Building client loyalty through personalized relationships

Building client loyalty through personalized relationships

Advisors can build client loyalty not only by offering comprehensive financial and investment guidance but also by communicating often and demonstrating a personal interest in clients’ lives.

How can financial advisors engender more client loyalty?

Of course, delivering “market-beating” investment returns every year might be a good way to ensure that happens—but that is hardly realistic or even an objective for well-diversified client portfolios.

So what does it take to make sure clients stick with an advisor through thick and thin?

A recent study by Spectrem Group among advisory firm clients identified “investment performance” and “superior client service” as factors that undoubtedly have a great impact on client loyalty. In its ongoing research series, Spectrum Group also identified “the perceived knowledge and expertise” of one’s advisor as an important attribute contributing to client satisfaction.

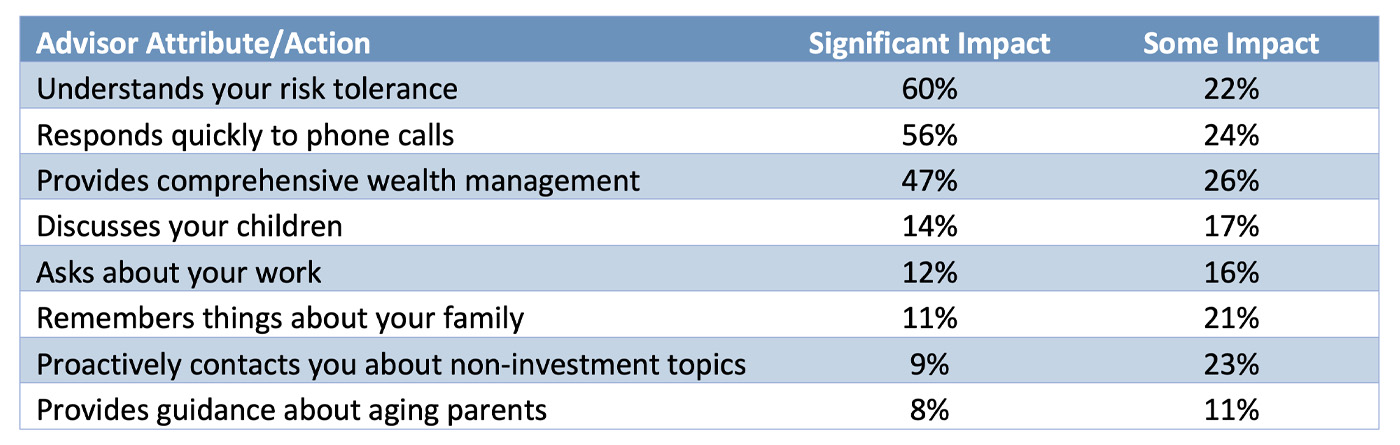

The study looked deeper at other influences on client loyalty, finding that clients said it’s very important for advisors to fully understand their risk tolerance and to respond quickly to their phone calls. Also high on the respondent’s list is the provision of comprehensive wealth-management services.

Personal touches—such as remembering family birthdays, asking about work and children, and discussing aging parents—can also strengthen relationships. Indeed, only 20% of clients said that they felt it was relatively unimportant for advisors to be actively interested in their personal lives.

TABLE 1: FACTORS THAT CAN INFLUENCE CLIENT LOYALTY

Source: Spectrem Group, November 2022

Two important ‘loyalty-building’ skills of successful advisors

Frank A. Leyes is the founder and president of Frank A. Leyes & Associates and the author of “Shaping the Future: 6 Ways Exceptional Advisors Transform Financial Futures.”

Frank A. Leyes is the founder and president of Frank A. Leyes & Associates and the author of “Shaping the Future: 6 Ways Exceptional Advisors Transform Financial Futures.”

In the book, Leyes offers a comprehensive discussion of six traits that characterize successful advisors, along with illustrative anecdotes and practical examples and exercises to help other financial advisors in developing these skills.

Leyes says that one of the most important attributes that clients look for in an advisor is leadership, especially in times “when convictions are being tested.” He notes that this is especially important in today’s information-saturated world, which is full of conflicting messages.

He also says that exceptional advisors are almost universally exceptional communicators with their clients. A major element of this is developing the skill to deliver important—and often complex—financial concepts in a concise and user-friendly fashion. He cites a well-known quote from Albert Einstein, “The definition of genius is taking the complex and making it simple.”

For this issue, we asked four financial professionals to share a few of their insights and best practices regarding building and enhancing client loyalty.

Building client loyalty through communication

“The number one way to build client loyalty is establishing trust, as we’re managing their future,” says Shannon LaRosse, an investment advisor at Informed Family Financial Services in Norristown, Pennsylvania. “The key is communication. It’s not just about open and timely communication; it’s about how you communicate. Each client has a different capacity and understands things in different formats, so you have to meet them where they are.”

“The number one way to build client loyalty is establishing trust, as we’re managing their future,” says Shannon LaRosse, an investment advisor at Informed Family Financial Services in Norristown, Pennsylvania. “The key is communication. It’s not just about open and timely communication; it’s about how you communicate. Each client has a different capacity and understands things in different formats, so you have to meet them where they are.”

Clients also appreciate quick responses to not only phone calls but also emails, says Claudia Mott, CFP, CDFA, and principal of Epona Financial Solutions in Basking Ridge, New Jersey.

Clients also appreciate quick responses to not only phone calls but also emails, says Claudia Mott, CFP, CDFA, and principal of Epona Financial Solutions in Basking Ridge, New Jersey.

“As an investment advisor, you have a responsibility to be prompt and respectful of whatever request or reason they’ve reached out to you—certainly by the following day,” Mott says. “Not being timely in getting back to someone is not appropriate.”

Aligne Wealth Advisors Investment Management (AWAIM) in Los Angeles builds client loyalty by having a good track record. More importantly, the firm’s advisors actively communicate with clients, says Ivan Illan, AIF, CFS, and AWAIM’s founder and chief investment officer.

Aligne Wealth Advisors Investment Management (AWAIM) in Los Angeles builds client loyalty by having a good track record. More importantly, the firm’s advisors actively communicate with clients, says Ivan Illan, AIF, CFS, and AWAIM’s founder and chief investment officer.

Illan calls it “education programming” for clients, helping them to understand why their portfolio is performing the way it’s performing—especially during volatile markets. It’s just as important to communicate to clients when they are doing well, because there will be a time when they won’t be doing so well relative to a benchmark.

“This really builds client loyalty,” he says. “So often we hear clients tell us that they couldn’t imagine working with another advisory firm—that we make everything so clear about what’s going on, how the client is positioned, and what we think is going to happen next.”

Building client loyalty by providing sound investment planning

Mott’s clients appreciate her comprehensive wealth-management planning services and that she understands far more than just their risk tolerance in seeking to help them reach their investment goal—whether that is saving for their retirement or for their kids’ or grandkids’ college education—with the resources they have.

“You really need to provide comprehensive services, given that clients pay a fee for you to oversee their portfolios,” she says. “The idea of just reviewing their investments and making occasional adjustments isn’t my view of client service. Building a deeper connection by learning about all facets of their lives enables you to build trust and gain the knowledge necessary to provide the best financial advisory services you can.”

The concept of active investment management comes up often in LaRosse’s conversations with her clients.

“Most clients don’t want to get into the nitty-gritty of how investments work. Sometimes just explaining the intricacies of a mutual fund can lead to eyes glazing over,” she says. “But through our educational process, they come to understand the concept of active investment management, which is usually an important element in our investment planning. Our third-party investment manager really creates a story around risk management, explaining the theory behind active strategies. I’m the client’s liaison that facilitates on their behalf, and I meet them on their level.”

Active management does build client loyalty, as clients like to know that somebody is watching over their money at all times, says Parker C. Molitor, a financial advisor at RAI Advisors in Murfreesboro, Tennessee.

Active management does build client loyalty, as clients like to know that somebody is watching over their money at all times, says Parker C. Molitor, a financial advisor at RAI Advisors in Murfreesboro, Tennessee.

“As an advisor, I can’t watch every single account every week, so our third-party manager provides an extra set of eyes to help with the monitoring and trading,” Molitor says. “Together, we strive to give clients the best risk-adjusted returns based on their objectives. It’s given clients an extra level of confidence and engendered more loyalty to me and our team.”

Aligne Wealth Advisors doesn’t outsource active managers. Instead, the firm runs a global active strategy internally using index funds, Illan says. As the chief investment officer, he leads all of the associated research and writes the firm’s forecast and market outlook articles.

The firm also builds client loyalty by posting quarterly YouTube videos with informative content, as well as weekly newsletters, podcasts, and emails with links to a monthly article Illan writes for Forbes.

“It’s one thing to be an active manager but quite another thing to package your active management into a program that’s easily digestible for clients,” he says. “Our clients demonstrate their loyalty by sharing our content with others. They become almost like disciples. We never need to ask for referrals—they refer us to family and friends on their own.”

Building client loyalty by building relationships

“Development of the client relationship is just so incredibly important in terms of creating that loyalty. Who they are, what interests them, what’s going on with their kids and grandkids—all that personal information is what helps you get to know the person,” Mott says. “To be able to better work with them, you have to dig beyond the surface.”

Whenever Molitor speaks with clients, they may spend roughly half of the time discussing their portfolio and finances and the rest catching up on what’s going on in the clients’ lives—whether it’s travel plans that may be coming up or new things happening with their family.

“Talking about what’s important to them beyond finances creates a lot of loyalty. If you focus only on their finances, then it would be a pretty shallow relationship,” he says. “You also need to be transparent with who you are as a person, and be open and available to clients.”

For example, Molitor and his team hosted a Christmas party last year for their clients. Instead of doing it at a restaurant, they did it in his home. “That’s huge relationship building,” he says. The team also hosts events such as outings at a golf digital driving range with a food lounge, water skiing on a lake, or skeet shooting—a variety of events for different client groups.

It’s also important to be a good listener, and to understand what clients really need, including things that are not investment-related, LaRosse says. When she gets a new client, LaRosse takes detailed notes about their interests, hobbies, and families. “Being genuinely interested—just engaging in their lives—builds trust,” she says.

“When I talk to clients that I’ve had for a while, it’s their agenda, not always mine, and I’m willing to discuss whatever’s on their mind,” she says. “My favorite part of the job is connecting with clients on a personal level. To be an effective advisor, you really have to care.”

***

It’s critical that advisors build client loyalty by not only offering comprehensive financial guidance but also by communicating often—and in a way that each client can best understand. Striving to foster strong relationships demonstrates that a financial advisor is genuinely interested in the client’s total welfare—not just their investments.

Frank Leyes puts it well, “My goal as one of your peers is to remind you that you play a role in the lives of your clients that should never be taken for granted. … Advisors who possess strong core beliefs, and communicate them effectively, will more likely be seen as highly effective stewards of their clients’ hard-earned resources and, ultimately, their financial futures.”

The opinions expressed in this article are those of the author and those interviewed and do not necessarily represent the views of Proactive Advisor Magazine. The information provided here is for general informational and educational purposes only and should not be considered an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Please see disclosures for each interviewed advisor on their respective websites.

New this week: