Exploring the current landscape of the ‘AI revolution’

Exploring the current landscape of the ‘AI revolution’

The constant stream of artificial intelligence (AI) news and market developments can be overwhelming. A big-picture look at key trends and concepts helps make sense of the AI landscape.

It seems like every third email in my inbox, whether a market update, newsletter, or webinar invitation, mentions artificial intelligence (AI).

This is not a new topic—we first discussed transformative technologies, including AI, in Proactive Advisor Magazine in 2017.

Since then, we have looked at a variety of AI-related topics, including AI’s increasingly important role in financial planning and the accelerating development of AI-enabled investment management technology.

However, the constant stream of AI news can be overwhelming. For me, it’s like continually peeling an onion to get to the next layer. And that next layer, and the layers beneath, are in constant flux.

I thought it would be a good idea to take a step back and attempt to connect some dots surrounding the “AI revolution.”

How does AI itself define the AI revolution?

Microsoft CoPilot offers a compelling definition:

“The AI revolution refers to the extraordinary changes in technology brought about by artificial intelligence (AI). Unlike previous waves of technology, AI has the unique ability to unleash new powers and transform existing power structures. Here are some key aspects of the AI revolution:

- “Proliferation of Power: Unlike earlier technologies, AI is not limited to a small elite or national governments. It’s becoming more powerful and radically cheaper by the month. What was computationally impossible or prohibitively expensive a few years ago is now widespread.

- “Doing, Not Just Broadcasting: While the internet era focused on broadcasting information, the AI revolution is about doing. AIs can manage tasks, develop business strategies, design drugs, and even plan invasions. The pace of change is unprecedented.

- “Neural Networks and AI Chips: The driving force behind this revolution includes neural networks, GPT [generative pre-trained transformer] architectures, and specialized AI chips. These technologies enable AI systems to perform tasks we once thought only humans could do.

“In summary, the AI revolution is reshaping our world, unlocking new possibilities, and redistributing power on an unprecedented scale.”

It is pretty telling that this definition was largely derived from two third-party articles. It reminds us that the current consumer applications of AI, and most applications in general, are sophisticated, iterative, and algorithm-based processes built on preexisting data and knowledge bases. That is not necessarily a bad thing, but it introduces the risk of bias, intentional or not.

A related piece from CoPilot explores ethical concerns related to AI, including bias and fairness; reliability of source data; data privacy and protection; accountability; and impacts on the environment, society, and the workforce.

![]() Related Article: Revolutionizing investment risk management through the power of AI

Related Article: Revolutionizing investment risk management through the power of AI

Concerns about the unchecked power of AI have existed for decades. For early consumer exposure to AI, you can look to Stanley Kubrick’s 1968 classic film, “2001: A Space Odyssey,” which explored themes related to human evolution, technology, artificial intelligence, and the possibility of extraterrestrial life.

Carrying the movie reference one step further, a 2024 outlook survey conducted among institutional investors framed AI opportunities and concerns in the context of several popular movies:

“On the one hand, 75% believe AI will unlock investment opportunity that was otherwise undetectable. On the other, almost four in ten (38%) worry that AI poses an existential threat to civilization as we know it. …

“Half of those surveyed say their view on AI is best captured by the film Moneyball, telling us AI is nothing more than a tool analyzing data to find hidden opportunity. …

“… Just 6% worry about the machines taking over as the dystopian future of The Terminator. Few (10%) see it as being a boon to humanity either… like the title character in Disney’s Wall-E.

“Most telling of institutional concerns about AI are the 35% who likened it to the 1983 film War Games, in which a teenage hacker unwittingly sets off a nuclear war protocol thinking it was nothing more than a video game.”

How is business adoption of AI turning into economic opportunity?

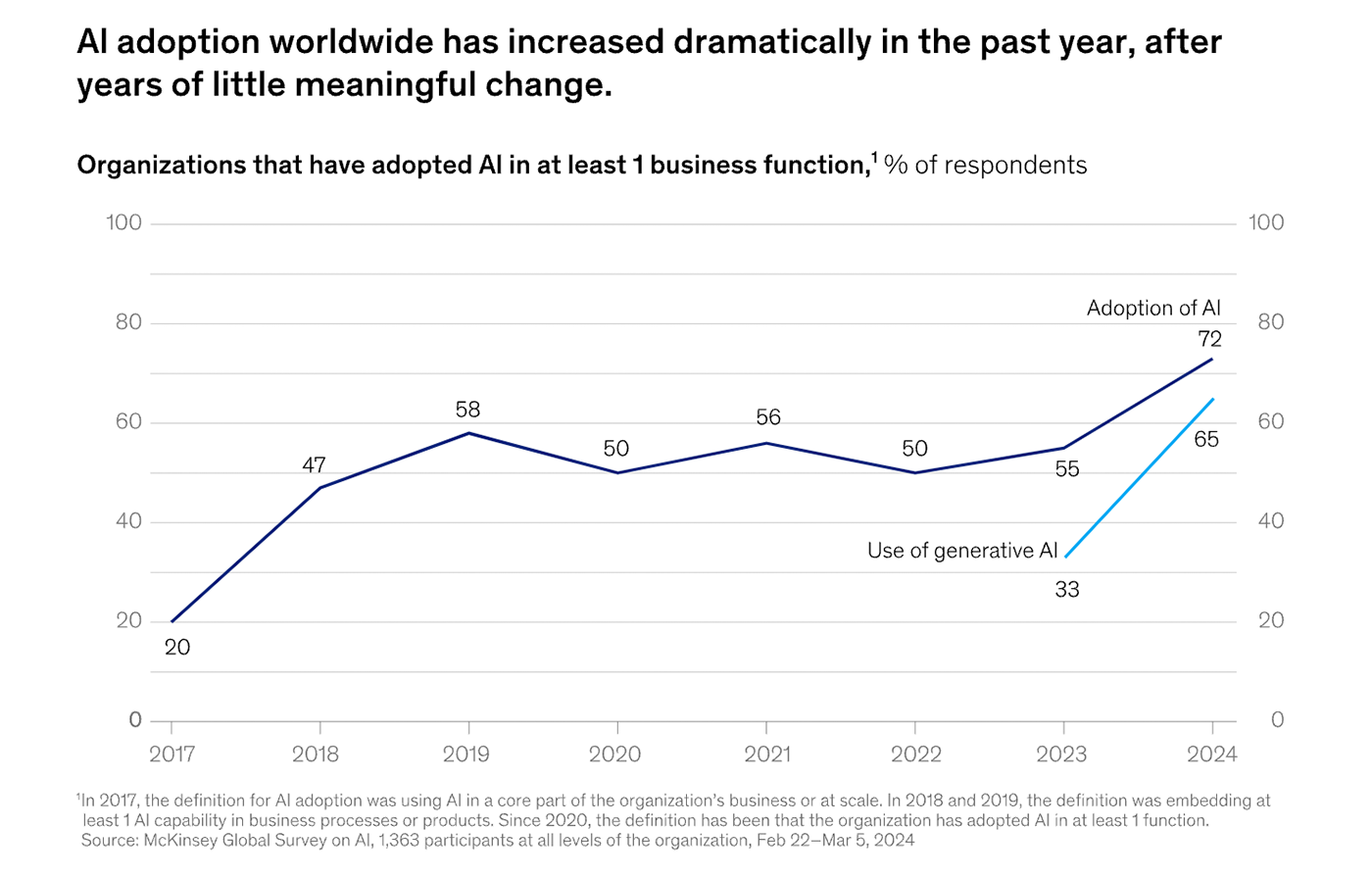

McKinsey and Company offers this assessment regarding the continued growth in business adoption of generative AI:

“If 2023 was the year the world discovered generative AI (gen AI), 2024 is the year organizations truly began using—and deriving business value from—this new technology. In the latest McKinsey Global Survey on AI, 65 percent of respondents report that their organizations are regularly using gen AI, nearly double the percentage from our previous survey just ten months ago. Respondents’ expectations for gen AI’s impact remain as high as they were last year, with three-quarters predicting that gen AI will lead to significant or disruptive change in their industries in the years ahead.”

Sources: McKinsey and Company, The state of AI in early 2024, McKinsey Global Survey on AI

In another report, McKinsey estimates the economic value unleashed by generative AI in some key industry segments:

“The emergence of generative AI (gen AI) presents both a challenge and a significant opportunity for leaders looking to steer their organizations into the future. How big is the opportunity? McKinsey research estimates that gen AI could add to the economy between $2.6 trillion and $4.4 trillion annually while increasing the impact of all artificial intelligence by 15 to 40 percent. In the technology, media, and telecommunications (TMT) space, new gen AI use cases are expected to unleash between $380 billion and $690 billion in impact—$60 billion to $100 billion in telecommunications, $80 billion to $130 billion in media, and about $240 billion to $460 billion in high tech. In fact, it seems possible that within the next three years, anything not connected to AI will be considered obsolete or ineffective.”

Understanding the broader structure of AI and its market impact

AI-leading companies, especially Nvidia (NVDA), have significantly impacted recent earnings and dominated S&P 500 returns this year.

Bespoke Investment Group calculated in June that the S&P 500 Index would be about 20% lower without the gains made by companies in its basket of 30 AI-oriented stocks. Before a pullback in mid-to-late June, MarketWatch asserted that Nvidia alone “has driven 34.5% of the S&P 500’s advance so far in 2024 [through June 14].”

AI’s influence has not been limited to companies directly related to AI technology or platforms. FactSet notes that 199 S&P 500 companies mentioned AI in earnings conference calls during the March–May 2024 period.

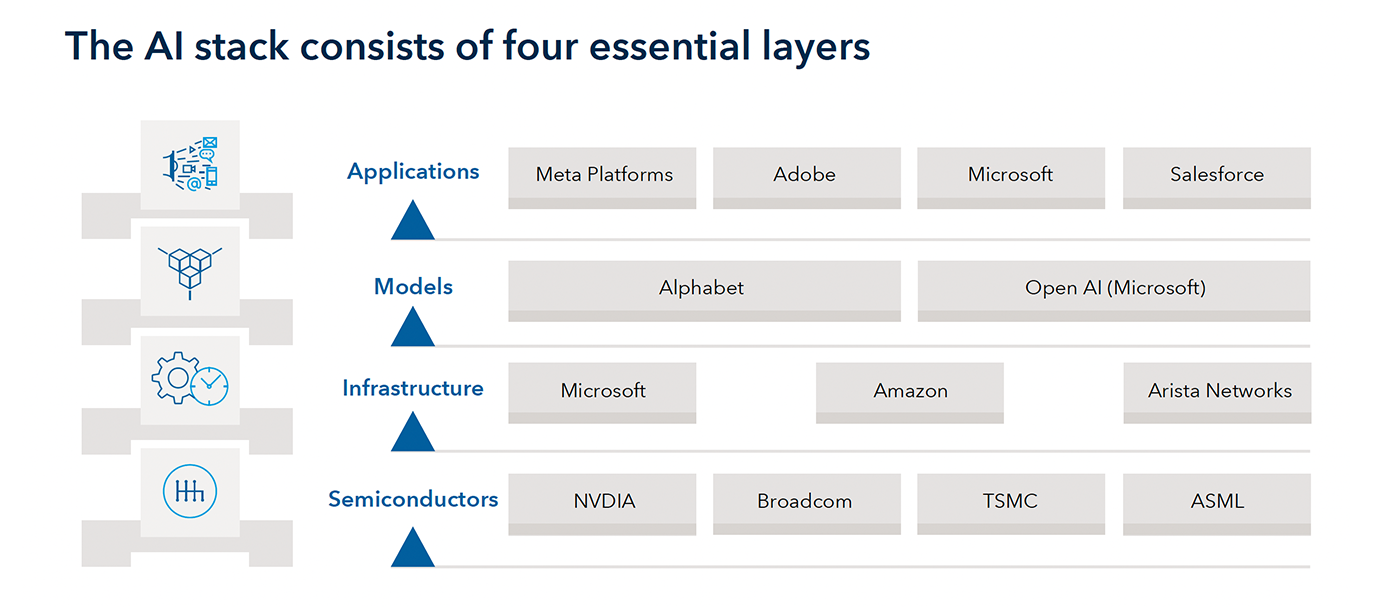

Where do the key players fit into the AI infrastructure? The following Capital Group schematic presents a clear view of what it calls the “AI stack”—technology that enables AI to operate. The illustration includes companies that lead market share in each segment.

Source: Capital Group

The future impact of emerging technologies

The previous exhibit is just one snapshot of the current AI environment. Looking ahead, a thought-provoking article in Proactive Advisor Magazine explores the broader technology revolution, with many of the new trends impacted by AI. The article’s author, Martha Stokes, notes,

“In 1985, the emergence of personal computers, software, semiconductor materials, integrated circuits, telecommunication, and internet technology fueled the great bull market that peaked in 2000.

“Today, several technological advancements are close to being introduced to the market or achieving widespread acceptance, including the following:

- “Digital and crypto technologies: advanced phases of distributed ledger technology (DLT) that could support the decentralization of industry, finance, and monetary systems.

- “Robotics and automation: assembly lines, robots replacing human workers, and business hyperautomation.

- “Sensing and AI innovations: sensors, image sensor technologies, integrated artificial intelligence, advanced machine learning, voice user interface (VUI), machine vision, facial recognition, advanced language and audio interpretation, scent recognition, and pressure recognition.

- “Data and connectivity: advanced dark data mining, enhanced connectivity technologies, 5G, personalization internet technologies, and the Internet of Behaviors (IoB).

- “Virtual and augmented realities: the metaverse and extended reality (XR).

- “Health and biotechnologies: personalized health care, humanoid robots for health care, and integrated wearables like smart clothing and implants.

- “Sustainable and advanced materials: integrated solar technologies and second-phase nanotechnology.

- “Logistics and transportation innovations: supply-chain reinvention and platooning.”

What does this mean from an investment perspective?

Investors certainly want exposure to the upside potential presented by what might be the next great secular bull market—one driven by technology.

Stokes notes, “With just a few of the 20-plus new technologies now in the mass market phase, there should be substantial fundamental support for further growth in new streams of corporate revenues and operating efficiencies across many industry sectors.”

However, some analysts believe a major tech shakeout, similar to the early 2000s, might be on the horizon, with a highly concentrated stock market ripe for a major correction.

As this market risk, and many others, are ever-present, advisors and their investor clients should consider a disciplined, rules-based strategic approach for portfolio allocations. Such an approach, incorporating dynamic risk management, aims to mitigate the risk of large market drawdowns while seeking opportunities and growth in highly rated sectors and favorable market environments.

Flexible Plan Investments (FPI), a leading third-party investment manager, is one firm incorporating artificial intelligence methodologies into its strategic development process. FPI’s research team says some of FPI’s strategies can “learn from their experiences” and rapidly adapt to changing market conditions. The firm uses a “walk-forward optimization approach,” which involves testing a strategy by finding its optimal trading parameters in a past segment of market data and then checking the performance of those parameters by testing them over subsequent periods. The framework is also applied in backtesting—a process that tests strategies using historical data to evaluate their potential performance—to reduce biases and provide more realistic performance expectations.

If, as Stokes suggests, this young secular bull market “has the potential for many years of growth,” well-diversified investors should be able to capitalize on it through a blend of quantitatively-based strategies that can be customized for investors all along the risk spectrum.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

RECENT POSTS