COVID+4: Have we achieved ‘normalization’—financial or otherwise?

COVID+4: Have we achieved ‘normalization’—financial or otherwise?

On the fourth anniversary of the COVID outbreak, most Americans believe their lives are mostly back to normal. However, the economic and financial aftereffects remain a major concern.

This month is the fourth “anniversary” of the World Health Organization (WHO) declaring COVID to be a global pandemic.

Although we may not want to, I think everyone remembers the major impacts of COVID: the severe illness, hospitalizations, and tragic deaths; shutdowns affecting all aspects of our daily lives; vaccine controversies and anxiety surrounding availabilities; and great economic, employment, health-care, education, and societal uncertainty. It is hard to underestimate the varied impacts of this period in our history.

Do people perceive COVID as being ‘over’?

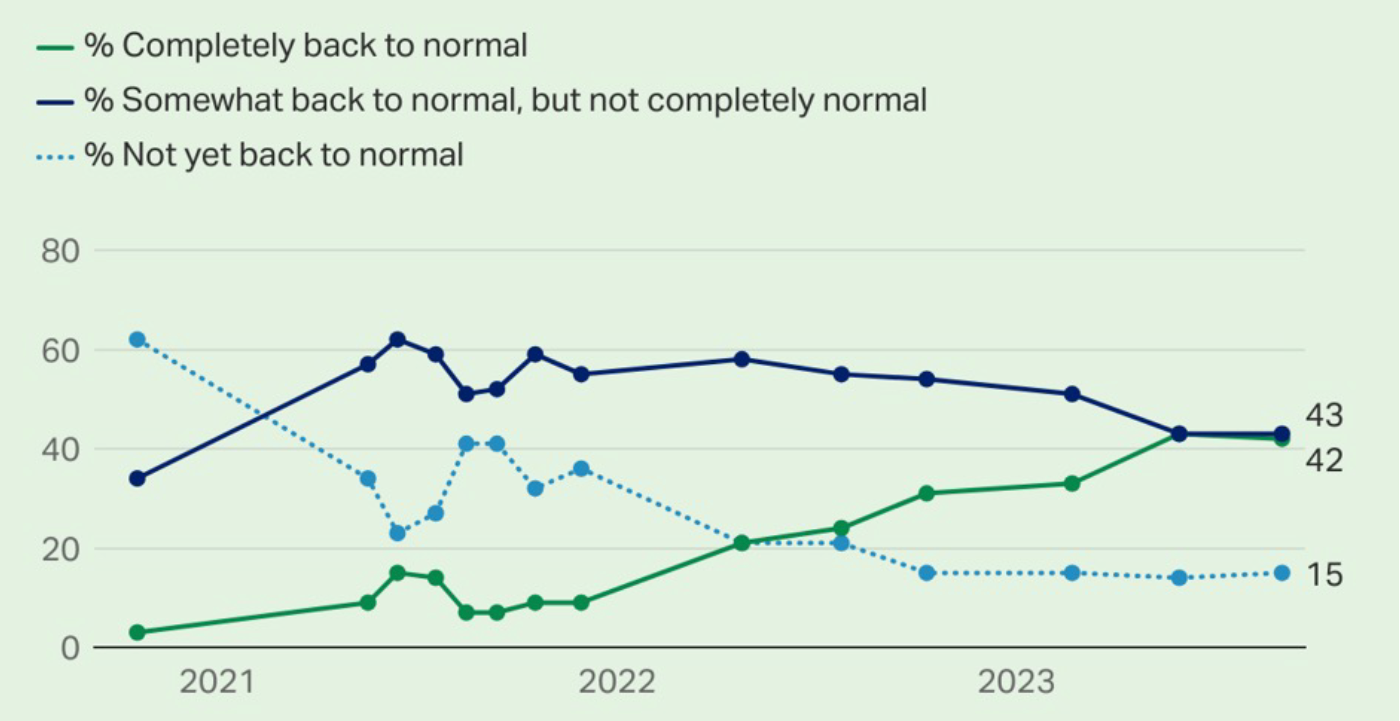

Gallup research conducted in August–September 2023 reported that Americans’ attitudes about COVID reflect less concern for COVID’s impact on daily lives, while recognizing that the coronavirus has not gone away:

“Americans spent much of 2022 and 2023 growing more positive in their assessments of the COVID-19 situation. But at summer’s end, they became a bit less confident and slightly more worried—perhaps reflecting the rise in COVID-19 infections and emergence of new variants.

“… Forty-two percent say their life is completely back to normal, and an equal proportion say their life is somewhat back to normal (43%).”

FIGURE 1: AMERICANS’ PERCEPTION OF A RETURN TO NORMALCY SINCE THE PANDEMIC

Source: Gallup

Dr. Ashish Jha, dean of the Brown University School of Public Health, summed up the current COVID situation in January 2024: “The straight facts are: COVID is not gone, it’s not irrelevant, but it’s not the risk it was four years ago, or even two years ago. … It’s totally reasonable for people to go back to living their lives.”

Do consumers see a post-COVID financial ‘normalization’?

It is hard to make that case.

Since 2020, there have been major shifts in both fiscal and monetary policy. Cause and effect can be debated but the results are clear: higher government spending and an ever-rising national debt; soaring inflation that has been slowly improving; and a rapid anti-inflation increase in the fed funds rate in 2022–2023, after cuts in rates in response to COVID in 2020.

While the rate of inflation growth has decreased, that is little solace to American households dealing with cost-of-living expenses that have increased anywhere from 17% to more than 20% over the past three calendar years. Similarly, arguments that interest rates are not all that high by historical standards are minimizing the impact on individuals and households trying to buy a home or automobile, paying off a variable-rate loan, or dealing with high credit card balances. It is especially jarring to younger people who have become accustomed to relatively low interest rates for much of this century.

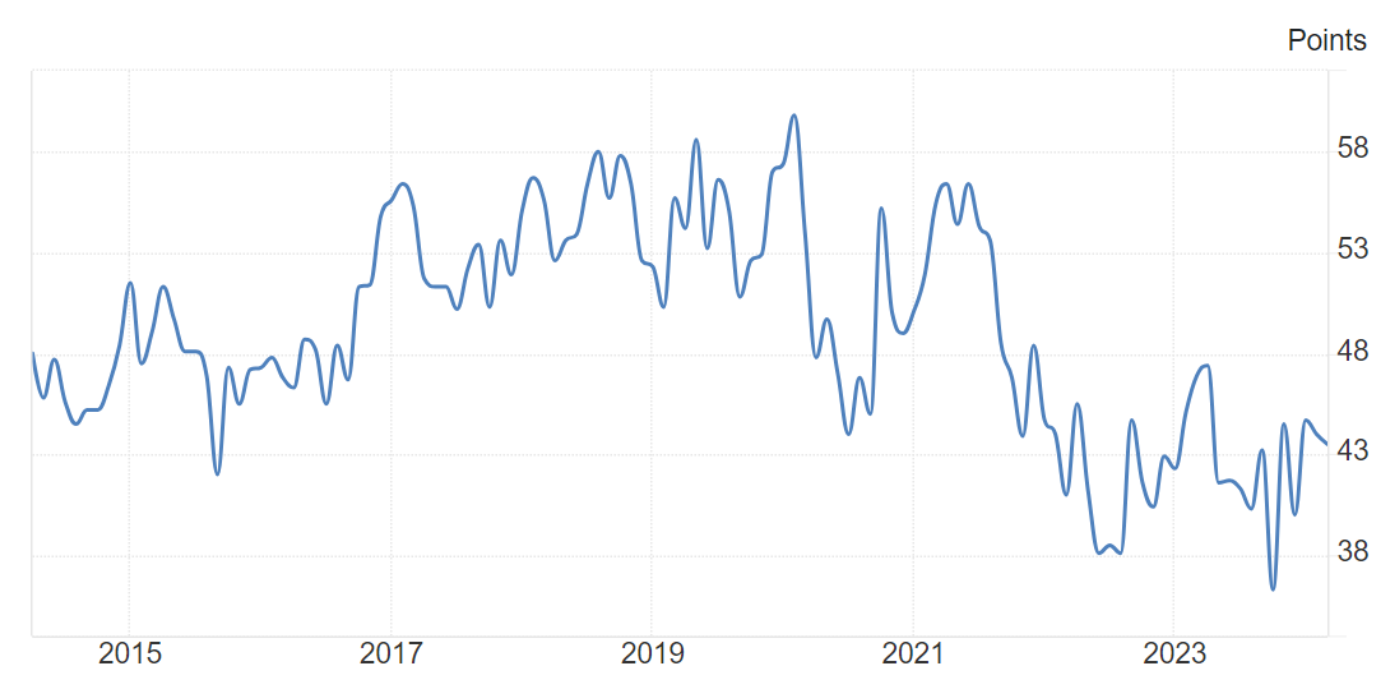

The University of Michigan Consumer Sentiment survey, The Conference Board’s Consumer Confidence Index, and the RCM/TIPP Economic Optimism Index all point to some improvement in consumer attitudes about their financial outlook, coincident with inflation measures improving. But there is a long way to go, with the Economic Optimism Index “remaining in negative territory [under 50] for 31 consecutive months.” (This Index’s components include an economic outlook, personal financial outlook, and confidence in federal economic policies.)

FIGURE 2: U.S. ECONOMIC OPTIMISM INDEX

Sources: RealClearMarkets (RCM), Trading Economics

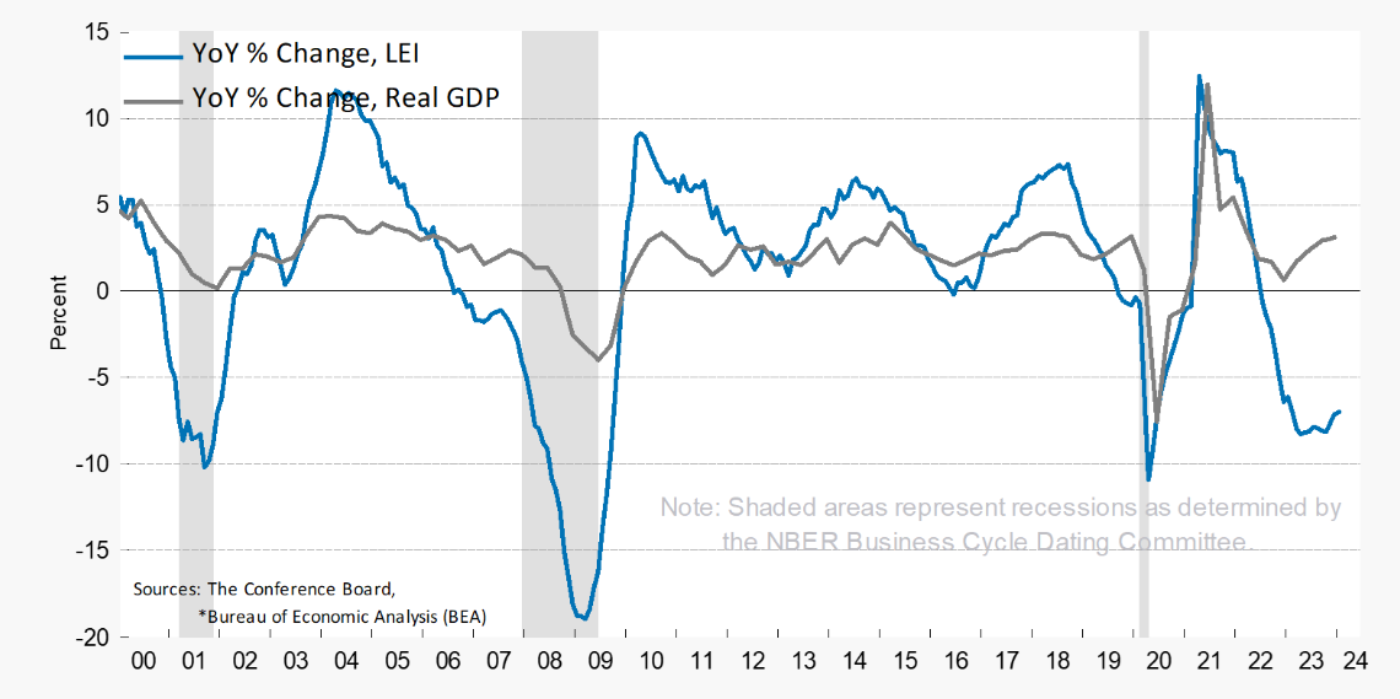

Despite ongoing concerns over inflation, the economy, employment prospects, wages, and interest rates, the good news is that the much-anticipated recession has not appeared, the unemployment rate is low, and GDP growth remains positive despite spotty business conditions. The Conference Board Leading Economic Index (LEI), while showing some improvement, continues to be in negative territory (see Figure 3). Although U.S. household wealth is at record levels, wealth distribution by income levels remains a hot-button political issue. Unfortunately, credit card debt is also at record levels.

FIGURE 3: THOUGH THE LEI DECLINED IN JANUARY 2024, IT WAS AT THE SLOWEST PACE SINCE MARCH 2023

Sources: The Conference Board, Bureau of Economic Analysis (BEA)

What are the implications for investors?

The past four years have been a unique period for investors, to say the least.

It started with the global COVID “flash crash” that began on Feb. 20, 2020, which included several days of declines between 8% and 13% for the Dow Jones Industrial Average. The S&P 500 had a 33.9% drawdown in 2020 before one of the fastest market recoveries in history, finishing the year with a total return of 18.4%. (See “Why 2020 was a rare opportunity to judge an active manager’s performance.”)

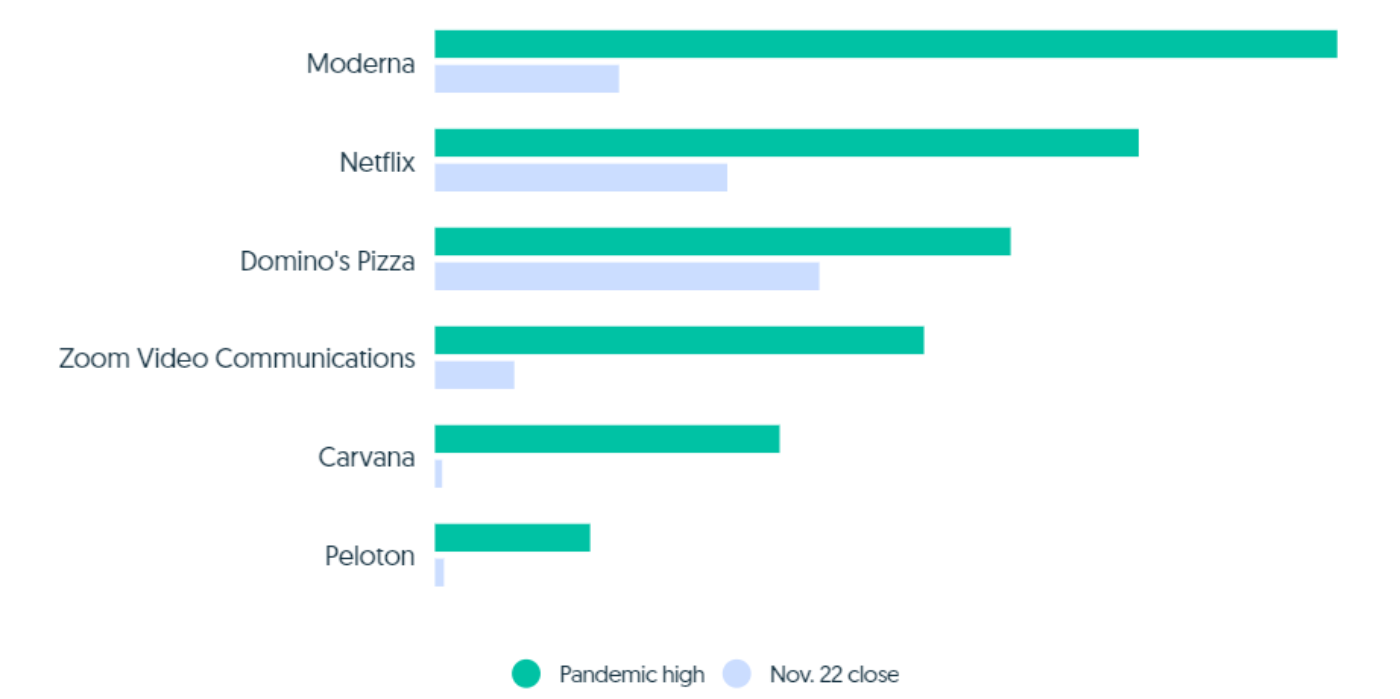

The fallout from COVID created some interesting short- and long-term trends, such as the phenomenon of “meme stocks,” thought to be largely pursued by younger self-directed investors fueled by stimulus checks and trading on platforms like Robinhood. We also saw a boom-and-bust cycle for several stocks that soared during the early months of the pandemic, like Zoom, Peloton, and Moderna, which gave up much of those gains by 2022. Netflix (and Amazon) also rocketed higher in 2020–2021, then fell hard, but have since made comebacks.

FIGURE 4: PANDEMIC STOCKS THAT FELL SHARPLY FROM THEIR HIGHS

Source: Crunchbase

Looking at broader asset classes, the past four years have seen a stubborn bear market for bonds, a stop-and-go bull market for gold (recently reaching all-time highs), extreme volatility for cryptocurrencies, and crude oil front-month futures that had about a $100 swing between the lows of 2020 and the highs in 2022—settling back down to fairly range-bound trading for most of 2023 and 2024.

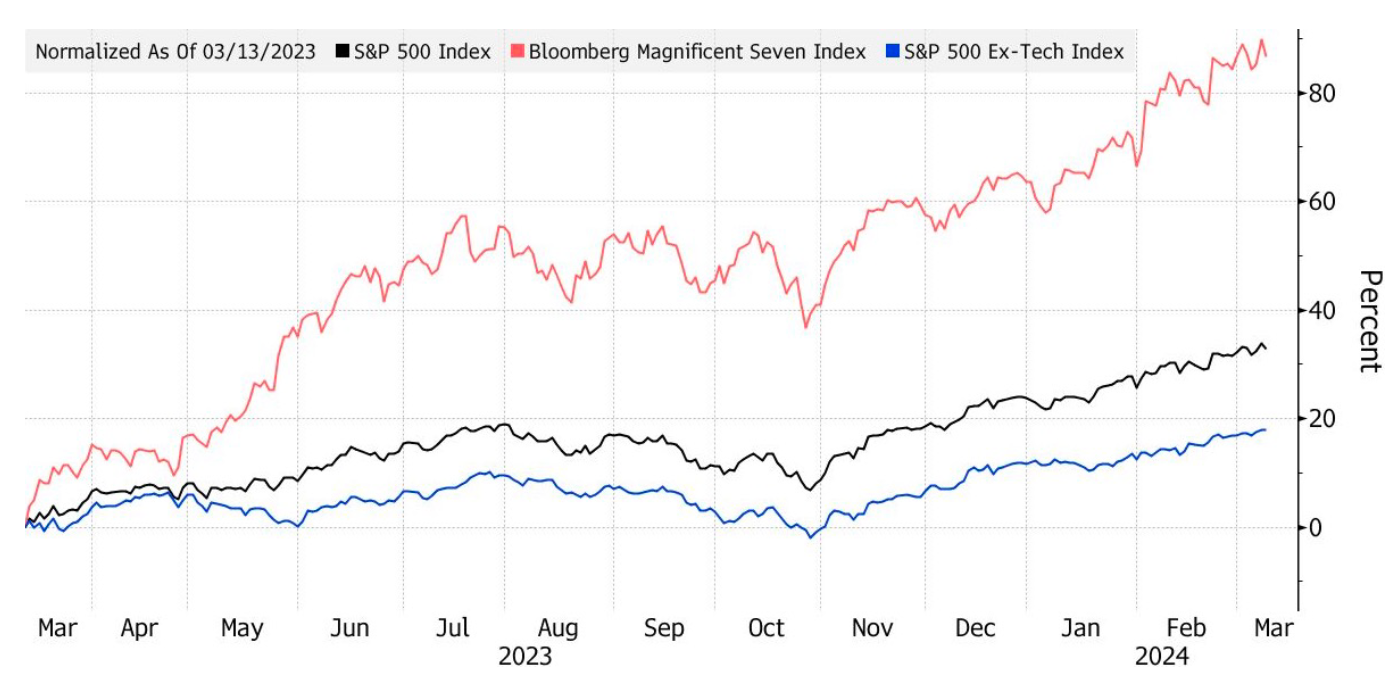

Moving to today’s U.S. equity situation, it is hard to argue with market indexes that have been up for four consecutive months and consistently reaching new all-time highs.

However, some analysts do make the argument that on an inflation-adjusted basis, the rally since October 2022 has been less impressive than typical cyclical bull markets. And the financial press has also consistently mentioned the lack of breadth of the current rally across late 2023 and early 2024—as well as the elevated Shiller P/E ratio (indicating an overvalued market). Through the first two months of 2024, according to Barron’s, four stocks (Nvidia, Amazon, Microsoft, and Meta Platforms) accounted for 59% of the S&P 500’s gains. However, Goldman Sachs points out, says Bloomberg, that “while the US equity market’s concentration [see Figure 5] is the highest in decades, the top stocks trade at much lower valuations than the largest names did at the peak of the tech bubble.”

FIGURE 5: BIG TECH DRIVES S&P 500 GAINS OVER THE PAST YEAR

Excluding tech, the SPX is up about 18% in the past 12 months

Source: Bloomberg

Many analysts think that there is much more left to the U.S. economy’s story in 2024—and not all of it may be positive. Will there be a recession, mild or otherwise? Could the U.S. employment situation deteriorate? Will the U.S. enter a period of stagflation? How will Federal Reserve rate policy ultimately play out? What will be the impact of the November elections? Will the artificial intelligence (AI) market phenomenon evolve in tangible ways to create a “fourth industrial revolution”—or is that many years away? And despite historical evidence that market momentum is on the side of the bulls, will some catalyst cause that to rapidly come to an end?

Navigating the future with an adaptive investment approach

We have interviewed many financial advisors who espouse the benefits of working with a third-party investment manager (or TAMP). These managers can provide a strategic investment approach that can adapt to ever-changing economic and market conditions.

Several benefits advisors have mentioned include the following:

- Access to modern, rules-based analytical strategies in portfolio allocations and the research capabilities and focus of a dedicated team of investment strategists.

- Emphasis on risk mitigation and dampening volatility.

- Helping to remove “emotion” from investment decision-making, which can result in higher levels of client satisfaction over full market cycles.

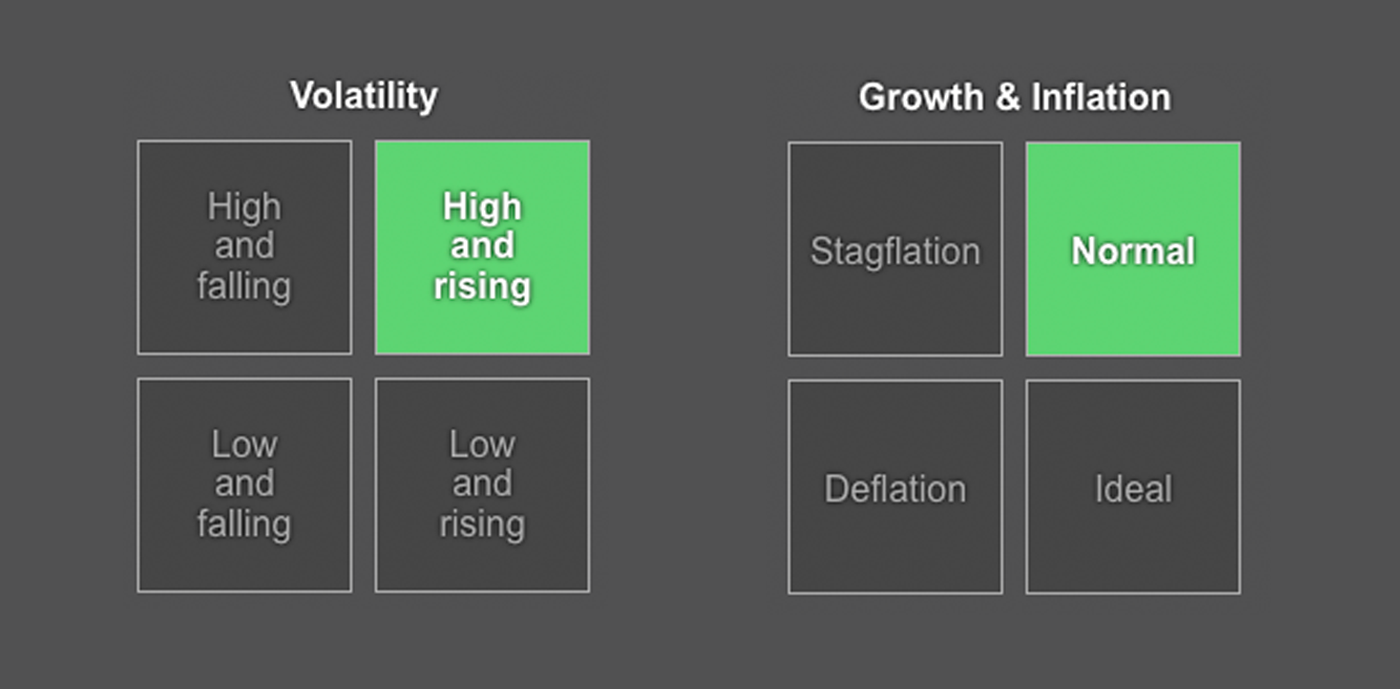

- The ability to identify strategies that have historically performed best in different types of markets (bull, sideways, or bear markets), as well as different volatility and economic regimes. One TAMP uses the following model to assess current regimes.

FIGURE 6: EXAMPLES OF CURRENT VOLATILITY AND GROWTH/INFLATION ECONOMIC REGIMES

Source: Flexible Plan Investments, data analysis as of March 12, 2024

Strategically diversified portfolios can then seek to mitigate risk by using varied asset classes allocated among multiple actively managed strategies, each guided by a different methodology. The result for clients is in implementing a dynamic and sophisticated portfolio strategy that seeks to deliver competitive returns in both bull and bear markets, while mitigating the steep drawdowns of unfavorable market and economic scenarios.

Why is this important?

While the worst impacts of the COVID crisis are now mostly seen in the rearview mirror, history tells us that systematic market risk is something that never really goes away.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

RECENT POSTS