is the latest GDP report, which showed an acceleration of economic growth in the third quarter, thanks to growing consumer confidence in light of cooling inflation.

“As our chart illustrates (Figure 2), many key indicators are currently moving in the right direction to fuel hopes of a soft landing.”

FIGURE 2: KEY LABOR MARKET AND INFLATION INDICATORS (SEASONALLY ADJUSTED)

Notes: *Monthly change in total nonfarm employment **Year-over-year change in average hourly earnings for all private employees

Sources: Statista, U.S. Bureau of Labor Statistics

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

RECENT POSTS