Correcting five common misconceptions about TAMPs

Correcting five common misconceptions about TAMPs

While outsourced investment management has become increasingly important for many advisory practices, some advisors still have a poor understanding of the role and capabilities of TAMPs.

There’s a lot of confusion among advisors over what a turnkey asset management program (TAMP) is—and isn’t. According to The Wealth Advisor, about two-thirds of financial advisors don’t understand what TAMPS do or how they work.

At their most basic level, TAMPs offer a way for advisors to outsource some or all of their everyday investment management responsibilities.

Grier Rubeling, principal at Advisor Transition Services, likes the definition provided by a representative of a well-known TAMP firm: “A TAMP is a platform where an advisor can easily access suitability, investment management, and trading tools.”

But many TAMPs go beyond this to offer a complete suite of services that enable advisors to outsource just about any aspect of their practice.

Still, many advisors are resistant to using TAMPs for a variety of reasons, some of them based on common misconceptions we’ll now to try correct.

Misconception 1: TAMP firms are simply subadvisors with a fancy name

There’s some element of truth to this, but it ignores the enhanced capabilities of many TAMPs. When you outsource investment management of your clients’ portfolios to a TAMP firm, you’re essentially hiring them as a subadvisor.

TAMPs can offer both proprietary and third-party strategies that can be implemented for your clients through mutual funds and ETF wrap accounts or separately managed accounts (SMAs) comprising individual stocks and bonds.

Many TAMPs also offer unified managed accounts (UMAs) that organize multiple accounts owned by a single client into separate “sleeves,” making it make it easier for you to view, analyze, and rebalance your clients’ portfolios.

Like traditional subadvised accounts, the TAMP handles ongoing trading of securities and funds in each client account. Most can also handle tax-loss harvesting and rebalancing at the portfolio level, or you can do it yourself.

Most TAMP firms implement their own strategies or those provided by outside managers using models. The models determine the allocation of individual securities or mutual funds or ETFs within the client’s account.

When the strategy’s portfolio manager changes the model, the TAMP can quickly implement these changes across all underlying accounts.

Most TAMP firms generally fall into two categories:

- Investment-only TAMPS: These tend to be smaller firms that only offer outsourced investment management capabilities.

- Multi-service TAMPS: These firms offer investment capabilities plus additional business support services, which may include outsourced back office, IT, compliance, and marketing support.

Most TAMPs also offer access to sophisticated technologies that can either be fully integrated into your existing technical infrastructure or replace it entirely. Many TAMP firms work with name-brand custodians, while others self-custody.

Misconception 2: Using TAMPs decreases my value as an advisor

TAMPs may not be appropriate for everybody. If you’re still an investment-only advisor, outsourcing the day-to-day management of your clients’ accounts may make them question why they need you.

On the other hand, if you’ve joined the growing ranks of advisors who are positioning themselves primarily as full-service, holistic financial planners who manage investments as part of their advisory model, partnering with a TAMP may enhance your overall value.

In fact, a 2018 Cerulli study found that 54% of CFP professionals were outsourcing investment management.

These full-service advisors are adapting their practices to reflect the reality that most of their clients and prospects aren’t hiring them solely to maximize investment returns.

They need help figuring out how much to save and invest effectively to live the way they want during retirement, developing a reliable retirement-income plan. They want guidance on how to plan today to pay for their children’s college costs. They’re seeking solutions to minimize their tax obligations, and leave as much money as possible to their heirs. And as they reach retirement age, there are a host of important decisions they must make regarding Social Security, health benefits, and long-term-care planning.

In short, they want to partner with professionals who can provide holistic approaches to solving their financial challenges. Improving investment results is just one piece of the puzzle.

Becoming a credible and trustworthy advisor requires a considerable investment of time on your part.

You need to gain the knowledge and requisite industry designations that legitimize your practice, master the intricacies of today’s sophisticated financial-planning applications, and keep up with ever-changing industry best practices so you can ensure that you’re providing accurate and relevant advice.

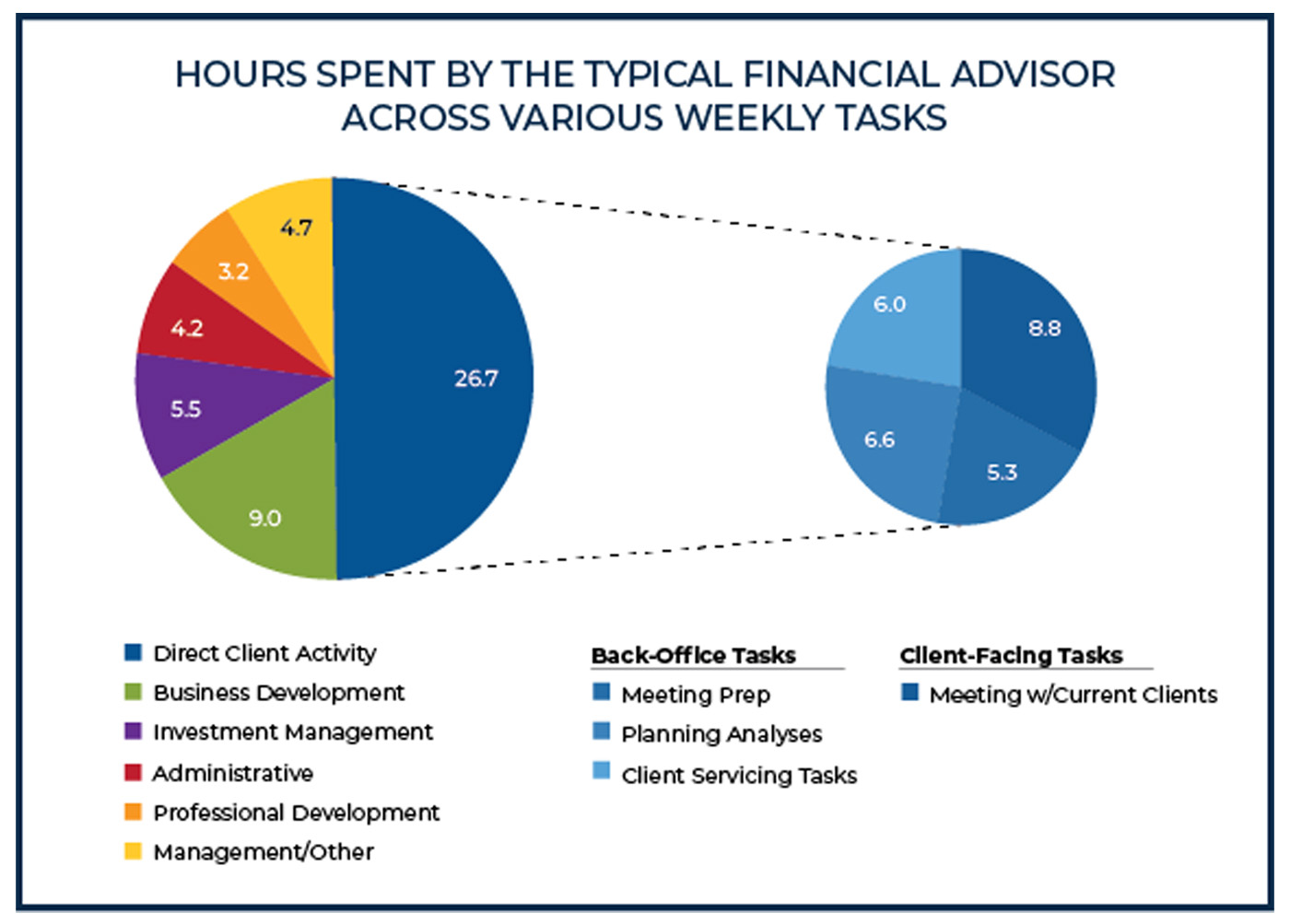

The following exhibit details the time demands on a typical advisor as they serve their clients and manage their practice.

Source: www.kitces.com

This time has to come from somewhere. If you’re like many advisors, you probably spend at least 5.5 hours of your workweek conducting routine investment management activities that don’t particularly enhance your value to clients.

Outsourcing investment management can give those precious hours back to you—hours you can use to deliver your far more valuable financial-planning advice.

And, contrary to what you might think, partnering with a TAMP firm may make you more valuable as an investment advisor.

That’s because instead of building and maintaining static, vanilla portfolios of mutual funds and ETFs, you’ll be able to offer clients access to specialized, professionally managed strategies that address a wide range of investment mandates and risk profiles.

These could include socially responsible strategies for values-based investors or direct indexing strategies for clients who want a more tax-efficient way to align performance of their equity allocations to the S&P 500 or other benchmarks. Additionally, there are tactical allocation strategies that employ active risk management that can shift money between equities, bonds, and cash based on market-driven risk-on/off signals triggered by sophisticated quantitative algorithms.

Tara Nolan, co-founder of Nolan Financial Partners, appreciates the value of these rules-driven strategies.

“The benefits of this approach include downside protection for client portfolios while seeking competitive returns, mitigating sequence-of-returns risk for those near retirement, and the behavioral benefit of having an investment plan built for the long term—one that helps alleviate emotional ups and downs for clients and increases the likelihood that they will stick with their plan,” she says.

Many TAMPs allow customization with their separately managed account strategies, such as allowing investors to exclude certain companies or sectors.

And even though the TAMP is handling day-to-day investment management of your clients’ accounts, you’re still quarterbacking the relationship with your clients and guiding them on big-picture investment decisions appropriate for their specific financial-planning needs.

You can mandate when and how often rebalancing and tax-loss harvesting occurs. In many cases, statements and performance reports may carry your firm’s branding. And you’ll still be your clients’ first point of contact whenever they have questions about their investments or need to redeem money from their accounts.

Misconception 3: Using TAMPs will increase the complexity of managing my practice

In reality, the reverse is often true.

Think of how much energy and effort you spend researching, selecting, and monitoring investment options for your clients. Or how much time you spend rebalancing their accounts, conducting tax-loss harvesting, or facilitating redemption requests.

When you outsource everyday investment management to a TAMP, you’re offloading these granular responsibilities.

Your main responsibility shifts from hands-on management to serving in a more consultative role, recommending asset-allocation models that align with your clients’ investment objectives and risk tolerance and evaluating and selecting strategies to fill each asset class.

Many TAMPs offer sophisticated risk profiling and portfolio construction tools that can do this for you, while giving you the flexibility to tweak the results.

Compliance becomes easier as well. Since you’re no longer buying and selling individual funds or securities, you no longer have to document the suitability of every trade or whether they were made on a discretionary or nondiscretionary basis. Instead, you only need to document how your interactions with clients determined the suitability of a particular strategy or model you selected for them.

Technology is a key selling point for most TAMP firms, and most are committed to providing solutions that align with the way you do business.

Some of these technologies can be fully integrated with your existing portfolio-management infrastructure, allowing the TAMP to handle trade execution, billing, and reporting using your existing custodian.

Other TAMP firms offer sophisticated cloud-based applications that can completely replace your existing technologies, giving you as much hands-on or hands-off management of your clients’ accounts as you want.

While outsourced investment management is still the core offering of all TAMP firms, many are expanding their suite of services to address the business-management challenges of independent wealth managers and RIAs.

These multi-service TAMP firms offer back-office support solutions that can automate common tasks like account opening, documentation, recordkeeping, and billing.

Some TAMPs have built teams of in-house specialists that serve as outsourced client service representatives; operations, IT, and compliance managers; and sales assistants.

Taking advantage of these services eliminates the time-consuming task of hiring, training, and supervising support staff. So, you can spend more time with your clients, and less time managing your back office.

Misconception 4: Working with a TAMP will limit the number of investment managers I can work with

Most larger TAMP firms offer both proprietary strategies managed by their in-house investment resources as well as access to other strategies from both well-known institutional asset managers and smaller, more specialized third-party investment managers with highly proprietary strategic approaches.

But their approved investment provider lists will be limited to managers and strategies that have passed their strict due diligence processes.

This is particularly important for SMA strategies. Credible TAMP firms only select SMA managers that fully comply with GIPS, the CFA Institute’s standardized process for reporting the performance of SMA composites.

They’ll also conduct extensive due diligence on each manager’s methodology, including scrutinizing back-tested results, to determine the validity of long-term performance claims.

So, when you work with a TAMP firm, the available investment managers and strategies may be somewhat restricted. But for most advisors, the offerings of most reputable TAMPs should provide suitable and effective choices for their clients—no matter where they fall along the risk spectrum.

Also, this doesn’t mean you can only work with one TAMP at a time. For example, you might be able to work with several different investment-only TAMPS serving solely as subadvisors.

You’d make separate arrangements with each TAMP to establish and manage separate SMA or wrap accounts for your clients using the strategies you’ve chosen.

However, a more efficient approach might be to initially identify subadvised strategies you’d like to offer your clients and then try to identify one TAMP firm that offers them on their platform.

Misconception 5: It will be difficult to justify my own advisory fees when a TAMP is managing my clients’ accounts

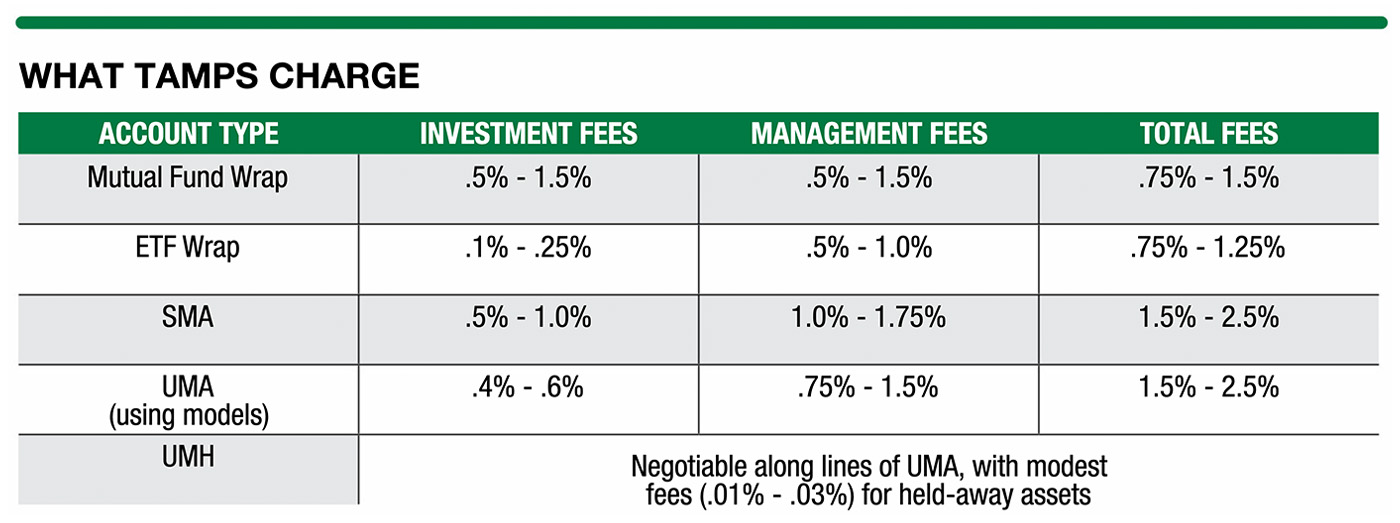

TAMP firms generally charge investment and administrative fees for accounts they manage, which may be anywhere from 75 to 250 basis points per account.

Source: The Wealth Advisor, America’s Best TAMPS 2024

Some advisors pay these TAMP fees themselves. Others pass them on to their clients or bill these charges separately from their own.

If your clients are paying all of these costs, they may be fine with paying the TAMP fees, but they may question why you’re still charging investment advisory fees when you’re no longer directly managing their accounts.

If you’re an investment-only advisor, you could respond by saying that your elevated role in overseeing ongoing due diligence on the investment strategies offered by the TAMP, monitoring and reporting the overall performance of your clients’ portfolios, and serving as their single point of contact for account-related requests justifies your fees.

Or you might remind them that if you were personally managing portfolios of mutual funds, your clients would be paying “hidden” investment management fees for these funds in addition to your own.

On the other hand, if you’re outsourcing investment management to facilitate your transition to becoming a full-service financial advisor, there may be creative ways to reduce your investment advisory fees without sacrificing your revenue.

Traditionally, advisors charge a one-time fee (averaging around $2,500) to develop a comprehensive financial plan for a client whose assets they’re not managing.

When that client starts paying the advisor to manage their investments, an annual review of their financial plan may be included at minimal or no extra cost.

But a growing number of advisors are now charging separate standalone annual financial-planning fees in addition to investment advisory fees.

These fees may entitle the client to a comprehensive review and updating of their financial plan; invitations to client workshops and seminars on various financial and investment topics; and access to the advisor’s network of accountants, attorneys, estate planners, and Medicare, and long-term-care consultants.

John Patrick Swee, a principal and managing advisor at Gryphon Advisors in Evanston, Illinois, suggests a more holistic approach.

“Advisors who provide ongoing tax or estate planning or charitable giving guidance on assets they don’t manage, such as a client’s real estate properties, stock options, small business shares, or deferred compensation plans, may want to consider charging a single fee based on that client’s entire net worth,” he says. “For example, if you charge 50 basis points based on their net worth, rather than 100 basis points on the assets you manage, you’re lowering your overall fee percentage without sacrificing revenue. You can justify that fee because you’re helping your clients maximize all of their wealth, of which investable assets are definitely a very significant part, but not the only part.”

If you embrace these more creative fee structures when outsourcing investment management, you may be able to significantly lower your investment advisory fees.

Positioned correctly, your clients will appreciate the fact that you’re lowering your share of their investment expenses because you’re now spending more time serving as their comprehensive “financial concierge.”

Can TAMPs transform your practice?

If you’ve embraced the role of financial planner/investment advisor, TAMPs can actually enhance your practice’s value. The time and energy you no longer have to spend in directly managing client investments can be used to cultivate new business and spend more time helping your clients address their ever-changing financial challenges.

You will also be able to spend more time educating your clients and resolving behavioral finance issues. Once you’ve proven your true value as their holistic financial problem solver, your clients should be far more amenable to allowing a reputable outside entity to manage their portfolios—with you as their fiduciary quarterback.

The opinions expressed in this article are those of the author and the sources cited and do not necessarily represent the views of Proactive Advisor Magazine. This material is presented for educational purposes only.

CFP is a registered trademark of the Certified Financial Planner Board of Standards Inc. (CFP Board).

Jeffrey Briskin is a marketing director with a Boston-area financial-planning firm. He is also principal of Briskin Consulting, which provides strategic marketing and financial content development services to asset managers, TAMPs, and fintech firms. Mr. Briskin has more than 25 years’ experience serving as a marketing executive and financial writer for some of America’s largest mutual fund companies, DC plan record keepers, and wealth-management firms. His articles have appeared in Pensions & Investments, Advisor Perspectives, The Wealth Advisor, Rethinking65, Kiplinger’s Adviser Angle, and Alts.co.

Jeffrey Briskin is a marketing director with a Boston-area financial-planning firm. He is also principal of Briskin Consulting, which provides strategic marketing and financial content development services to asset managers, TAMPs, and fintech firms. Mr. Briskin has more than 25 years’ experience serving as a marketing executive and financial writer for some of America’s largest mutual fund companies, DC plan record keepers, and wealth-management firms. His articles have appeared in Pensions & Investments, Advisor Perspectives, The Wealth Advisor, Rethinking65, Kiplinger’s Adviser Angle, and Alts.co.

RECENT POSTS