The financial challenges facing the Federal Reserve

The financial challenges facing the Federal Reserve

In this week’s edition of “Three on Thursday,” we delve into the current financial challenges facing the Federal Reserve. Back in 2008, the Federal Reserve embarked on a novel experiment in monetary policy by transitioning from a “scarce reserve” system to one characterized by “abundant reserves.” In addition to inflation, this experiment has resulted in some other developments that are worrisome. Higher interest rates have resulted in substantial unrealized losses on the Fed’s securities portfolio. Simultaneously, they have caused the Fed to pay out more in interest to banks than it is earning, resulting in sizable and ongoing losses. To offer deeper insights into this matter, we have included the following two charts and table.

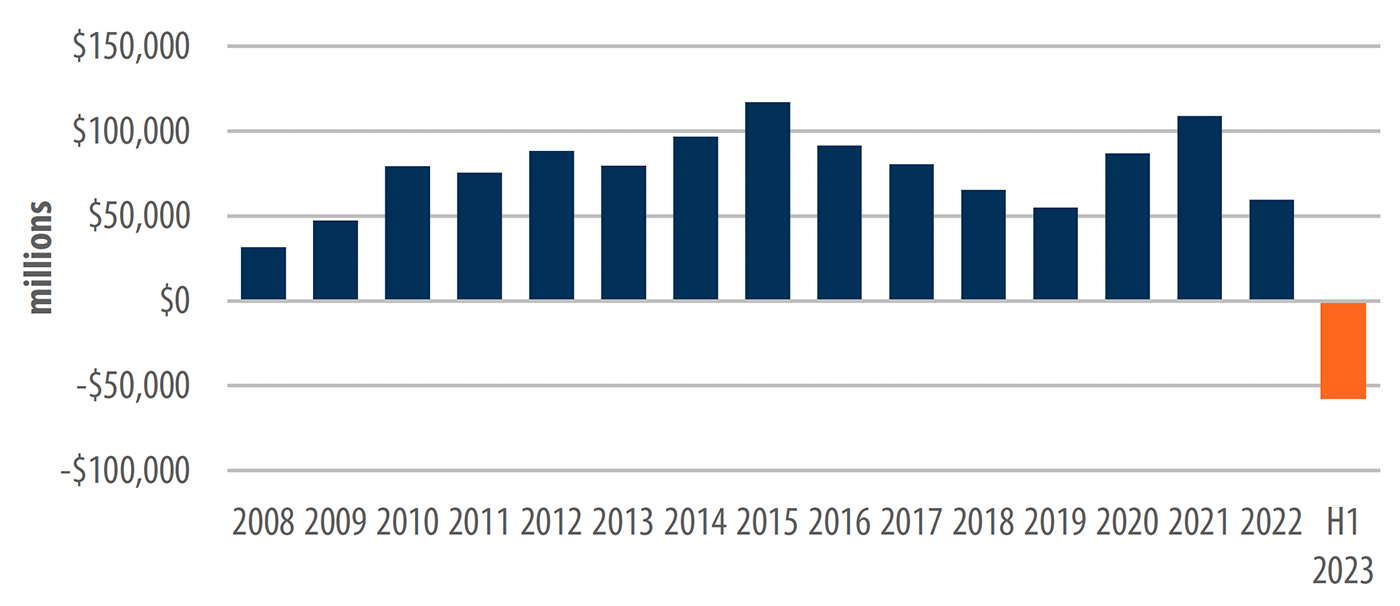

Before 2022, the Fed was able to buy Treasury and mortgage-backed securities (MBS) that generated higher yields than what it was paying banks. Consequently, the Fed consistently earned substantial operating surpluses, which were then remitted to the Treasury Department on a weekly basis. Over a span of 15 years, the Federal Reserve contributed an average of over $75 billion annually to government revenue through this mechanism. But now, after the equivalent of 21 quarter-point rate hikes in about a year and a half, it pays banks 5.4% per annum to hold reserves—much more than what it earns from its portfolio of Treasury bonds and MBS, leading to $58.1 billion in losses over the first half of 2023. These accumulated losses are called a deferred asset on the Fed’s balance sheet and will only be paid off if/when the Fed starts to make a profit again down the road.

FIGURE 1: NET EARNINGS REMITTANCES TO THE TREASURY DEPARTMENT

Sources: Federalreserve.gov, First Trust Advisors; data from 2008 through the second quarter of 2023

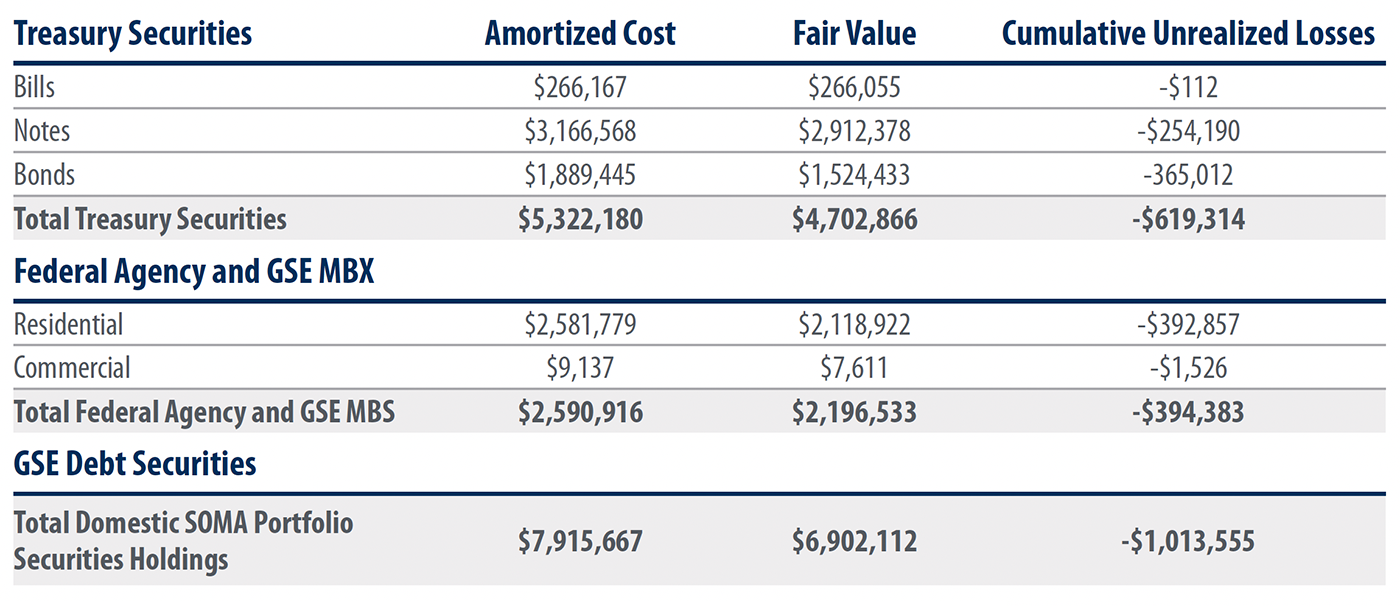

The Federal Reserve has $1.0 trillion in unrealized losses on its balance sheet, but it’s important to note the unique position it’s in. Unlike many financial institutions, the Fed doesn’t face solvency concerns because it’s not required to mark its portfolio to market values. The Fed has the option to hold its securities until they mature, and there’s no regulatory agency that can intervene and force it to shut down due to accounting losses. With total reported capital of just $42 billion in Q2 of 2023, the Fed’s unrealized loss of $1.0 trillion represents a staggering 24 times its capital.

TABLE 1: DOMESTIC SOMA PORTFOLIO HOLDINGS

Note: The Federal Reserve System Open Market Account (SOMA) contains dollar-denominated assets acquired through open market operations.

Sources: Federalreserve.gov, First Trust Advisors; data as of the second quarter of 2023

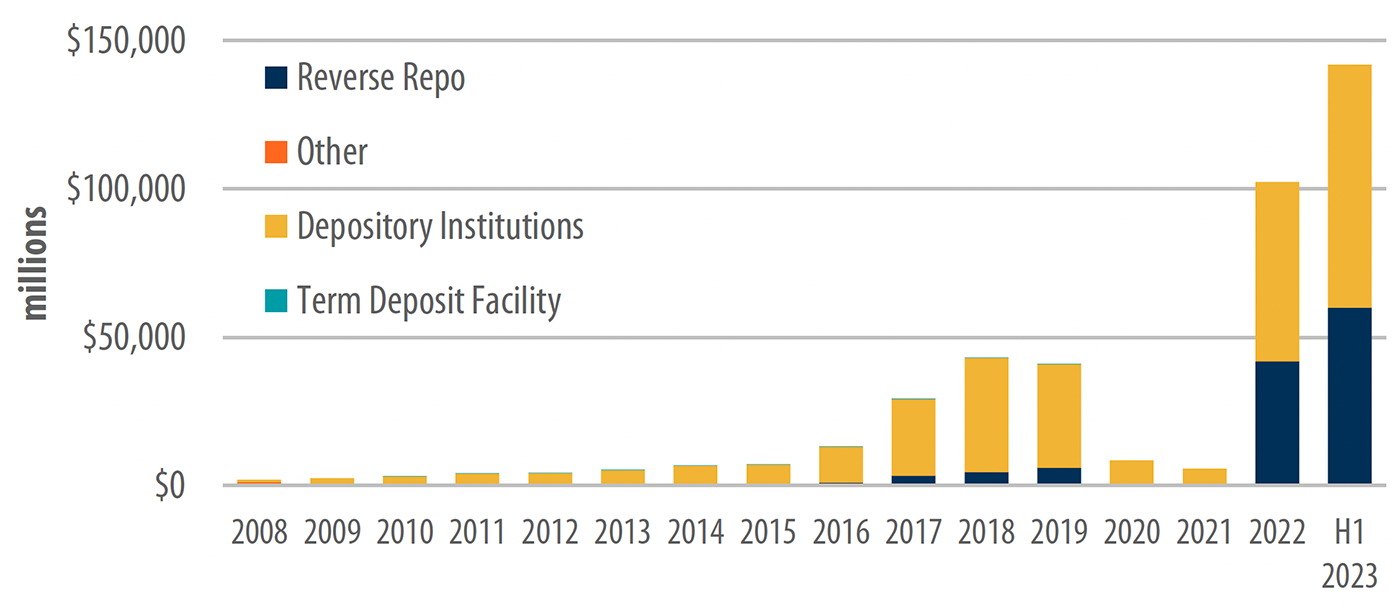

Meanwhile, the Fed is set to pay banks and other institutions close to $300 billion this year at current interest rates to just hold reserves, money that must ultimately come from taxpayers. So far through just the first half of this calendar year, banks and other institutions have already received $141.8 billion in risk-free income, more than the $102.3 billion they received for all of 2022.

FIGURE 2: INTEREST PAID TO BANKS AND INSTITUTIONS BY THE FEDERAL RESERVE

Sources: Federalreserve.gov, First Trust Advisors; data from 2008 through the second quarter of 2023

Editor’s note: Brian Wesbury is chief economist at First Trust Advisors LP. He and his team prepare a weekly market commentary titled “Monday Morning Outlook,” as well as frequent research reports. Proactive Advisor Magazine thanks First Trust for permission to republish an edited version of this commentary, which was first published on Oct.12, 2023.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

First Trust Portfolios LP and its affiliate First Trust Advisors LP (collectively “First Trust”) were established in 1991 with a mission to offer trusted investment products and advisory services. The firms provide a variety of financial solutions, including UITs, ETFs, CEFs, SMAs, and portfolios for variable annuities and mutual funds. www.ftportfolios.com

RECENT POSTS